Оригинал статьи на русском языке

Can we always accurately determine the martingale or grid strategy?

Most traders think that they can easily visually identify dangerous martingale or grid strategies according to the following criteria:

1. They see consistent opening of orders in one direction during the formation of the loss from the previous open orders (grid).

2. They see that the lot size of consistently opened orders increases (martingale)

In this article we would like to show using simple examples that this can be misleading.

The main risk of martingale and grid strategies is sequential opening of additional orders with the purpose to cover the loss gained by earlier open orders with profit of additional orders. This goal is utopian during long one-direction price movements, often resulting in loss of the Deposit.

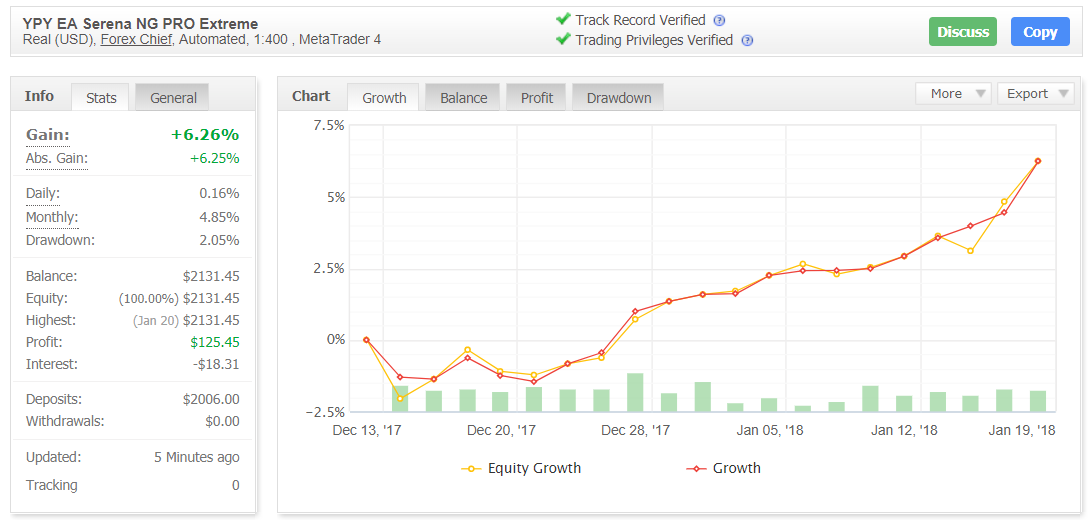

Strategies that open only one order for every used instrument are considered more safe (such as YPY EA Serena NG PRO trading system)

