Price Action. Automating the Engulfing Pattern Trading Strategy

Introduction

All Forex traders come across the Price Action at some point. This is not a mere chart analysis technique but the entire system for defining the possible future price movement direction. In this article, we will analyze the Engulfing pattern and create an Expert Advisor which will follow this pattern and make relevant trading decisions based on it.

We have previously examined the automated trading with Price Action patterns, namely the Inside Bar trading, in the article Price Action. Automating the Inside Bar Trading Strategy.

Rules of the Engulfing Pattern

The Engulfing pattern is when the body and shadows of a bar completely engulf the body and shadows of the previous bar. There are two types of patterns available:

- BUOVB — Bullish Outside Vertical Bar;

- BEOVB — Bearish Outside Vertical Bar.

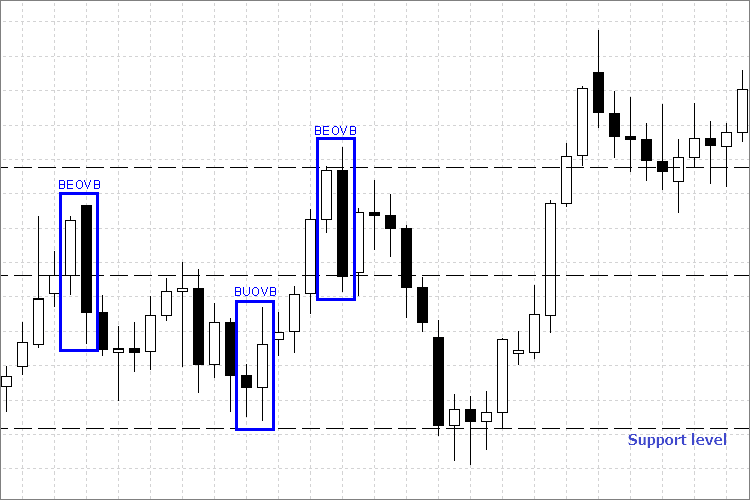

Fig. 1. Types of pattern shown on the chart

BUOVB. The chart shows that the High of the outside bar is above the High of the previous bar, and the Low of the outside bar is below the Low of the previous one.

BEOVB. This pattern can also be easily identified on the chart. The High of the outside bar is above the High of the previous bar, and the Low of the outside bar is below the Low of the previous bar.

Their differences are that each pattern gives a clear understanding of the possible directions of the market.

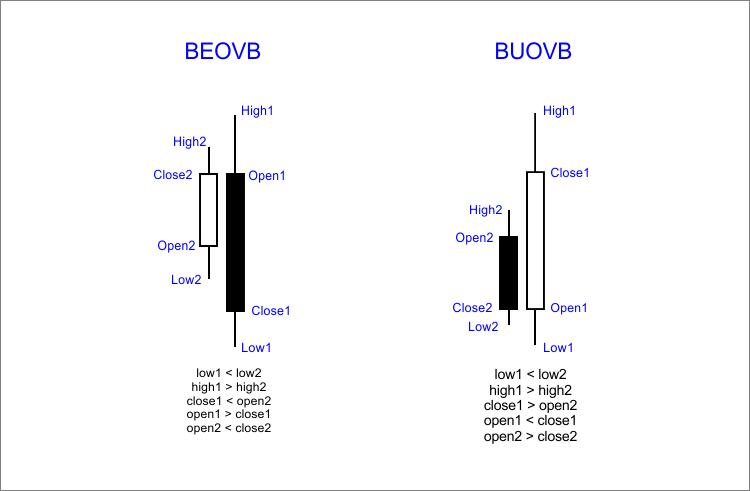

Fig. 2. Structure of the pattern

Rules of the Engulfing pattern:- It is required to operate with this pattern on higher timeframes: H4, D1.

- For more refined entry, additional elements of graphical analysis should be applied, such as trend lines, support/resistance levels, Fibonacci levels, other Price Action patterns, etc.

- Use pending orders to avoid premature or false market entries.

- Patterns repeated in flat trading should not be used as a signal for entering the market.

Establishing Entry Points for "BUOVB", Placing Stop Orders

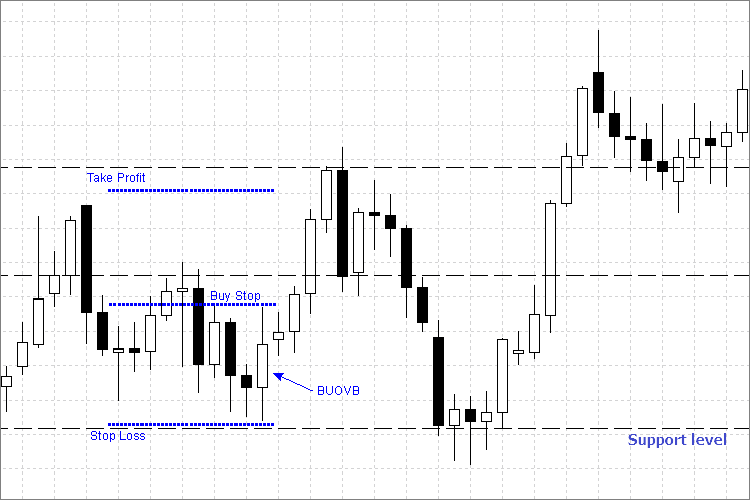

Fig. 3. Setting Buy Stop and stop orders

We will analyze the entry rules and stop orders placement for BUOVB (bullish outside vertical bar) using the example above:

- We set Buy Stop pending order at a price slightly above the High price (by few points, for confirmation) of the outside bar.

