Technical analysis

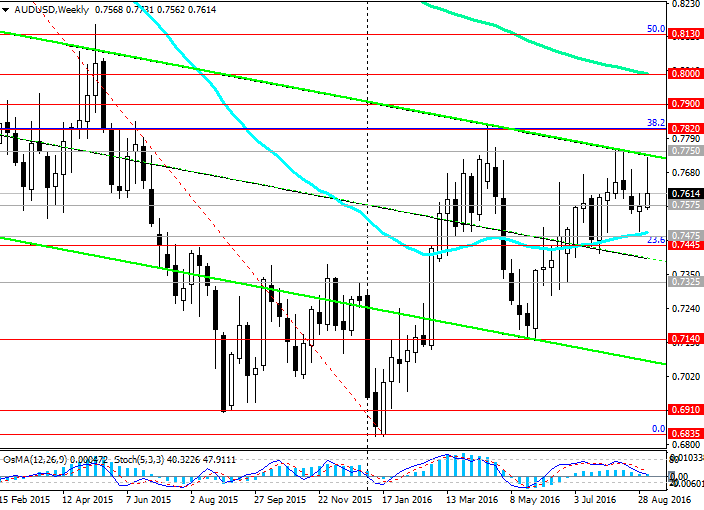

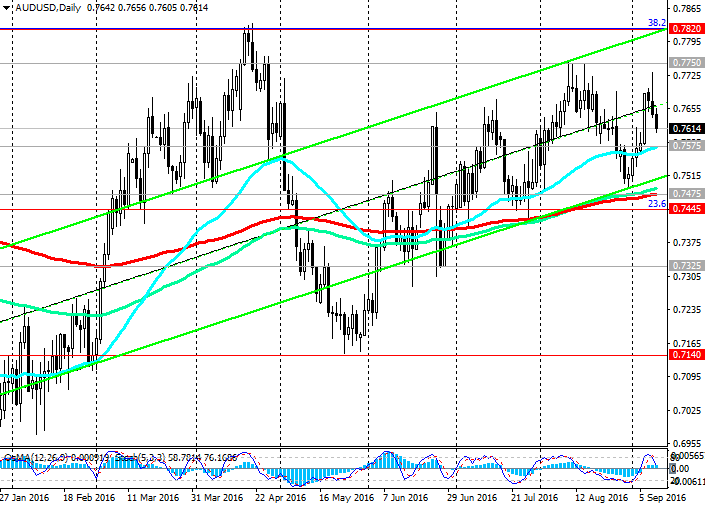

The AUD/USD has found support at the current levels of 0.7600, 0.7595 (EMA144, EMA200 on 4-hour chart). In the event of breakdown of the nearest support level will be the level 0.7575 (EMA50 daily chart). Indicators OsMA and Stochastic on the 4-hour, daily, weekly charts recommend short positions.

In case of breaking the support level of 0.7575, a decrease pair AUD / USD may continue to level 0.7520 (the lower line of the rising channel on the daily chart), 0.7475 (EMA200, EMA144 on the daily chart), 0.7445 (23.6% Fibonacci level of the correction to the wave of decrease in pair July 2014). If the negative trend prevails, the goals of further reducing the pair AUD / USD then can become levels 0.7325, 0.7140 (May lows).

The reverse scenario for the medium-term growth of pair within the rising channel on the daily chart will be supported in the event of breakdown of the resistance level 0.7750 (August highs). Then, the AUD / USD may continue to grow to the levels of 0.7820 (Fibonacci level of 38.2%, the April highs), 0.7900, 0.8000 (EMA144 on the weekly chart). The AUD/USD remains within the limits of two oppositely-directed channels - downtrend on the weekly chart and rising on the daily chart. However, while more preferred is short position.

Support levels: 0.7575, 0.7520, 0.7500, 0.7475, 0.7445, 0.7325, 0.7290, 0.7200, 0.7140

Resistance levels: 0.7685, 0.7720, 0.7750, 0.7800, 0.7820, 0.7900, 0.8000

Overview and Dynamics

Increasing the Fed in September still looks unlikely. This increases the pressure on the RBA to issue its easing monetary policy in Australia. Weak national currency could support the export-oriented sectors, such as tourism, education, as well as oil and gas and mining sectors of Australia's economy.

The forecasts of the central bank of Australia suggested that the rate of inflation in the country in the near future will remain weak. Inflation indicators, growth in the volume of retail sales in August and a report on production costs in the private sector for the 2nd quarter, were weak (0.0% and -5.4% respectively). Reserve Bank of Australia has carried out an easing of monetary policy in May and in August, lowering the rate from 2.0%, kept unchanged since last May, to a level of 1.5%.

Reserve Bank of Australia may further lower the rate on 4 October when will the next RBA meeting on this issue, or in November to spur economic growth if inflation remains low. And this is a negative factor for the AUD.

At 11:45 (GMT) President of the Federal Reserve Bank of Boston Eric Rosengren speaks today. It is interesting to hear his opinion on the US monetary policy prospects after negative US macroeconomic indicators, arrived earlier in the week, and after yesterday's ECB meeting. His comments may further support the US dollar.

At 17:00 report oilfield services company Baker Hughes in the US will be published in the number of active drilling rigs, which is an important indicator of the activity of the oil sector of the US economy and significantly affects the quotations of oil prices and commodity currencies such as the Canadian and Australian dollars. Increase in the number of drilling rigs could adversely affect oil prices and quotations of the Australian dollar.

Despite the rise in oil prices against the background of unexpectedly sharp reduction in US oil inventories last week, the pair AUD / USD declines at the end of the trading week. Reducing develops against the backdrop of the pulse received yesterday from the ECB inaction in terms of its monetary policy and profit taking at the end of the week trading in short positions on the US dollar.

The European Central Bank on Thursday left its policy unchanged, and its head Mario Draghi for the first time more than not declared for two years, no new measures to stimulate or on the preparation of any action in this direction. European stocks and government bonds fell in the European price, and commodity currencies have reacted quite sensitively on the decision of the ECB.

Lowering the oil may be only temporary, and next week the oil reserves may well show the opposite trend. Also, only a few participants in the oil market expect that OPEC will be able to reach an agreement to freeze production at the upcoming meeting this month in Algeria.

Trading recommendations

Sell on the market. Stop-Loss 0.7650. Take-Profit 0.7575, 0.7520, 0.7500, 0.7475, 0.7445, 0.7325

Buy Stop 0.7660. Stop-Loss 0.7610. Take-Profit 0.7685, 0.7720, 0.7750, 0.7800, 0.7820, 0.7900