Expert Advisors Based on Popular Trading Systems and Alchemy of Trading Robot Optimization (Part V)

Introduction

In my previous articles from this cycle (1, 2, 3, 4) I described simplest trading systems, the distinctive of which was working on only one frame. As a result, such a trading system has absolutely no reaction to the change of market trends in a more global time scale. This may result in losses in conditions of a changed market, such changes are not detected in a system of that kind. Actually, in live trading systems based on data obtained from a chart of only one timeframe can hardly be used. Usually at least two timeframes are used for a normal operation. A current trend is usually identified on a chart of a higher timeframe, while the point of market entering in the direction of this trend is calculated on a chart of a smaller timeframe. In my opinion, examples of simplest trading strategies described in previous articles are enough for a reader to learn designing such systems. So now let's discuss methods to improve such trading systems on the basis of the above described reasoning.

Trading System using Two Timeframes

From the point of view of logics, there is no difference, on the basis of what trading system described in previous articles we will build a more complicated system. As for their initial essence, each simplest trading system can be presented in the following form:

For long positions:

For short positions:

In our trading system using two timeframes, these conditions for market entering will be defined on the basis of indicators calculated on a smaller timeframe. Trend direction will be identified on a higher timeframe. So, the algorithm containing these conditions will look like this:

For long positions:

For short positions:

In this case the Trend variable defines only the direction of a current trend on a higher timeframe and the additional condition for market entering limits trading actions of an Expert Advisor only to the direction of this global trend. From the point of view of program code, it makes no difference using what algorithm the current trend will be detected on a higher timeframe. So it is up to an EA writer to decide what algorithms to use both for calculating a market entering point on a smaller timeframe and detecting the current trend on a higher timeframe. Let's analyze the earlier described algorithm with the OsMA oscillator represented by the EA Exp_5.mq4, to define the current trend let's use the moving J2JMA.mq4. In such a case the condition of trade defining will be very simple:

![]()

So now let's add some code to the existing Exp_5.mq4 including into it the above described logics. the ready code will look like this:

