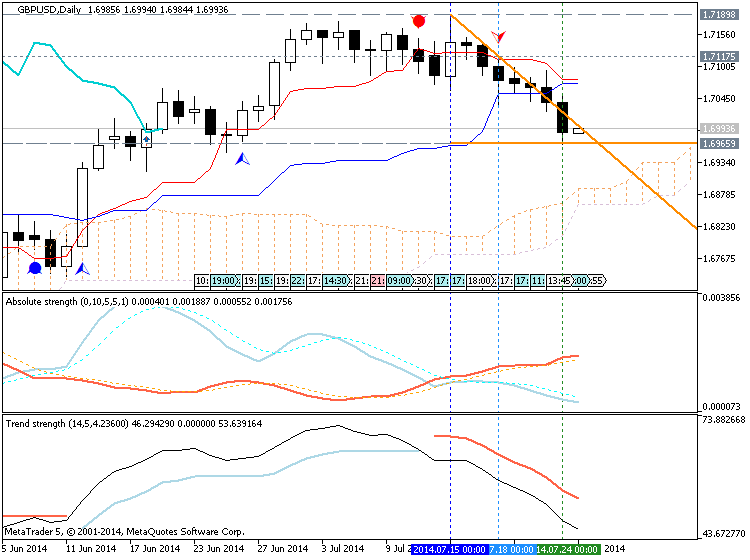

The pound retreated again in yesterday’s forex trading sessions, as the UK retail sales fell short of expectations. The report showed a mere 0.1% uptick instead of the projected 0.2% gain, barely enough to rebound from the previous 0.5% decline. This added support to the BOE’s less upbeat outlook for the economy, convincing more traders that the central bank might not hike rates this year. UK preliminary GDP data is due today and it might show another 0.8% reading.

The franc consolidated for the most part as it drew a bit of support from the euro zone PMI readings yet had no data from Switzerland to give it an extra boost. There are still no reports due from Switzerland today, which suggests that the franc might be in for a bit of consolidation or might be vulnerable to euro movements once more.

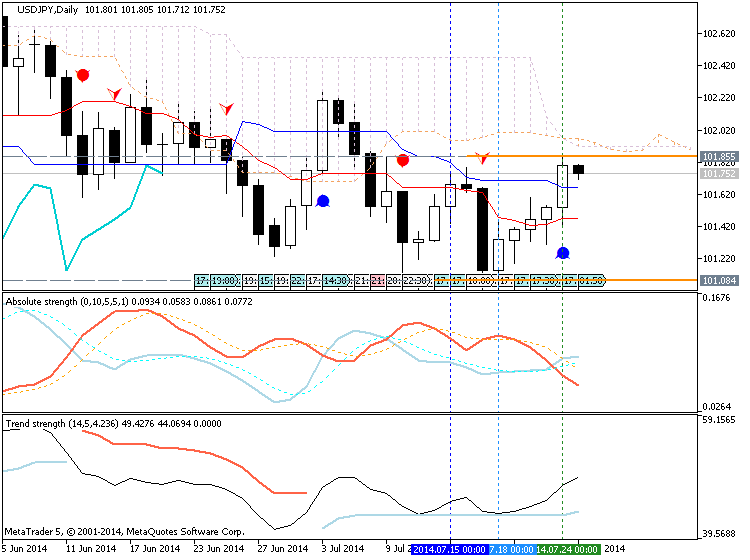

The yen had a mixed performance recently, as it functioned more as a counter currency. It lost ground to the dollar and euro then gained against the Kiwi and the pound, as Japan’s flash manufacturing PMI came in weaker than expected at 50.8. Earlier today, the Tokyo core CPI release showed a stronger than expected increase of 2.8% versus the estimated 2.7% rise while the national core CPI came in line with expectations of a 3.3% gain.

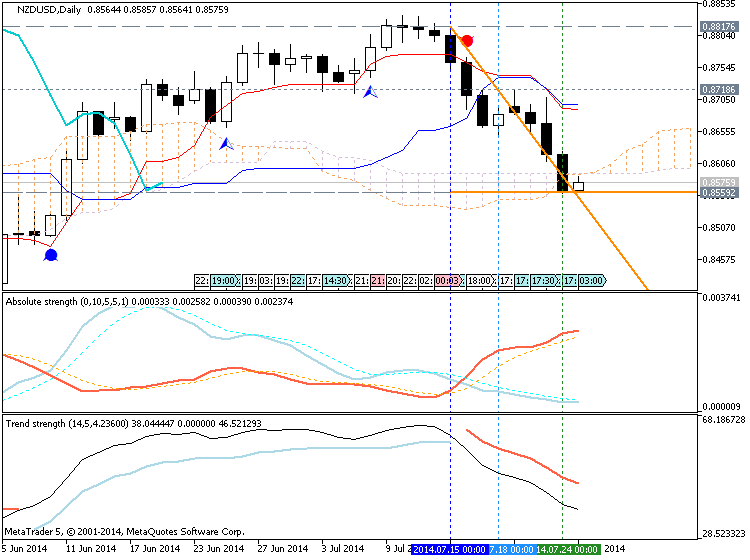

The Kiwi suffered a sharp selloff in recent forex trading, as the RBNZ signaled that it is pausing from its rate hikes to assess the impact on the economy. Wheeler also jawboned the currency in saying that its exchange rate levels are unjustified and unsustainable. Earlier today, the ANZ business confidence index marked a drop from 42.8 to 39.7, reflecting a downturn in sentiment. No other reports are due from the comdoll economies for the rest of the day.