- Stop Loss level is set below the Low price of the outside bar.

- And Take Profit level is set before it reaches the next resistance level.

Establishing Entry Points for "BEOVB", Placing Stop Orders

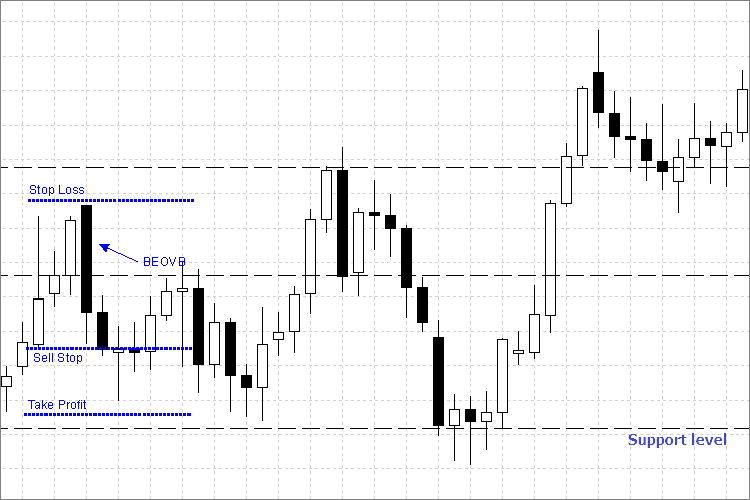

Fig. 4. Setting Sell Stop and stop orders

Let's examine the rules for entry and placement of stop orders for BEOVB (bearish outside vertical bar) from the example above:

- We place the pending Sell Stop order at a price below the Low price (by few points, for confirmation) of an outside bar.

- The Stop Loss level is set above the High price of the outside bar.

- The Take Profit level is set before it reaches the next support level.

Creating an Expert Advisor for Trading the Engulfing Pattern

We reviewed the Engulfing pattern, learned how to enter the market safely, and also determined the levels of stop orders to limit losses or lock in profits.

Next we will try to implement the algorithms of an Expert Advisor and automate the Engulfing trading pattern.

We open MetaEditor from the MetaTrader 4 terminal and create a new Expert Advisor (we will not go into details about creating Expert Advisors, as there is enough information available on the website). At the creation stage we leave all parameters blank. You can name them however you like. Eventually, you should get the following results:

//+------------------------------------------------------------------+ //| BEOVB_BUOVB_Bar.mq4 | //| Copyright 2015, Iglakov Dmitry. | //| cjdmitri@gmail.com | //+------------------------------------------------------------------+ #property copyright "Copyright 2015, Iglakov Dmitry." #property link "cjdmitri@gmail.com" #property version "1.00" #property strict //+------------------------------------------------------------------+ //| Expert initialization function | //+------------------------------------------------------------------+ int OnInit() { //--- //--- return(INIT_SUCCEEDED); } //+------------------------------------------------------------------+ //| Expert deinitialization function | //+------------------------------------------------------------------+ void OnDeinit(const int reason) { //--- } //+------------------------------------------------------------------+ //| Expert tick function | //+------------------------------------------------------------------+ void OnTick() { //--- } //+------------------------------------------------------------------+

Converting the Pattern into MQL4 Algorithm

After creating an Expert Advisor we must define the Engulfing pattern after a candle is closed. For this purpose, we introduce new variables and assign values to them. See the code below:

//+------------------------------------------------------------------+ //| BEOVB_BUOVB_Bar.mq4 | //| Copyright 2015, Iglakov Dmitry. | //| cjdmitri@gmail.com | //+------------------------------------------------------------------+ #property copyright "Copyright 2015, Iglakov Dmitry." #property link "cjdmitri@gmail.com" #property version "1.00" #property strict double open1,//first candle Open price open2, //second candle Open price close1, //first candle Close price close2, //second candle Close price low1, //first candle Low price low2, //second candle Low price high1, //first candle High price high2; //second candle High price //+------------------------------------------------------------------+ //| Expert initialization function | //+------------------------------------------------------------------+ int OnInit() { return(INIT_SUCCEEDED); } //+------------------------------------------------------------------+ //| Expert deinitialization function | //+------------------------------------------------------------------+ void OnDeinit(const int reason) { } //+------------------------------------------------------------------+ //| Expert tick function | //+------------------------------------------------------------------+ void OnTick() { //--- define prices of necessary bars open1 = NormalizeDouble(iOpen(Symbol(), Period(), 1), Digits); open2 = NormalizeDouble(iOpen(Symbol(), Period(), 2), Digits); close1 = NormalizeDouble(iClose(Symbol(), Period(), 1), Digits); close2 = NormalizeDouble(iClose(Symbol(), Period(), 2), Digits); low1 = NormalizeDouble(iLow(Symbol(), Period(), 1), Digits); low2 = NormalizeDouble(iLow(Symbol(), Period(), 2), Digits); high1 = NormalizeDouble(iHigh(Symbol(), Period(), 1), Digits); high2 = NormalizeDouble(iHigh(Symbol(), Period(), 2), Digits); } //+------------------------------------------------------------------+