//For the EA operation Metatrader\EXPERTS\indicators folder must //contain indicators 5c_OsMA.mq4 and J2JMA.mq4 //+==================================================================+ //| Exp_11.mq4 | //| Copyright © 2008, Nikolay Kositsin | //| Khabarovsk, farria@mail.redcom.ru | //+==================================================================+ #property copyright "Copyright © 2008, Nikolay Kositsin" #property link "farria@mail.redcom.ru" //----+ +--------------------------------------------------------------------------+ //---- EA INPUT PARAMETERS FOR BUY TRADES extern bool Test_Up = true;//filter of trade calculations direction extern double Money_Management_Up = 0.1; //---- input parameters of the custom indicator J2JMA.mq4 extern int TimeframeX_Up = 240; extern int Length1X_Up = 4; // depth of the first smoothing extern int Phase1X_Up = 100; // parameter of the first smoothing //changing in the range -100 ... +100, influences the quality //of the transient process of averaging; extern int Length2X_Up = 4; // depth of the second smoothing extern int Phase2X_Up = 100; // parameter of the second smoothing, //changing in the range -100 ... +100, influences the quality //of the transient process of averaging; extern int IPCX_Up = 0;/* Selecting prices on which the indicator will be calculated (0-CLOSE, 1-OPEN, 2-HIGH, 3-LOW, 4-MEDIAN, 5-TYPICAL, 6-WEIGHTED, 7-Heiken Ashi Close, 8-SIMPL, 9-TRENDFOLLOW, 10-0.5*TRENDFOLLOW, 11-Heiken Ashi Low, 12-Heiken Ashi High, 13-Heiken Ashi Open, 14-Heiken Ashi Close.) */ //---- input parameters of the custom indicator 5c_OsMA.mq4 extern int Timeframe_Up = 60; extern double IndLevel_Up = 0; // breakout level of the indicator extern int FastEMA_Up = 12; // quick EMA period extern int SlowEMA_Up = 26; // slow EMA period extern int SignalSMA_Up = 9; // signal SMA period extern int STOPLOSS_Up = 50; // stop loss extern int TAKEPROFIT_Up = 100; // take profit extern int TRAILINGSTOP_Up = 0; // trailing stop extern int PriceLevel_Up =40; // difference between the current price and // the price of a pending order triggering extern bool ClosePos_Up = true; // forced position closing allowed //----+ +--------------------------------------------------------------------------+ //---- EA INPUT PARAMETERS FOR SELL TRADES extern bool Test_Dn = true;//filter of trade calculations direction extern double Money_Management_Dn = 0.1; //---- input parameters of the custom indicator J2JMA.mq4 extern int TimeframeX_Dn = 240; extern int Length1X_Dn = 4; // smoothing depth extern int Phase1X_Dn = 100; // parameter of the first smoothing //changing in the range -100 ... +100, influences the quality //of the transient process of averaging; extern int Length2X_Dn = 4; // smoothing depth extern int Phase2X_Dn = 100; // parameter of the second smoothing //changing in the range -100 ... +100, influences the quality //of the transient process of averaging; extern int IPCX_Dn = 0;/* Selecting prices on which the indicator will be calculated (0-CLOSE, 1-OPEN, 2-HIGH, 3-LOW, 4-MEDIAN, 5-TYPICAL, 6-WEIGHTED, 7-Heiken Ashi Close, 8-SIMPL, 9-TRENDFOLLOW, 10-0.5*TRENDFOLLOW, 11-Heiken Ashi Low, 12-Heiken Ashi High, 13-Heiken Ashi Open, 14-Heiken Ashi Close.) */ //---- input parameters of the custom indicator 5c_OsMA.mq4 extern int Timeframe_Dn = 60; extern double IndLevel_Dn = 0; // breakout level of the indicator extern int FastEMA_Dn = 12; // quick EMA period extern int SlowEMA_Dn = 26; // slow EMA period extern int SignalSMA_Dn = 9; // signal SMA period extern int STOPLOSS_Dn = 50; // stop loss extern int TAKEPROFIT_Dn = 100; // take profit extern int TRAILINGSTOP_Dn = 0; // trailing stop extern int PriceLevel_Dn = 40; // difference between the current price and // the price of a pending order triggering extern bool ClosePos_Dn = true; // forced position closing allowed //----+ +--------------------------------------------------------------------------+ //---- Integer variables for the minimum of calculation bars int MinBarX_Up, MinBar_Up, MinBarX_Dn, MinBar_Dn; //+==================================================================+ //| TimeframeCheck() functions | //+==================================================================+ void TimeframeCheck(string Name, int Timeframe) { //----+ //---- Checking the correctness of Timeframe variable value if (Timeframe != 1) if (Timeframe != 5) if (Timeframe != 15) if (Timeframe != 30) if (Timeframe != 60) if (Timeframe != 240) if (Timeframe != 1440) Print(StringConcatenate("TimeframeCheck: Parameter ",Name, " cannot ", "be equal to ", Timeframe, "!!!")); //----+ } //+==================================================================+ //| Custom Expert functions | //+==================================================================+ #include <Lite_EXPERT1.mqh> //+==================================================================+ //| Custom Expert initialization function | //+==================================================================+ int init() { //---- Checking the correctness of Timeframe_Up variable value TimeframeCheck("Timeframe_Up", Timeframe_Up); //---- Checking the correctness of TimeframeX_Up variable value TimeframeCheck("TimeframeX_Up", TimeframeX_Up); //---- Checking the correctness of Timeframe_Dn variable value TimeframeCheck("Timeframe_Dn", Timeframe_Dn); //---- Checking the correctness of Timeframe_Dn variable value TimeframeCheck("TimeframeX_Dn", TimeframeX_Dn); //---- Initialization of variables MinBar_Up = 3 + MathMax(FastEMA_Up, SlowEMA_Up) + SignalSMA_Up; MinBarX_Up = 3 + 30 + 30; MinBar_Dn = 3 + MathMax(FastEMA_Dn, SlowEMA_Dn) + SignalSMA_Dn; MinBarX_Dn = 3 + 30 + 30; //---- end of initialization return(0); } //+==================================================================+ //| expert deinitialization function | //+==================================================================+ int deinit() { //----+ //---- End of the EA deinitialization return(0); //----+ } //+==================================================================+ //| Custom Expert iteration function | //+==================================================================+ int start() { //----+ Declaring local variables double J2JMA1, J2JMA2, Osc1, Osc2; //----+ Declaring static variables //----+ +---------------------------------------------------------------+ static double TrendX_Up, TrendX_Dn; static datetime StopTime_Up, StopTime_Dn; static int LastBars_Up, LastBarsX_Up, LastBarsX_Dn, LastBars_Dn; static bool BUY_Sign, BUY_Stop, SELL_Sign, SELL_Stop; //----+ +---------------------------------------------------------------+ //----++ CODE FOR LONG POSITIONS | //----+ +---------------------------------------------------------------+ if (Test_Up) { int IBARS_Up = iBars(NULL, Timeframe_Up); int IBARSX_Up = iBars(NULL, TimeframeX_Up); if (IBARS_Up >= MinBar_Up && IBARSX_Up >= MinBarX_Up) { //----+ +----------------------+ //----+ DEFINING TREND | //----+ +----------------------+ if (LastBarsX_Up != IBARSX_Up) { //----+ Initialization of variables LastBarsX_Up = IBARSX_Up; BUY_Stop = false; //----+ calculating