US GDP Data Ahead, USDJPY Gets Tighter, GBPUSD Confirmed Our Expectations

30 January 2015, 11:38

0

206

The British pound against the greenback achieved lower territory as we have been previously expected, despite that the CBI Realized Sales were stronger than expected. The US Jobless Claims were released at 265K lower than expectations at 301K and that strengthened the greenback, driving the GBPUSD from 1.5128 down to as low as 1.5023. Bearish bias is still in place and the cable currency pair could decline lower towards 1 ½ year lows at 1.4951.

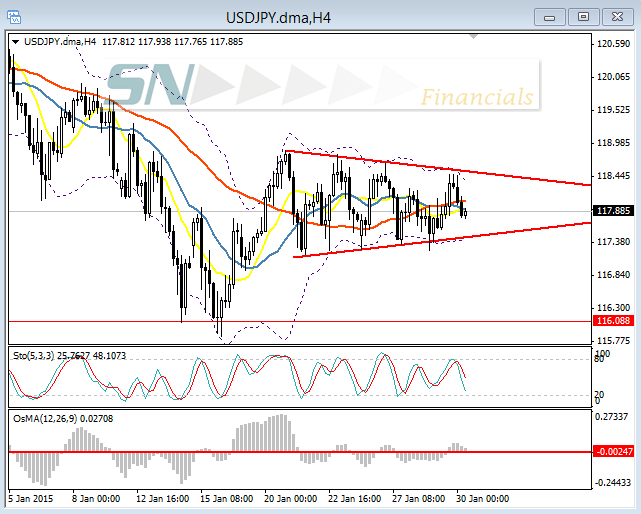

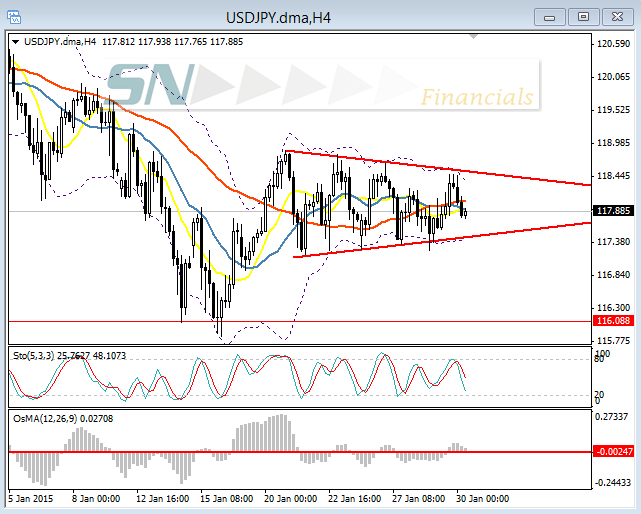

The Japanese Yen was not so much affected by the CPI and Jobless rate data released overnight. The National Core CPI increased by 2.4% in December higher than expected at 2.3% and the same like the previous month. The Jobless rate declined to 3.4% and the Job to applicant ratio jumped higher than projected to 1.2. Data seem stronger for the Japanese economy, US data were better than expected as well therefore the USDJPY remains in indecision trading. As we see at the chart below in the H4 timeframe the currency pair continues in a formation which seems like a symmetrical triangle, the trading territory is getting tighter, with a falling line above and rising line below. A break out of the symmetrical triangle could indicate the direction.

Looking ahead us we have the US Advance GDP data release today, which could impact the USDJPY as well as other major currency pairs. Taking into account that the US Durable Goods orders were well below expectations, US Retail Sales disappointed market participants and Industrial production missed forecasts for December as well as the US dollar significantly strengthened in the last quarter of 2014. Then we would expect a lower GDP growth as well. That could weigh on the greenback which is overbought across the board in the longer term.

Elsewhere, the EURUSD remains in consolidation around the 1.1330 ahead of the EZ flash CPI number and the EZ unemployment rate. The most important figure here is the CPI data since that is the number the ECB looks at. The USDCAD continued its bullish bias yesterday after the better than expected US Jobless Claims at 1.2673 and the currency pair price is continuously pushing to higher ground. Lastly, the Australian dollar against the greenback bounced up to short term resistance at 0.7796 overnight and is providing chances to reposition on the short side at better price for those who favor the bearish continuation.

The Japanese Yen was not so much affected by the CPI and Jobless rate data released overnight. The National Core CPI increased by 2.4% in December higher than expected at 2.3% and the same like the previous month. The Jobless rate declined to 3.4% and the Job to applicant ratio jumped higher than projected to 1.2. Data seem stronger for the Japanese economy, US data were better than expected as well therefore the USDJPY remains in indecision trading. As we see at the chart below in the H4 timeframe the currency pair continues in a formation which seems like a symmetrical triangle, the trading territory is getting tighter, with a falling line above and rising line below. A break out of the symmetrical triangle could indicate the direction.

Looking ahead us we have the US Advance GDP data release today, which could impact the USDJPY as well as other major currency pairs. Taking into account that the US Durable Goods orders were well below expectations, US Retail Sales disappointed market participants and Industrial production missed forecasts for December as well as the US dollar significantly strengthened in the last quarter of 2014. Then we would expect a lower GDP growth as well. That could weigh on the greenback which is overbought across the board in the longer term.

Elsewhere, the EURUSD remains in consolidation around the 1.1330 ahead of the EZ flash CPI number and the EZ unemployment rate. The most important figure here is the CPI data since that is the number the ECB looks at. The USDCAD continued its bullish bias yesterday after the better than expected US Jobless Claims at 1.2673 and the currency pair price is continuously pushing to higher ground. Lastly, the Australian dollar against the greenback bounced up to short term resistance at 0.7796 overnight and is providing chances to reposition on the short side at better price for those who favor the bearish continuation.