Oil Market Faces Dual Challenge: Oversupply Now, Decline Risks Ahead

The oil market rarely offers a straightforward narrative, but this past week has been particularly confusing for traders. On one side, headlines continue to emphasize oversupply and weak demand as reasons for lower prices. On the other side, the International Energy Agency (IEA) has raised the alarm about accelerating decline rates in oil and gas fields, warning that without sufficient upstream investment, the world could face tighter supply in the years ahead.

For traders, this dual storyline creates a paradox: crude looks heavy in the short term, but the longer-term picture points to scarcity risks that could eventually push prices higher.

Oversupply Still Dominates the Short-TerEarly in the week of September 8–12, the IEA and several research desks highlighted a build-up in supply that could exceed demand in the second half of 2025. Non-OPEC producers such as Brazil and Guyana are adding barrels, while OPEC+ members have slowly brought more production online. Meanwhile, U.S. demand indicators have softened, with refinery intake slowing and gasoline consumption lagging seasonal norms.

The result: Brent and WTI both struggled to hold gains, even when geopolitical risks were in the background. Traders focused on oversupply, and the market’s inability to rally was itself a bearish signal.

In short: oversupply, weaker U.S. demand, and higher inventories defined the near-term tone.

IEA Highlights a Very Different Risk

Just days later, on September 16, the IEA released another report, this time pointing to a different danger: decline rates in existing oil and gas fields are accelerating. Many fields are past their peak and now require heavy investment just to maintain production.

The warning is clear: if companies fail to invest, millions of barrels per day could be lost to natural depletion. In practice, this means that today’s oversupply could turn into tomorrow’s shortage.

For the trading community, this was a striking shift in tone. One week: too much oil. The next: not enough oil in the future.

Brent Technical Outlook

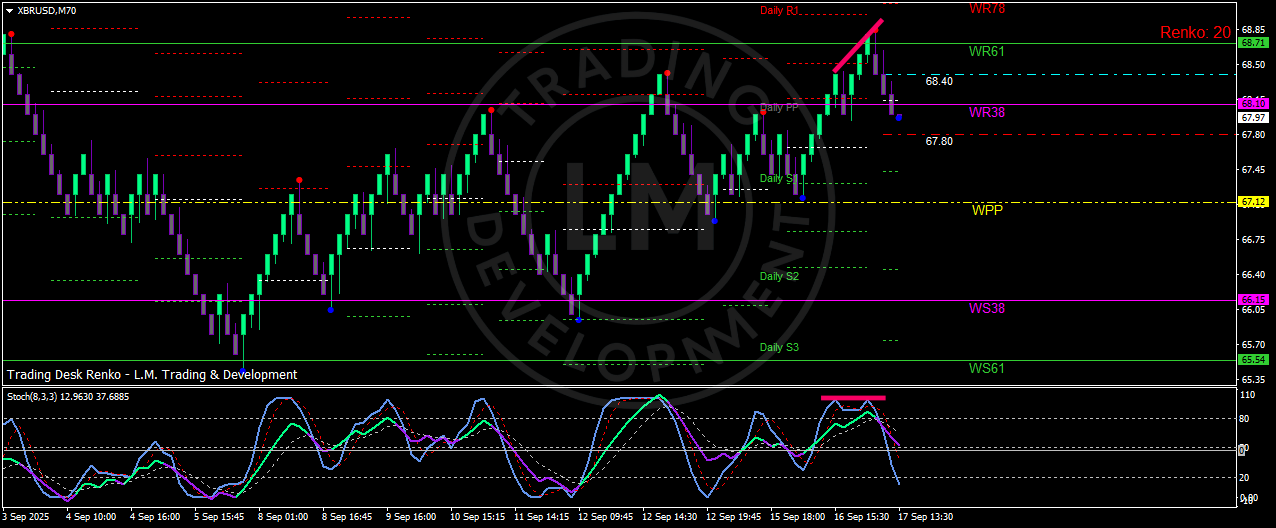

Technical levels are reflecting this indecision.

| Resistance | Support |

|---|---|

| WR78 – 69.14 | 68.40 (intraday pivot) |

| Daily R1 – 68.70 | WR38 – 68.10 |

| 67.80 (local lows) | |

| WPP – 67.12 | |

| WS38 – 66.15 |

Bias: Bearish below 68.40. The rejection at WR78 69.14 combined with bearish divergence on the Stochastic oscillator suggests momentum has faded. Short-term pressure points toward 67.80 and possibly 67.10. Only a breakout above 69.14 would reopen upside potential toward 69.50–70.00.

Trading Implications

For short-term traders, the oversupply narrative is still in control. Selling rallies toward resistance makes sense as long as Brent stays capped below $69.14. Inventory data and U.S. gasoline demand remain key intraday drivers.

For medium- to longer-term traders, the IEA’s warning on decline rates matters more. If upstream investment remains weak, the supply cushion could erode quickly. In that case, dips into support zones might become attractive accumulation points, especially if macro demand indicators stabilize.

This creates an asymmetric risk profile:

-

Downside in the short term may be limited, as supply risks remain in the background.

-

Upside shocks could be violent if sentiment flips on investment concerns or geopolitical disruptions.

Macro Drivers to Watch

-

U.S. Inventories: Weekly EIA reports remain crucial for gauging demand.

-

China’s Data: Industrial production and retail sales figures will influence demand expectations.

-

OPEC+ Policy: Any adjustments in supply quotas could alter the balance in Q4.

-

Capex Announcements: Oil majors’ investment plans will determine whether the IEA’s warnings materialize.

Conclusion

The oil market is facing a classic commodity dilemma. Near-term oversupply and weak demand are capping rallies and weighing on sentiment. At the same time, the longer-term sustainability of production is in doubt as decline rates accelerate.

For traders, the message is clear:

-

Respect the short-term bearish bias below $68.40.

-

Keep an eye on supports at $67.80 and $67.10.

-

Be prepared for volatility if capex or geopolitical headlines trigger a re-pricing.

In other words, the market is trapped between today’s surplus and tomorrow’s scarcity.

Traders should brace for choppy price action as these two forces collide.