The Sultanate of Oman’s Potential Excites Frontier Resources FD - oil and gas industry is undergoing a much needed revival.

Since Oman’s proven reserves, thought to be in the region of 5.5 billion barrels of oil equivalent, are considerably less than neighboring powerhouses of Saudi Arabia, United Arab Emirates and Iraq, the country has always been decidedly less protectionist. Oil majors, who get better terms in this non-OPEC Middle Eastern production zone compared to other hubs in the region, were meaningfully behind the first wave of E&P activity.

On a visit to Oman last year, the latest E&P wave felt different to me courtesy of independent upstarts. Don’t get me wrong, I am not overplaying their significance. Shell’s historic presence is well documented and BP , Occidental and MOL are all active prospectors in the sultanate, along with state-owned oil and gas firms from Asia Pacific. However, rubbing shoulders, or should we say exploration blocks, with them are the likes of DNO, Circle Oil and Frontier Resources.

According to Barbara Spurrier, Finance Director of Frontier Resources,

the company reassessed its priorities well before its decision to raise

equity in London. “In October 2012, we sold all our US assets, in favor

of projects in Oman alongside Namibia and Zambia. It might seem a bit

dramatic, but aside from our desire to concentrate elsewhere, the

decision made commercial sense.

“Our US holdings comprised of small shares, often in the shape of

limited partnerships, in nearly 80 wells, mostly onshore in Texas.

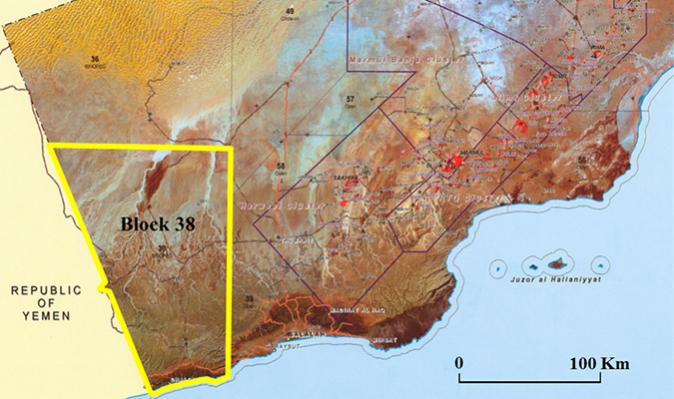

Getting a CPR (Competent Person’s Report, viz. Mineral Expert Report) on

each of them would have been very expensive and time consuming ahead of

our Initial Public Offering (IPO). So we decided to divest and

concentrate on exploration assets such as Oman’s Block 38.”

“Of the three countries we’re in, Oman holds the greatest potential.

Initial seismic surveys and feelers have provided a very positive view

of what the asset may generate. Furthermore, Oman is a very stable

country politically, which gives any company, not just us, the ideal

conditions to enter the market. On the legislative and regulatory side,

the government is making the right noises, working proactively to match

international standards. The Omanis are also investing heavily in their

infrastructure, including ports.”

“There are difficult E&P prospects around the world that may

materialize against all expectations. Conversely, some prospects the

market is counting on might turn out to be duds or uneconomical to

exploit. All I can say is Oman will play its part in the world, and I

certainly hope Frontier Resources will play its part in Oman.”