Sticky CPI and Weak Jobs: Dollar Struggles, Gold Extends Gains

Macro Background

The August U.S. data delivered a mixed signal that left traders with no easy answers. Inflation surprised on the upside, with headline CPI rising 0.4% m/m against expectations of 0.3%. Core CPI matched forecasts at 0.3%. On a yearly basis, headline inflation printed 2.9% y/y, slightly above consensus.

At the same time, the labor market sent a clear warning. Unemployment claims jumped to 263K, well above the 235K expected, marking the highest weekly print since early 2023. Combined with last week’s weak Nonfarm Payrolls report (+22K jobs) and negative revisions, the picture of cooling employment is becoming harder to ignore.

For the Federal Reserve, this combination is difficult: inflation is still sticky, but growth momentum and labor strength are fading quickly.

Market Reaction

Markets responded with sharp intraday swings.

-

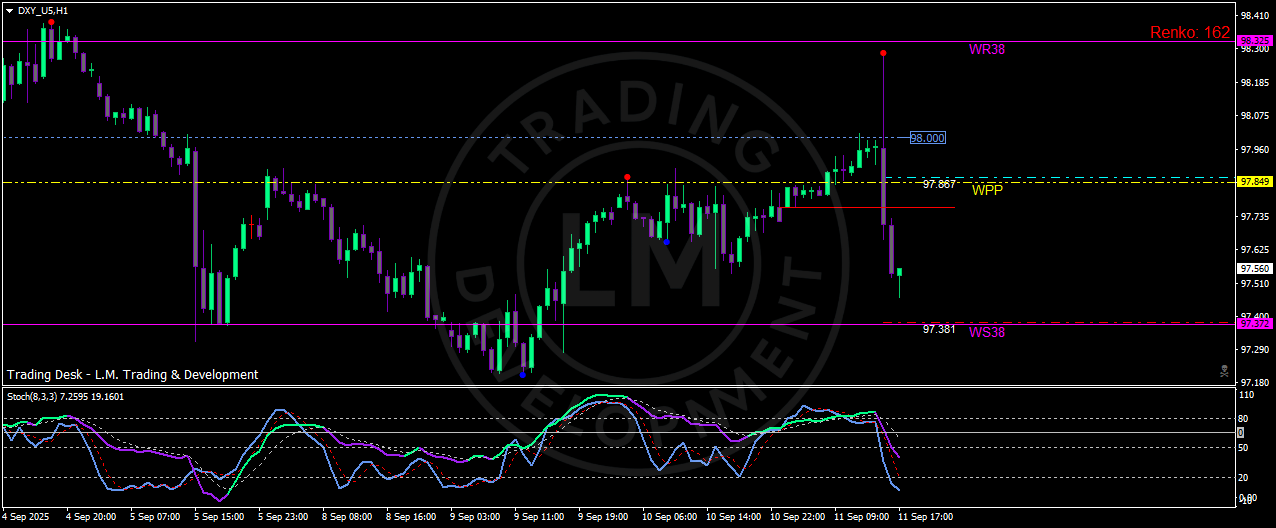

Dollar Index (DXY): The index initially spiked toward 98.00 after the CPI release but quickly reversed lower as jobless claims highlighted labor fragility. Price fell back under the weekly pivot at 97.85 and tested support around 97.56.

