Simple Steps To Correct Lot Sizes When Subscribing To Signals

Introduction

You've been searching all over the MQL signals database for a signal that fits your risk/reward appetite and you think you've finally found your holy grail!! The numbers look perfect, 400% return for a maximum 10% draw down and there's over 500 other subscribers rolling in the money already! You want in baby!

You subscribe to the signal, hook it up to a $10,000 demo account and sure enough, it performs pretty much as advertised. That Porsche 911 Turbo might finally be within your grasp!? So you take the plunge and connect the signal to your real account. But you're still cautious, so you only commit a small amount of $300 of your available funds to the new signal. Within a short amount of time your whole account is destroyed! What happened?? The statistics on MQL still show only a 10% drawdown on the signal account but you've been margin called and lost 95% of your account! What happened???

Why Lot Sizing Matters So Much

Three crucial elements in any trading system are the entry, the exit and money management. Even the best signal with perfect entries, brilliant exits and a high win rate can be disastrous if the whole money management logic is flawed.

Traders developing systems and signals spend a great deal of time optimizing and testing the money management logic, squeezing out every last percentage of profit and minimizing drawdown as much as possible. And depending on the system, much of this can be achieved by optimizing the lot size of a trade in proportion to the available equity, the risk/reward ratio and the probability of a successful trade. And if you subscribe to a martingale or variable grid trading signal, the lot sizing can be even more important than the entry and exit.

You're right to be cautious and only risk what money you can afford to lose, just in case the signal turns against you. But when you're signal copying, risking too little can actually be worse than risking more. I suggest you read that sentence again.

If you don't setup your signal copying account correctly, there is a very good chance that you will change the proportional lot sizing and hence change the whole money management logic of the system. You can easily turn a very profitable system into a losing money drain, and only pure luck will save your account. On the other hand, if you know how these calculations work, you can actually manipulate the system to increase the profitability of the signal (but of course the risk will also increase proportionally).

How Metatrader Calculates Your Lot Size On A Signal

Before getting into details, I will let you know now that at the end of this article I will give you a free tool I have created that will take a lot of the guess work and calculations out of this process. But it is very important that you understand the mechanics behind this so please, for your own benefit, spend 5 minutes reading through the rest of this short, and I hope, easy to follow article.

Before getting into details, I will let you know now that at the end of this article I will give you a free tool I have created that will take a lot of the guess work and calculations out of this process. But it is very important that you understand the mechanics behind this so please, for your own benefit, spend 5 minutes reading through the rest of this short, and I hope, easy to follow article.

- It first looks at your available balance, in your deposit currency, on the account you are connecting the signal to. It then looks at the percentage of this balance that you want to assign to this signal. You set this yourself in MetaTrader, between a minimum of 5% and a maximum of 95%*. This is set in Tools->Options->Signals. So if you have $USD 200 available in your account and you select to use 95% of this "deposit", you will actually only be using an amount of $USD 190 for the lot sizing calculation.

IMPORTANT: Note how I said this is used for your lot sizing calculation. Don't confuse this with the next option, "Stop if equity is less than...". That option will close all trades and disconnect the signal if your account goes lower than this set amount. But that has nothing to do with the lot size calculation which is what we're focusing on here.

So in our example it will calculate the first ratio by taking into account your balance and allocation percentage, compared to the Signal balance (found on the Signals web page on MQL5.com). The different currency rates are not considered at this stage.

eg: ($USD 200 * 95%) / €EUR 1000 = 0.19 (19%) - The next calculation involves your leverage compared with the signals leverage. You can see the signal account's leverage on its web page on MQL5.com. If your leverage is the same or greater than the signal then no change is made. However, if your leverage is less than the signals leverage then another proportional calculation is made. So if in our example the signal has a 1:100 leverage and you have a 1:50 leverage, that's 50% difference (50/100 * 100). This "leverage penalty" is then applied to the calculation we had in step 1:

eg: 0.19 * (50/100) = 0.095 (9.5%)

This leverage calculation is incredibly important but quite misunderstood. It can make a massive difference to the final calculation. For instance, if the signal provider is using 1:500 leverage and you are using only 1:50 leverage, that's a 10 fold difference so your final lot size percent after step 1 could be reduced by as much as 90% - After this it then takes into account your currency compared to the base currency of the signal provider. You can easily see the base currency of the signal by looking at any of the balance or trade figures on the particular signals web page. They are always shown in the signal's base currency. So using the current USD/EUR exchange rate of 0.7328, our calculation becomes:

eg: 0.095 * 0.7328 = 0.0696 (6.96%) - Finally, MT uses a step-by-step algorithm to round the percentage using the following (slightly strange) formula

- If the value is less than 1%, it is rounded up to 1%, i.e. assumed to be 1%. Example: 0.25% => 1%

- If the value is greater than 1% and less than 10%, it is rounded down to the nearest whole number. Example: 6.96% => 6%

- If the value is more than 10% and less than 100%, it is rounded down with a step of 5%. Example: 28.7% => 25%

- If the value is more than 100% and less than 1000%, it is

rounded down with a step of 10%. Example: 127.6% => 120%

But this is now the dangerous point! If you don't follow through with these next steps, you may have inadvertently corrupted the money management logic of the system and a large drawdown could be heading your way.......

