Is Grid Trading Really Bad? Using Trends and Technical Indicators to Turn Grid Strategies into Controlled Systems

The Problem with Traditional Grid Trading

Grid trading is one of the most popular strategies among retail traders because of its simplicity. A grid EA places buy and sell orders at fixed price intervals, aiming to profit from market fluctuations regardless of direction.

However, the biggest weakness of traditional grid systems is also their defining feature: they open trades blindly, without understanding market structure, trend direction, or momentum.

This approach works temporarily in ranging markets, but it behaves like gambling during strong trends. When price moves aggressively in one direction, blind grids keep adding losing positions, leading to excessive drawdown or complete account wipeout.

The real problem is not grid trading itself — the problem is using grids without market intelligence.

Why Grid Trading Got a Bad Reputation

Grid trading is often criticized because many implementations ignore market context. In strong trends, a grid that keeps averaging against price can accumulate large floating losses in a very short time.

This behavior has led to the perception that grid systems are inherently unsafe. In reality, most failures come from poor control logic, not from the grid concept itself.

A grid is simply a position management method. Without direction, filters, or limits, it behaves randomly. With structure and rules, it becomes predictable.

The reputation problem comes from how grids are used — not what they are.

Ranging vs Trending Markets: Why Context Matters

Markets do not behave the same way at all times.

In ranging conditions, grids can perform well because price naturally oscillates between support and resistance levels. In trending conditions, however, the same grid logic can become dangerous if it continues to add positions against momentum.

A trend-aware grid strategy first classifies market state:

- Range

- Weak trend

- Strong trend

Based on this classification, the system can:

- Enable grids

- Restrict grids to one direction

- Reduce position size

- Pause trading completely

This simple context check dramatically changes long-term survivability.

Adding Market Intelligence to Grid Trading

A modern grid strategy does not need to guess. It can observe, filter, and align with the market before placing any grid orders. Instead of opening grids mechanically, a smart grid system first answers three critical questions:

-

Is the market trending or ranging?

-

What is the dominant direction?

-

Is momentum strong enough to justify new positions?

This is achieved by integrating trend detection and technical indicators directly into the grid logic.

1. Trend-Aligned Grids Instead of Bidirectional Gambling

Rather than opening both buy and sell grids at the same time, a trend-aware grid system:

-

Opens buy-only grids in bullish conditions

-

Opens sell-only grids in bearish conditions

-

Avoids trading completely when conditions are unclear

Common tools used for this include:

-

Moving average alignment

-

Higher-timeframe trend confirmation

-

Price structure (higher highs / lower lows)

This single change dramatically reduces drawdown during strong market moves.

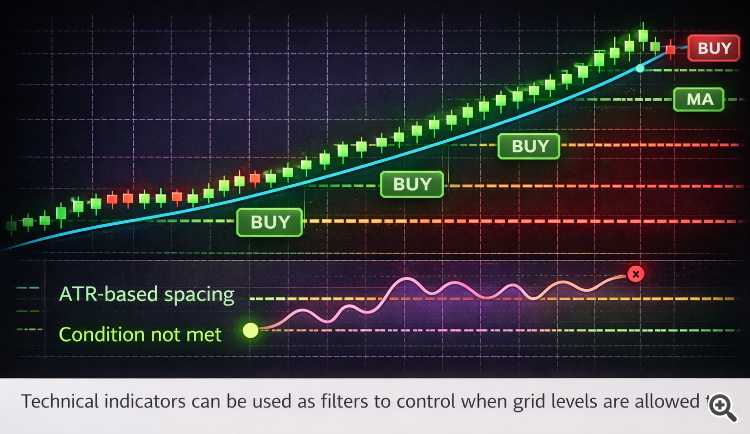

2. Indicator-Filtered Grid Entries

Grid spacing alone is not enough. Smart grid systems use indicators as entry filters, not signals.

Examples:

-

RSI or momentum indicators to avoid buying into overbought conditions

-

Volatility filters to prevent grids during extreme market spikes

-

ATR-based spacing to adapt grid distance dynamically to market conditions

This transforms the grid from a static trap into a responsive system that adapts to market behavior.

3. Conditional Grid Expansion Instead of Fixed Layers

Traditional grids keep adding positions no matter what. A modern grid system expands only when:

-

Trend conditions remain valid

-

Momentum does not weaken

-

Risk limits are still respected

If conditions change, the system can:

-

Pause new grid levels

-

Reduce position size

-

Close exposure early

This makes the grid behave more like a professional position-management tool rather than a martingale.

Risk Control: The Missing Layer in Most Grid Systems

Many grid strategies fail because risk is managed implicitly rather than explicitly. A modern grid system should define:

-

Maximum number of grid levels

-

Maximum total exposure per symbol

-

Maximum acceptable drawdown

-

Conditions for forced shutdown

When combined with trend and indicator filters, these limits prevent grid expansion from turning into uncontrolled averaging. Risk control does not reduce profitability — it ensures the strategy can stay in the market long enough to be profitable.

From Gambling Logic to System Logic

Grid strategies fail when they assume the market will always return. They succeed when they operate under the assumption that sometimes it will not.

By incorporating trend analysis, indicator confirmation, and strict risk boundaries, grid trading shifts from hope-based logic to system-based decision making.

Conclusion

Grid trading does not have to be reckless.

By combining trend analysis, technical indicators, and adaptive logic, grid strategies can evolve from high-risk gambling tools into controlled, rule-based trading systems.

A smart grid strategy:

-

Trades with the market, not against it

-

Reduces unnecessary drawdown

-

Avoids catastrophic trend exposure

-

Behaves predictably under stress

The future of grid trading is not about adding more orders — it is about adding better decisions before placing them.

Grid trading isn’t dead. Blind grid trading is.