Forex Scalpers should always identify market conditions before trading

Factor in the spread to reduce transaction costs

Consider liquidity when trading to maximize trading

Scalpers are continuously faced with choices and tough decisions when trading Forex. On a day to day basis however, none is as important as deciding which currency pair to trade. Choosing a currency not only will affect the strategy we choose but ultimately our profitability as well. So today we will review two key factors that need to be evaluated prior to implementing your favorite scalping strategy.

Spreads and Cost

Spreads and costs should be on every trader’s minds, but they are

particularly important to scalpers. Since scalpers tend to favor high

frequency strategies, this means they will incur the spread more often

than their average positions trader. So throughout the trading year, to

keep costs down scalpers should gravitate to pairs with lower spreads.

Let’s look at an example.

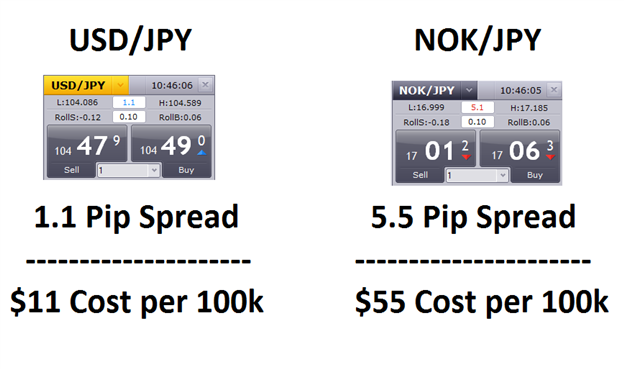

Above we can see the effects of trading a currency with a lower spread

by comparing two yen pairs. First we have the USDJPY with a 1.1 pip

spread compared to the NOKJPY with a 5.5 pip spread. Being Yen pairs at

some point a trader may have to decide between the two pairs above.

However when looking at spreads it should make this decision

considerably easier. It costs more to trade the NOKJPY! Traders save

approximately $44 in spread costs per 100k transaction trading the

USDJPY!

Liquidity

Next when choosing a currency pair it is also important to consider

liquidity. Liquidity in Forex is easily defined as the amount of

currency quoted at any specific price point. Scalpers should value

liquidity because it will ultimately coincide with the ease we enter and

exit the market.

From a traders perspective, illiquid markets are known to be volatile and are more prone to market gaps based off of fewer buyers and sellers present in the market place. This happens since every buyer must transact with a seller, and the further they are off in regards to price the more a pair is prone to jump while exposing scalpers to slippage. This is compared to a deep market where there is a breath of market volume at multiple pricing points. With more liquidity available we increase the ease that we can enter and exit the market because more buyers and sellers are readily available to cross a scalper’s transaction.

Currency Pairs

Now that you know what to look for it’s time to narrow the field of

potential pairs for scalping. Out of 56 different pairs,

traders should consider scalping pairs comprised of the G8 currencies

shown above or one of the Forex Majors pictured below. These pairs are

comprised of the most frequently traded currencies in the world which

helps when it comes to factoring in both spreads and liquidity.

Now that you are a little more familiar with the best currency pairs for

scalping, we can now begin to look at the technical aspect of trading.