As we enter the final week of 2025, we're sharing a performance review and some insights about seasonal trading dynamics that may benefit traders in our community.

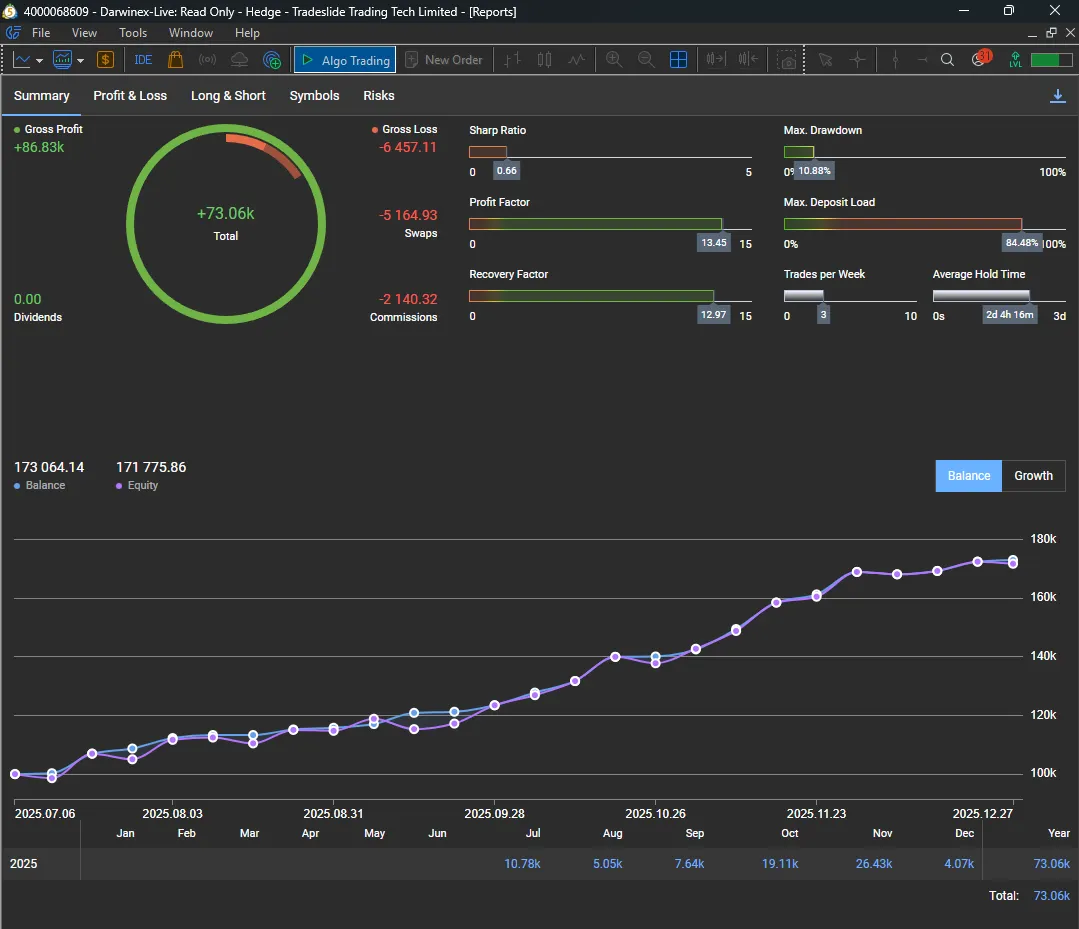

📊 6-Month Performance Overview (July – December 2025)

Live SignalStarting Capital: $100,000

Current Balance: $173,064.14

Total Growth: 73.06% (6 months)

