USD/JPY fails again near 121.63; BOJ - monetary policy unchanged by an 8 to 1 vote

2 November 2015, 12:11

0

943

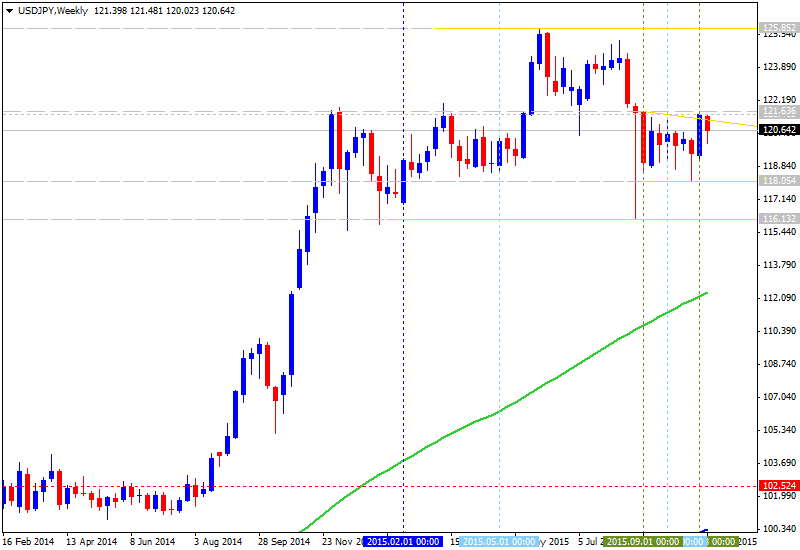

D1 price is on primary bullish condition with the ranging between 125.85 resistance level and 118.05 support level. The price is moved to be around 121.63/121.50 for the ranging market condition to be continuing.

- "The BOJ decision came with the Bank leaving monetary

policy unchanged by an 8 to 1 vote. The

price action in USD/JPY in response was actually quite interesting as

the exchange rate fell initially then rallied sharply to come within a

pip of two-month highs before turning down aggressively. It could all

just be month-end shenanigans, but classical technical analysis would

suggest the rate is vulnerable here following that second failure in a

week around 121.50 as it sets ups a fairly clear double top near the top

end of the range."

-

"The near-term cyclical view is predictably a bit of a mess given how

choppy things have been these past couple months."

- "However, last week’s

high close in USD/JPY did occur exactly 17.2 years (Armstrong Pi cycle)

from the high in 1998 so the exchange rate should probably be monitored

closely here to see if this latest decline actually morphs into

something."

- "Traction under 120.00 would trigger the aforementioned double-top and set the stage for a move towards the bottom end of the range, but it is going to take traction sub-118.00 to get excited about anything of substance developing on the downside."

Trend:

- W1 - ranging bullish