We find both types of the Engulfing pattern:

void OnTick() { //--- define prices of necessary bars open1 = NormalizeDouble(iOpen(Symbol(), Period(), 1), Digits); open2 = NormalizeDouble(iOpen(Symbol(), Period(), 2), Digits); close1 = NormalizeDouble(iClose(Symbol(), Period(), 1), Digits); close2 = NormalizeDouble(iClose(Symbol(), Period(), 2), Digits); low1 = NormalizeDouble(iLow(Symbol(), Period(), 1), Digits); low2 = NormalizeDouble(iLow(Symbol(), Period(), 2), Digits); high1 = NormalizeDouble(iHigh(Symbol(), Period(), 1), Digits); high2 = NormalizeDouble(iHigh(Symbol(), Period(), 2), Digits); //--- Finding bearish pattern BEOVB if(low1 < low2 &&// First bar's Low is below second bar's Low high1 > high2 &&// First bar's High is above second bar's High close1 < open2 && //First bar's Close price is below second bar's Open open1 > close1 && //First bar is a bearish bar open2 < close2) //Second bar is a bullish bar { //--- we have described all conditions indicating that the first bar completely engulfs the second bar and is a bearish bar }

The same way we find a bullish pattern:

//--- Finding bullish pattern BUOVB if(low1 < low2 &&// First bar's Low is below second bar's Low high1 > high2 &&// First bar's High is above second bar's High close1 > open2 && //First bar's Close price is higher than second bar's Open open1 < close1 && //First bar is a bullish bar open2 > close2) //Second bar is a bearish bar { //--- we have described all conditions indicating that the first bar completely engulfs the second bar and is a bullish bar }

- We create customizable variables: stop orders, slippage, order expiration time, EA magic number, trading lot. Stop loss can be omitted, as it will be set according to the pattern rules.

- We introduce local variables to convert variables into a normal form.

- Furthermore, we bear in mind that stop orders are set at a certain distance from the bar's price values. In order to implement that, we add the Interval variable responsible for the interval between High/Low prices of bars and stop order levels, as well as pending order levels.

- We enter the variable timeBUOVB_BEOVB to prevent re-opening the order on this pattern.

- We enter the variable bar1size to check whether the outside bar is big enough. Thus, we can assume that the current market is not flat.

As a result, we obtain the following code:

//+------------------------------------------------------------------+ //| BEOVB_BUOVB_bar.mq4 | //| Copyright 2015, Iglakov Dmitry. | //| cjdmitri@gmail.com | //+------------------------------------------------------------------+ #property copyright "Copyright 2015, Iglakov Dmitry." #property link "cjdmitri@gmail.com" #property version "1.00" #property strict extern int interval = 25; //Interval extern double lot = 0.1; //Lot Size extern int TP = 400; //Take Profit extern int magic = 962231; //Magic number extern int slippage = 2; //Slippage extern int ExpDate = 48; //Expiration Hour Order extern int bar1size = 900; //Bar 1 Size double buyPrice,//define BuyStop setting price buyTP, //Take Profit BuyStop buySL, //Stop Loss BuyStop sellPrice, //define SellStop setting price sellTP, //Take Profit SellStop sellSL; //Stop Loss SellStop double open1,//first candle Open price open2, //second candle Open price close1, //first candle Close price close2, //second candle Close price low1, //first candle Low price low2, //second candle Low price high1, //first candle High price high2; //second candle High price datetime _ExpDate =0; // local variable for defining pending orders expiration time double _bar1size;// local variable required to avoid a flat market datetime timeBUOVB_BEOVB;// time of a bar when pattern orders were opened, to avoid re-opening //+------------------------------------------------------------------+ //| Expert initialization function | //+------------------------------------------------------------------+ int OnInit() { return(INIT_SUCCEEDED); } //+------------------------------------------------------------------+ //| Expert deinitialization function | //+------------------------------------------------------------------+ void OnDeinit(const int reason) { } //+------------------------------------------------------------------+ //| Expert tick function | //+------------------------------------------------------------------+ void OnTick() { double _bid = NormalizeDouble(MarketInfo (Symbol(), MODE_BID), Digits); // define Low price double _ask = NormalizeDouble(MarketInfo(Symbol(), MODE_ASK), Digits); //define High price double _point = MarketInfo(Symbol(), MODE_POINT); //--- define prices of necessary bars open1 = NormalizeDouble(iOpen(Symbol(), Period(), 1), Digits); open2 = NormalizeDouble(iOpen(Symbol(), Period(), 2), Digits); close1 = NormalizeDouble(iClose(Symbol(), Period(), 1), Digits); close2 = NormalizeDouble(iClose(Symbol(), Period(), 2), Digits); low1 = NormalizeDouble(iLow(Symbol(), Period(), 1), Digits); low2 = NormalizeDouble(iLow(Symbol(), Period(), 2), Digits); high1 = NormalizeDouble(iHigh(Symbol(), Period(), 1), Digits); high2 = NormalizeDouble(iHigh(Symbol(), Period(), 2), Digits); //--- _bar1size=NormalizeDouble(((high1-low1)/_point),0); //--- Finding bearish pattern BEOVB if(timeBUOVB_BEOVB!=iTime(Symbol(),Period(),1) && //orders are not yet opened for this pattern _bar1size > bar1size && //first bar is big enough, so the market is not flat low1 < low2 &&//First bar's Low is below second bar's Low high1 > high2 &&//First bar's High is above second bar's High close1 < open2 && //First bar's Сlose price is lower than second bar's Open price open1 > close1 && //First bar is a bearish bar open2 < close2) //Second bar is a bullish bar { //--- we have described all conditions indicating that the first bar completely engulfs the second bar and is a bearish bar timeBUOVB_BEOVB=iTime(Symbol(),Period(),1); // indicate that orders are already placed on this pattern } //--- Finding bullish pattern BUOVB if(timeBUOVB_BEOVB!=iTime(Symbol(),Period(),1) && //orders are not yet opened for this pattern _bar1size > bar1size && //first bar is big enough not to consider a flat market low1 < low2 &&//First bar's Low is below second bar's Low high1 > high2 &&//First bar's High is above second bar's High close1 > open2 && //First bar's Close price is higher than second bar's Open price open1 < close1 && //First bar is a bullish bar open2 > close2) //Second bar is a bearish bar { //--- we have described all conditions indicating that the first bar completely engulfs the second bar and is a bullish bar timeBUOVB_BEOVB=iTime(Symbol(),Period(),1); // indicate that orders are already placed on this pattern } } //+------------------------------------------------------------------+

