Review of trades of the Owl Smart Levels strategy for the week from February 9 to 13, 2026

Today I present you an overview of trades made using the Owl strategy - smart levels for the EURUSD, GBPUSD and AUDUSD currency pairs for the week from February 9 to 13, 2026. The report covers all trades generated by the system's signals, taking into account strict risk management and predefined entry and exit levels.

For convenience and timely receipt of signals I use the Owl Smart Levels Indicator. The main trading timeframe is M15, while the H1 and H4 timeframes are used to confirm the trend direction of the higher timeframe.

EURUSD review

The first trade on the EURUSD currency pair was opened by the signal of the Owl Smart Levels indicator on Tuesday, February 10, 2026.

The signal formed a buy. The entry, stop loss, and target levels were set in advance based on the wave structure and Fibonacci levels. However, the scenario didn't work out: the price returned to the stop loss level, so the trade closed with a loss at the pre-set risk.

Fig. 1. EURUSD BUY, Lot = 18.75, OpenPrice = 1.19040, StopLoss = 1.18960, TakeProfit = 1.19300, Profit = -$1 500.00

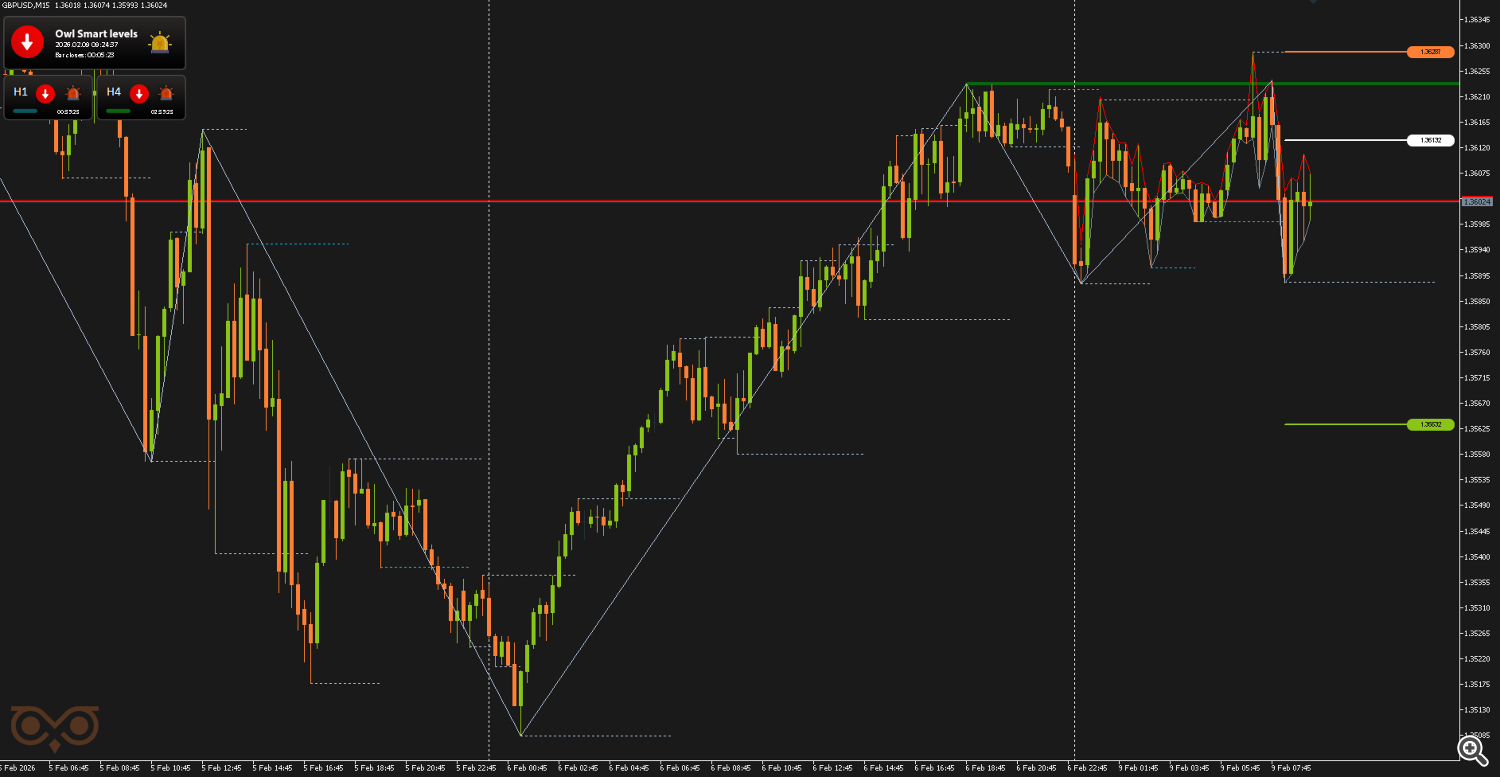

GBPUSD review

The first trade on the GBPUSD currency pair this week was opened by the signal of the Owl Smart Levels indicator on February 6, 2026.

The entry was executed as a sell from the pre-marked levels of the system. Since the previous trade was closed at Stop Loss, the risk in this trade was increased by 0.25% (from 1.5% to 1.75%). After opening, the market didn't continue to decline: the price returned to the Stop Loss level, and the position was closed with a loss according to the calculated risk.

Fig. 2. GBPUSD SELL, Lot = 12.77, OpenPrice = 1.36132, StopLoss = 1.36267, TakeProfit = 1.35632, Profit = -$1 723.75

AUDUSD review

The first trade on the AUDUSD currency pair was opened by the signal of the Owl Smart Levels indicator on February 10, 2026. At the time of the signal formation, the system showed an upward trend on the higher timeframes, so the entry was made for a buy from a pre-marked level.

Since the two previous trades were closed at Stop Loss, the risk in this trade was increased by 0.25% to 2.00% (in accordance with the rule of increasing risk after stops). The entry, stop loss, and take profit levels were set immediately — based on the wave structure and the system's calculated levels, without manual adjustments after opening. After a slight pullback, the price returned to the main movement, continued to grow, and reached Take Profit, fixing the profit according to the plan.

Fig. 3. AUDUSD BUY, Lot = 32.26, OpenPrice = 0.70705, StopLoss = 0.70645, TakeProfit = 0.70912, Profit = +$6 677.56

The second trade on the AUDUSD currency pair was opened by the signal of the Owl Smart Levels indicator on February 12, 2026. The entry was made for a buy from a pre-marked level of the system.

Since the previous trade closed with a profit, the risk was returned to the standard value of 1.5%. After opening, the price failed to continue growing and quickly returned to the Stop Loss level, so the position was closed at a loss.

Fig. 4. AUDUSD BUY, Lot = 14.15, OpenPrice = 0.71300, StopLoss = 0.71194, TakeProfit = 0.71642, Profit = -$1 500.00

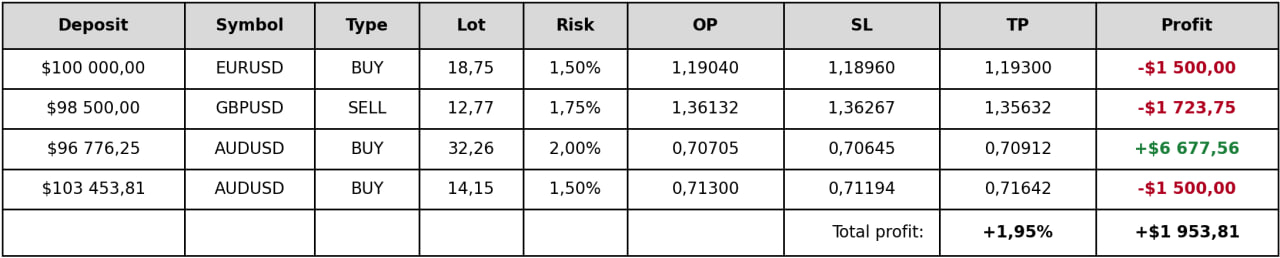

Summary:

There were 4 trades made based on Owl Smart Levels signals during the past trading week. Despite the fact that the market was in consolidation for most of the week and showed little directional movement, the overall result for the week remained positive. The result for the week: +$1953.81, which is +1.95% of the deposit. The detailed data are presented in the final table.

I'm Sergei Ermolov, follow me and don't miss more useful tools for profitable trading on the Forex market.