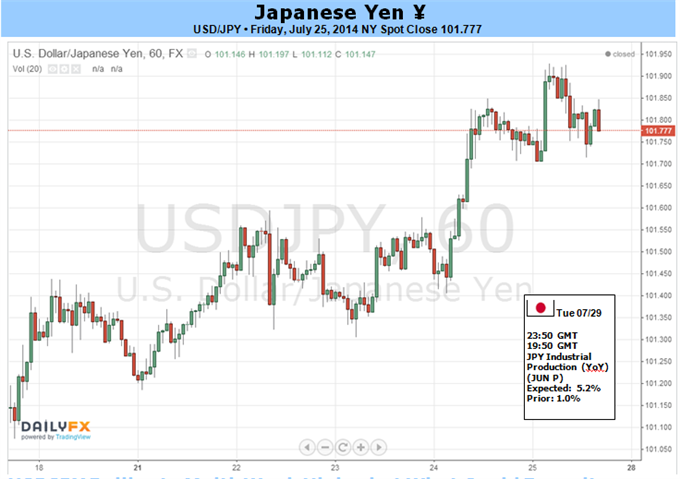

- Sentiment extremes suggest that the Japanese Yen may lose versus Euro

- These are the critical levels to watch for the USDJPY exchange rate

The Japanese Yen remains in a miniscule trading range versus the US

Dollar, but a jump in volatility suggests some predict key events ahead

could finally force some sharper USD/JPY moves.

What keeps the Japanese Yen from much larger price swings? Record-low

interest rates across the globe almost certainly play a part;

yield-sensitive traders see little reason to buy or sell given

expectations that global central banks will keep rates near record-lows.

We’ll watch a potentially significant US Federal Reserve interest rate decision and US Nonfarm Payrolls report for USDJPY volatility.

The monthly US Nonfarm Payrolls report provides the other important

bit of economic event risk for the Dollar/Yen. Economists predict that

the US added over 200k jobs in the month of July for the

sixth-consecutive month, and lofty expectations leave ample room for

disappointment. It would likely take a substantially above-forecast

print to force a major Dollar rally, while a disappointment could kill

the momentum of positive data for the Greenback.

Will the week ahead finally force the USDJPY out of its narrow range?

The odds are admittedly low, but a slow build in FX volatility prices

suggests some are betting on/hedging against larger moves. Until we see

a break of much more sig