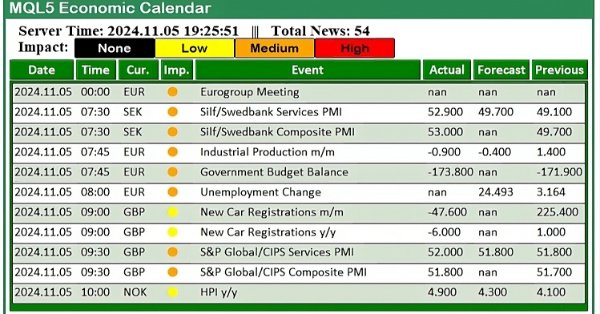

Trading with the MQL5 Economic Calendar (Part 5): Enhancing the Dashboard with Responsive Controls and Filter Buttons

In this article, we create buttons for currency pair filters, importance levels, time filters, and a cancel option to improve dashboard control. These buttons are programmed to respond dynamically to user actions, allowing seamless interaction. We also automate their behavior to reflect real-time changes on the dashboard. This enhances the overall functionality, mobility, and responsiveness of the panel.

Introduction to MQL5 (Part 10): A Beginner's Guide to Working with Built-in Indicators in MQL5

This article introduces working with built-in indicators in MQL5, focusing on creating an RSI-based Expert Advisor (EA) using a project-based approach. You'll learn to retrieve and utilize RSI values, handle liquidity sweeps, and enhance trade visualization using chart objects. Additionally, the article emphasizes effective risk management, including setting percentage-based risk, implementing risk-reward ratios, and applying risk modifications to secure profits.

Trading with the MQL5 Economic Calendar (Part 4): Implementing Real-Time News Updates in the Dashboard

This article enhances our Economic Calendar dashboard by implementing real-time news updates to keep market information current and actionable. We integrate live data fetching techniques in MQL5 to update events on the dashboard continuously, improving the responsiveness of the interface. This update ensures that we can access the latest economic news directly from the dashboard, optimizing trading decisions based on the freshest data.

Trading with the MQL5 Economic Calendar (Part 3): Adding Currency, Importance, and Time Filters

In this article, we implement filters in the MQL5 Economic Calendar dashboard to refine news event displays by currency, importance, and time. We first establish filter criteria for each category and then integrate these into the dashboard to display only relevant events. Finally, we ensure each filter dynamically updates to provide traders with focused, real-time economic insights.

Creating a Trading Administrator Panel in MQL5 (Part VII): Trusted User, Recovery and Cryptography

Security prompts, such as those triggered every time you refresh the chart, add a new pair to the chat with the Admin Panel EA, or restart the terminal, can become tedious. In this discussion, we will explore and implement a feature that tracks the number of login attempts to identify a trusted user. After a set number of failed attempts, the application will transition to an advanced login procedure, which also facilitates passcode recovery for users who may have forgotten it. Additionally, we will cover how cryptography can be effectively integrated into the Admin Panel to enhance security.

Creating a Trading Administrator Panel in MQL5 (Part VI):Trade Management Panel (II)

In this article, we enhance the Trade Management Panel of our multi-functional Admin Panel. We introduce a powerful helper function that simplifies the code, improving readability, maintainability, and efficiency. We will also demonstrate how to seamlessly integrate additional buttons and enhance the interface to handle a wider range of trading tasks. Whether managing positions, adjusting orders, or simplifying user interactions, this guide will help you develop a robust, user-friendly Trade Management Panel.

Automating Trading Strategies in MQL5 (Part 1): The Profitunity System (Trading Chaos by Bill Williams)

In this article, we examine the Profitunity System by Bill Williams, breaking down its core components and unique approach to trading within market chaos. We guide readers through implementing the system in MQL5, focusing on automating key indicators and entry/exit signals. Finally, we test and optimize the strategy, providing insights into its performance across various market scenarios.

Creating a Trading Administrator Panel in MQL5 (Part VI): Multiple Functions Interface (I)

The Trading Administrator's role goes beyond just Telegram communications; they can also engage in various control activities, including order management, position tracking, and interface customization. In this article, we’ll share practical insights on expanding our program to support multiple functionalities in MQL5. This update aims to overcome the current Admin Panel's limitation of focusing primarily on communication, enabling it to handle a broader range of tasks.

Trading with the MQL5 Economic Calendar (Part 2): Creating a News Dashboard Panel

In this article, we create a practical news dashboard panel using the MQL5 Economic Calendar to enhance our trading strategy. We begin by designing the layout, focusing on key elements like event names, importance, and timing, before moving into the setup within MQL5. Finally, we implement a filtering system to display only the most relevant news, giving traders quick access to impactful economic events.

From Python to MQL5: A Journey into Quantum-Inspired Trading Systems

The article explores the development of a quantum-inspired trading system, transitioning from a Python prototype to an MQL5 implementation for real-world trading. The system uses quantum computing principles like superposition and entanglement to analyze market states, though it runs on classical computers using quantum simulators. Key features include a three-qubit system for analyzing eight market states simultaneously, 24-hour lookback periods, and seven technical indicators for market analysis. While the accuracy rates might seem modest, they provide a significant edge when combined with proper risk management strategies.