Defining Stop Order Levels

We have fulfilled all the conditions and found high-quality patterns. Now it is necessary to set the stop order levels, pending order prices, as well as orders expiration date for each pattern.

Let's add the following code to the OnTick() function body:

//--- Define prices for placing orders and stop orders buyPrice =NormalizeDouble(high1 + interval * _point,Digits); //define a price of order placing with intervals buySL =NormalizeDouble(low1-interval * _point,Digits); //define stop-loss with an interval buyTP =NormalizeDouble(buyPrice + TP * _point,Digits); //define take profit _ExpDate =TimeCurrent() + ExpDate*60*60; //pending order expiration time calculation //--- We also calculate sell orders sellPrice=NormalizeDouble(low1-interval*_point,Digits); sellSL=NormalizeDouble(high1+interval*_point,Digits); sellTP=NormalizeDouble(sellPrice-TP*_point,Digits);

Correction of Execution Errors

If you have ever engaged in the development of Expert Advisors, you probably know that errors often occur when closing and setting orders, including waiting time, incorrect stops, etc. To eliminate such errors, we should write a separate function with a small built-in handler of basic errors.

//+----------------------------------------------------------------------------------------------------------------------+ //| The function opens or sets an order | //| symbol - symbol, at which a deal is performed. | //| cmd - a deal (may be equal to any of the deal values). | //| volume - amount of lots. | //| price - Open price. | //| slippage - maximum price deviation for market buy or sell orders. | //| stoploss - position close price when an unprofitability level is reached (0 if there is no unprofitability level).| //| takeprofit - position close price when a profitability level is reached (0 if there is no profitability level). | //| comment - order comment. The last part of comment can be changed by the trade server. | //| magic - order magic number. It can be used as a user-defined ID. | //| expiration - pending order expiration time. | //| arrow_color - open arrow color on a chart. If the parameter is absent or equal to CLR_NONE, | //| the open arrow is not displayed on a chart. | //+----------------------------------------------------------------------------------------------------------------------+ int OrderOpenF(string OO_symbol, int OO_cmd, double OO_volume, double OO_price, int OO_slippage, double OO_stoploss, double OO_takeprofit, string OO_comment, int OO_magic, datetime OO_expiration, color OO_arrow_color) { int result = -1;// result of opening an order int Error = 0; // error when opening an order int attempt = 0; // amount of performed attempts int attemptMax = 3; // maximum amount of attempts bool exit_loop = false; // exit the loop string lang =TerminalInfoString(TERMINAL_LANGUAGE);// trading terminal language for defining the language of the messages double stopllvl =NormalizeDouble(MarketInfo (OO_symbol, MODE_STOPLEVEL) * MarketInfo (OO_symbol, MODE_POINT),Digits);// minimum stop loss/take profit level, in points //the module provides safe order opening //--- checking stop orders for buying if(OO_cmd==OP_BUY || OO_cmd==OP_BUYLIMIT || OO_cmd==OP_BUYSTOP) { double tp = (OO_takeprofit - OO_price)/MarketInfo(OO_symbol, MODE_POINT); double sl = (OO_price - OO_stoploss)/MarketInfo(OO_symbol, MODE_POINT); if(tp>0 && tp<=stopllvl) { OO_takeprofit=OO_price+stopllvl+2*MarketInfo(OO_symbol,MODE_POINT); } if(sl>0 && sl<=stopllvl) { OO_stoploss=OO_price -(stopllvl+2*MarketInfo(OO_symbol,MODE_POINT)); } } //--- checking stop orders for selling if(OO_cmd==OP_SELL || OO_cmd==OP_SELLLIMIT || OO_cmd==OP_SELLSTOP) { double tp = (OO_price - OO_takeprofit)/MarketInfo(OO_symbol, MODE_POINT); double sl = (OO_stoploss - OO_price)/MarketInfo(OO_symbol, MODE_POINT); if(tp>0 && tp<=stopllvl) { OO_takeprofit=OO_price -(stopllvl+2*MarketInfo(OO_symbol,MODE_POINT)); } if(sl>0 && sl<=stopllvl) { OO_stoploss=OO_price+stopllvl+2*MarketInfo(OO_symbol,MODE_POINT); } } //--- while loop