EUR/USD: The dollar is recovering, but continues to decline against the euro

The third day, the EUR / USD is growing and at the beginning of today's European session again reached the level of 1.1875 (last month's highs). The growth of the pair is facilitated by the sharp weakening of the dollar after the publication of the protocol from the November meeting of the Fed, and the strengthening of the euro against the background of positive macro data on the Eurozone, published on Thursday and Friday.

Today we received information about the growth of business optimism in Germany in November.

The German IFO index reached a new record high of 117.5 (against the forecast of 116.6 and 116.8 in October), the index of expectations in Germany rose to 111.0 in November (against the forecast of 108.9 and 109.2 last month).

The economy of Germany, which is the leading economy of the Eurozone, ranked 4th in the world in terms of GDP, is moving towards a boom. Among the leaders of the Fed there is uncertainty about the rate of inflation, which may somewhat reduce investors' optimism about future increases in rates in the US. At the same time, in the minutes of the ECB meeting published on Thursday, it was said about the proposal of some leaders in the guidelines for the future policy of the ECB - not to link the quantitative easing program to the steady growth of inflation.

According to economists, this is a key factor, since it "implies the possibility of completing the program for the purchase of assets in 2018, even if there are no clear signs of accelerating inflation."

The dollar is now attempting to recover from a large-scale decline the day before and is rising against commodity currencies and the yen. Nevertheless, the dollar is falling against the euro.

A number of positive macro data on the Eurozone, received in the last two days, more than offset political uncertainty in Germany, where the ruling conservative party of Angela Merkel, was in the minority after the German chancellor failed to form a coalition with other opposition parties.

In the US today, a shorter working day after Thanksgiving and in view of "Black Friday", when the Christmas sales period starts, and in retail trade huge discounts.

From the news for today, we are waiting for the publication of important macro data from the US, when at 14:45 (GMT) the indexes of business activity in various sectors of the US economy for November will be published, as well as the composite PMI index. The growth of indicators with values above 50 is expected, which is seen as evidence of economic growth.

If the indices are above the forecast values, the dollar will continue to recover. In the second half of the US trading session, the activity of traders will decline, and the volume of trading will be insignificant.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

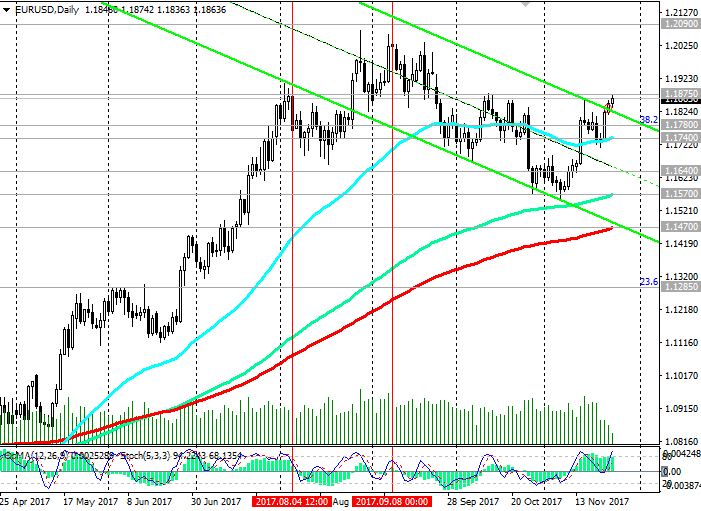

Indicators OsMA and Stochastics on the 4-hour, daily, weekly charts are on the buyers side. Positive dynamics persists. Nevertheless, the likelihood of a downward correction is also high, if strong macro data comes from the US (at 14:45 GMT).

Support levels: 1.1848, 1.1800, 1.1780, 1.1740, 1.1640, 1.1600, 1.1570, 1.1470, 1.1285

Resistance levels: 1.1875, 1.1900, 1.1925, 1.2000, 1.2050, 1.2090, 1.2100, 1.2180, 1.2320, 1.2430

Trading recommendations

Sell Stop 1.1840. Stop-Loss 1.1885. Take-Profit 1.1800, 1.1780, 1.1740, 1.1640, 1.1600, 1.1570, 1.1470, 1.1285

Buy Stop 1.1885. Stop-Loss 1.1840. Take-Profit 1.1900, 1.1925, 1.2000, 1.2050, 1.2090, 1.2100, 1.2180, 1.2320, 1.2430

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com