indicator values for J2JMA J2JMA1 = iCustom(NULL, TimeframeX_Up, "J2JMA", Length1X_Up, Length2X_Up, Phase1X_Up, Phase2X_Up, 0, IPCX_Up, 0, 1); //--- J2JMA2 = iCustom(NULL, TimeframeX_Up, "J2JMA", Length1X_Up, Length2X_Up, Phase1X_Up, Phase2X_Up, 0, IPCX_Up, 0, 2); //----+ defining trend TrendX_Up = J2JMA1 - J2JMA2; //----+ defining a signal for closing trades if (TrendX_Up < 0) BUY_Stop = true; } //----+ +----------------------------------------+ //----+ DEFINING SIGNAL FOR MARKET ENTERING | //----+ +----------------------------------------+ if (LastBars_Up != IBARS_Up) { //----+ Initialization of variables BUY_Sign = false; LastBars_Up = IBARS_Up; StopTime_Up = iTime(NULL, Timeframe_Up, 0) + 60 * Timeframe_Up; //----+ calculating indicator values Osc1 = iCustom(NULL, Timeframe_Up, "5c_OsMA", FastEMA_Up, SlowEMA_Up, SignalSMA_Up, 5, 1); //--- Osc2 = iCustom(NULL, Timeframe_Up, "5c_OsMA", FastEMA_Up, SlowEMA_Up, SignalSMA_Up, 5, 2); //----+ defining signals for trades if (TrendX_Up > 0) if (Osc2 < IndLevel_Up) if (Osc1 > IndLevel_Up) BUY_Sign = true; } //----+ +-------------------+ //----+ EXECUTION OF TRADES | //----+ +-------------------+ if (!OpenBuyLimitOrder1(BUY_Sign, 1, Money_Management_Up, STOPLOSS_Up, TAKEPROFIT_Up, PriceLevel_Up, StopTime_Up)) return(-1); if (ClosePos_Up) if (!CloseOrder1(BUY_Stop, 1)) return(-1); if (!Make_TreilingStop(1, TRAILINGSTOP_Up)) return(-1); } } //----+ +---------------------------------------------------------------+ //----++ CODE FOR SHORT POSITIONS | //----+ +---------------------------------------------------------------+ if (Test_Dn) { int IBARS_Dn = iBars(NULL, Timeframe_Dn); int IBARSX_Dn = iBars(NULL, TimeframeX_Dn); if (IBARS_Dn >= MinBar_Dn && IBARSX_Dn >= MinBarX_Dn) { //----+ +----------------------+ //----+ DEFINING TREND | //----+ +----------------------+ if (LastBarsX_Dn != IBARSX_Dn) { //--- Initialization of variables LastBarsX_Dn = IBARSX_Dn; SELL_Stop = false; //----+ calculating indicator values for J2JMA J2JMA1 = iCustom(NULL, TimeframeX_Dn, "J2JMA", Length1X_Dn, Length2X_Dn, Phase1X_Dn, Phase2X_Dn, 0, IPCX_Dn, 0, 1); //--- J2JMA2 = iCustom(NULL, TimeframeX_Dn, "J2JMA", Length1X_Dn, Length2X_Dn, Phase1X_Dn, Phase2X_Dn, 0, IPCX_Dn, 0, 2); //----+ defining trend TrendX_Dn = J2JMA1 - J2JMA2; //----+ defining a signal for closing trades if (TrendX_Dn > 0) SELL_Stop = true; } //----+ +----------------------------------------+ //----+ DEFINING SIGNAL FOR MARKET ENTERING | //----+ +----------------------------------------+ if (LastBars_Dn != IBARS_Dn) { //----+ Initialization of variables SELL_Sign = false; LastBars_Dn = IBARS_Dn; StopTime_Dn = iTime(NULL, Timeframe_Dn, 0) + 60 * Timeframe_Dn; //----+ calculating indicator values Osc1 = iCustom(NULL, Timeframe_Dn, "5c_OsMA", FastEMA_Dn, SlowEMA_Dn, SignalSMA_Dn, 5, 1); //--- Osc2 = iCustom(NULL, Timeframe_Dn, "5c_OsMA", FastEMA_Dn, SlowEMA_Dn, SignalSMA_Dn, 5, 2); //----+ defining signals for trades if (TrendX_Dn < 0) if (Osc2 > IndLevel_Dn) if (Osc1 < IndLevel_Dn) SELL_Sign = true; } //----+ +-------------------+ //----+ EXECUTION OF TRADES | //----+ +-------------------+ if (!OpenSellLimitOrder1(SELL_Sign, 2, Money_Management_Dn, STOPLOSS_Dn, TAKEPROFIT_Dn, PriceLevel_Dn, StopTime_Dn)) return(-1); if (ClosePos_Dn) if (!CloseOrder1(SELL_Stop, 2)) return(-1); if (!Make_TreilingStop(2, TRAILINGSTOP_Dn)) return(-1); } } //----+ +---------------------------------------------------------------+ //----+ return(0); } //+------------------------------------------------------------------+