while(!exit_loop) { result=OrderSend(OO_symbol,OO_cmd,OO_volume,OO_price,OO_slippage,OO_stoploss,OO_takeprofit,OO_comment,OO_magic,OO_expiration,OO_arrow_color); //attempt to open an order using the specified parameters //--- if there is an error when opening an order if(result<0) { Error = GetLastError(); //assign a code to an error switch(Error) //error enumeration { //order closing error enumeration and an attempt to fix them case 2: if(attempt<attemptMax) { attempt=attempt+1; //define one more attempt Sleep(3000); //3 seconds of delay RefreshRates(); break; //exit switch } if(attempt==attemptMax) { attempt=0; //reset the amount of attempts to zero exit_loop = true; //exit while break; //exit switch } case 3: RefreshRates(); exit_loop = true; //exit while break; //exit switch case 4: if(attempt<attemptMax) { attempt=attempt+1; //define one more attempt Sleep(3000); //3 seconds of delay RefreshRates(); break; //exit switch } if(attempt==attemptMax) { attempt = 0; //reset the amount of attempts to zero exit_loop = true; //exit while break; //exit switch } case 5: exit_loop = true; //exit while break; //exit switch case 6: if(attempt<attemptMax) { attempt=attempt+1; //define one more attempt Sleep(5000); //3 seconds of delay break; //exit switch } if(attempt==attemptMax) { attempt = 0; //reset the amount of attempts to zero exit_loop = true; //exit while break; //exit switch } case 8: if(attempt<attemptMax) { attempt=attempt+1; //define one more attempt Sleep(7000); //3 seconds of delay break; //exit switch } if(attempt==attemptMax) { attempt = 0; //reset the amount of attempts to zero exit_loop = true; //exit while break; //exit switch } case 64: exit_loop = true; //exit while break; //exit switch case 65: exit_loop = true; //exit while break; //exit switch case 128: Sleep(3000); RefreshRates(); continue; //exit switch case 129: if(attempt<attemptMax) { attempt=attempt+1; //define one more attempt Sleep(3000); //3 seconds of delay RefreshRates(); break; //exit switch } if(attempt==attemptMax) { attempt = 0; //reset the amount of attempts to zero exit_loop = true; //exit while break; //exit switch } case 130: exit_loop=true; //exit while break; case 131: exit_loop = true; //exit while break; //exit switch case 132: Sleep(10000); //sleep for 10 seconds RefreshRates(); //update data //exit_loop = true; //exit while break; //exit switch case 133: exit_loop=true; //exit while break; //exit switch case 134: exit_loop=true; //exit while break; //exit switch case 135: if(attempt<attemptMax) { attempt=attempt+1; //define one more attempt RefreshRates(); break; //exit switch } if(attempt==attemptMax) { attempt = 0; //set the number of attempts to zero exit_loop = true; //exit while break; //exit switch } case 136: if(attempt<attemptMax) { attempt=attempt+1; //define one more attempt RefreshRates(); break; //exit switch } if(attempt==attemptMax) { attempt = 0; //set the amount of attempts to zero exit_loop = true; //exit while break; //exit switch } case 137: if(attempt<attemptMax) { attempt=attempt+1; Sleep(2000); RefreshRates(); break; } if(attempt==attemptMax) { attempt=0; exit_loop=true; break; } case 138: if(attempt<attemptMax) { attempt=attempt+1; Sleep(1000); RefreshRates(); break; } if(attempt==attemptMax) { attempt=0; exit_loop=true; break; } case 139: exit_loop=true; break; case 141: Sleep(5000); exit_loop=true; break; case 145: exit_loop=true; break; case 146: if(attempt<attemptMax) { attempt=attempt+1; Sleep(2000); RefreshRates(); break; } if(attempt==attemptMax) { attempt=0; exit_loop=true; break; } case 147: if(attempt<attemptMax) { attempt=attempt+1; OO_expiration=0; break; } if(attempt==attemptMax) { attempt=0; exit_loop=true; break; } case 148: exit_loop=true; break; default: Print("Error: ",Error); exit_loop=true; //exit while break; //other options } } //--- if no errors detected else { if(lang == "Russian") {Print("Ордер успешно открыт. ", result);} if(lang == "English") {Print("The order is successfully opened.", result);} Error = 0; //reset the error code to zero break; //exit while //errorCount =0; //reset the amount of attempts to zero } } return(result); } //+------------------------------------------------------------------+