*NOTE: In my opinion, there should be no reason to ever set the deposit allocation in step 1 below 95%, and I wish it could be set at 100%. Your FX Broker should make it easy for you to setup multiple accounts and to instantly transfer money between your accounts to get the correct account balance for these calculations. And you should never have more than one signal running per account or perform any manual trading on that account. Therefore, any additional money in this account above what allocation % you select is effectively sitting idle. I personally have one main account that does not trade at all - it is only used as a "holding account" as I transfer money between my other accounts for various systems, signals and manual trading.

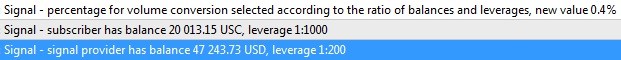

MetaTrader Journal tab showing signal lot sizing results

The Golden Rule

So let's stick with the example that your final calculation is 6% lot sizing. What happens when the signal attempts a trade at 0.05 lots? Well 6% of 0.05 lots is 0.003 lots which is below the minimum trade lot size of 0.01 lots (for a micro account). So your trade has to be rounded up to 0.01 lots to be accepted by your broker's trade server. That's effectively three times the size (proportional to the account size) and three times the risk of what the signal is doing. And if the trade goes against you, you will also potentially suffer three times the percentage drawdown that the signal does.

So the next trade comes along and the signal opens a trade for 0.09 lots. Well 6% of this is 0.0054 lots so it is again rounded up to 0.01 lots for your trade....

Not only are you again risking more than the signal, this trade is nearly twice the size of the last trade on the signal, but exactly the same size as the last trade on your account (0.01 lots). Basically, you are not trading in proportion, or "in sync" to the signal account. This is one way the money management of the signal can become totally corrupted, the strategy fails to perform as the developer intended and large drawdowns can easily occur on your account (but not on the signal account).

So my Golden Rule is to look back at the recent history of the signal and find the smallest trade lot size that the signal uses. How far you look back will depend on a few factors such as the the trading frequency of the signal, how often funds are deposited and withdrawn etc. But you'll get the feel of it. A couple of weeks history should be sufficient and should take less than a minute to analyse.

Now multiply that smallest lot size by your lot size percentage from the original calculations. If the result is below 0.01 lots, that's the first sign of trouble. You will have to either increase your account balance, your allocation percentage or your leverage (if possible). This will increase your lot size percentage and hopefully get you back to the magic 0.01 lot figure. If you can't get to that magic figure, I strongly suggest you find another signal, because this one could very easily end in tears. **

Even if these first calculations pass the Golden Rule, it still doesn't mean your safe yet....

**NOTE: If you simply haven't got the funds to make the Golden Rule work, there is one more trick. Some brokers offer a nano or "cent" account. In some instances, MetaTrader sees the funds in these accounts as 1 cent = $1. So a $100 balance looks like a $10,000 balance to MetaTrader. These type of accounts normally have very low maximums of only a few hundred dollars and can have bad spreads. So you won't be able to quit your day job with one but it can get you into a good signal for a small outlay and allow you to slowly build your equity.

Blowing Up Your Account:- The 1% Problem

The majority of problems you will have when signal copying is when your final lot size calculation is less than 1% and so gets round up to 1% by MT. This situation happens when you don't assign enough funds, or the signal account has a very large account or a combination of the two. And it happens a lot! Some signal providers actually do have significant funds while others use a "cent" account as mentioned above. So their deposit of say $1000 appears to be $100000. This can be done for a number of reasons, including being part of their lot sizing / money management / drawdown equation. Whatever the reason, it can cause massive problems.

So what happens when your lot sizing gets rounded up to 1% but your balance is still only say 0.2% the size of the signal balance? You end up out of sync with the signal, in this case by a factor of 5 (1%/0.2%). In this case, you've actually changed some of the signals money management logic.

Secondly, your drawdown could be significantly larger than the signal due to these out of sync trades. Remember from the above example where your account is only 0.2% of the signal balance but your lot size was rounded up to 1% (factor of 5). Well if the signal has a drawdown of only 19%, you could potentially be in for a drawdown of....... 19% * 5 = 95% !! BOOM!!!

The flip side is that if you know the risks, you could also be in for a 5 time higher ROI. But you still face the problem of being out of sync on your lot sizes and not following the logic of the signal. So this is a very dangerous game to play unless you know what you are doing and can accept that risk. Unfortunately, most people don't even realize that they've accidentally opened themselves up to so much risk and this is where accounts get blown up and subscribers start screaming at the signal provider. Now you know the rules, I hope you can avoid being one of these statistics.

