Goldman Sachs official macro forecast - things aren't looking good this year

27 July 2015, 06:11

1

1 015

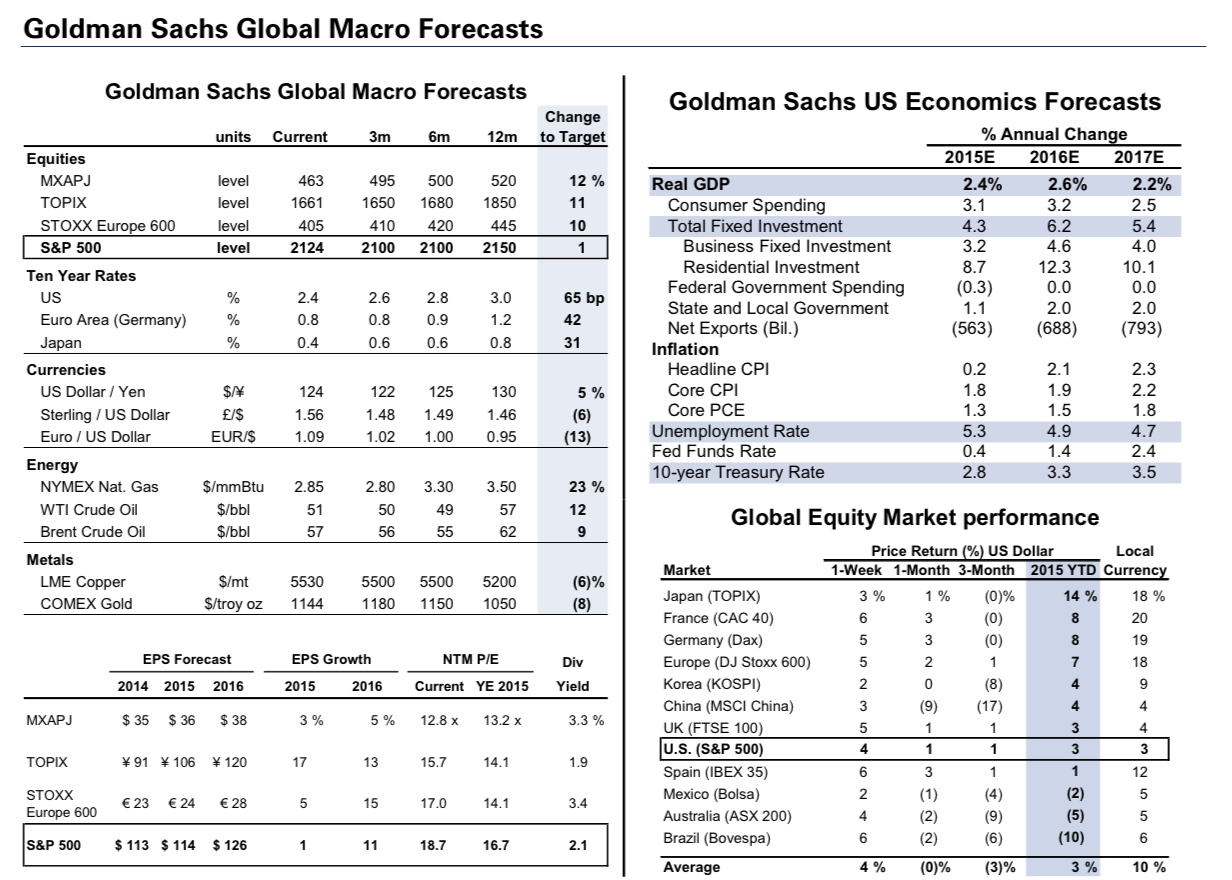

Goldman Sachs' chief equity strategist David Kostin made a long-term macro forecast for S&P 500, currencies, energy, metals and equity, and - after summarizing all those market forecasts - he decided that things aren't looking good this year. Besides, Kostin provided a slide summarize Goldman's market forecasts, both for the United States and the world:

As we see - David Kostin made forecasts based on 3 months, 6 months and 12 months. And this is what we are having as a result:

EUR/USD | USD/JPY | GBP/USD | S&P 500 | Comex Gold | Crude Oil Brent | |

|---|---|---|---|---|---|---|

| October 2015 | 1.02 | 122 | 1.48 | 2100 | 1080 | 56 |

| January 2016 | 1.00 | 125 | 1.49 | 2100 | 1150 | 55 |

| July 2016 | 0.95 | 130 | 1.46 | 2150 | 1050 | 62 |

So, this is really about 'things aren't looking good this year'... and for next year as well for example.

As to me expectation so I see the following (using my personal technical analysis) - by January 2016:

- EUR/USD: 1.04;

- GBP/USD: 1.45;

- USD/JPY: 125;

- S&P 500: 2130;

- Gold: 1000;

- Crude Oil Brent: 45.