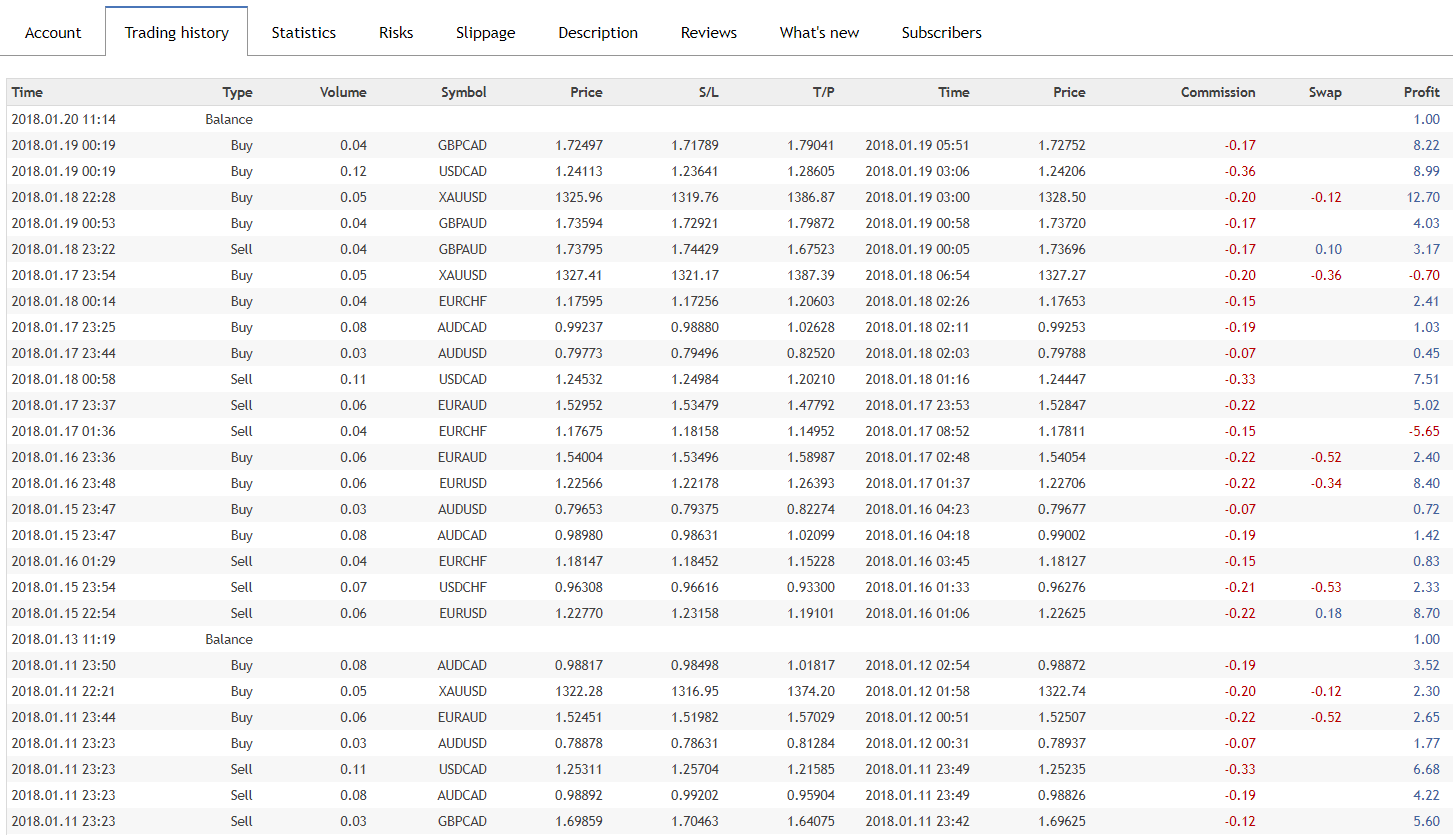

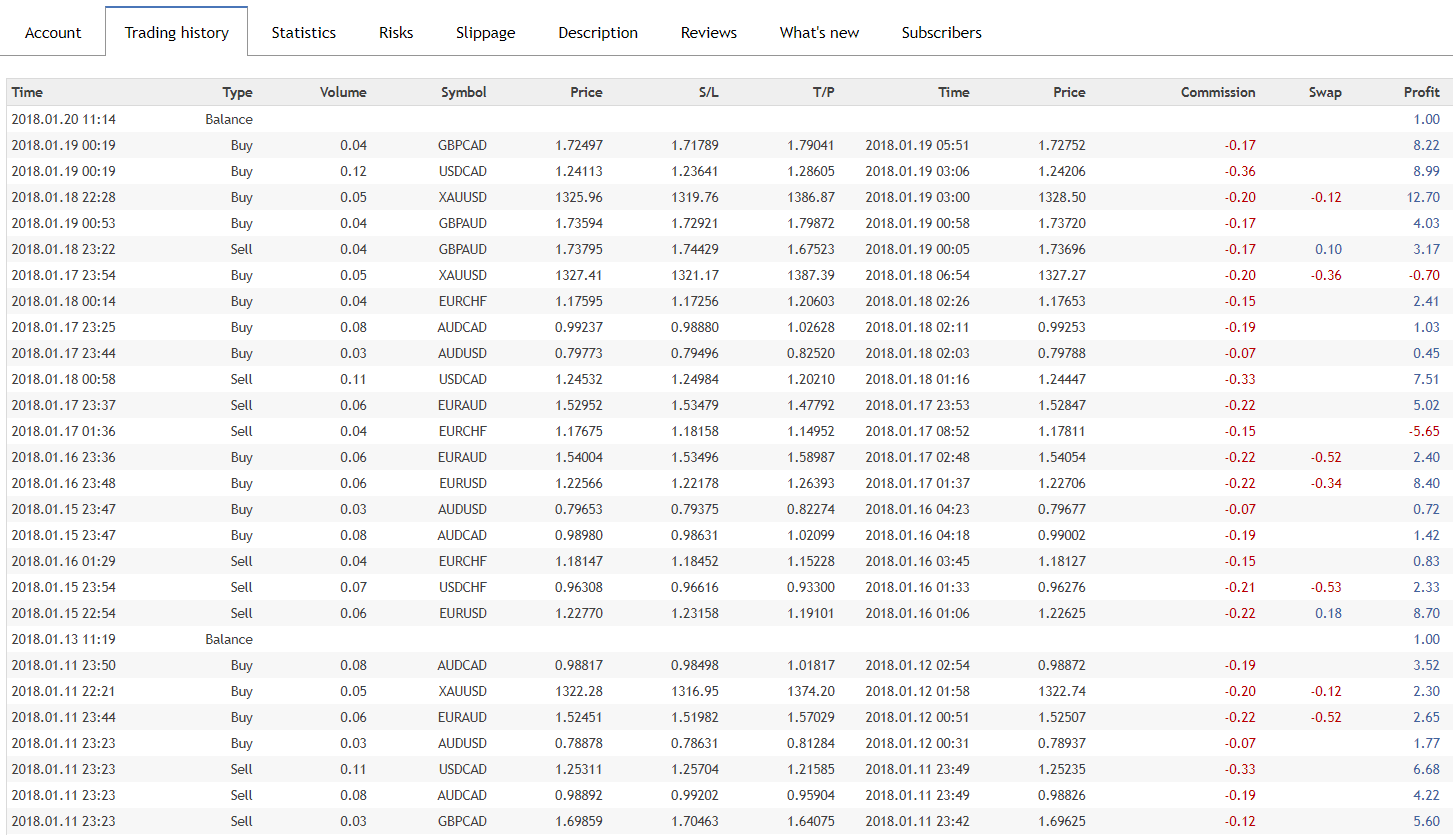

