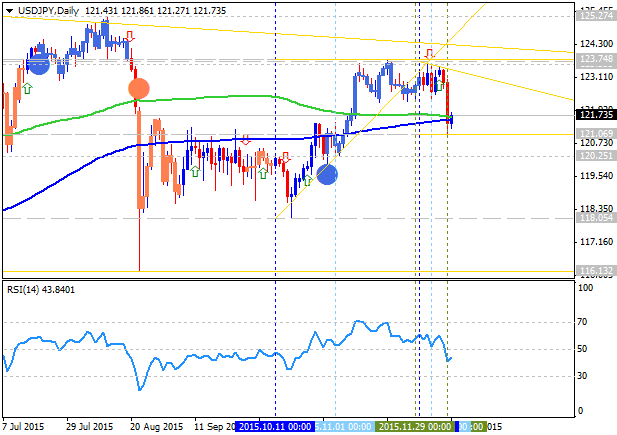

USD/JPY Daily Technicals: near 200 day SMA on reversal area waiting for direction

10 December 2015, 13:11

0

7 973

D1 price is near 100 day SMA (100 SMA) and 200 day SMA (200 SMA) waiting for daily bearish/bullish direction of the trend. The key support/resistance levels for this pair are the following:

- 121.06 support level located below 100 SMA/200 SMA in the beginning of the bearish area of the daily chart, and

- 123.78 resistance level located above 100 SMA/200 SMA in the bullish area of the chart.

RSI indicator is estimating the ranging bearish condition.

- If the price will break 123.78 resistance level so the bullish trend will be continuing.

- If price will break 121.06 support so the bearish reversal will be started.

- If not so the price will be ranging within the levels.

| Resistance | Support |

|---|---|

| 123.78 | 121.06 |

| 125.27 | 116.13 |

- Recommendation to go short: watch the price to break 121.06 support level for possible sell trade

- Recommendation to go long: watch the price to break 123.78 resistance level for possible buy trade

- Trading Summary: ranging for direction

SUMMARY : ranging