As Glencore's shares hit record trough, analysts reflect on who will be next

Anglo-Swiss commodity and mining giant Glencore saw its shares drop another 26 percent on Monday with analysts highlighting that the weakness is likely to be reflected in the entire sector.

Glencore was on its way for its worst

intraday move on record with shares plummeting 75 percent year-to-date and

85 percent since its flotation in 2011.

Weaker commodity prices and softening

Chinese demand have put the brakes on the formerly formidable rise the

sector enjoyed over the last decade, but analysts have suggested that

Glencore's main problem is actually its debt load.

"Mining companies gorged themselves on cheap

debt in a race to grow production following the Chinese stimulus that

occurred in the wake of the (global financial crash)," Investec analysts, led by Hunter Hillcoat, said in a note on Monday

morning.

"The consequences are only now coming home to roost, as mines take a long time to build."

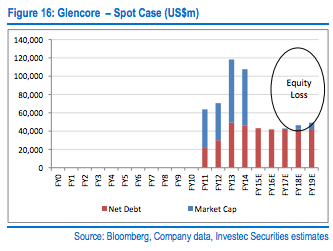

Glencore had a higher debt base than its counterparts and a lower-margin asset base, Investec said adding that its debt levels would still be above its rivals despite an intense period of restructuring over the next five years.

Analysts detailed a scenario of weakening commodity prices -

which is not its base case scenario - where they see an almost total crash in potential earnings for Glencore as the firm would be

solely working to repay debt obligations. Under this scenario, shareholder value would be totally eliminated:

The FTSE 100-listed company, which specializes in copper, coal, nickel and zinc, has announced it would be scrapping its shareholder dividend and partaking in an equity issue. On Monday, it was confirmed that it would be selling a nickel mining project in Brazil to Horizonte Minerals for $8 million.

On Thursday, Goldman Sachs said in a note that Glencore's steps to trim debt and bolster its balance sheet were inadequate.

Last week, Credit Suisse slashed its earnings

estimates for the metals and mining sector.

Who will be the next to suffer?

Glencore's closest rivals weren't safe from the drop in share prices, or from

the pessimism noted in Investec's research.

"While the picture is less extreme for BHP Billiton and Rio Tinto, they too would face a substantial challenge to meet management's apparently steadfast commitment to maintaining dividends, which we estimate would consume 50 percent of ongoing operating cash flows in this scenario," the investment bank said, adding that Anglo American is also in a more vulnerable position than BHP Billiton or Rio Tinto if commodity prices remain under pressure.

Anglo American's shares slipped 8 percent,

while BHP Billition and Rio Tinto both slid 4.7 percent. Traders in

London highlighted the Investec note for the further weakness in the

sector.

Brenda Kelly, the head analyst at London Capital Group, said in a note Monday that the copper price is currently "scraping its knuckles on the floor and trading at $2.27 a pound."

Investec's note this morning is hardly helping, she said.