Technical Analysis: EUR/USD trades at lowest level in two years, USD/JPY testing key Gann resistance and SPX cycles point to weakness in Q1

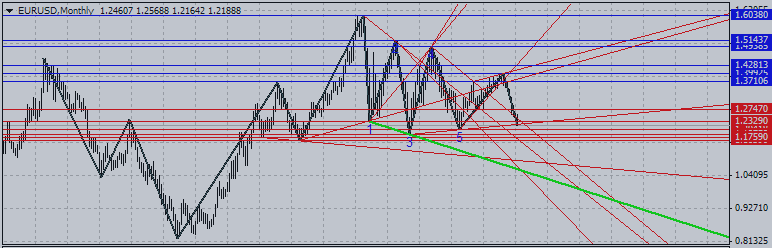

Price & Time Analysis: EUR/USD

- EUR/USD fell to its lowest level since August of 2012 on Tuesday

- Our near-term trend bias is lower in EUR/USD while below 1.2360

- The 50% retracement of the all-time low and the all-time high around 1.2135 is the next important pivot for the exchange rate

- The next turn window of importance is seen around the end of the month

- A close above 1.2360 would turn us positive on the euro

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| EUR/USD | 1.2135 | 1.2165 | 1.2190 | 1.2260 | 1.2360 |

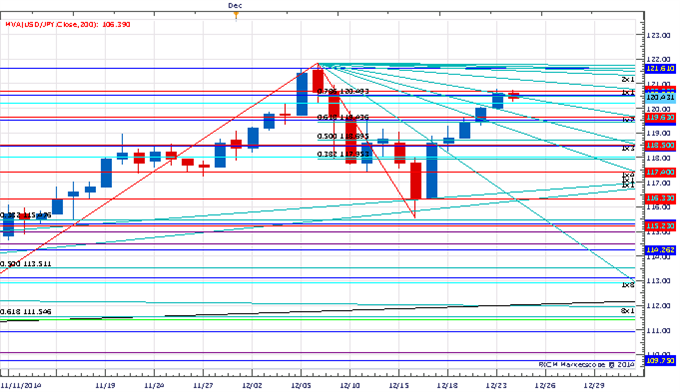

Price & Time Analysis: USD/JPY

- USD/JPY traded at its highest level in over two weeks on Tuesday before encountering resistance around the 1st square root relationship of the year’s high in the 120.70 area

- Our near-term trend bias is positive while over 119.50

- Traction over 120.70 is needed to prompt a push towards the yearly high

- An important turn window is seen this month

- A close under 119.50 would turn us negative on the exchange rate

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| USD/JPY | 119.65 | 120.25 | 120.40 | 120.70 | 121.85 |

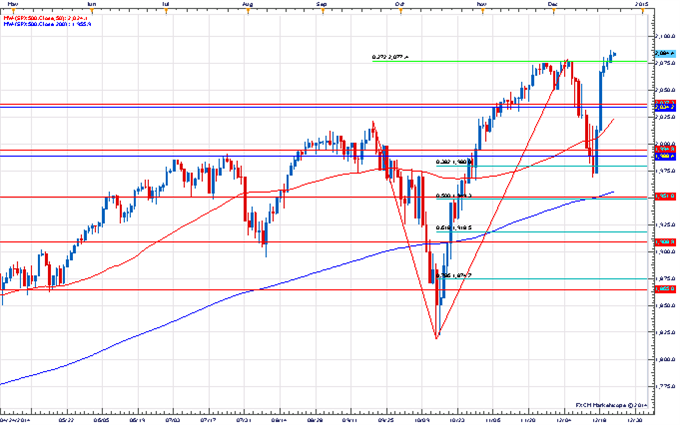

Focus Chart of the Day: S&P 500

The S&P 500 finally managed to break convincingly above the key

resistance at 2075/80 (127% extension of the September/October decline

& 6th square root relationship of the October low) on Tuesday. The

end of December is historically one of the strongest seasonal periods of

the year for the US equity market and it is very difficult seeing the

index letting up much before year-end. The first quarter of next year

could be a different story, however, as a slew of important cyclical

relationships during this time suggest the index will probably surprise

and come under a bit of pressure. The first important ‘turn window’ of

the year is seen around the 2nd week of January.