Look for uncertainty in the markets as investors look towards the FOMC for how bullish the US Fed thinks their economy will be. Expect further volatility in commodities and emerging markets as the global slowdown continues to spread.

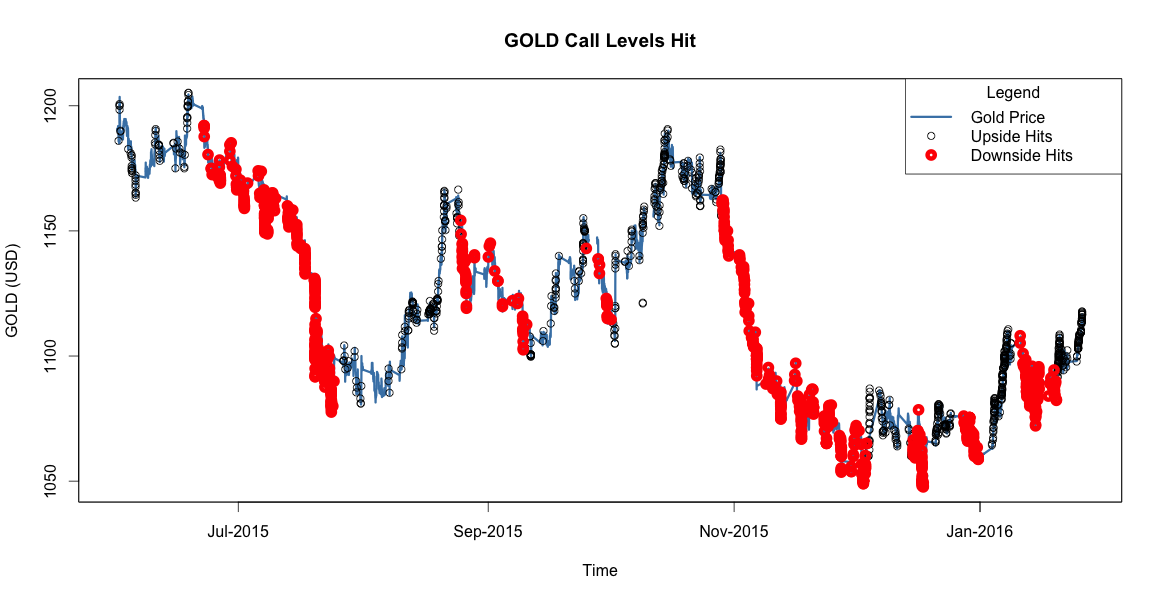

Watch XAUUSD @ 1103 - http://www.calvl.co/zJqAnnJ1/

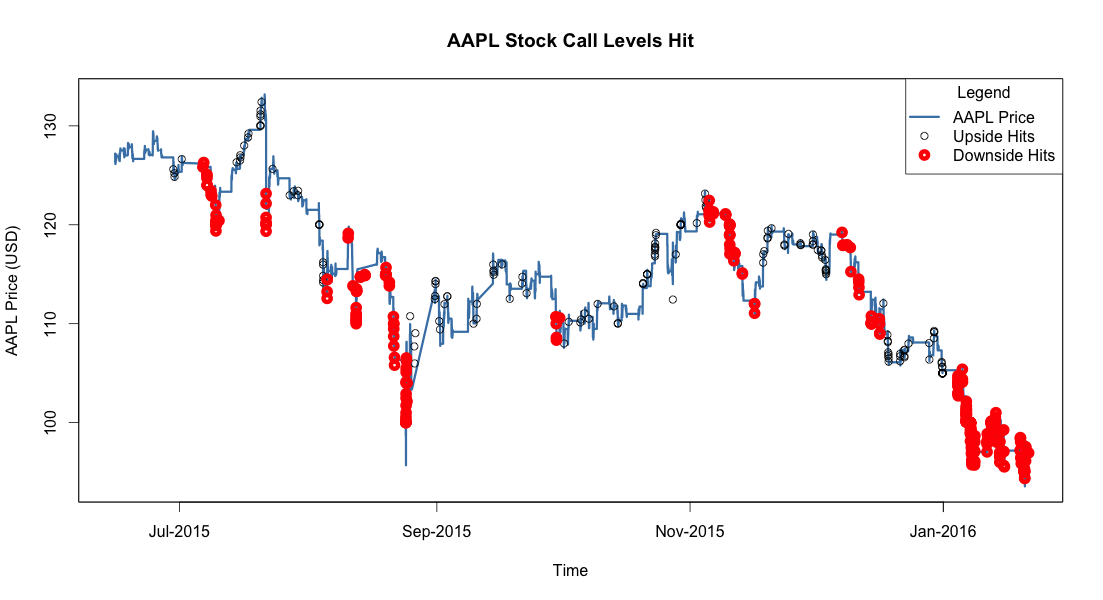

Watch AAPL @ 98.53 - http://www.calvl.co/lXoxD3O5/

Trading Updates with The Market Master

The S&P 500 staged a strong recovery as oil prices bounced on the cold front approaching the US Northeast coast. There is an inverse head and shoulders in the S&P500 at this juncture with a target of 1970, and the coming sessions will be key for the pair if bulls are to regain some bullish momentum. At this juncture, whilst a growth scare has certainly taken hold of the markets, a bounce and stabilisation in crude oil prices over the next few weeks should help to at least create a tradable bottom for the S&P500 and oil. We continue to keep a watch out for a potential ‘Lehman’ moment which is not obvious for now. However, we do note that volatility is very stretched right now and some sort of a mean reversion should be seen over the next few trading sessions, which we will use to exit our XIV position.

Watch S&P500 @ 1970 - http://www.calvl.co/1X32z1GV/

[Originally published on 2016-01-27 at http://blog.call-levels.com/setting-call-levels-saves-you-from-downside-in-the-markets/ . Republished with permission]