On Monday, the dollar makes an attempt to adjust after a long day's fall. The dollar index DXY recovered to the beginning of the European session, halving the Friday's decline and reaching the level of 89.10. On Friday, the dollar closed with a decline for the seventh week in a row, and this was the longest period of decline since 2010.

The index of the dollar WSJ, reflecting the value of the dollar against the basket of 16 other currencies, also rose by 0.2% on Monday, recovering slightly after falling to new 3-year lows last week.

The large-scale decline in the dollar last week was facilitated by the decision of the White House administration to impose restrictions on the importation of a number of goods produced in Asian countries in the US, as well as the statement of US Treasury Secretary Stephen Mnuchin that "the weakening of the dollar is favorable for trade". Despite the current correction, the dollar remains vulnerable. The negative attitude of investors towards the dollar is preserved, and its bearish trend remains predominant.

A series of important economic news are expected to come out this week, beginning with the Fed meeting, ending with the publication on Friday of data from the US labor market for January. In view of this, volatility in the financial markets will continue to be increased.

With regard to the Eurozone, it is worthwhile to pay attention to the publication on Tuesday of preliminary data on Eurozone and France GDP for the 4th quarter (10:00 GMT) and consumer price inflation data in Germany for January (13:00 GMT). On Wednesday (10:00 GMT) report on inflation in the Eurozone for January, as well as data on employment in the Eurozone and Germany (09:00 GMT) for January, will be published. On Thursday, the PMI is expected for the manufacturing sector in Italy, France, Germany (08:45, 08:50, 08:55 (GMT), respectively), Euro zone (09:00) from Markit. Data on consumer inflation in Italy and producer prices in the Eurozone will come out on Friday (10:00 GMT).

However, the focus of traders will be the publication on Friday (13:30 GMT) of data from the US labor market in January. It is expected that the number of jobs outside agriculture increased by 175,000, which is above the average for six months of 166,000 (the previous value was +148,000). Unemployment remained at 4.1% in January, hourly wages of Americans increased by 0.3%.

If the data is confirmed or will be better, it is worth waiting for the strengthening of the dollar. How much the dollar will be strengthened will depend on data from the US labor market and comments from the Fed's leaders on the future plans of the US Central Bank regarding its monetary policy. The publication of comments by the Federal Reserve on monetary policy is scheduled for 19:00 (GMT) on Wednesday, along with the publication of the Fed's decision on rates.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

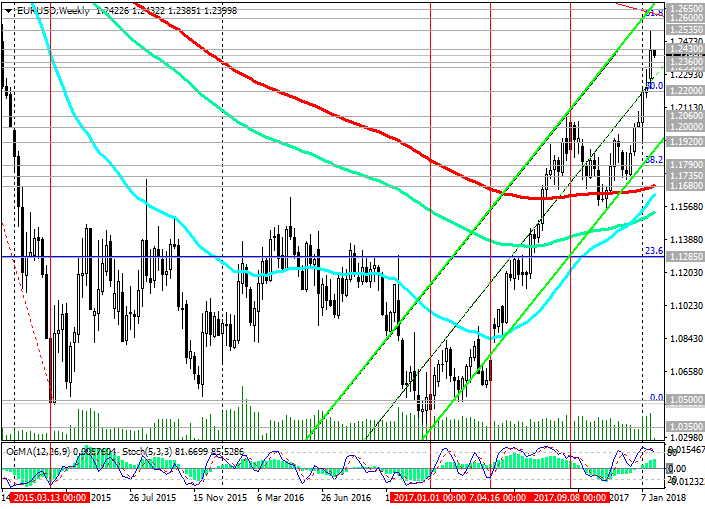

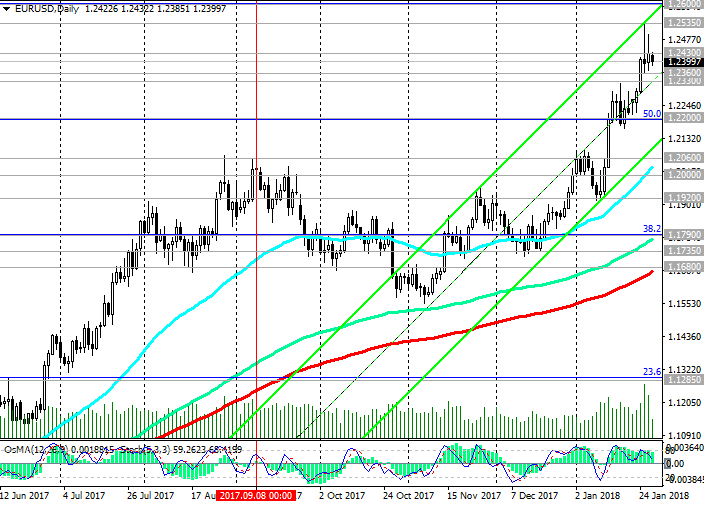

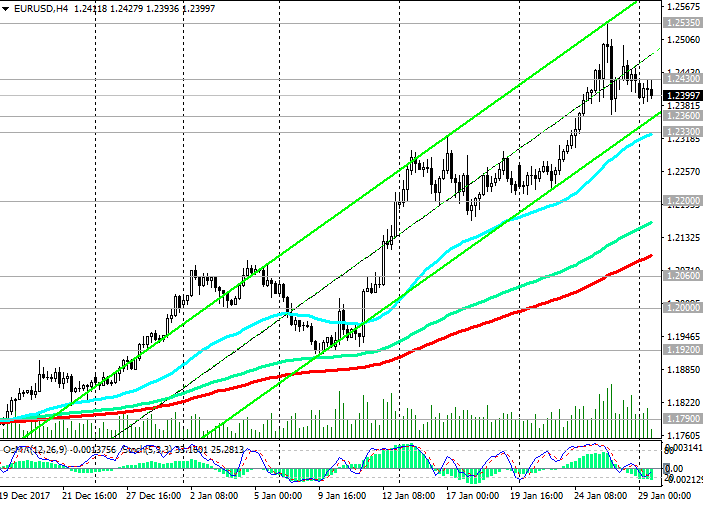

Last week, the EUR / USD reached another multi-month high near the 1.2535 mark, continuing to move in the upward channels on the daily and weekly charts, and trying to gain a foothold in the zone above the important level of 1.2330 (EMA200 on the monthly chart).

The closest targets in the case of continued growth in EUR / USD are resistance levels 1.2600 (Fibonacci level 61.8% of correction to the fall from 1.3900, which began in May 2014), 1.2650 (the upper line of the rising channel on the weekly chart and the top line of the convergent triangle on the monthly graphics). In case of breakdown of the level of 1.2650, the agenda will raise the question of the ECB's further plans for monetary policy and how much the ECB will tolerate against a strong euro. From a technical point of view, the next medium-term target is the resistance level 1.3900 (Fibonacci level of 100%, ie the beginning of the last wave of EUR / USD decline in May 2014).

There is a strong upward momentum and a bullish trend. Long positions are preferred.

Support levels: 1.2400, 1.2360, 1.2330, 1.2200, 1.2100, 1.2060, 1.2000, 1.1920, 1.1790, 1.1735, 1.1680

Resistance levels: 1.2500, 1.2535, 1.2600, 1.2650

Trading Scenarios

Sell Stop 1.2350. Stop-Loss 1.2440. Take-Profit 1.2330, 1.2200, 1.2100, 1.2060

Buy Stop 1.2440. Stop-Loss 1.2350. Take-Profit 1.2500, 1.2535, 1.2600, 1.2650

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com