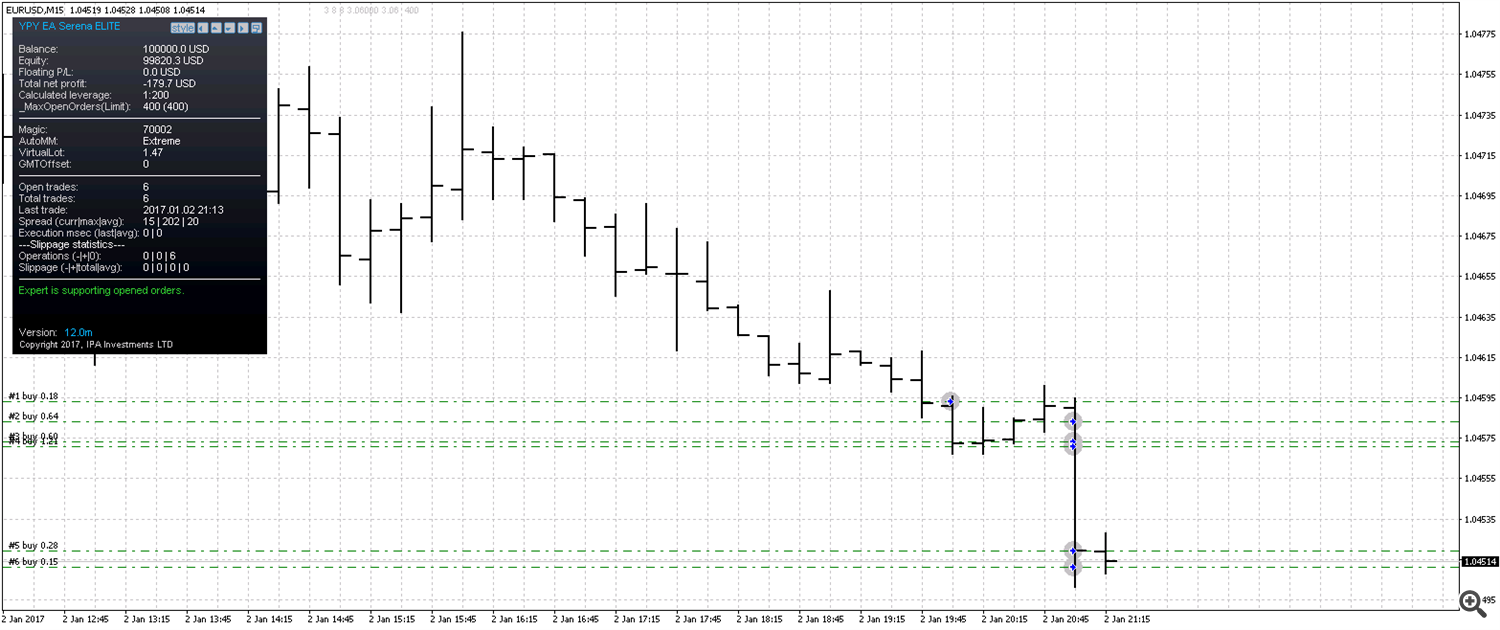

Below is an example of the history of trading.