Visually this code is twice larger than the initial Exp_5mq4 code, though the idea was seemingly not so large! Now let's discuss the result. Again I will analyze only the EA part for long positions, for short ones it is analogous. The additional source code for getting necessary values of the J2JMA indicator looks like this:

//----+ calculating indicator values for J2JMA J2JMA1 = iCustom(NULL, TimeframeX_Up, "J2JMA", Length1X_Up, Phase1X_Up, Length2X_Up, Phase2X_Up, 0, IPCX_Up, 0, 1); //--- J2JMA2 = iCustom(NULL, TimeframeX_Up, "J2JMA", Length1X_Up, Phase1X_Up, Length2X_Up, Phase2X_Up, 0, IPCX_Up, 0, 2); //----+ defining trend Trend_Up = J2JMA1 - J2JMA2;

On this ground the EA head part now contains the declaration of six new external variables corresponding to J2JMA indicator call:

extern int TimeframeX_Up = 240; extern int Length1X_Up = 4; // depth of the first smoothing extern int Phase1X_Up = 100; // parameter of the first smoothing //changing in the range -100 ... +100, influences the quality //of the transient process of averaging; extern int Length2X_Up = 4; // depth of the second smoothing extern int Phase2X_Up = 100; // parameter of the second smoothing, //changing in the range -100 ... +100, influences the quality //of the transient process of averaging; extern int IPCX_Up = 0;/* Selecting prices on which the indicator will be calculated (0-CLOSE, 1-OPEN, 2-HIGH, 3-LOW, 4-MEDIAN, 5-TYPICAL, 6-WEIGHTED, 7-Heiken Ashi Close, 8-SIMPL, 9-TRENDFOLLOW, 10-0.5*TRENDFOLLOW, 11-Heiken Ashi Low, 12-Heiken Ashi High, 13-Heiken Ashi Open, 14-Heiken Ashi Close.) */

A new analogous variable MinBarX_Up is added to the line of declaration of global variables for the minimum of calculation bars, which follows the EA external variables:

//---- Integer variables for the minimum of calculation bars int MinBarX_Up, MinBar_Up, MinBarX_Dn, MinBar_Dn;

In the EA initialization block additional check of the new external variable TimeframeХ_Up correctness is made:

//---- Checking the correctness of TimeframeX_Up variable value TimeframeCheck("TimeframeХ_Up", TimeframeX_Up);

В этом же блоке делают инициализацию переменной MinBarX_Up:

MinBarX_Up = 3 + 30 + 30;

Further code modifications are performed in the start() function block of the EA. Two new variables are added in the line of local variables declaration: J2JMA1 and J2JMA2:

//----+ Declaring local variables double J2JMA1, J2JMA2, Osc1, Osc2;

The Trend_Up variable is declared as a static variable because it is initialized only once at bar changing, its value is used in further tick of the start() function:

static double TrendX_Up, TrendX_Dn;

By analogy the variable LastBarsX_Up is declared as static:

static int LastBars_Up, LastBarsX_Up, LastBarsX_Dn, LastBars_Dn;

In the code for long positions the check of sufficiency for calculations becomes more complicated:

if (Test_Up) { int IBARS_Up = iBars(NULL, Timeframe_Up); int IBARSX_Up = iBars(NULL, TimeframeX_Up); if (IBARS_Up >= MinBar_Up && IBARSX_Up >= MinBarX_Up) { // CODE FOR LONG POSITIONS } }

and a new block is added:

//----+ +----------------------+ //----+ DEFINING TREND | //----+ +----------------------+ if (LastBarsX_Up != IBARSX_Up) { //----+ Initialization of variables LastBarsX_Up = IBARSX_Up; BUY_Stop = false; //----+ calculating indicator values for J2JMA J2JMA1 = iCustom(NULL, TimeframeX_Up, "J2JMA", Length1X_Up, Phase1X_Up, Length2X_Up, Phase2X_Up, 0, IPCX_Up, 0, 1); //--- J2JMA2 = iCustom(NULL, TimeframeX_Up, "J2JMA", Length1X_Up, Phase1X_Up, Length2X_Up, Phase2X_Up, 0, IPCX_Up, 0, 2); //----+ defining trend TrendX_Up = J2JMA1 - J2JMA2; //----+ defining a signal for closing trades if (Trend_Up < 0) BUY_Stop = true; }

In this block the necessary to us variable Trend_Up is initialized, besides signals for the forced closing of open positions are defined here (initialization of the BUY_Stop variable). Generally, in the initial Exp_5.mq4 the last variable was initialized in the block "DEFINING SIGNALS FOR MARKET ENTERING", but it is more logical in the new EA to place this initialization in the block "DEFINING TREND" and to change the algorithm of its initialization.

And the most important thing is a small change of signal defining algorithm in the block "DEFINING SIGNALS FOR MARKET ENTERING":

//----+ defining signals for trades if (TrendX_Up > 0) if (Osc2 < IndLevel_Up) if (Osc1 > IndLevel_Up) BUY_Sign = true;

After all modifications this algorithm takes into account the direction of a current trend with the help of the variable Trend_Up.

