Understanding the Offline AI Assistant in AI GOLD PRIME: A Practical User Guide

PART 1 – WHAT THIS AI IS AND WHAT IT DOES

What kind of AI is used in AI GOLD PRIME?

The AI inside AI GOLD PRIME is an offline AI assistant designed to observe real trading results and adapt the EA’s behavior over time.

This AI:

-

Does not predict price

-

Does not use neural networks or machine learning

-

Does not rely on cloud servers or external data

Instead, it learns only from completed trades and adjusts how actively the EA trades under different market conditions.

This makes it safe, stable, and suitable for real-money trading.

What does the AI actually do?

The AI has three main responsibilities:

1️⃣ Learns from closed trades (Offline learning)

The AI analyzes only closed trades — winning or losing.

From each trade, it understands:

-

Whether the trade was profitable or not

-

How strong the market was at that time

-

Whether the environment was trending, ranging, or volatile

This information is stored locally and is not lost when MT5 is restarted.

The AI never interferes with open trades.

It only learns after trades are completed.

2️⃣ Understands market conditions

The AI continuously evaluates:

-

Market volatility

-

Trend strength

-

Market stability vs. noise

Based on this, it identifies whether the market is:

-

Ranging (sideways and noisy)

-

Weak trend

-

Strong trend

-

High volatility (riskier conditions)

This allows the EA to behave differently depending on the market, instead of trading the same way all the time.

3️⃣ Adjusts activity and protects the account

Depending on conditions, the AI can:

-

Reduce trading activity during unstable markets

-

Slightly increase activity when conditions are favorable

-

Reduce trade size during poor performance periods

-

Temporarily pause trading after consecutive losses

The AI’s main goal is capital protection first, performance second.

Key strengths of this AI approach

✔ Works fully offline – no data sharing, no servers

✔ Learns only from real trading results

✔ Avoids overfitting and “black-box” behavior

✔ Designed for long-term, real-account trading

✔ Improves stability and drawdown control

How this AI differs from other “AI EAs”

| Common AI approaches | Typical problems |

|---|---|

| Price-prediction AI | Overfitting, unstable behavior |

| Neural networks | Black box, unpredictable |

| “AI” indicators | No real learning |

| AI GOLD PRIME | Adaptive control based on real trades |

This AI does not try to outsmart the market.

It focuses on adapting responsibly to market reality.

PART 2 – HOW TO USE THE AI (USER GUIDE)

This section explains only the AI assistant, not trading strategies.

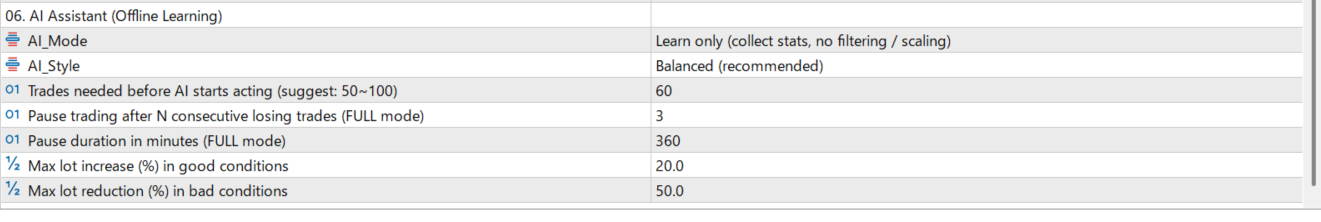

1️⃣ AI Operating Modes

The AI offers four operating modes, each serving a different purpose.

🔹 AI Disabled

The AI does not interfere at all.

-

No learning

-

No trade filtering

-

No risk adjustment

-

No protection after losses

Recommended only for:

-

Strategy testing

-

Debugging

-

Advanced users analyzing core behavior

Not recommended for live trading.

🔹 Learning Mode

The AI collects data only.

-

Records trade outcomes

-

Builds performance statistics

-

Does not filter trades

-

Does not change trade size

This is the recommended starting mode.

Use when:

-

Starting a new account

-

Changing broker or trading conditions

-

Running the EA for the first time

Typical duration:

-

2–4 months

-

Or until a sufficient number of trades is completed

🔹 Smart Mode (Recommended)

The AI actively supports trading.

In this mode, the AI:

-

Trades less during unfavorable or noisy markets

-

Trades more confidently in stable conditions

-

Slightly increases trade size in good environments

-

Reduces trade size when performance degrades

This mode provides adaptive behavior without being overly defensive.

Recommended for most users and most market conditions.

Typical duration:

-

4–8 months

🔹 Smart + Protection Mode

This is the most defensive mode.

In addition to Smart Mode features, the AI:

-

Temporarily pauses trading after consecutive losses

-

Enforces a cooldown period to avoid overtrading

-

Applies stricter filters during sideways markets

Recommended for:

-

Prop firm accounts

-

Traders with strict drawdown limits

-

Difficult or highly unstable market periods

Typical duration:

-

> 8 months

2️⃣ AI Activity Style (Behavior Intensity)

The AI can operate with different behavior intensity levels.

🟢 Safe

-

More conservative market evaluation

-

Earlier risk reduction

-

Fewer trades

-

Best for small accounts or prop firms

🟡 Balanced (Recommended)

-

Stable and neutral behavior

-

Balanced trade frequency

-

Suitable for most traders

🔴 Fast / Active

-

More aggressive market recognition

-

Higher activity

-

For experienced users only

3️⃣ When does the AI start making decisions?

The AI does not act immediately.

It becomes effective only after:

-

A sufficient number of completed trades

-

Enough data to make reliable decisions

This prevents the AI from reacting incorrectly to small sample sizes.

4️⃣ Protection after consecutive losses

In protection mode:

-

If several trades are lost in a row

-

The AI pauses trading for a defined period

-

Trading resumes automatically afterward

This feature helps:

-

Prevent emotional overtrading

-

Reduce drawdown during bad market phases

-

Enforce disciplined behavior

5️⃣ Trade size adjustment behavior

The AI:

-

Increases trade size only slightly and cautiously

-

Applies strict upper limits

-

Reduces trade size more aggressively during bad conditions

The design philosophy is simple:

Reduce risk quickly, increase risk slowly.

6️⃣ Best practices for users

✔ Start with Learning Mode

✔ Move to Smart Mode for daily use

✔ Use Protection Mode when safety is critical

✔ Let the EA run continuously

✔ Evaluate performance over weeks, not individual trades

Summary

The AI in AI GOLD PRIME is not a “magic button”.

It does not:

-

Chase the market

-

Predict prices

-

Override discipline

Instead, it acts as a risk-aware assistant, helping the EA decide when to slow down and when to act.

This AI is built for:

-

Real accounts

-

Real risk

-

Long-term consistency