In this example, users do not see any signs of dangerous martingale or grid strategies.

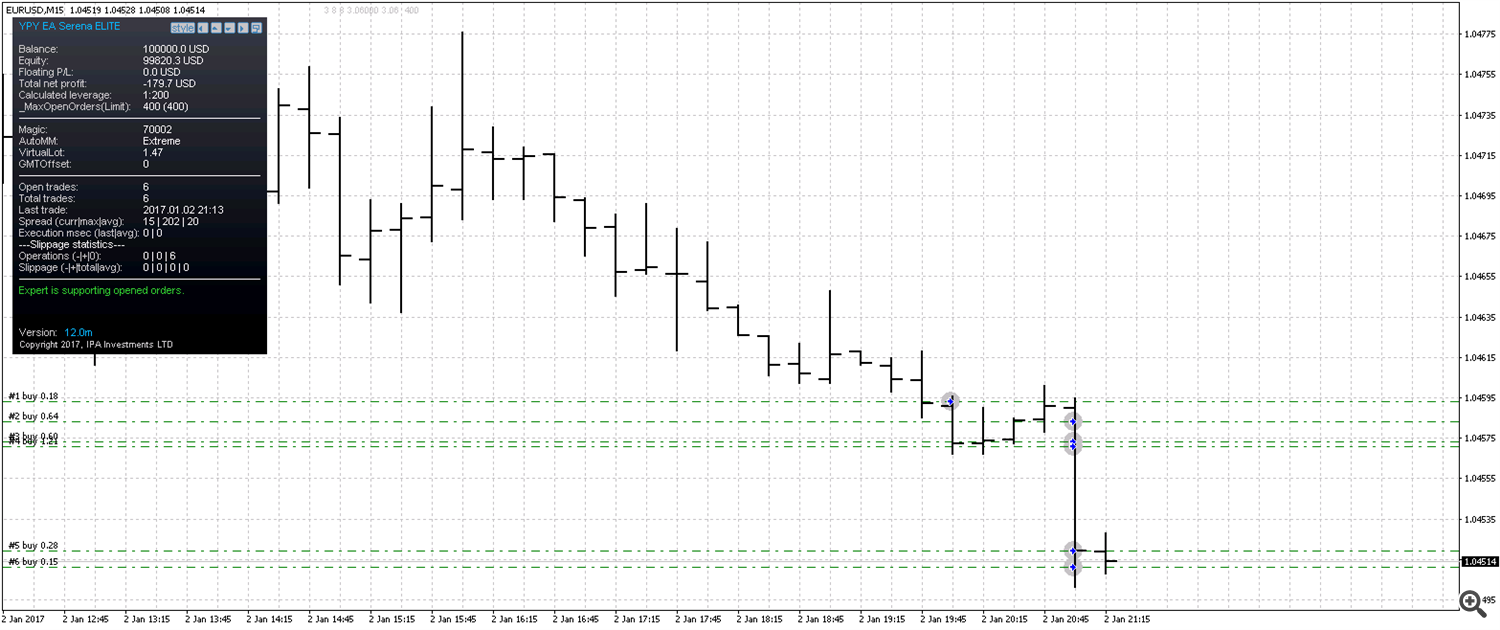

Now consider the example of a portfolio of the safest possible strategies (like YPY EA Serena ELITE trading system), where each strategy opens only one order for each used instrument. In addition, each strategy in the portfolio has unique conditions for opening and closing orders, as well as individual lot size of open orders. And the main thing that all strategies used in the portfolio are independent from each other.

