Do you remember how often it happened where a trade looked so obvious to you but immediately reversed? Hitting your stop loss? But you were so sure about your trade and the direction.

A bull trap occurs when traders take a long position and then have price reverse and move lower with huge momentum.and this pattern often follows a very similar rhythm of luring traders into “obvious” long trades, followed by a sudden move against them. Bull traps often happen around previous highs where it looks as if the price is continuing the rally.

Especially amateur traders often tend to enter at that point, thinking the ongoing trend will continue in their favor. When price then reverses, they hold on to their positions until their stops are hit or exit the position. This behaviour brings even more momentum into the reversal.This pattern is caused most likely by market makers or the so called smart money. They trap the majority of the herd of retail/amateur traders and eating up their positions.

If you know how to trade these traps and follow the smart money, you will trade setups with a high probability and a huge risk/reward ratio. Before we jump right into the exact strategies, let us take a look at the orderflow and the thought process behind a bull trap.

01.THE BASE -WHAT HAPPENS-

1. Long up-trend. Higher Highs and higher lows. Most retail traders get greedy and jump in late. Buying the trend at the pullbacks. The smart money is already accumulating their short position.

2. Break of major resistance and the recent highs. More buyers come into the market. The buyers see profits immediately. Thinking the up-trend will continue. and give them a feeling of security and convidence in their positions.

3. Here we go. Price reverses to the downside. People in disbelieve hold on to their trades that are suddenly turning into a loss. Others add to their loss, hoping to average down. The professionals are the ones who are aggressively selling and the trapped amateurs are buying, hoping that price turns again.

04. Price rallies further and the trapped long traders are now facing their losses. Most are forced out of their long trades which means that they have to sell which accelerates the rally. Bull and Bear Traps can show you the difference between professional and retail/amateur traders and why the smart money usually wins. So the question is. How to recognize these setups and how to trade them.

02.THE INDICATOR

You will not need it, but without hours of practicing it would probably still be really hard for you to decide if the chart in front of you really shows a bull or bear trap. I developed a n indicator which shows you the traps in realtime. It does not re- or backpaint. As soon as the neckline gets broken, the trap will be marked on the chart. You can get it here: https://www.mql5.com/en/market/product/42056

03. THE 2 METHODS: GET THE RIGHT ENTRY

Trading Bull & Bear Traps can be so simple, easy and pretty straight forward. Patience is key! The indicator will show you a lot of signals. But you should definitely not trade all of them. With this strategy you have an edge over the market and can have high risk reward setups.

THE SETUP

In the picture below a Bear Trap occured on EURGBP M30 chart.

02.HIGHER TIMEFRAME CONFIRMATION

When a Bull/Bear Trap occurs on M30 or H1 you switch up to the H4 and Daily Chart. On these higher timeframes you draw a trendline. (Trendlines are drawn connecting the extremes of the ongoing trend.) Make sure you have two extreme points. The Trap itself should not be included as an extreme. It is rather just a bounce of that trendline.

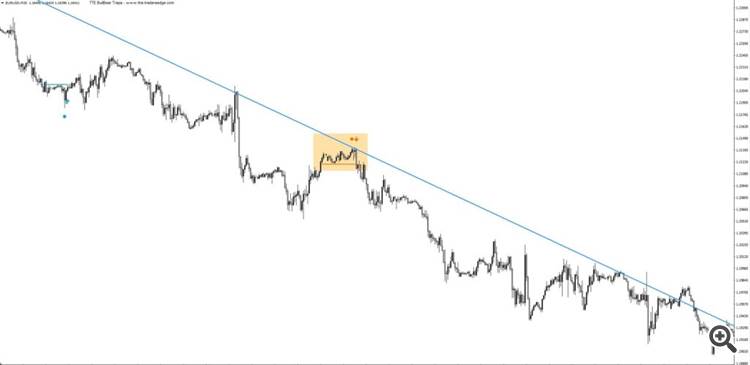

Here is another example of a short trade (Bull Trap) on M30 timeframe.

And the trendline drawn on the 4H chart

03.CONCLUSION

When the Bull/Bear Trap occurs on the M15-H1 chart directly on or pretty close to the trendline of the 4H and daily chart , the odds are in your favor that there will be a huge move in the direction of the major trend. When you look at picture No 1, where you placed your Stop below the deepest low of the Bear Trap, the reward would be almost 5 times the risk. Bull and Bear Traps are always a reversal pattern.

In the case of this strategy we use it as a reversal pattern on a shortterm timeframe, but also as a trend continuation on the higher timeframe. This gives you high probability trading setups with a huge risk/reward. How you take it from there is totally up to you.

Remember to take Bear Traps only in the direction of a bullish trend in the higher timeframe.

And Bull

Traps only in the direction of a bearish trend in the higher timeframe.

If a Trap occurs against the major trend. Do not take the trade!

If a Trap occurs

far away from the trendline. Do not take the trade!

This strategy filters out a lot of signals, but you would not spent money on anything, where you do not know what you get. Patience is key!!! If you stick to the rules and follow the system, you will make money in the end. There will be losers of course. But the winners will totally outweigh your losers, trust me. Happy trading!

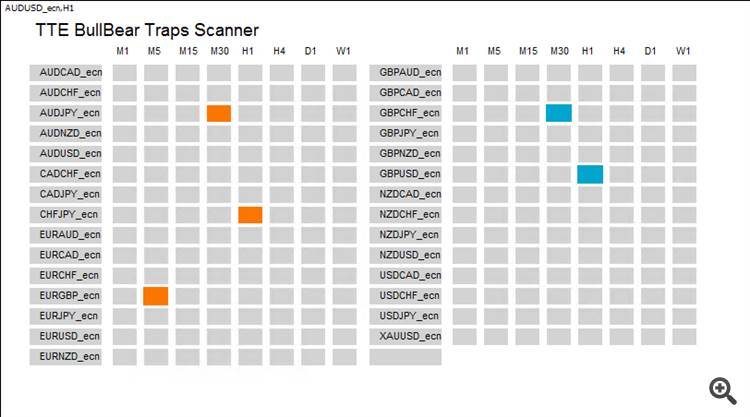

04. THE GOOD NEWS

A lot of people do not have the time to watch the charts the entire day. And even if you do, you would never have the ability to watch all pairs and all timeframes looking for a good trading setup. That is the reason why I created a Scanner for the Bull & Bear Traps that scans all pairs and all timeframes you like. Once a Bull- or Bear Trap appears you have the option to get an alert via MT4, Email or even Push Notifications through your mobile phone. Never miss a good trading setup again. Even with your normal day job. Click the link to find it in the market place: https://www.mql5.com/en/market/product/42065