Building A Candlestick Trend Constraint Model (Part 9): Multiple Strategies Expert Advisor (II)

The number of strategies that can be integrated into an Expert Advisor is virtually limitless. However, each additional strategy increases the complexity of the algorithm. By incorporating multiple strategies, an Expert Advisor can better adapt to varying market conditions, potentially enhancing its profitability. Today, we will explore how to implement MQL5 for one of the prominent strategies developed by Richard Donchian, as we continue to enhance the functionality of our Trend Constraint Expert.

Trading with the MQL5 Economic Calendar (Part 1): Mastering the Functions of the MQL5 Economic Calendar

In this article, we explore how to use the MQL5 Economic Calendar for trading by first understanding its core functionalities. We then implement key functions of the Economic Calendar in MQL5 to extract relevant news data for trading decisions. Finally, we conclude by showcasing how to utilize this information to enhance trading strategies effectively.

How to Create an Interactive MQL5 Dashboard/Panel Using the Controls Class (Part 2): Adding Button Responsiveness

In this article, we focus on transforming our static MQL5 dashboard panel into an interactive tool by enabling button responsiveness. We explore how to automate the functionality of the GUI components, ensuring they react appropriately to user clicks. By the end of the article, we establish a dynamic interface that enhances user engagement and trading experience.

Creating an MQL5 Expert Advisor Based on the Daily Range Breakout Strategy

In this article, we create an MQL5 Expert Advisor based on the Daily Range Breakout strategy. We cover the strategy’s key concepts, design the EA blueprint, and implement the breakout logic in MQL5. In the end, we explore techniques for backtesting and optimizing the EA to maximize its effectiveness.

How to Create an Interactive MQL5 Dashboard/Panel Using the Controls Class (Part 1): Setting Up the Panel

In this article, we create an interactive trading dashboard using the Controls class in MQL5, designed to streamline trading operations. The panel features a title, navigation buttons for Trade, Close, and Information, and specialized action buttons for executing trades and managing positions. By the end of the article, you will have a foundational panel ready for further enhancements in future installments.

Data Science and ML (Part 31): Using CatBoost AI Models for Trading

CatBoost AI models have gained massive popularity recently among machine learning communities due to their predictive accuracy, efficiency, and robustness to scattered and difficult datasets. In this article, we are going to discuss in detail how to implement these types of models in an attempt to beat the forex market.

Integrate Your Own LLM into EA (Part 5): Develop and Test Trading Strategy with LLMs (II)-LoRA-Tuning

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

Developing a multi-currency Expert Advisor (Part 12): Developing prop trading level risk manager

In the EA being developed, we already have a certain mechanism for controlling drawdown. But it is probabilistic in nature, as it is based on the results of testing on historical price data. Therefore, the drawdown can sometimes exceed the maximum expected values (although with a small probability). Let's try to add a mechanism that ensures guaranteed compliance with the specified drawdown level.

How to create a trading journal with MetaTrader and Google Sheets

Create a trading journal using MetaTrader and Google Sheets! You will learn how to sync your trading data via HTTP POST and retrieve it using HTTP requests. In the end, You have a trading journal that will help you keep track of your trades effectively and efficiently.

Data Science and ML(Part 30): The Power Couple for Predicting the Stock Market, Convolutional Neural Networks(CNNs) and Recurrent Neural Networks(RNNs)

In this article, We explore the dynamic integration of Convolutional Neural Networks (CNNs) and Recurrent Neural Networks (RNNs) in stock market prediction. By leveraging CNNs' ability to extract patterns and RNNs' proficiency in handling sequential data. Let us see how this powerful combination can enhance the accuracy and efficiency of trading algorithms.

Risk manager for algorithmic trading

The objectives of this article are to prove the necessity of using a risk manager and to implement the principles of controlled risk in algorithmic trading in a separate class, so that everyone can verify the effectiveness of the risk standardization approach in intraday trading and investing in financial markets. In this article, we will create a risk manager class for algorithmic trading. This is a logical continuation of the previous article in which we discussed the creation of a risk manager for manual trading.

Creating a Trading Administrator Panel in MQL5 (Part III): Enhancing the GUI with Visual Styling (I)

In this article, we will focus on visually styling the graphical user interface (GUI) of our Trading Administrator Panel using MQL5. We’ll explore various techniques and features available in MQL5 that allow for customization and optimization of the interface, ensuring it meets the needs of traders while maintaining an attractive aesthetic.

Developing a multi-currency Expert Advisor (Part 10): Creating objects from a string

The EA development plan includes several stages with intermediate results being saved in the database. They can only be retrieved from there again as strings or numbers, not objects. So we need a way to recreate the desired objects in the EA from the strings read from the database.