The Simple Fix:- Finding The Golden Percentage (GP%)

So the simple fix to this problem is to ensure our lot sizing and balance sizing is "in sync" with the signal as much as possible. Of course this can never be 100% accurate and will drift with time, but we need to minimize the error as much as possible.

To start with, we're looking for what I like to call the Golden Percentage or GP%. This is the minimum lot size and signal size percentage that will be in sync with the signal. We already know that the minimum percentage is 1% and for a micro account, minimum lot size is 0.01. So we start from there and use the "quick and dirty" formula:

(Your Smallest Lots Wanted / Smallest Signal Lots) * 100 = GP% (must be greater than or equal to 1%)

GP% = round UP (not down) to the nearest percentage in accordance with the MT rounding rules above (see Step 4)

Signal Account Balance * GP% = Your Account Balance Needed (in the signals currency)

A real world example:

(0.01 / 0.4) * 100 = 2.5%

Round UP to 3%

$USD 91000 * 3% = $USD 2730

So in this example, 3% is the absolute lowest amount you need to commit to be "in sync" with the signal. We round UP because if we don't, MT will round DOWN and we will be out of sync again.

From here, you will need to work backwards through the currency conversion, penalty leverage and deposit allocation, to arrive at the final figure, in your currency, that you need to commit to this signal. Even after this, you may find that too many of your lot sizes still remain at 0.01 while the signal increases and decreases. So 0.01 may in fact not be the perfect minimum lot size, you may need to go even higher.

The Golden Percentage will be anywhere from 1%, all the way up to 100% on some signals. But once you know it, you will always be in sync. However, the percentage can change if the signal provider adds or withdraws funds or adjusts their lot sizing. On some signals this happens on an almost daily basis, on other signals it hardly ever happens. So keep an eye on the signal's web page. If you see deposits or withdrawals, recalculate the GP%. If you notice minimum lot sizes increasing or decreasing out of sync with your account, recalculate the GP%. Then add or withdraw funds to get yourself back in sync.

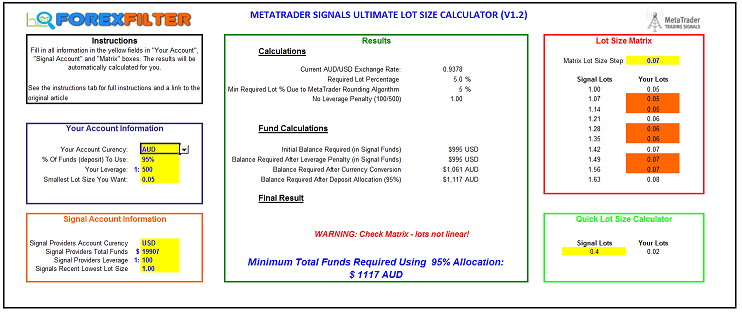

To save you the time and effort of running all of these numbers, I suggest simply using the calculator I've provided below. It will calculate all of these figures for you and you can quickly run through a range of different lot sizes and percentages until you find the one you feel comfortable with.

Free Lot Size Calculator

I've created a simple (free) tool that will take all of the guess work out of the calculations for you. All you need to do is fill in a few fields about your account and the signal account and the calculator will return the result which is the amount you need to invest to copy the signal correctly. This could be the absolute minimal amount, a direct 1 to 1 copy, doubling or tripling the signal and everything in between. The choice is yours.

Once you've selected your account currency and the signal currency, the calculator will automatically retrieve the current exchange rate between the two currencies so there's no need for you to look anything up. It does this through a Yahoo web service so don't worry, it can never log into your MT4 account. You never input any account numbers or passwords.

There is also a "Lot Size Matrix" that will tell you if there will be any point at which your lots will become out of sync with the signal.

And finally, there is a "Quick Lot Size Calculator" where you can enter any lot size that the signal might try to trade and see what the same lot size will be on your account.

The calculator is in Excel 2003 format so should be useable by most people. I've had to zip it up as MQL5.com does not accept Excel files as attachments. You can download the calculator from the link below this article.

Please don't hesitate to send me a message if you have any feature requests or spot any bugs in the calculator.

Conclusion

Subscribing to signals can be a fantastic way to increase your ROI and diversify your risks. I urge you to carry out the necessary due diligence on any signal you plan to subscribe to and ensure it suits your risk/reward appetite. And know that any signal, no matter how long it's been trading and what the past performance, can fail at any time. But hopefully, with the knowledge you now have, you are adequately prepared to understand and manage the risks involved.

If you're a signal provider, I urge you to run through these calculations yourself and make the minimum amounts known in the description of your signal. Better yet, point your potential subscribers back to this article so they can gain the knowledge themselves. It'll save a lot of heart ache, blown accounts, and hopefully reduce the amount of negative comments and ratings you may receive.

I hope this article has helped you understand the MetaTrader signal lot sizing better and that the calculator is helpful to you. Good trading to you!