Sapphire Strat Maker - How to create your own strategy (part. II)

1. Introduction

This is the continuation on Sapphire Strat Maker and Sapphire Strat Maker Alt (Free) expert advisor - an EA which allows you to create your own strategy without coding. This is the beauty of this Expert Advisor: create your own strategies - be creative - and don't be locked to a single strategy anymore. Optimize the parameters you want to find the best sets and you're ready to go!

2. Blog posts

- Documentation - General information

- Documentation - ENUMs information

- Documentation - Indicators

- Documentation - Indicators buffers

2. Creating your own strategy

This is designed to be of a simple use: insert the indicators you want, define the series/bars you want to retrieve the price. Customize your risk management settings and go.

Let's create a simple strategy with a Volume Weighted Moving Average and RSI (Relative Strength Index). This strategy will not be optimized. The intention now is not to create a profitable strategy, just to show how to create one.

The strategy will open a new buy position when RSI crosses to a level under 30 and the close price is above the VWMA; a new sell position is opened when RSI crosses to a level above 70 and the close price is below the VWMA.

First things first, READ the Documentation - General, the Documentation - Indicators and the Documentation - ENUMs in the linked blog posts.

Then, load the reset preset linked here to the input parameters (right click anywhere in the strategy tester area → Load → choose the reset preset). This will erase all parameters and set them to 0/None. This will allow us to work with the EA more safely.

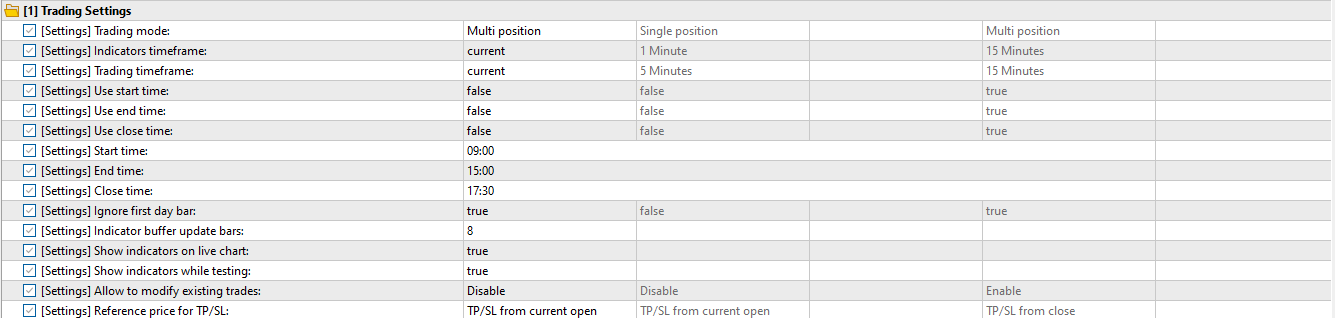

We'll not change the parameters from the section [1] Trading Settings, so leave them as it is:

Since we're not optimizing our EA, the same is applied to [2] Tester Settings group.

In the [3] Indicators, we set the indicator of index 0 as the VWMA (Volume Weighted Moving Average) and define its parameters. As per the documentation (attached), Param 1 is the period, Param 2 is the shift, Param3 is the applied price and Param4 is the applied volume (tick volume, since we're dealing with forex). I chose the following values:

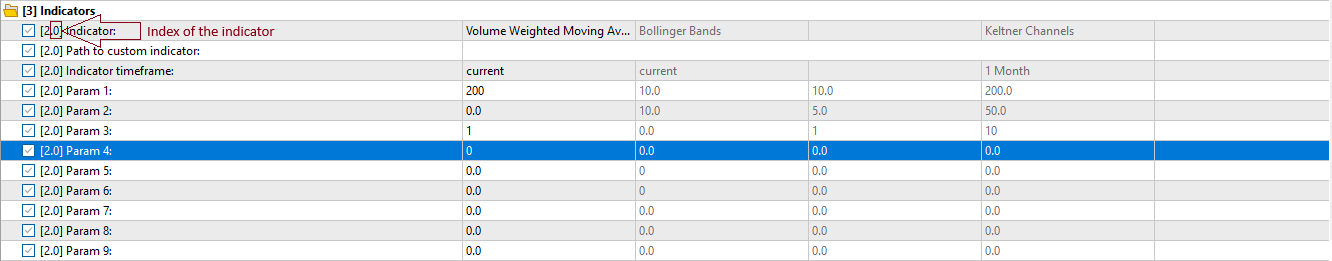

We do the same for indicator of index 1. We set it as the RSI and set its parameters (Param 1 is the period and Param 2 is the applied price):

In the section [4] Entry signals, we will allow both buy and sell signals, so leave as it is.

