Societe Generale made some review for Non-Farm Employment Change report (Change in the number of employed people during the previous month, excluding the farming industry) which will be on Friday:

- "There’s a risk that we see edgy markets in the meantime...At the risk of sounding like a broken record, the case for raising rates to less unusually low levels does not rest on wage growth or inflation returning in earnest first. Rates are too low, and capital is misallocated as a result."

-

"More than the wage data however, we’d focus on the unemployment rate. We

look for a solid 240k increase in non-farm payrolls, a 2.2% increase in

hourly earnings and a drop to 5.2% from 5.3% in the unemployment rate."

-

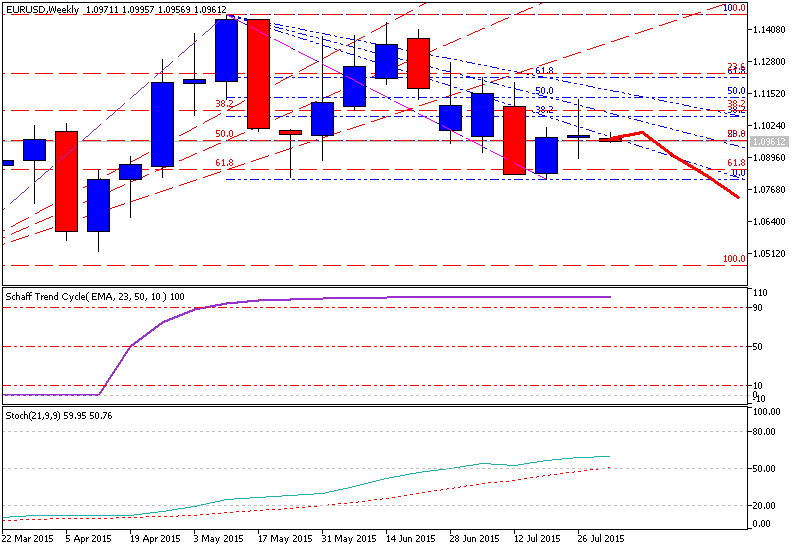

"Anything that gets the front end of the curve higher in the US should be negative for EUR/USD. A meander back above 1.10 is possible in the early part of the week, but we’d like to sell against 1.11 and look for a break lower in August."

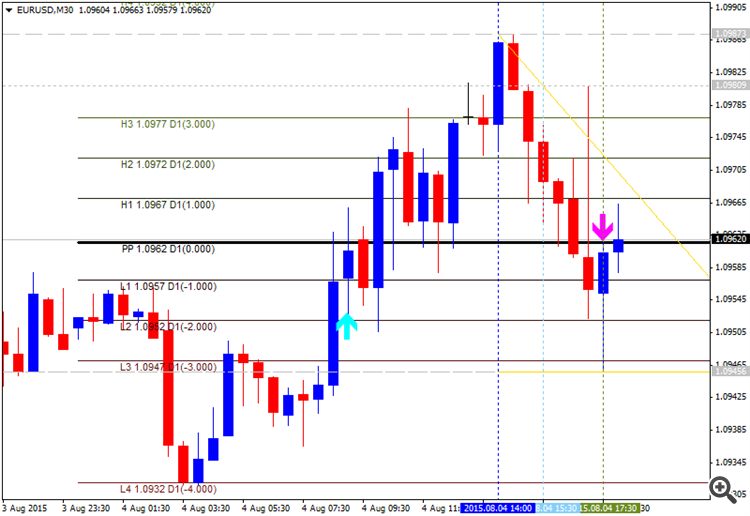

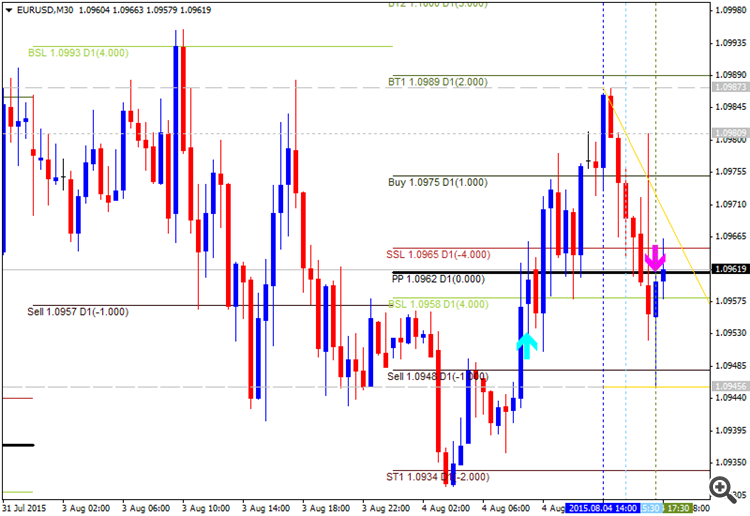

Just to remind that previous NFP data was 223K, and forecasting for this Friday is around 224K for example (from 222K to 225K), so if Societe Generale is looking for 240K as an actual data for this Friday - it means to be more bearish for EURUSD. Because in case of NPF: actual > forecast = good for currency (for US Dollar in our case). So, it means: more bearish for EURUSD with some key support levels to be broken. And 'Unemployment Rate' is forecadting to be 5.2% from 5.3% by SG (for 'Unemployment Rate': actual < forecast = good for currency).

Thus, I think - it may be good bearish breakdown during this high impacted news event.