Technical Analysis: The Next Big Levels in EURUSD, GBPUSD and USDCAD by Goldman Sachs

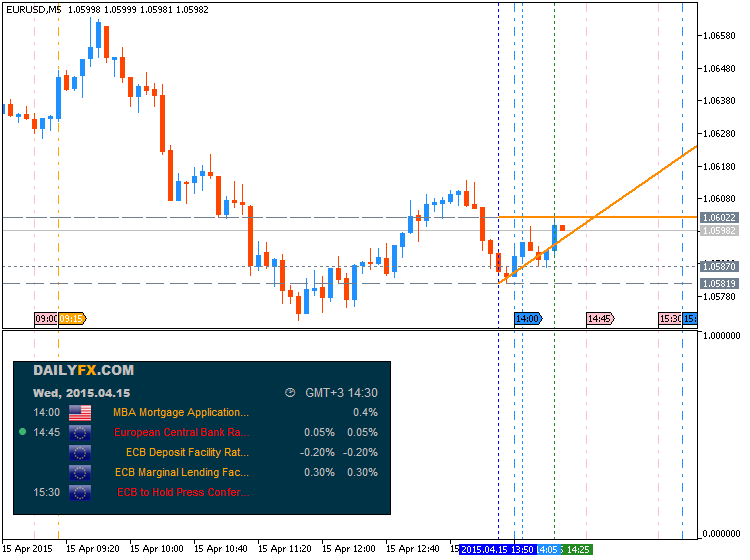

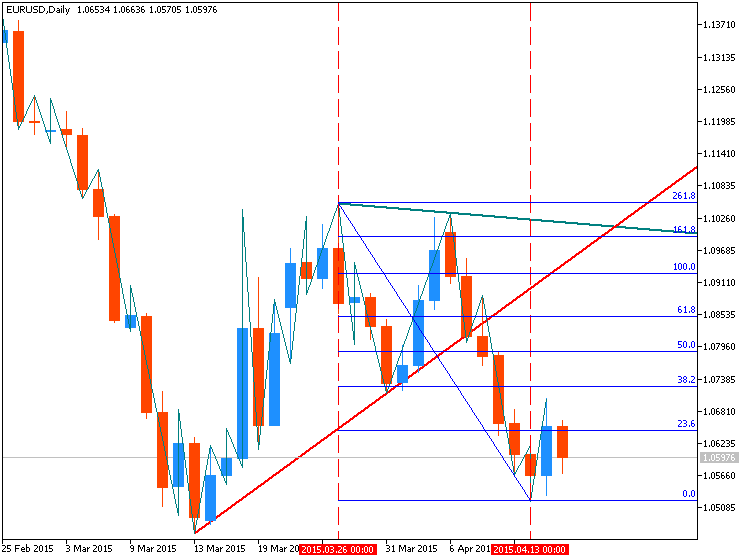

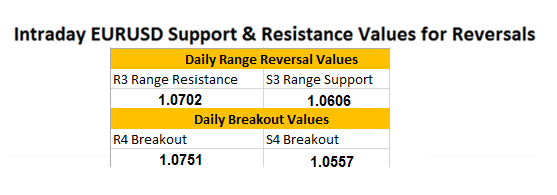

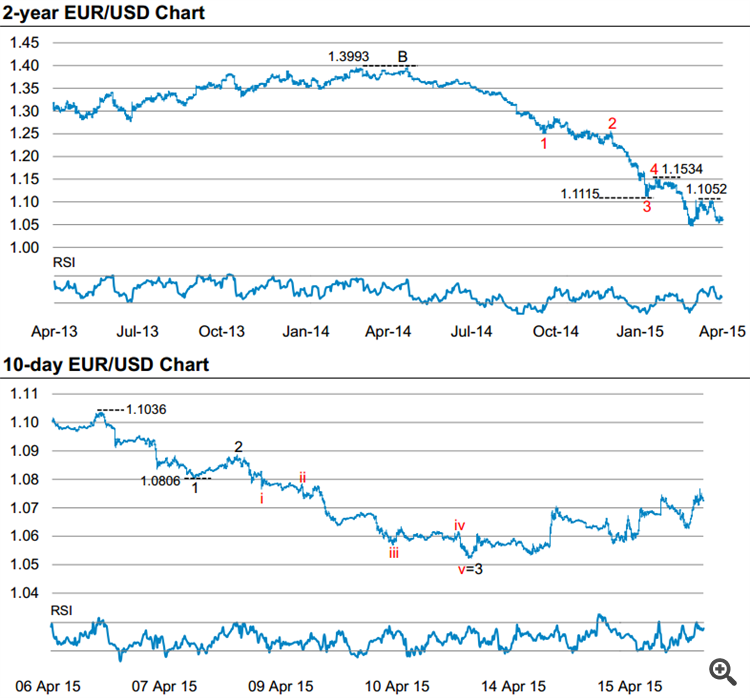

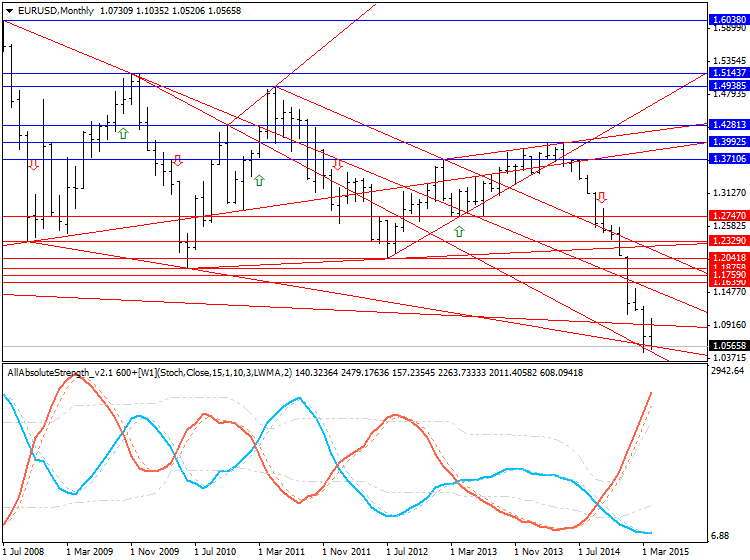

Starting with EUR/USD, GS notes that it peaked least week right underneath an important resistance area at 1.1052-1.1099, a region included the interim high (bearish key day reversal) from Mar. 26th , the interim low from Jan. 26th and the 55-dma.

"It’s since broken lower from a triangle type pattern (ABCDE). Triangles tend to be characteristic of wave 4s which in this case suits the underlying wave count and implies that there is further downside potential. The next near-term support stands down at 1.0487- 1.0458 (1.618 extension from Mar. 26th and the low from Mar. 15th)," GS projects.

Bigger picture, GS targets f EURUSD at 1.0286-1.0103 pivot which includes 76.4% retrace of the entire ‘00/’08 rise as well as an equality target taken from the Jul. ’08 peak.