Now about some details of the EA optimization. Naturally, the EA should be optimized separately either for only long or short positions, and even in this case there are too many external variables for optimization. Probably, it is not reasonable to optimize all these variable at the same time. The more so - the genetic algorithm of optimization will not optimize more than eight variables! The most suitable solution in this case is fixing values of some variables and optimizing only the part remaining unfixed - the most urgent variables. And after the optimization select the most suiting variant and try to optimize remaining parameters.

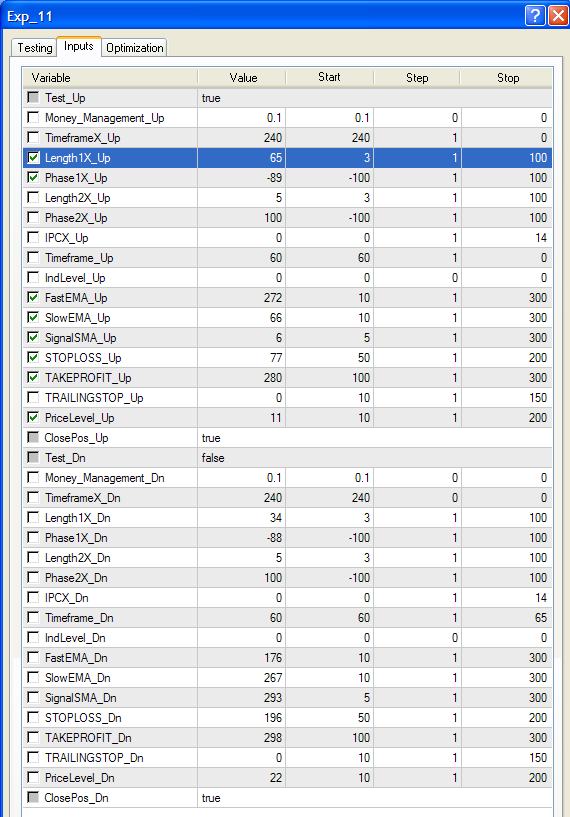

For example, for long positions this may look like this:

A file with these settings for the tester Exp_11.ini is in TESTER.zip archive. Here we don't need to optimize Money_Management_Up, as well as TimeframeX_Up. AS for the TimeframeX_Up variable, it should be noted that initially its value must be larger than that of the variable Timeframe_Up. Values of Length1X_Up can be changed in quite a large range, values of Phase1X_Up in the range from -100 to 100. Parameters Length2X_Up, Phase2X_Up and IPCX_Up should be better fixed at the first optimization, the same is about the IndLevel_Up parameter described in my previous article describing Exp_5.mq4. For FastEMA_Up and SlowEMA_Up parameters lower values of parameter changing shouldn't be too small. Of course, they can show amazing results, but will their be any sense in such results? The reasonability of using a trailing stop should be also checked after optimization. But the forced position closing by the logical variable ClosePos_Up should be applied always at trend changing. To its value should be better fixed equal to 'true'.

During optimization chart period in the Strategy tester should be equal to the value of the variable Timeframe_Up or Timeframe_Dn (depending on trading direction during optimization) and in the final testing or in operation on an account the chart period should be set equal to the smallest of these values. There is one more important detail. This Expert Advisor uses at least two timeframes, so be attentive when downloading history data for optimizations, testing and operation on an account, especially if you use several accounts opened at different dealers.

In the fourth article I described exporting optimization results for further statistical analysis in Microsoft Excel. In my opinion, the EA offered in this article suits best for such procedures. If anyone wants to try this, I modified the EA code with account for recommendations of this article (Exp_11_2.mq4). The code is attached to the article.

