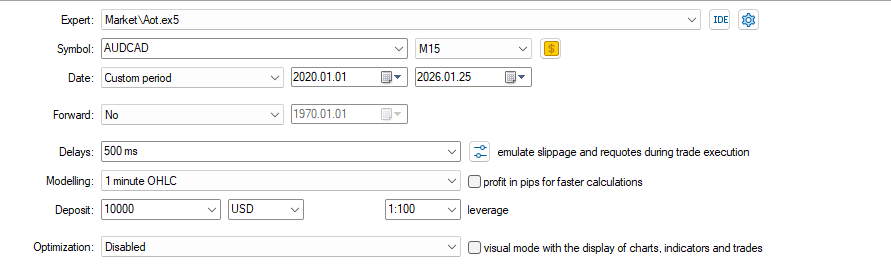

This article explains how users can evaluate AOT behavior through different backtesting approaches. The goal is to help users understand how various configurations affect trading behavior and drawdown characteristics.

1. Raw Test

In this test, the objective is to observe the core behavior of AOT under strict and simplified conditions.

- Use a fixed lot size.

- Disable the recovery function.

- Allow only one open trade per symbol at any given time.

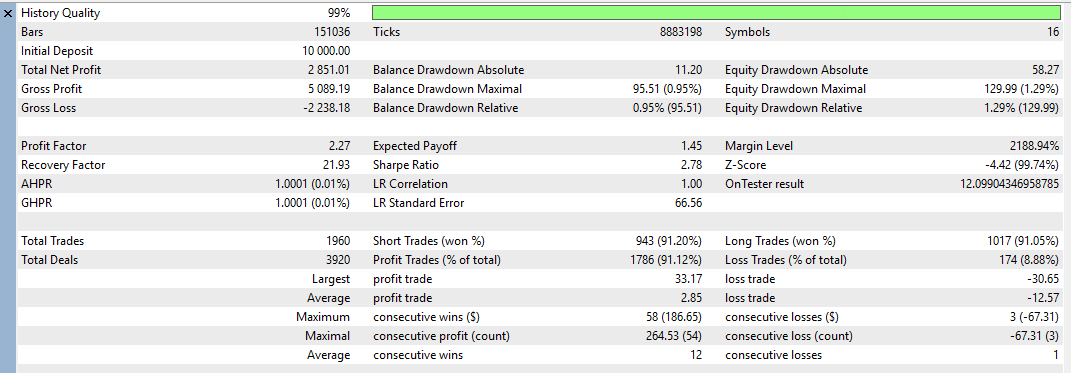

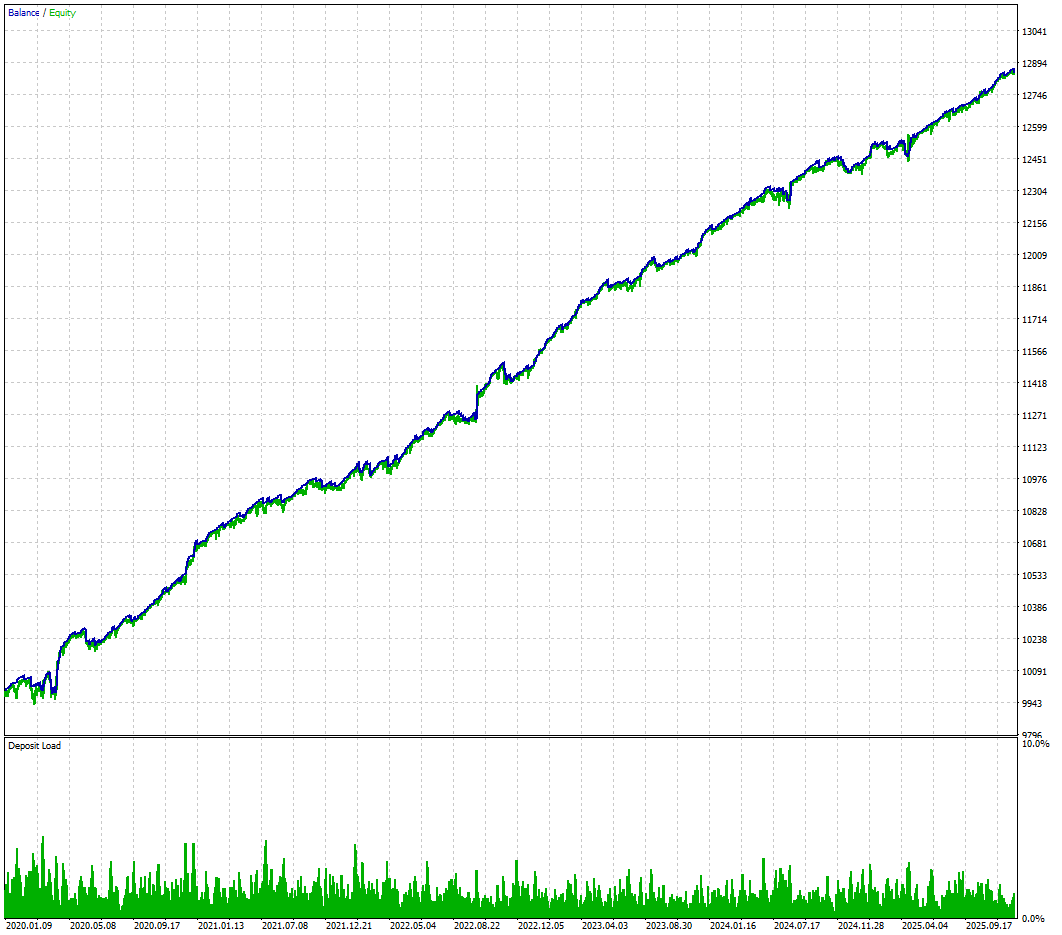

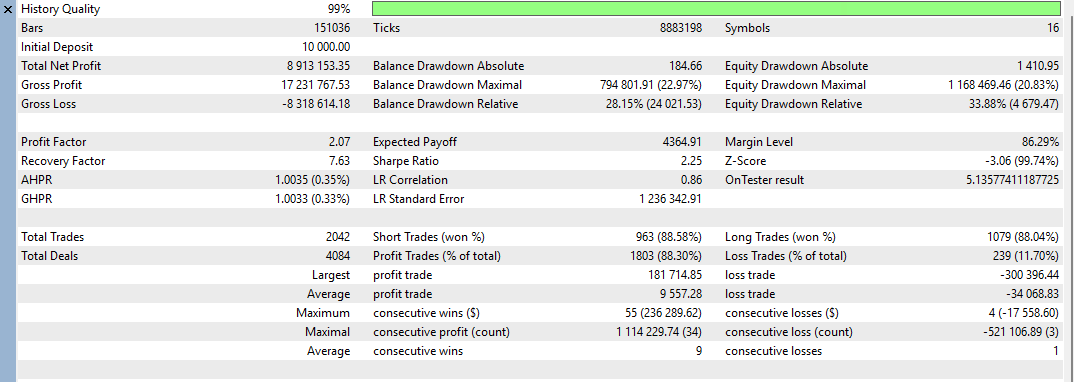

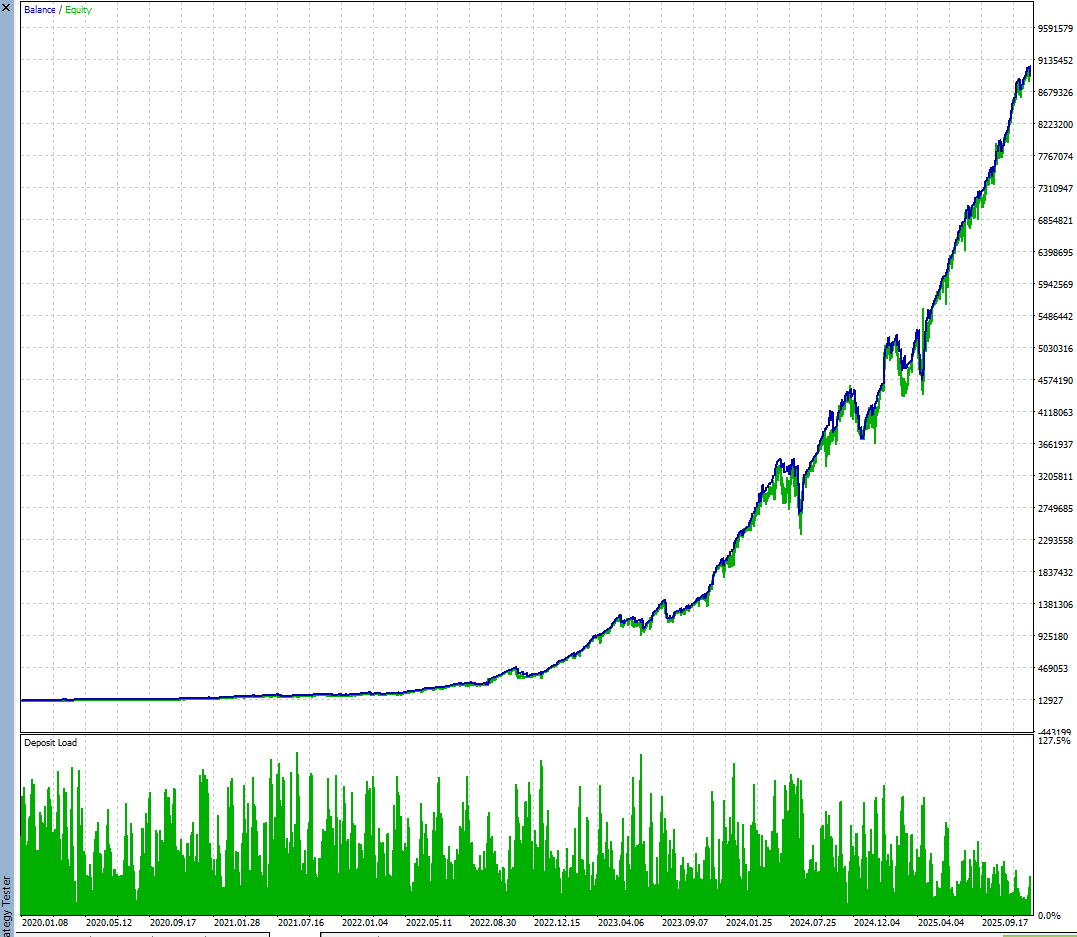

After running the test, review the statistical data for the period before the EA release and compare it with more recent market conditions. This helps identify how the strategy logic behaves across different market environments.