As a result, we obtain the following code:

//+------------------------------------------------------------------+ //| BEOVB_BUOVB_bar.mq4 | //| Copyright 2015, Iglakov Dmitry. | //| cjdmitri@gmail.com | //+------------------------------------------------------------------+ #property copyright "Copyright 2015, Iglakov Dmitry." #property link "cjdmitri@gmail.com" #property version "1.00" #property strict extern int interval = 25; //Interval extern double lot = 0.1; //Lot Size extern int TP = 400; //Take Profit extern int magic = 962231; //Magic number extern int slippage = 2; //Slippage extern int ExpDate = 48; //Expiration Hour Order extern int bar1size = 900; //Bar 1 Size double buyPrice,//define BuyStop price buyTP, //Take Profit BuyStop buySL, //Stop Loss BuyStop sellPrice, //define SellStop price sellTP, //Take Profit SellStop sellSL; //Stop Loss SellStop double open1,//first candle Open price open2, //second candle Open price close1, //first candle Close price close2, //second candle Close price low1, //first candle Low price low2, //second candle Low price high1, //first candle High price high2; //second candle High price datetime _ExpDate =0; // local variable for defining pending orders expiration time double _bar1size;// local variable required to avoid a flat market datetime timeBUOVB_BEOVB;// time of a bar when pattern orders were opened, to avoid re-opening //+------------------------------------------------------------------+ //| Expert initialization function | //+------------------------------------------------------------------+ int OnInit() { return(INIT_SUCCEEDED); } //+------------------------------------------------------------------+ //| Expert deinitialization function | //+------------------------------------------------------------------+ void OnDeinit(const int reason) { } //+------------------------------------------------------------------+ //| Expert tick function | //+------------------------------------------------------------------+ void OnTick() { double _bid = NormalizeDouble(MarketInfo (Symbol(), MODE_BID), Digits); // define Low price double _ask = NormalizeDouble(MarketInfo(Symbol(), MODE_ASK), Digits); //define High price double _point = MarketInfo(Symbol(), MODE_POINT); //--- define prices of necessary bars open1 = NormalizeDouble(iOpen(Symbol(), Period(), 1), Digits); open2 = NormalizeDouble(iOpen(Symbol(), Period(), 2), Digits); close1 = NormalizeDouble(iClose(Symbol(), Period(), 1), Digits); close2 = NormalizeDouble(iClose(Symbol(), Period(), 2), Digits); low1 = NormalizeDouble(iLow(Symbol(), Period(), 1), Digits); low2 = NormalizeDouble(iLow(Symbol(), Period(), 2), Digits); high1 = NormalizeDouble(iHigh(Symbol(), Period(), 1), Digits); high2 = NormalizeDouble(iHigh(Symbol(), Period(), 2), Digits); //--- Define prices for placing orders and stop orders buyPrice =NormalizeDouble(high1 + interval * _point,Digits); //define a price of order placing with intervals buySL =NormalizeDouble(low1-interval * _point,Digits); //define stop loss with an interval buyTP =NormalizeDouble(buyPrice + TP * _point,Digits); //define take profit _ExpDate =TimeCurrent() + ExpDate*60*60; //pending order expiration time calculation //--- We also calculate sell orders sellPrice=NormalizeDouble(low1-interval*_point,Digits); sellSL=NormalizeDouble(high1+interval*_point,Digits); sellTP=NormalizeDouble(sellPrice-TP*_point,Digits); //--- _bar1size=NormalizeDouble(((high1-low1)/_point),0); //--- Finding bearish pattern BEOVB if(timeBUOVB_BEOVB!=iTime(Symbol(),Period(),1) && //orders are not yet opened for this pattern _bar1size > bar1size && //first bar is big enough, so the market is not flat low1 < low2 &&//First bar's Low is below second bar's Low high1 > high2 &&//First bar's High is above second bar's High close1 < open2 && //First bar's Close price is lower than second bar's Open price open1 > close1 && //First bar is a bearish bar open2 < close2) //Second bar is a bullish bar { //--- we have described all conditions indicating that the first bar completely engulfs the second bar and is a bearish bar OrderOpenF(Symbol(),OP_SELLSTOP,lot,sellPrice,slippage,sellSL,sellTP,NULL,magic,_ExpDate,Blue); timeBUOVB_BEOVB=iTime(Symbol(),Period(),1); //indicate that orders are already placed on this pattern } //--- Finding bullish pattern BUOVB if(timeBUOVB_BEOVB!=iTime(Symbol(),Period(),1) && //orders are not yet opened for this pattern _bar1size > bar1size && //first bar is big enough, so the market is not flat low1 < low2 &&//First bar's Low is below second bar's Low high1 > high2 &&//First bar's High is above second bar's High close1 > open2 && //First bar's Close price is higher than second bar's Open price open1 < close1 && //First bar is a bullish bar open2 > close2) //Second bar is a bearish bar { //--- we have described all conditions indicating that the first bar completely engulfs the second bar and is a bullish bar OrderOpenF(Symbol(),OP_BUYSTOP,lot,buyPrice,slippage,buySL,buyTP,NULL,magic,_ExpDate,Blue); timeBUOVB_BEOVB = iTime(Symbol(),Period(),1); //indicate that orders are already placed on this pattern } } //+------------------------------------------------------------------+