One More Example of an EA Using for Calculations Data of Two Charts of Different Timeframes

I suppose one example of an EA based on this idea is not enough for this article, so I will include one more Expert Advisor constructed according to this principle. As the basis I will use my first EA Exp_1.mq4 from my first article. The code part responsible for defining conditions for market entering and manages positions is ready. Now we need to define the active market trend for a larger timeframe. In this Expert Advisor I use the indicator MAMA_NK.mq4:

The condition for defining a trend direction in this case is the difference of values of two movings on the first bar:

![]()

Let's wright a cody by analogy, code of Exp_11.mq4 is used as a template:

//+==================================================================+ //| Exp_12.mq4 | //| Copyright © 2008, Nikolay Kositsin | //| Khabarovsk, farria@mail.redcom.ru | //+==================================================================+ #property copyright "Copyright © 2008, Nikolay Kositsin" #property link "farria@mail.redcom.ru" //----+ +---------------------------------------------------------------------------+ //---- EA INPUT PARAMETERS FOR BUY TRADES extern bool Test_Up = true;//filter of trade calculations direction extern double Money_Management_Up = 0.1; //---- extern int TimeframeX_Up = 240; extern double FastLimitX_Up = 0.5; extern double SlowLimitX_Up = 0.05; extern int IPCX_Up = 9;/* Selecting prices, upon which the indicator will be calculated (0-CLOSE, 1-OPEN, 2-HIGH, 3-LOW, 4-MEDIAN, 5-TYPICAL, 6-WEIGHTED, 7-Heiken Ashi Close, 8-SIMPL, 9-TRENDFOLLOW, 10-0.5*TRENDFOLLOW, 11-Heiken Ashi Low, 12-Heiken Ashi High, 13-Heiken Ashi Open, 14-Heiken Ashi Close, 15-Heiken Ashi Open0.) */ //---- + - - - - - - - - - - - - - - - - - - - - - - - - - - - - - + extern int Timeframe_Up = 60; extern int Length_Up = 4; // smoothing depth extern int Phase_Up = 100; // parameter changing in the range //-100 ... +100, influences the quality of a transient process; extern int IPC_Up = 0;/* Selecting prices, upon which the indicator will be calculated (0-CLOSE, 1-OPEN, 2-HIGH, 3-LOW, 4-MEDIAN, 5-TYPICAL, 6-WEIGHTED, 7-Heiken Ashi Close, 8-SIMPL, 9-TRENDFOLLOW, 10-0.5*TRENDFOLLOW, 11-Heiken Ashi Low, 12-Heiken Ashi High, 13-Heiken Ashi Open, 14-Heiken Ashi Close.) */ extern int STOPLOSS_Up = 50; // stop loss extern int TAKEPROFIT_Up = 100; // take profit extern bool ClosePos_Up = true; // forced position closing is allowed //----+ +---------------------------------------------------------------------------+ //---- EA INPUT PARAMETERS FOR SELL TRADES extern bool Test_Dn = true;//filter of trade calculations direction extern double Money_Management_Dn = 0.1; //---- extern int TimeframeX_Dn = 60; extern double FastLimitX_Dn = 0.5; extern double SlowLimitX_Dn = 0.05; extern int IPCX_Dn = 9;/* Selecting prices, upon which the indicator will be calculated (0-CLOSE, 1-OPEN, 2-HIGH, 3-LOW, 4-MEDIAN, 5-TYPICAL, 6-WEIGHTED, 7-Heiken Ashi Close, 8-SIMPL, 9-TRENDFOLLOW, 10-0.5*TRENDFOLLOW, 11-Heiken Ashi Low, 12-Heiken Ashi High, 13-Heiken Ashi Open, 14-Heiken Ashi Close, 15-Heiken Ashi Open0.) */ //---- + - - - - - - - - - - - - - - - - - - - - - - - - - - - - - + extern int Timeframe_Dn = 60; extern int Length_Dn = 4; // smoothing depth extern int Phase_Dn = 100; // parameter changing in the range // -100 ... +100, influences the quality of a transient process; extern int IPC_Dn = 0;/* Selecting prices, upon which the indicator will be calculated (0-CLOSE, 1-OPEN, 2-HIGH, 3-LOW, 4-MEDIAN, 5-TYPICAL, 6-WEIGHTED, 7-Heiken