Set file used for this test:

Fixed_lot_size_test.set (attached file)

2. Scaling Lot Size Test

This test demonstrates how AOT behaves when using dynamic position sizing.

- Enable auto-scale lot size mode, where the lot size adjusts relative to account balance.

- Enable the recovery function.

- Use the Live set file, which is the same configuration applied on live signal accounts.

This approach allows users to observe how position scaling and recovery logic affect exposure and drawdown over time. Users should always backtest using their own account balance and preferred timeframe.

Comparison and Key Considerations

A comparison between these tests shows that even when the same strategy logic is used, different configurations and risk preferences can lead to noticeably different behavior and performance metrics.

The most important metric to focus on is drawdown. Before applying any configuration on a live account, users should clearly understand the potential drawdown characteristics associated with that setup.

AOT should be viewed as a technical trading tool. Its effectiveness depends heavily on how it is configured and managed by the user. Important factors to consider include:

- Proper risk management

- Understanding the strengths and limitations of the EA

- Risk diversification

- Maintaining realistic expectations

Backtesting remains an essential step for evaluating whether a specific configuration is suitable for an individual trading environment and risk tolerance.

Risk Disclosure

Trading foreign exchange, CFDs, and other financial instruments carries a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should carefully consider your investment objectives, level of experience, and risk appetite before making any trading decisions. Never invest money you cannot afford to lose.

Files: