Fundamental Weekly Forecasts for US Dollar, USDJPY, GBPUSD and AUDUSD

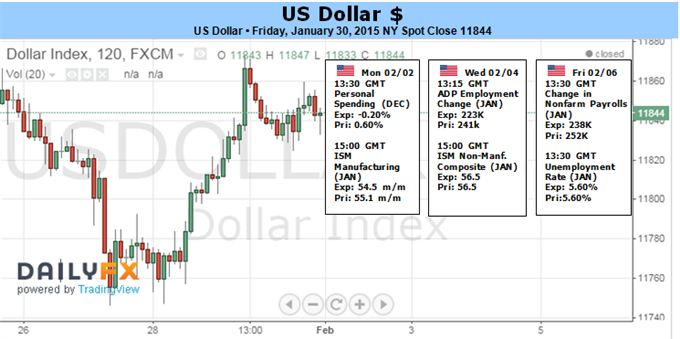

US Dollar Forecast– NFPs and the PCE inflation indicator will further stir hawkish Fed expectations, but the theme may be mature

The net change in payrolls isn’t nearly as important

as the ‘qualitative’ figures. The jobless rate has already touched past

year milestones for rate hikes – a few years ago, then Chairman Ben

Bernanke tied a first rate hike to an unemployment rate of under 6.5

percent. It is currently 5.6 percent. Perhaps the inflation aspect of

the labor data is the lynchpin. Wage growth has struggled to catch

traction. A particularly weak showing here, on the other hand, could

reinforce the more distant timeline the market has on hikes and instead

lead to a downgrade in FOMC forecasts at the March meeting.

Japanese Yen Forecast – Disappointing US economic data enough to keep pressure on USDJPY

The correlation between the USDJPY and the Nikkei

225 index has weakened notably as of late; recent gains in Japanese

equities have not been enough to lift the exchange rate. Yet a further

rise in equity market volatility would likely restore said link, and

we’ll keep a close eye on global equity markets as the US S&P 500 registers its second-consecutive monthly decline. Continued losses could be enough to send the USDJPY through key support.

British Pound Forecast – Pound May Rise as 4Q UK GDP Data Boosts BOE Rate Hike Bets

GBP/USD may continue to carve a string of

lower-highs in the week ahead as market participants speculate the

Federal Reserve to normalize monetary policy ahead of its U.K.

counterpart, and the pair remains at risk for a further decline over the

near-term as the Relative Strength Index (RSI) largely preserves the

bearish momentum carried over from the previous year.

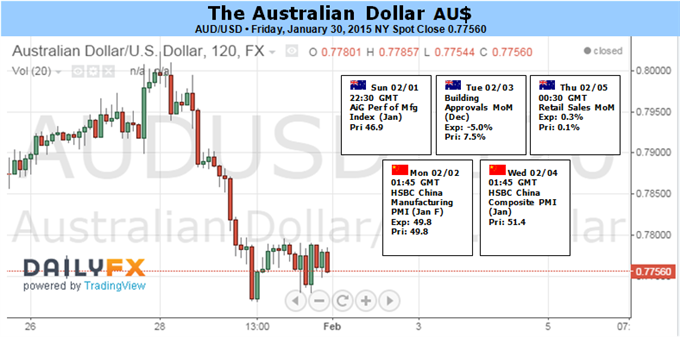

Australian Dollar Forecast – Australian Dollar May Bounce if RBA Opts Against Dovish Posture

Realized data outcomes have also increasingly

outperformed relative to consensus forecasts since the last RBA outing

in December. If this encourages the RBA to look through near-term price

declines and fall in with the Fed/BOE side of the argument – catching

markets off-guard with another neutral policy statement – a swift Aussie Dollar rebound is likely in the cards.