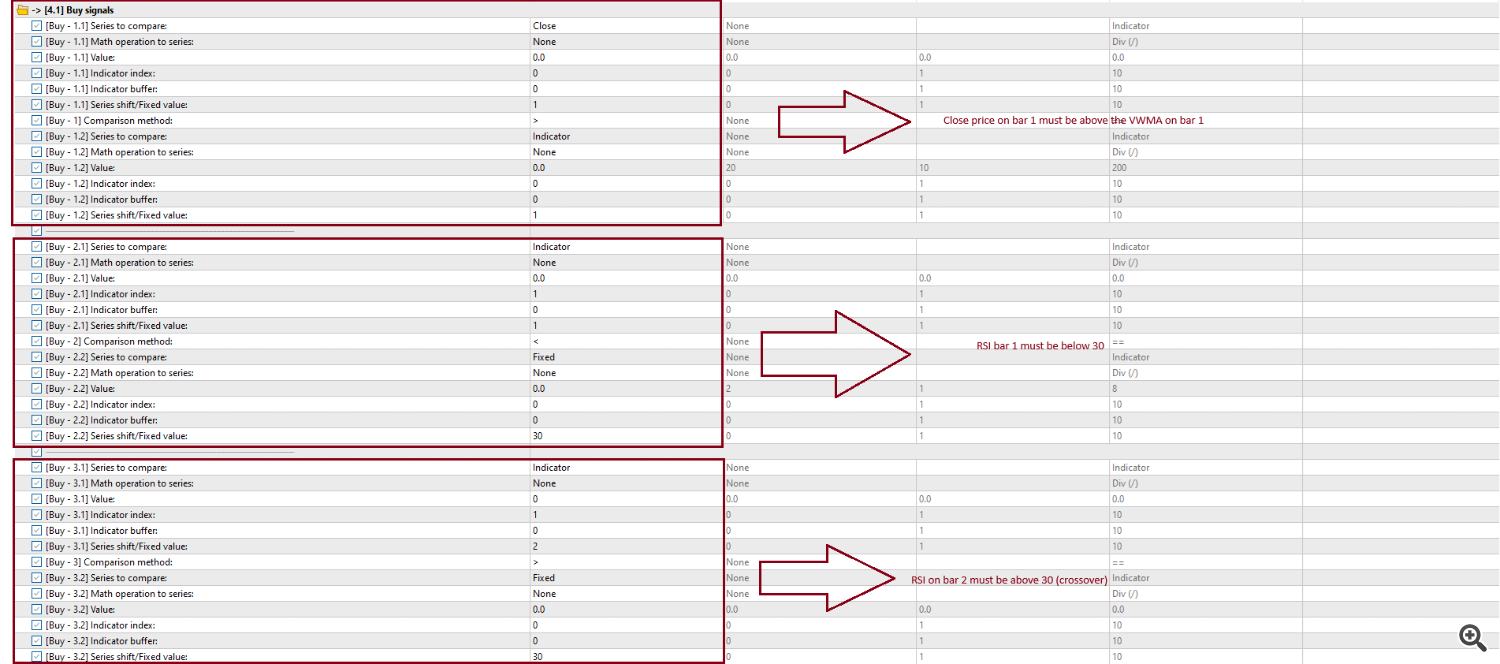

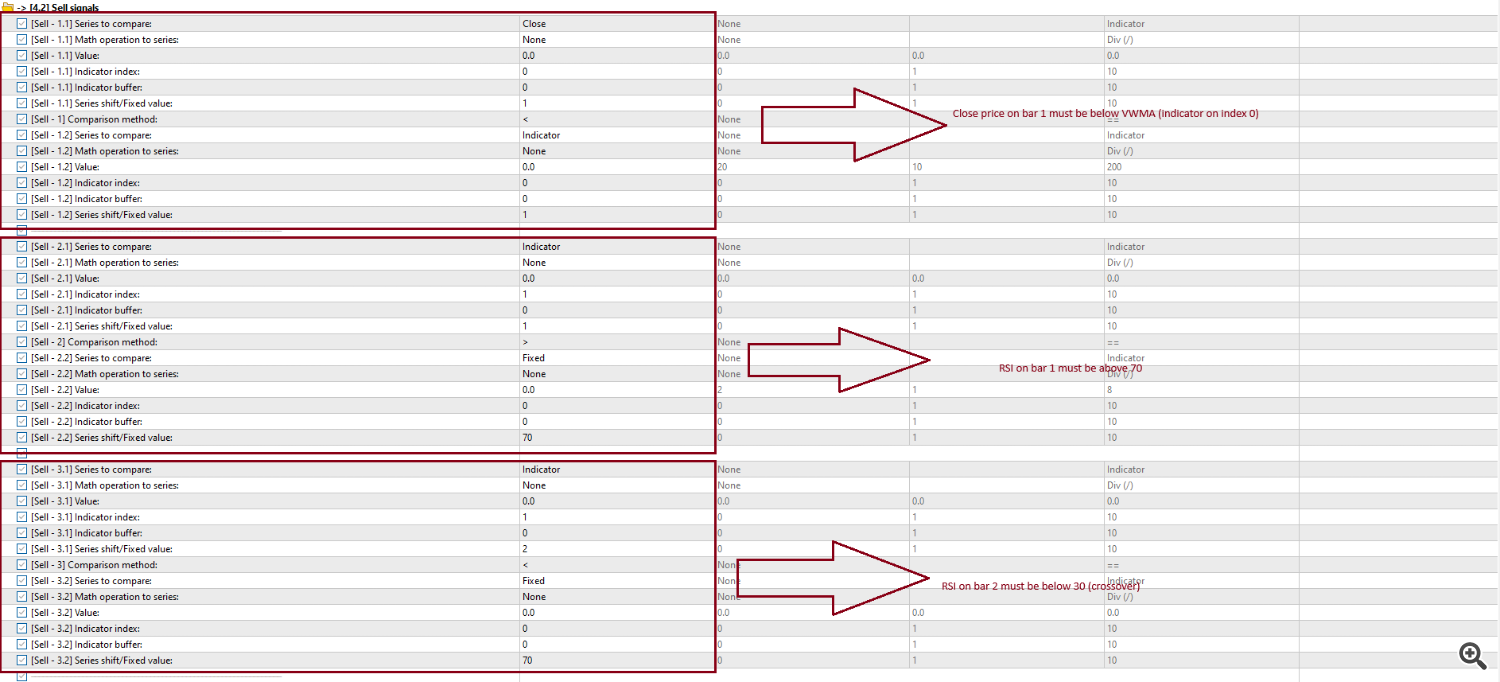

The group [4.1] Buy signals goes like this:

The group [4.2] Sell signals is defined like this:

We're not using common signals (signals that are checked before opening both buy and sell positions). So we must leave the input [Entry] Common signals filling mode at the group [4] Entry Signals as Fill any conditions.

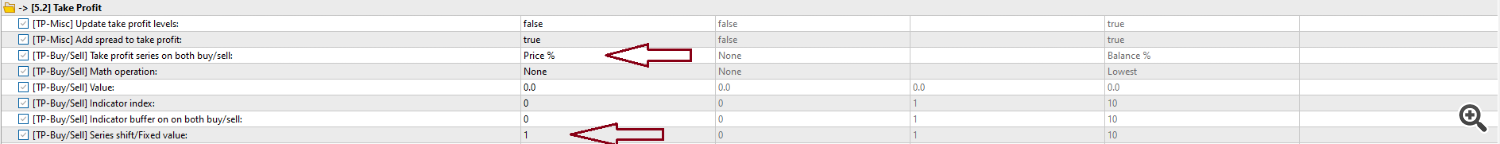

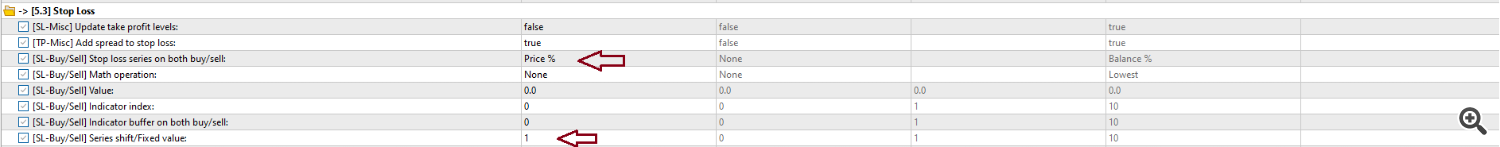

At [5.2] Take Profit and [5.3] Stop loss, we set [TP-Buy/Sell] Take profit reference on both buy/sell and [SL-Buy/Sell] Stop loss reference on both buy/sell to Price % (check the other possible parameters in the documentation), indicating we'll use a certain percentage from the entry price as tp and sl. In the Fixed take profit/bars and Fixed stop loss/bars, we set the percentage we want - i'll set it to 1. So both tp and sl will be placed at 1% distance from the current price.

