Market under pressure after Investec's downbeat note on Glencore

City firm Investec has driven the rout in shares of commodity trading company Glencore today, with a very bearish analyst note, which also weighed on the market.

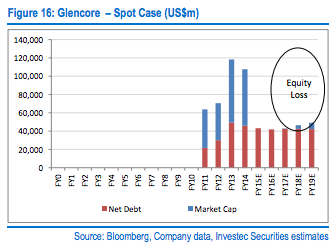

“The challenging environment for mining companies leads us to the question of how much value will be left for equity holders if commodity prices do not improve.”

Below is the key slide from today’s Investec report which shows how Glencore investors could be hurt unless commodity prices scramble back.

The company's shares have now lost 20%.

Glencore, however, argues that its debt pile is less dangerous than it appears, because it holds large reserves of copper and iron ore which can be sold if needed.

The company has just raised $2.5bn in a new equity issue - at 125p per shares, and is also trimming its dividend to help cut $10bn from its $30bn debt pile.

But with the Chinese economic slowdown continuing, and commodities prices slumping, will this be enough?

Meanwhile, the Guardian reports that Glencore is turning into one of the greatest destructions of shareholder value in recent years. Its shares have fallen steadily since floating just four years ago - today’s selloff means they’ve lost 84%.

Glencore launched a debt restructuring last month, to cut its borrowings from $30bn to $20bn. Economists estimated that the company’s debt pile could become increasingly hard to manage, unless commodity prices rally.