Trading News Events: US Retail Sales to Rebound After Holding Flat in April

Signs of a stronger recovery may encourage the Federal Open Market

Committee (FOMC) to adopt a more hawkish tone at the June 17 interest

rate decision, and expectations for higher borrowing-costs may spur a

resumption of the long-term bullish USD trend as the central bank moves

away from its easing cycle.

Nevertheless, retail sales may continue to disappoint amid easing

discounts paired with waning consumer confidence, and another

weaker-than-expected report may drag on the dollar as it raises the for a

further delay in the Fed’s normalization cycle.

How To Trade This Event Risk

Bullish USD Trade: U.S. Retail Sales Rebounds 1.2% or Greater

- Need red, five-minute candle following a positive print to consider a short EUR/USD trade.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same setup as the bullish dollar trade, just in reverse.

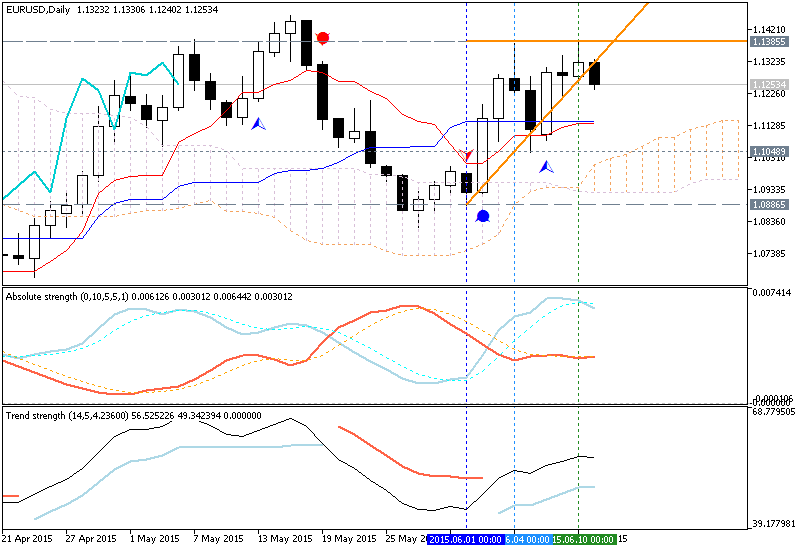

EURUSD Daily

- EUR/USD appears to be stuck in a long-term wedge/triangle formation following the failed attempt to test the February high back in May; remains at risk for range-bound prices as market participants weigh the outlook for monetary policy.

- Interim Resistance: 1.1510 (61.8% expansion) to 1.1532 (February high)

- Interim Support: 1.0970 (38.2% expansion) to 1.1000 (50% retracement)