-

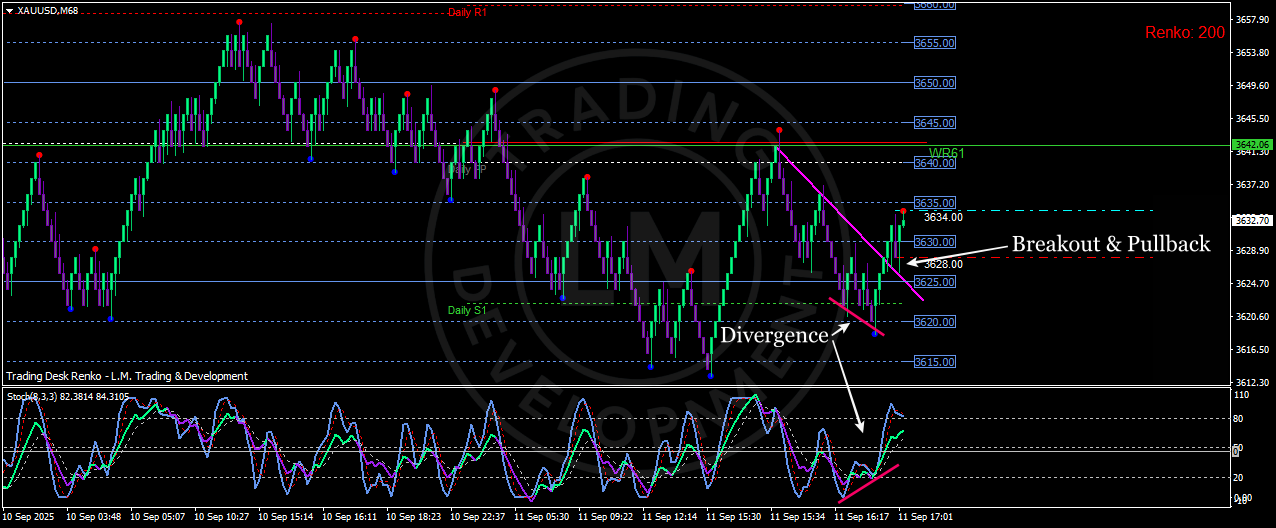

Gold (XAUUSD): The metal capitalized on the dollar’s weakness, breaking higher after defending the 3620–25 support zone. Momentum carried prices toward the 3635–3640 resistance area (WR61), with stochastic divergence confirming the bullish signal.

-

Bonds: Treasury yields jumped on the CPI surprise but later retreated, reflecting renewed expectations of Fed easing. The 2-year yield erased early gains.

-

Equities: U.S. indices stabilized after choppy trade, with investors focusing on the likelihood of policy support in September.

Policy Angle

The data intensified the Fed’s policy dilemma:

-

Inflation argues against aggressive easing.

-

Labor weakness argues for urgency.

CME FedWatch now assigns over 70% probability to a 25bp rate cut in September, while nearly 30% of traders are betting on a 50bp cut. This is a significant shift from just a few weeks ago, when many Fed officials still favored “higher for longer.”

Technical Levels

Dollar Index (DXY):

-

Resistance: 98.00, then WR38 at 98.32

-

Support: 97.56, then 97.38 (WS38)

Gold (XAUUSD):

-

Support: 3620–25, then 3615 (Daily S1)

-

Resistance: 3635, then 3640–42 (WR61)

-

Bias: bullish above 3625, with potential to retest 3645–50.

Trading Implications

For traders, the key is the divergence between asset classes:

-

Gold is leading higher as Fed cut bets strengthen, making it a cleaner hedge than oil or equities.

-

Dollar Index failed to hold gains, showing vulnerability despite sticky inflation.

-

Short-term setups:

-

Long XAUUSD bias above 3625, targeting 3640–3645.

-

DXY biased lower if 97.50 breaks, with room to 97.38.

-

In the coming sessions, attention will shift to upcoming U.S. retail sales and PPI. If both show softness alongside weak jobs data, recession fears will dominate, keeping pressure on the dollar and supporting gold.

Conclusion

The August data confirmed a difficult mix: inflation is proving sticky while labor markets weaken. For traders, the result is straightforward: the Fed is trapped, the dollar is vulnerable, and gold is the main beneficiary.

As long as XAUUSD holds above 3625, dips are likely to attract buyers. A sustained move through 3640–42 would confirm bullish momentum and open space toward 3650. Meanwhile, the Dollar Index must reclaim 98.00 to avoid further downside pressure.

This analysis reflects a personal view for educational purposes only and is not financial advice.