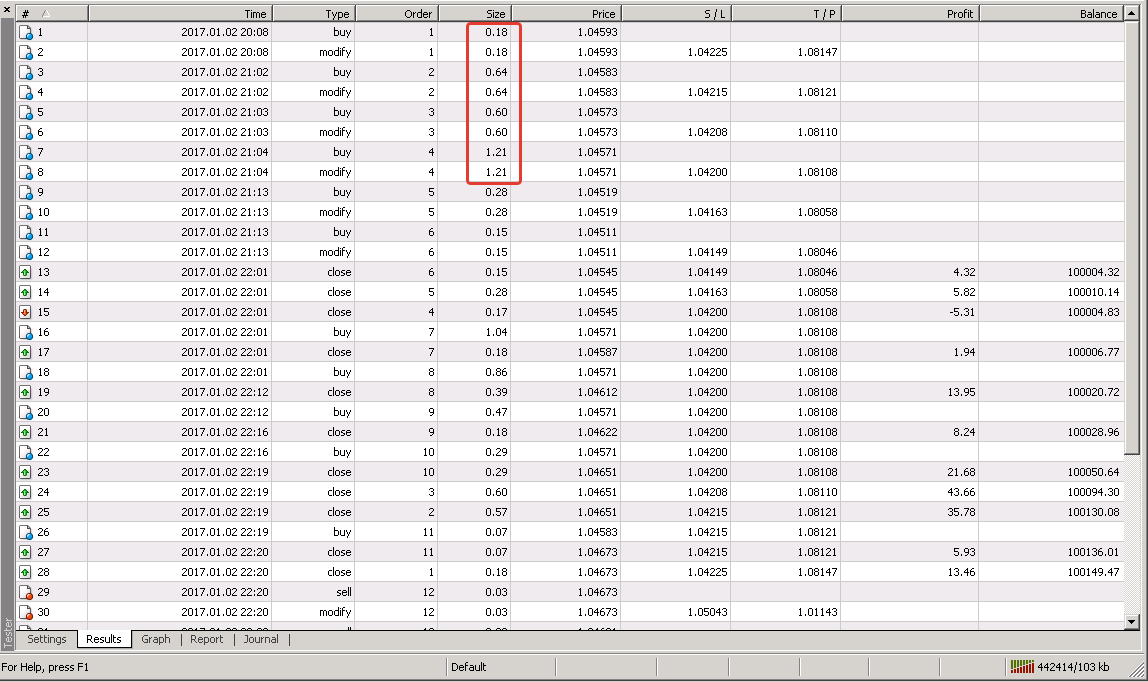

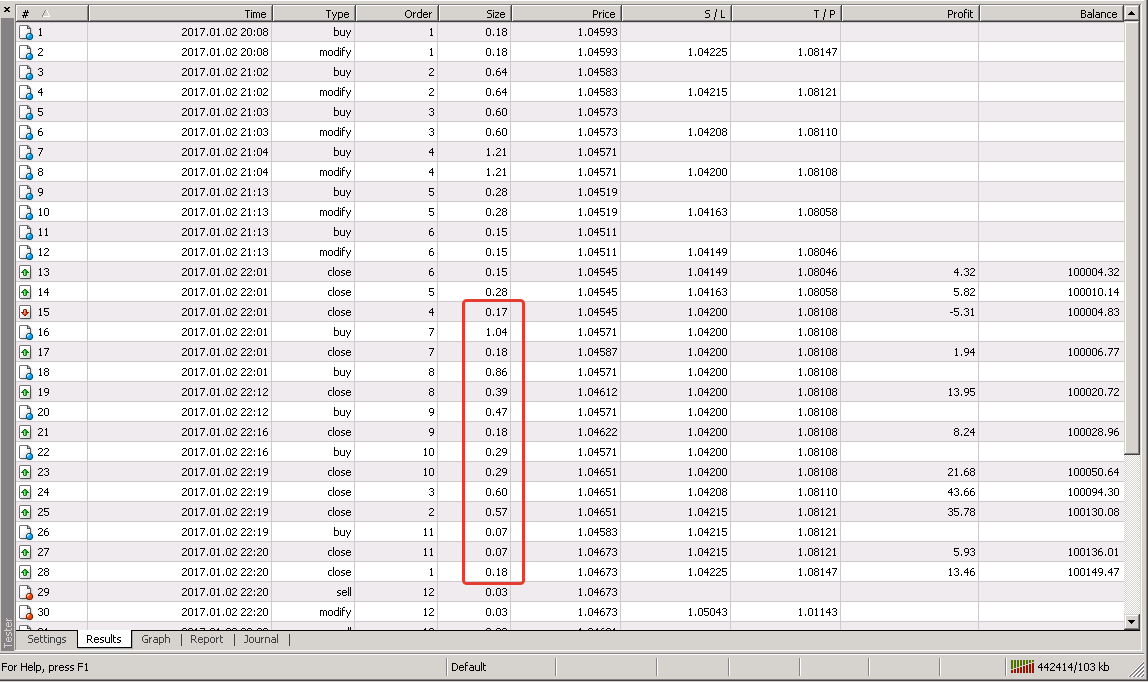

1. At 20:08 the first strategy opens a BUY order with lot size of 0.18

2. At 21:02 the second and third strategies are activated: for the second strategy is required to open a BUY order with lot size of 0.07, for the third strategy is required to open a BUY order with lot size of 0.57. In total as a result of aggregation at 21:02 the total volume of BUY is 0.64 lot.