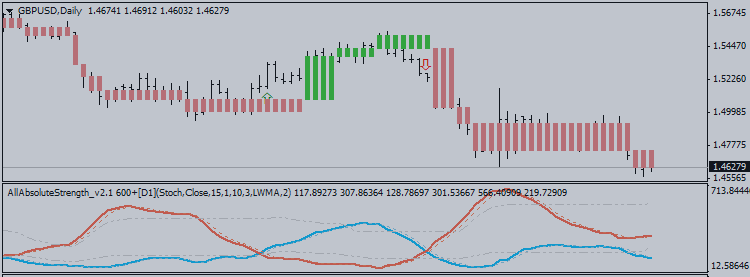

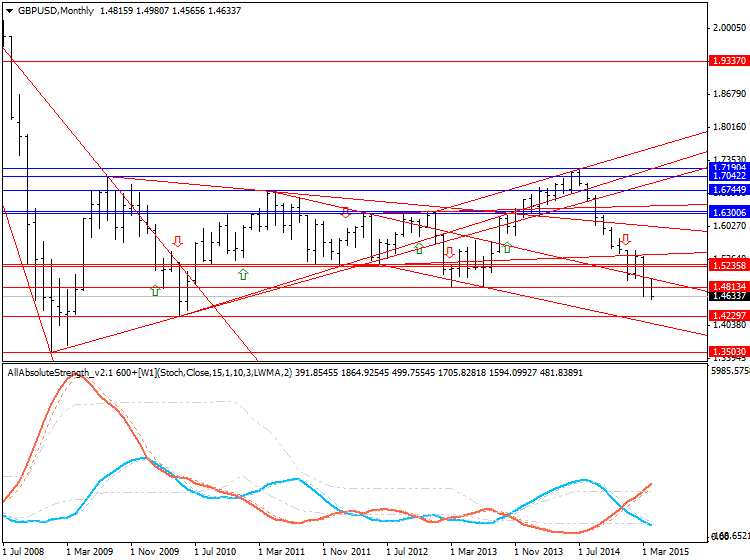

Moving to GBP/USD, GS notes that it has broken trendline support and this should in theory be a strong signal opening up potential to accelerate lower.

"The next big level lower is 1.4372-1.420. This

includes two long-term Fibonacci retracements and the low from May

’10...Put simply, it appears that GBPUSD is gradually making its way

down to the bottom of its multi-decade range," GS projects.

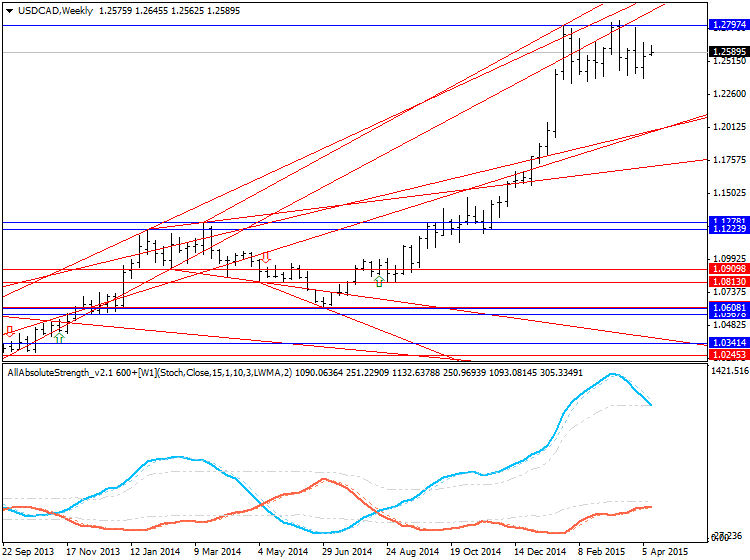

Finally in USD/CAD, GS thinks that the focus should be back on the range highs; 1.2799-1.2835.

"Would however need a clean break above 1.2799-1.2835 to cancel out the

risk of a double top and to diminish the bearish implications of the

bearish key day reversal which formed on Mar. 18th . Ideally want to play the range until a break in either direction is finally attain," GS advises.