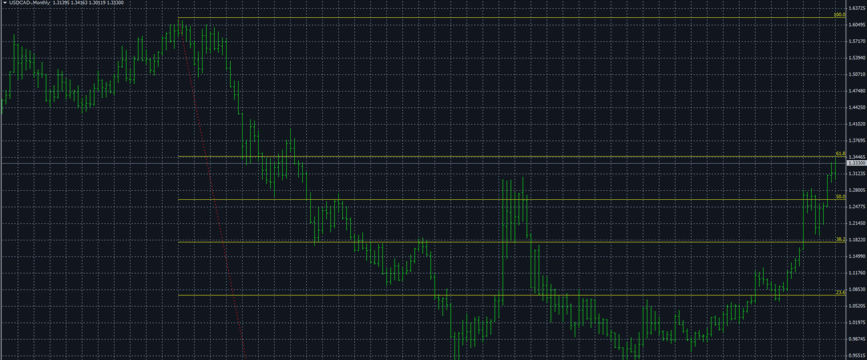

USD/CAD currently at 1.3330 just 85 pips shy of its recent high. This currency pair made its recent high of 1.3415 on Sept 24th but closed below for the week.

Now the question is how high it can go?

I wish, I have the answer for you. I am sure all market pundits are scratching their head to find the answer.

All I can tell you, that, this is not all time high for this currency pair. USD/CAD was at 1.6130 on Feb 2002. I have only analyzed data since 1998. USD/CAD was at current level 11 years ago.

What drives the currency price? “Economic condition” of a country among other things. Forex traders have to follow the fundamental issues of a country to determine the health of that country which also reflects on its currency. For that reason, traders all over the world keep their eyes on the economic calendar. Governments release economic data every week. GDP, Employment report, CPI, Retail Sales etc.

Canada is a commodity-dependent country. A big chunk of its revenue come from the oil industry. In recent years, the price of crude oil dropped significantly. A few years back, it was at USD $100 per barrel and now it’s $46. Some experts are calling for $20. Alberta and some eastern provinces are hurting from this price drop and for that reason Canada’s GDP is falling short. On the other hand, U.S. economy is much healthier among all other G7 countries. U.S. Federal Reserve Chair Janet Yellen is talking about rate hike this year, whereas Canada just cut its interest rate recently and may cut it again if the economy doesn’t improve. Rate differential is another big factor for currencies. If U.S. hike its interest rate, then, the U.S. dollar will go much higher against all other currencies including Canada. Canada needs higher oil price to boost its economy and I don’t see it in the near term.

USD/CAD has more room to go higher, but 1.3450 may work as a short term resistance which is also at 61.8% Fibonacci Retracement.

We need to keep our eyes on Oil price as well as the Fed rate decision to determine USD/CAD price action. Trading opportunities are still there no matter what the outcome.