Now, let's perform the compilation and check for error messages in the log.

Testing the Expert Advisor

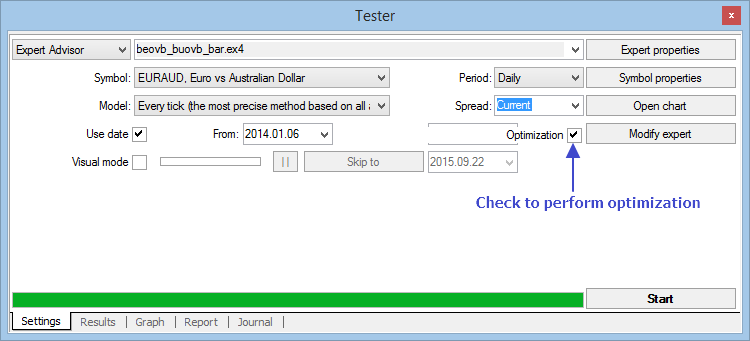

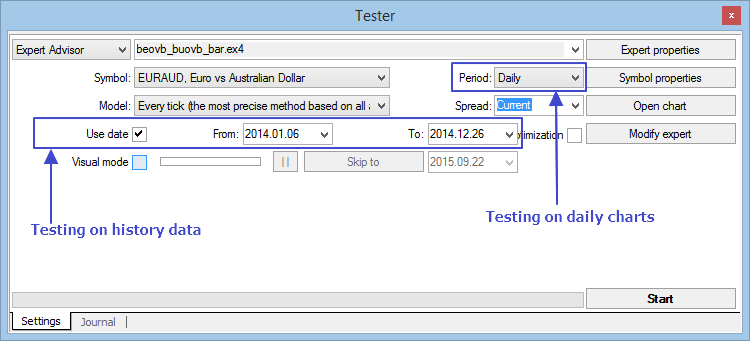

It is time to test our Expert Advisor. Let's launch the Strategy Tester and set the input parameters.

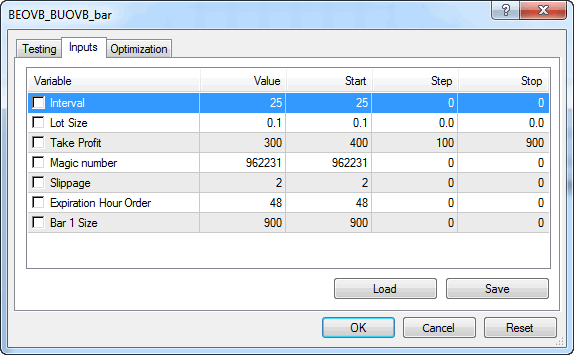

Fig. 5. Input Parameters for Testing

- Choose a currency pair for testing. I chose EURAUD.

- Make sure to set "Every tick" mode and define that testing is to be performed on history data. I have selected the entire year of 2014.

- Set D1 timeframe.

- Launch the test.

- After the test is complete, check the log. As we can see, no execution errors have occurred in the process.

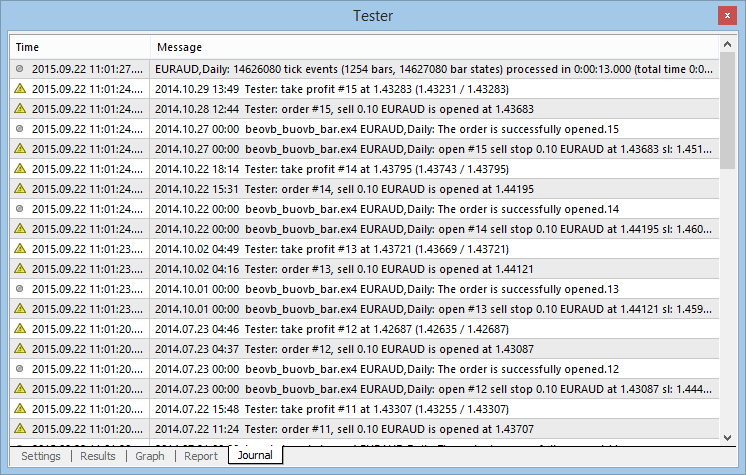

Below is the EA testing journal:

Fig. 7. Expert Advisor testing journal

Make sure there are no mistakes and optimize the EA.