Example of Stochastic Optimization and Optimal Control

This Expert Advisor, named SMOC (likely standing for Stochastic Model Optimal Control), is a simple example of an advanced algorithmic trading system for MetaTrader 5. It uses a combination of technical indicators, model predictive control, and dynamic risk management to make trading decisions. The EA incorporates adaptive parameters, volatility-based position sizing, and trend analysis to optimize its performance across varying market conditions.

Formulating Dynamic Multi-Pair EA (Part 1): Currency Correlation and Inverse Correlation

Dynamic multi pair Expert Advisor leverages both on correlation and inverse correlation strategies to optimize trading performance. By analyzing real-time market data, it identifies and exploits the relationship between currency pairs.

Building A Candlestick Trend Constraint Model (Part 8): Expert Advisor Development (II)

Think about an independent Expert Advisor. Previously, we discussed an indicator-based Expert Advisor that also partnered with an independent script for drawing risk and reward geometry. Today, we will discuss the architecture of an MQL5 Expert Advisor, that integrates, all the features in one program.

Automating Trading Strategies with Parabolic SAR Trend Strategy in MQL5: Crafting an Effective Expert Advisor

In this article, we will automate the trading strategies with Parabolic SAR Strategy in MQL5: Crafting an Effective Expert Advisor. The EA will make trades based on trends identified by the Parabolic SAR indicator.

Building a Candlestick Trend Constraint Model (Part 8): Expert Advisor Development (I)

In this discussion, we will create our first Expert Advisor in MQL5 based on the indicator we made in the prior article. We will cover all the features required to make the process automatic, including risk management. This will extensively benefit the users to advance from manual execution of trades to automated systems.

News Trading Made Easy (Part 3): Performing Trades

In this article, our news trading expert will begin opening trades based on the economic calendar stored in our database. In addition, we will improve the expert's graphics to display more relevant information about upcoming economic calendar events.

Developing a multi-currency Expert Advisor (Part 6): Automating the selection of an instance group

After optimizing the trading strategy, we receive sets of parameters. We can use them to create several instances of trading strategies combined in one EA. Previously, we did this manually. Here we will try to automate this process.

Example of Auto Optimized Take Profits and Indicator Parameters with SMA and EMA

This article presents a sophisticated Expert Advisor for forex trading, combining machine learning with technical analysis. It focuses on trading Apple stock, featuring adaptive optimization, risk management, and multiple strategies. Backtesting shows promising results with high profitability but also significant drawdowns, indicating potential for further refinement.

Integrate Your Own LLM into EA (Part 5): Develop and Test Trading Strategy with LLMs(I)-Fine-tuning

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

Implementing the Deus EA: Automated Trading with RSI and Moving Averages in MQL5

This article outlines the steps to implement the Deus EA based on the RSI and Moving Average indicators for guiding automated trading.

Implementing a Bollinger Bands Trading Strategy with MQL5: A Step-by-Step Guide

A step-by-step guide to implementing an automated trading algorithm in MQL5 based on the Bollinger Bands trading strategy. A detailed tutorial based on creating an Expert Advisor that can be useful for traders.

Risk manager for manual trading

In this article we will discuss in detail how to write a risk manager class for manual trading from scratch. This class can also be used as a base class for inheritance by algorithmic traders who use automated programs.

Data Science and ML (Part 28): Predicting Multiple Futures for EURUSD, Using AI

It is a common practice for many Artificial Intelligence models to predict a single future value. However, in this article, we will delve into the powerful technique of using machine learning models to predict multiple future values. This approach, known as multistep forecasting, allows us to predict not only tomorrow's closing price but also the day after tomorrow's and beyond. By mastering multistep forecasting, traders and data scientists can gain deeper insights and make more informed decisions, significantly enhancing their predictive capabilities and strategic planning.

From Novice to Expert: The Essential Journey Through MQL5 Trading

Unlock your potential! You're surrounded by opportunities. Discover 3 top secrets to kickstart your MQL5 journey or take it to the next level. Let's dive into discussion of tips and tricks for beginners and pros alike.

Practicing the development of trading strategies

In this article, we will make an attempt to develop our own trading strategy. Any trading strategy must be based on some kind of statistical advantage. Moreover, this advantage should exist for a long time.

Building A Candlestick Trend Constraint Model (Part 7): Refining our model for EA development

In this article, we will delve into the detailed preparation of our indicator for Expert Advisor (EA) development. Our discussion will encompass further refinements to the current version of the indicator to enhance its accuracy and functionality. Additionally, we will introduce new features that mark exit points, addressing a limitation of the previous version, which only identified entry points.

Introduction to MQL5 (Part 8): Beginner's Guide to Building Expert Advisors (II)

This article addresses common beginner questions from MQL5 forums and demonstrates practical solutions. Learn to perform essential tasks like buying and selling, obtaining candlestick prices, and managing automated trading aspects such as trade limits, trading periods, and profit/loss thresholds. Get step-by-step guidance to enhance your understanding and implementation of these concepts in MQL5.