At [5.5.1] Volume, set the [Volume] Calculation type to Balance % to calculate the volume so the stop loss is defined as certain % of your balance and default lot size to a number that suits your balance (U$ 1,000.00 == 0.1, in my opinion).

Now you're ready to deploy your strategy and start!

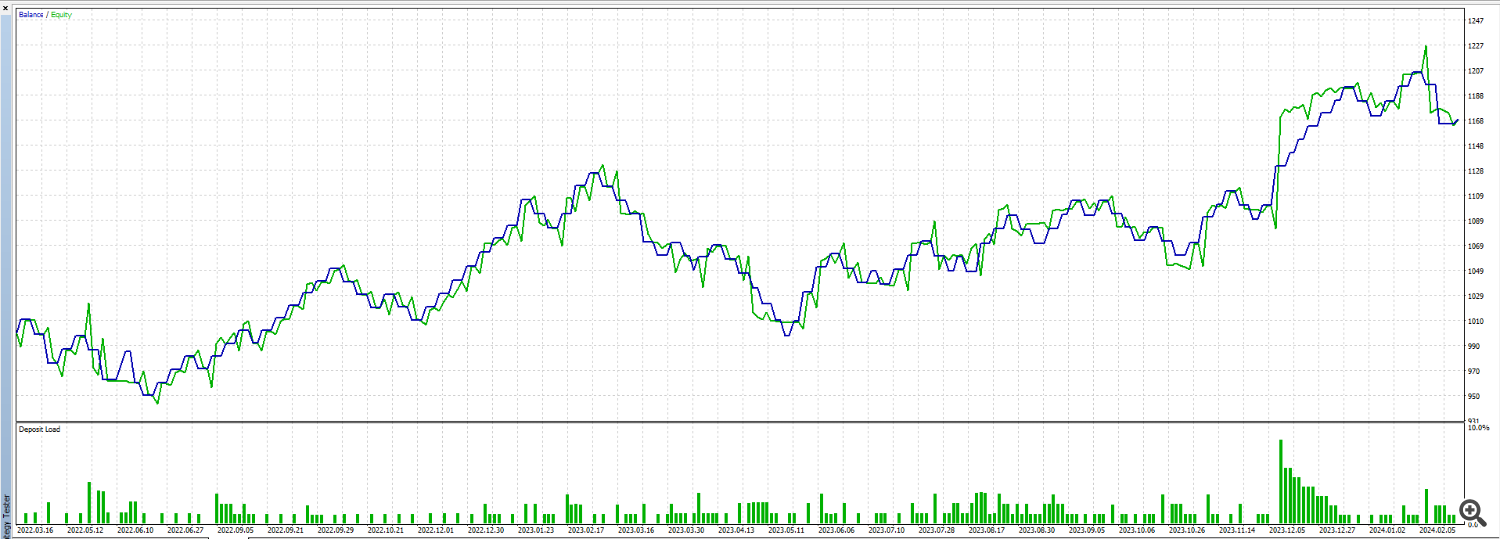

Just out of curiosity, this is how this simple strategy would've performed in the last 2 years in the 20 minutes timeframe on a U$ 1,000.00 account:

Optimize any parameters, like the moving average period, the tp/sl levels or use customs timeframes and find the best settings that works for you!

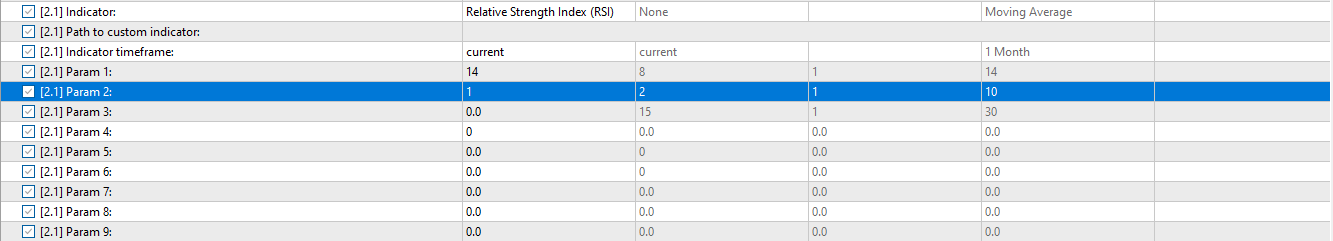

In the attached files there's a preset strategy using a Moving Average, ADX and ATR. This strategy is profitable in the last 2 years in the M5 timeframe - but BE AWARE that different brokers may provide slightly different data (from different market data providers), so the results may vary. Optimize the parameters to your broker.