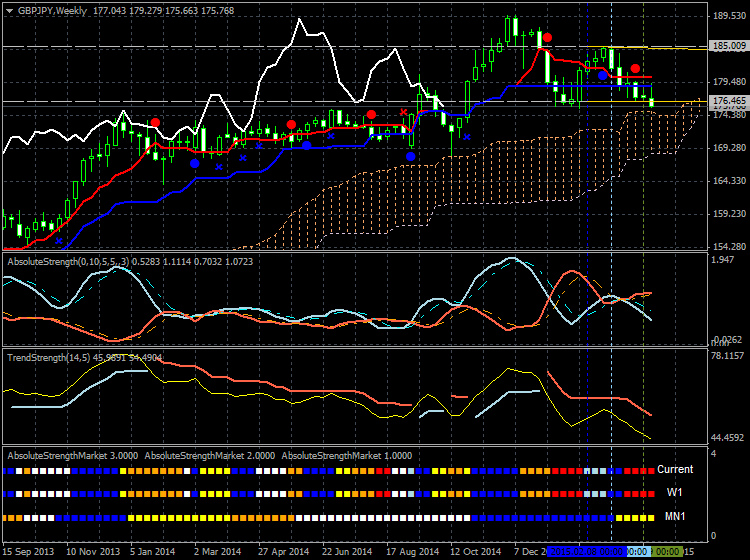

If the GBPJPY continues to move lower from the current levels, then a break below the recent low 176.46 on close W1 bar

The British pound was seen trading lower against the Japanese yen, as the latter one was bid across the board. Plus, the British also weakened in the short term igniting downside reaction in GBPUSD, GBPJPY. There are a few major releases lined up in the UK, including the industrial production data and the manufacturing report. The UK Industrial Production measuring outputs of the UK factories and mine will be released by the National Statistics. The forecast is lined up for an increase of 0.3% in February 2015, compared to the previous decline of 0.1%. Let us see how the outcome shapes and affects the British Pound moving ahead.

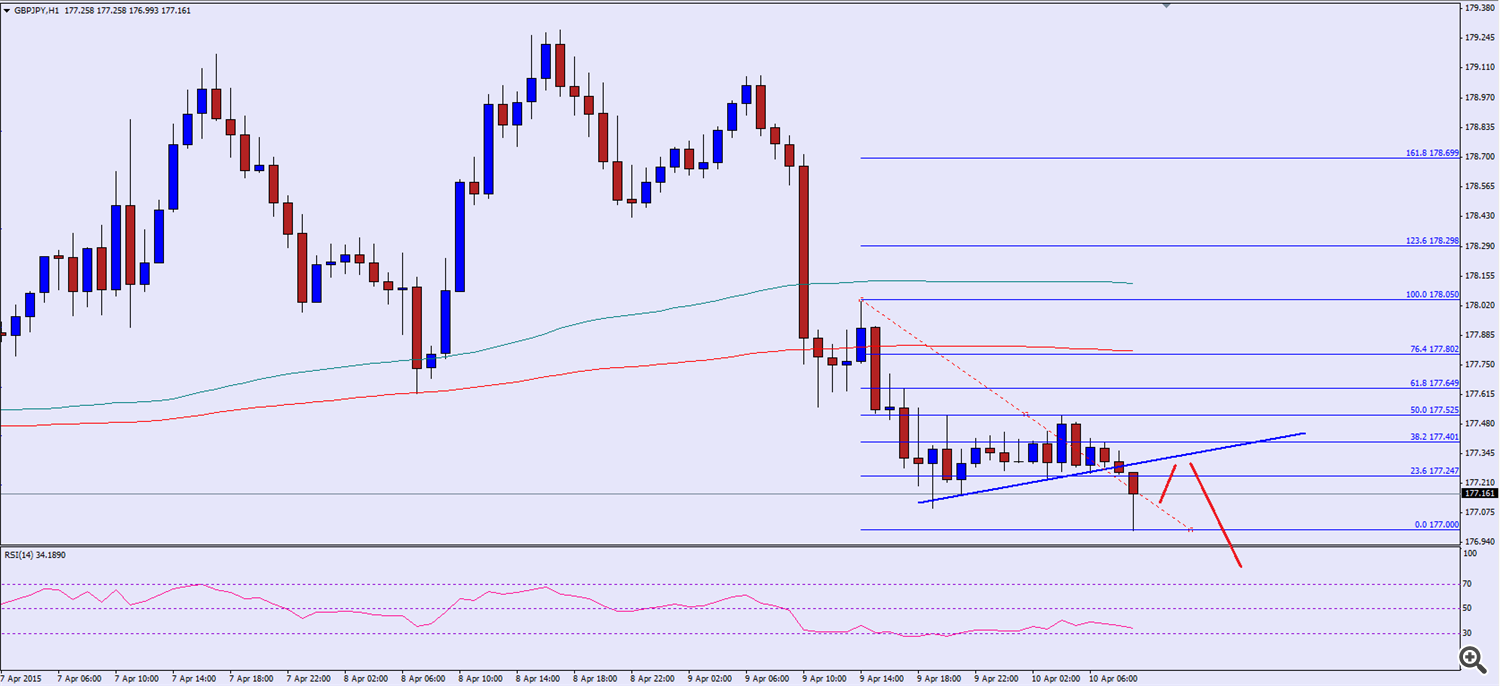

There was a minor bullish trend line formed on the hourly chart of the GBPJPY pair, which was broken recently by sellers. There was a sharp downside reaction after the break and the pair was seen testing the 177.00 area. The British pound buyers managed to protect losses around the mentioned area and it is currently correcting higher. However, it faces the same trend line as resistance, which is also coinciding with the 23.6% fib retracement level of the last drop from the 178.05 high to 177.00 low. The hourly RSI is well below the 50 level signalling more losses in the near term. Moreover, the 100 and 200 simple moving averages on the way up are also barriers for the pair.