Understanding December Market Conditions: A Lesson for All Traders

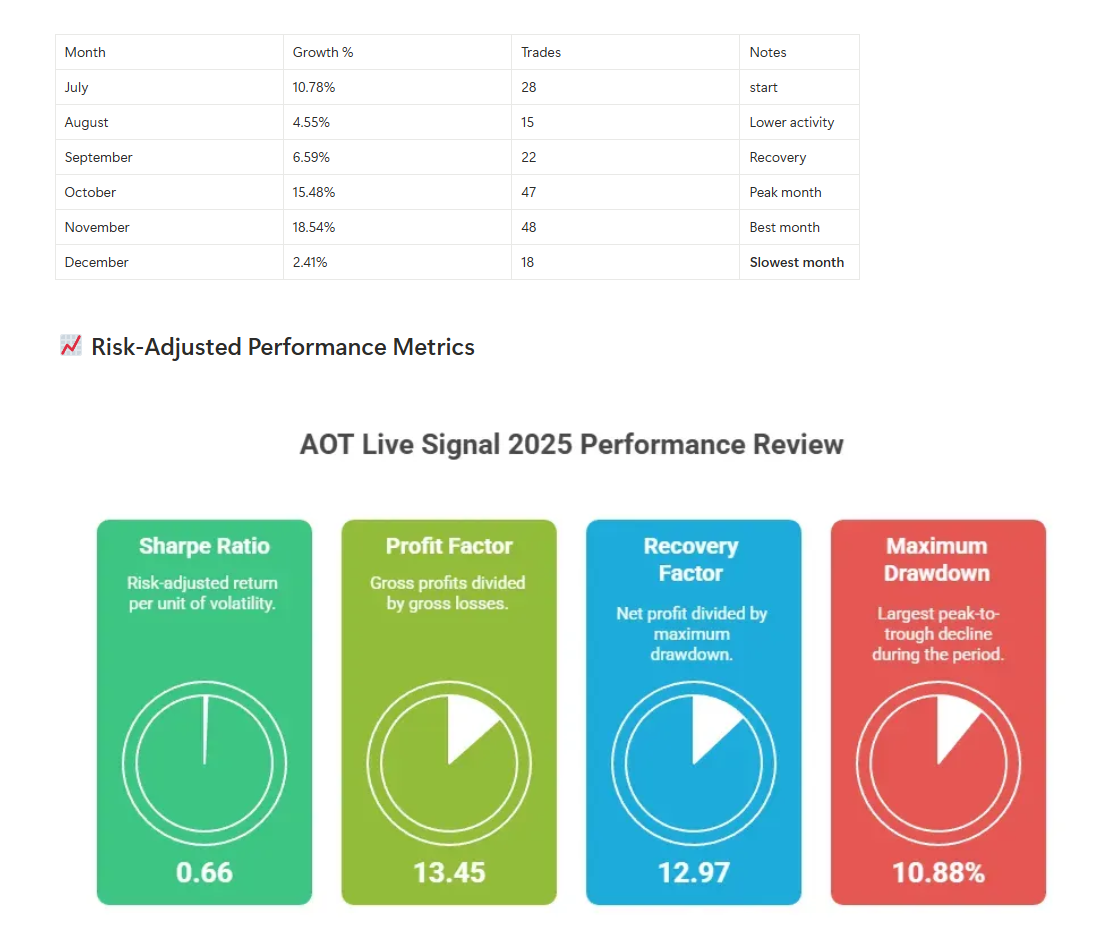

December's 2.41% growth represents our slowest month. Rather than viewing this as disappointing, we want to explain why this happens — because understanding seasonal market dynamics is valuable knowledge for any trader.

Why December Challenges Most Trading Systems

Institutional Behavior Shifts: Major market participants change their activity patterns significantly during this period. Hedge funds typically lock in annual gains before year-end reporting. Trading desks reduce positions and operate with minimal staff. Major banks close proprietary trading desks early for holidays. Overall volume drops 30 to 50 percent in the final two weeks.

Price Action Becomes Less Reliable: With reduced institutional participation, markets exhibit different characteristics. Price movements turn choppy and directionless. False signals and whipsaws increase in frequency. Traditional support and resistance levels break down more often. Risk-reward ratios deteriorate across most strategies.

How Systematic Traders Can Adapt

Whether you trade manually or use automated systems, December requires adjustment. Consider these approaches:

- Raise entry standards — only take the highest-probability setups

- Reduce position sizes — lower volume means higher slippage risk

- Prioritize capital preservation — protecting gains matters more than adding to them

- Plan for January — institutional activity resumes strongly in the new year

December's role in a trading year is to protect what has been built, not to maximize returns.

Six-Month Summary

Over this period, AOT has demonstrated:

- Six consecutive positive months

- Maximum drawdown contained to 10.88%

- Consistent risk management across varying market conditions

- Adaptability to seasonal market change

"The stock market is designed to transfer money from the impatient to the patient." — Warren Buffett

This same principle applies to trading systems.

Looking Ahead to 2026

Professional trading requires patience. Market cycles are natural, and successful traders — whether discretionary or systematic — must adapt rather than react emotionally to temporary conditions.

We thank our community for your continued support and look forward to the opportunities that 2026 will bring.

Happy New Year from the AOT Team! 🎆