Optimization

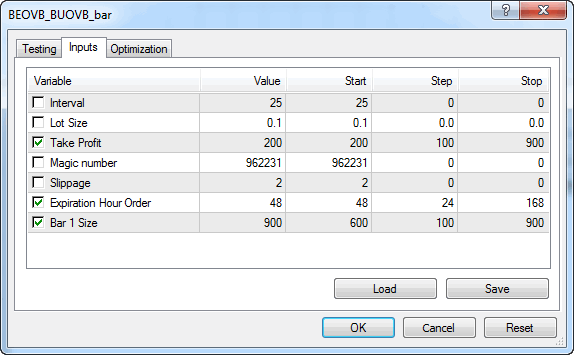

I have selected the following parameters for optimization:

Fig. 8. Optimization parameters

Fig. 9. Optimization settings

Thus, as a result of optimization and testing, we now have the ready-to-use robot.

Optimization and Testing Results

After the optimization of the most popular currency pairs, we obtain the following results:

| Currency pair | Net profit | Profit factor | Drawdown (%) | Gross Profit | Gross loss |

|---|---|---|---|---|---|

| EURAUD | 523.90$ | 3.70 | 2.13 | 727,98$ | 196.86$ |

| USDCHF | 454.19$ | - | 2.25 | 454.19$ | 0.00$ |

| GBPUSD | 638.71$ | - | 1.50 | 638.71$ | 0.00$ |

| EURUSD | 638.86$ | - | 1.85 | 638.86$ | 0.00$ |

| USDJPY | 423.85$ | 5.15 | 2.36 | 525.51$ | 102.08$ |

| USDCAD | 198.82$ | 2.41 | 2.74 | 379.08$ | 180.26$ |

| AUDUSD | 136.14$ | 1.67 | 2.39 | 339.26$ | 203.12$ |

Table 1. Optimization results

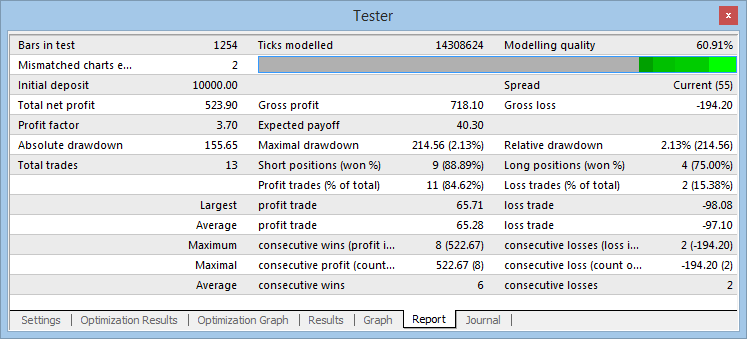

More detailed testing results were achieved on the currency pair EURAUD:

Fig. 10. Testing results

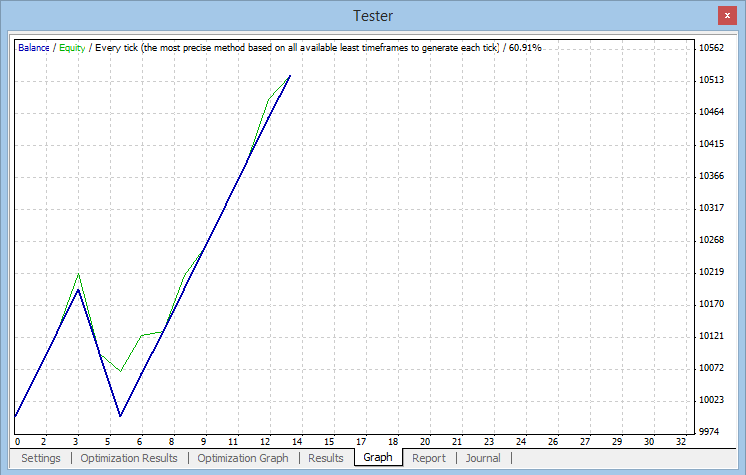

Fig. 11. Testing results chart

Conclusion

- In this article, we have created an Expert Advisor trading the Engulfing pattern.

- We made sure that Price Action patterns can work even with no additional market entry filters.

- No tricks (like Martingale or averaging) have been used.

- The drawdown has been minimized through the correct setting of the stop orders.

- No technical indicators have been used. The EA was based solely on reading a "bare" chart.

Thank you for reading, and I hope you find this article helpful.

Translated from Russian by MetaQuotes Ltd.

Original article: https://www.mql5.com/ru/articles/1946

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

How to Develop a Profitable Trading Strategy

How to Develop a Profitable Trading Strategy

How to Secure Your Expert Advisor While Trading on the Moscow Exchange

How to Secure Your Expert Advisor While Trading on the Moscow Exchange

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Good job on this EA Dmitry..I have been testing this EA on demo account for about a month now and results are quite good..But I have suggestion if you dont mind..I think it will be a good idea to add trailing stop feature to this EA so that we can let our winners run and cut losses short.Thank you for sharing this good EA.

this don,t work in demo account?

i can,t test it!

Hello good evening, how do I download this EA?

Hello good evening, how do I download this EA?

Read the article on the first post.