3. At 21:03 the fourth strategy opens a BUY order with lot size of 0.60

4. At 21:04 fifth, sixth, seventh, eighth, nine strategy are activated: for the fifth strategy is required to open a BUY order with lot size of 0.18, for the sixth strategy is required to open a BUY order with lot size of 0.29, for the seventh strategy is required to open a BUY order with lot size of 0.18, for the eighth strategy is required to open a BUY order with lot size of 0.39, for the nine strategy is required to open a BUY order with lot size of 0.17. In total as a result of aggregation at 21:04 total volume of BUY is 1.21.

Let's see how it looks visually on the trade history

By looking at this, many traders can quickly conclude that he saw clear signs (we wrote about them above) of dangerous martingale or grid strategies.

But these conclusions would be erroneous because they see not a single strategy, but the results of aggregation of several strategies (portfolio trading)

This portfolio never used martingale or grid strategies.

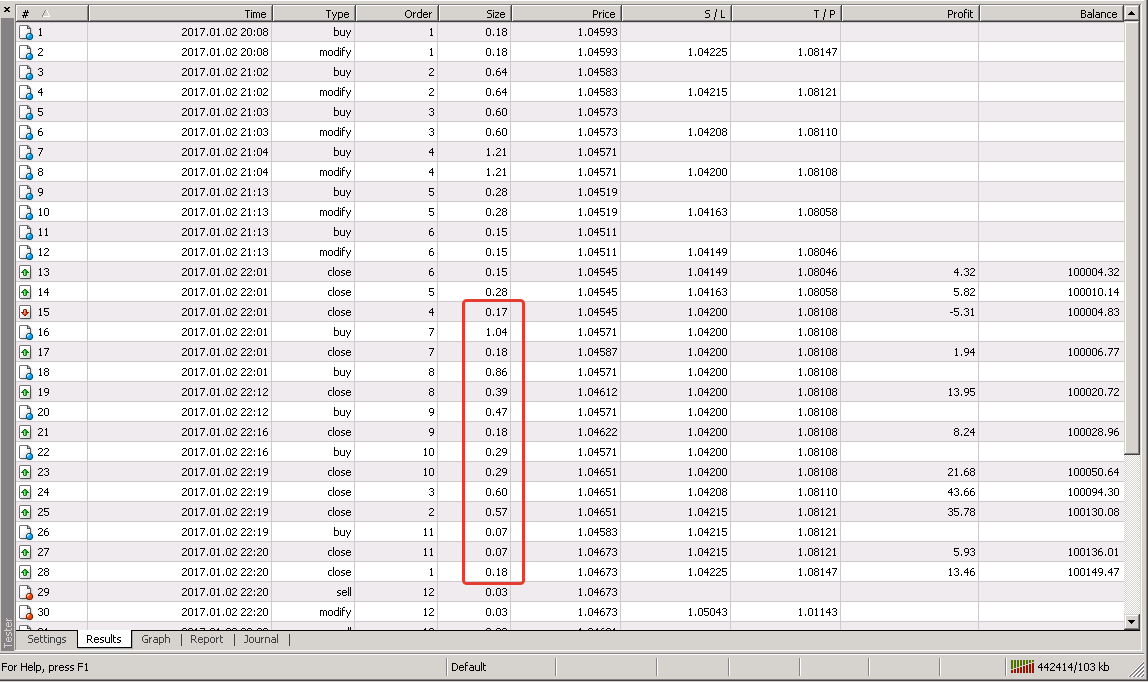

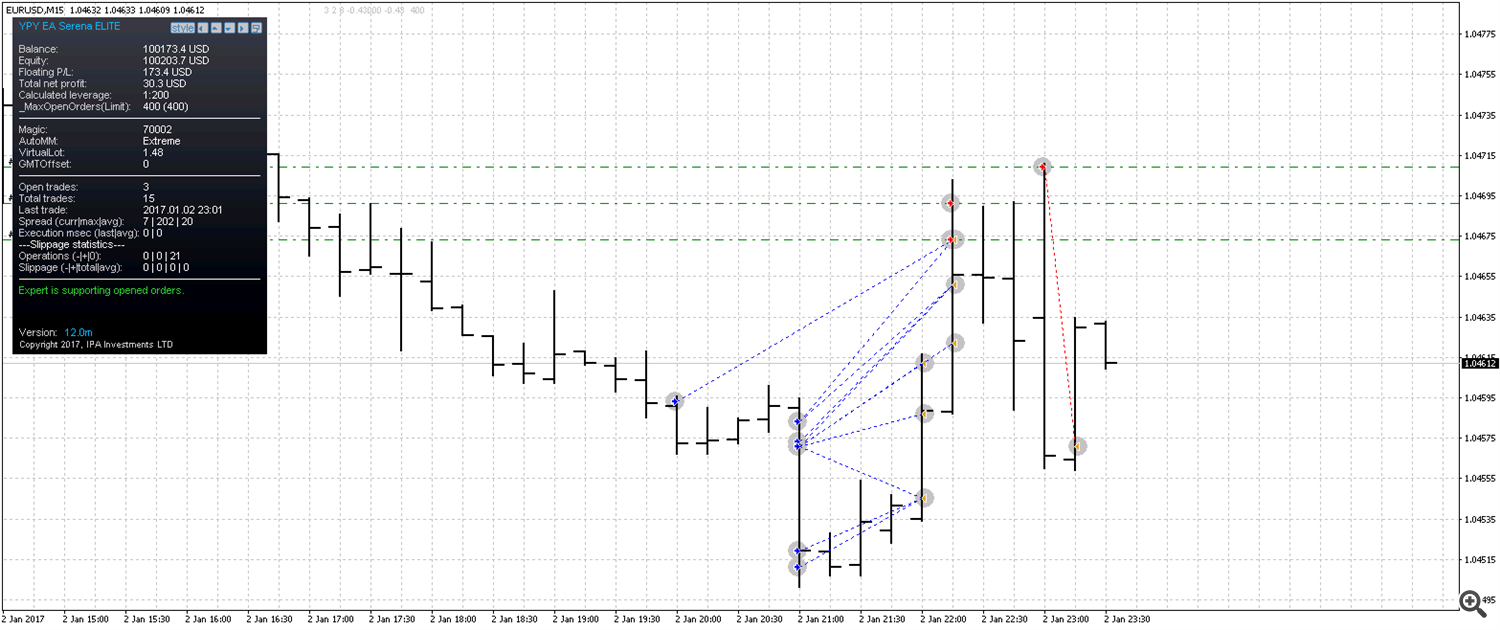

A more attentive trader can notice that open orders are closed at different times, and use partial closure.

This confirms the independence of each of the strategy used, and also the fact that some orders are the result of aggregation of multiple strategies (and therefore the partial closure is used).

