The bears are back and this means safe haven flows. What’s next? Here is what the team at Morgan Stanley says:

Here is their view, courtesy of eFXnews:

The Bear is Back. The USD pause we called for last week has been short-lived, as bearish spirits have returned to global markets, and FX has been no exception. As we approach the long-awaited Brexit vote, uncertainty is rising regarding a Leave vote, which has been reflected in volatility markets. At the sametime, Chinese data has been quietly softening, and our economists believe we could be nearing the end of the latest mini-cycle.

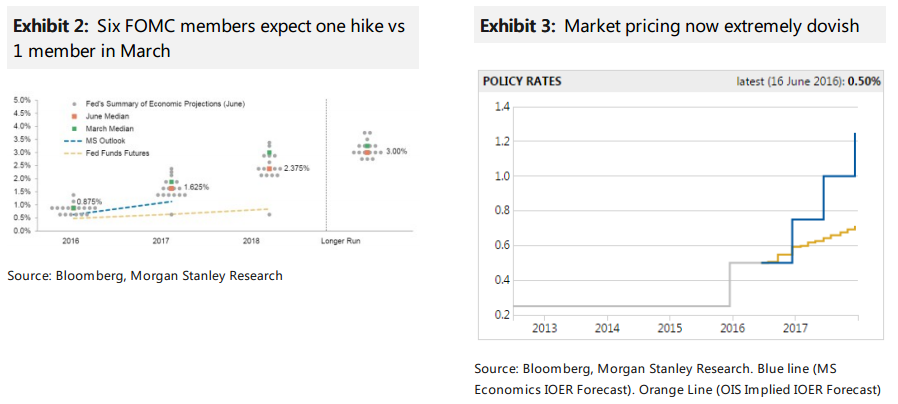

Fade the Fed. It is no surprise then that the Fed recently brought down its ‘dots’ and, as a result, the market has now pushed back the first hike to the end of 2017. However, we believe this dovish pricing will continue to have only a muted impact on USD as global growth concerns dominate. Indeed, the risks described above are likely to keep a bid for safety in place, making USD the most attractive currency excepting JPY.

On top of this, markets may have swung too far in pricing out the chance of a hike, and should we see a Remain vote and some pickup in US data expectations of tightening would likely rise once more, supporting USD.

JPY the Clear Winner. In this environment, our highest conviction view is to belong JPY. On top of the bearish risk factors mentioned above, it seems BoJ policy is limited in its ability to move the currency – the decision to remain on hold led to JPY strength, as have recent easing decisions. We prefer to go long against high-beta or commodity currencies,and hold our short CAD/JPY position.

*Morgan Stanley holds a short CAD/JPY and limit order to sell USD/JPY*