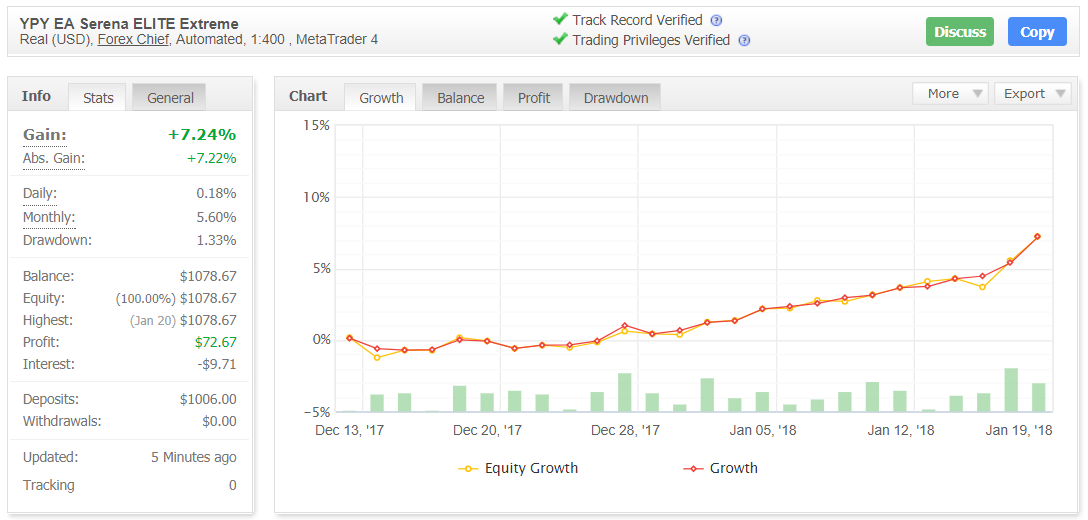

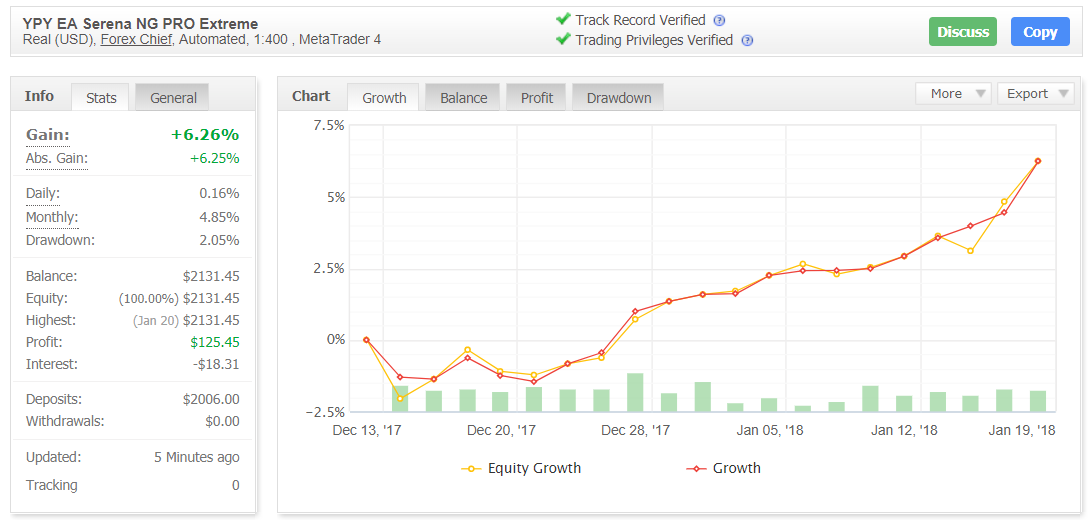

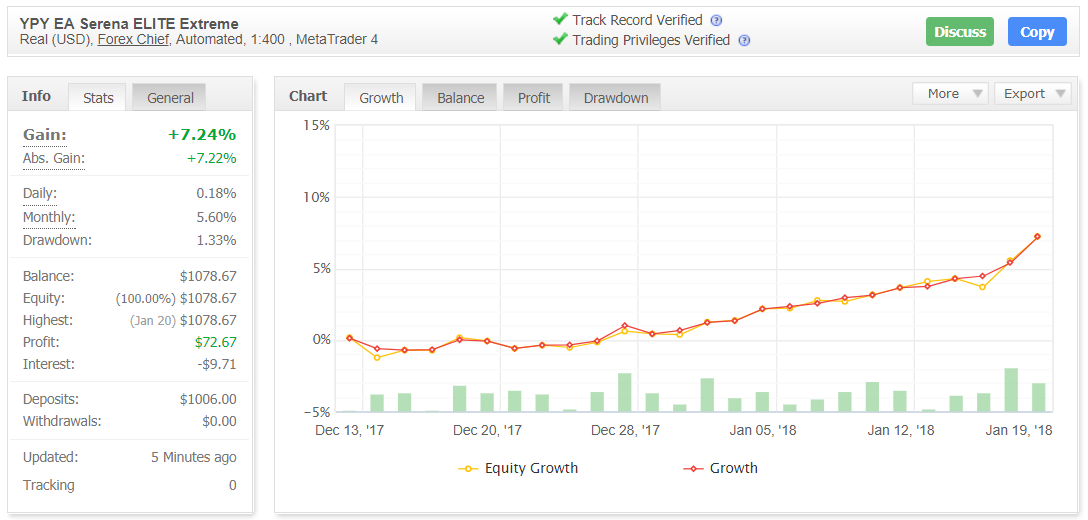

Below You can see how this trading looks on real accounts:

YPY EA Serena NG PRO trading system (uses only one strategy for each instrument)

YPY EA Serena ELITE trading system (which uses a portfolio of strategies for each instrument)

If You have read this article, You are able to understand that the combination of safest strategies in the portfolio can look like as averaging or martingale, but in fact, this trading is safe and does not have any relationship to the known martingale or grid strategies.

We wish all successful trading!

www.ypy.cc