Ashi Close, 8-SIMPL, 9-TRENDFOLLOW, 10-0.5*TRENDFOLLOW, 11-Heiken Ashi Low, 12-Heiken Ashi High, 13-Heiken Ashi Open, 14-Heiken Ashi Close.) */ extern int STOPLOSS_Dn = 50; // stop loss extern int TAKEPROFIT_Dn = 100; // take profit extern bool ClosePos_Dn = true; // forced position closing is allowed //----+ +---------------------------------------------------------------------------+ //---- Integer variables for the minimum of counted bars int MinBar_Up, MinBar_Dn, MinBarX_Up, MinBarX_Dn; //+==================================================================+ //| Custom Expert functions | //+==================================================================+ #include <Lite_EXPERT1.mqh> //+==================================================================+ //| TimeframeCheck() functions | //+==================================================================+ void TimeframeCheck(string Name, int Timeframe) { //----+ //---- Checking the correctness of Timeframe variable value if (Timeframe != 1) if (Timeframe != 5) if (Timeframe != 15) if (Timeframe != 30) if (Timeframe != 60) if (Timeframe != 240) if (Timeframe != 1440) Print(StringConcatenate("Parameter ",Name, " cannot ", "be equal to ", Timeframe, "!!!")); //----+ } //+==================================================================+ //| Custom Expert initialization function | //+==================================================================+ int init() { //---- Checking the correctness of Timeframe_Up variable value TimeframeCheck("TimeframeX_Up", TimeframeX_Up); //---- Checking the correctness of Timeframe_Up variable value TimeframeCheck("Timeframe_Up", Timeframe_Up); //---- Checking the correctness of Timeframe_Dn variable value TimeframeCheck("TimeframeX_Dn", TimeframeX_Dn); //---- Checking the correctness of Timeframe_Dn variable value TimeframeCheck("Timeframe_Dn", Timeframe_Dn); //---- Initialization of variables MinBarX_Up = 1 + 7; MinBar_Up = 4 + 39 + 30; MinBarX_Dn = 1 + 7; MinBar_Dn = 4 + 39 + 30; //---- end of initialization return(0); } //+==================================================================+ //| expert deinitialization function | //+==================================================================+ int deinit() { //----+ //---- End of the EA deinitialization return(0); //----+ } //+==================================================================+ //| Custom Expert iteration function | //+==================================================================+ int start() { //----+ Declaration of local variables int bar; double Mov[3], dMov12, dMov23, Mama1, Fama1; //----+ declaration of static variables static double TrendX_Up, TrendX_Dn; static int LastBars_Up, LastBars_Dn, LastBarsX_Up, LastBarsX_Dn; static bool BUY_Sign, BUY_Stop, SELL_Sign, SELL_Stop; //----+ +---------------------------------------------------------------+ //----++ CODE FOR LONG POSITIONS | //----+ +---------------------------------------------------------------+ if (Test_Up) { int IBARS_Up = iBars(NULL, Timeframe_Up); int IBARSX_Up = iBars(NULL, TimeframeX_Up); if (IBARS_Up >= MinBar_Up && IBARSX_Up >= MinBarX_Up) { //----+ +----------------------+ //----+ DEFINING TREND | //----+ +----------------------+ if (LastBarsX_Up != IBARSX_Up) { //----+ Initialization of variables LastBarsX_Up = IBARSX_Up; BUY_Stop = false; //----+ calculating indicator values Fama1 = iCustom(NULL, TimeframeX_Up, "MAMA_NK", FastLimitX_Up, SlowLimitX_Up, IPCX_Up, 0, 1); //--- Mama1 = iCustom(NULL, TimeframeX_Up, "MAMA_NK", FastLimitX_Up, SlowLimitX_Up, IPCX_Up, 1, 1); //----+ defining trend TrendX_Up = Mama1 - Fama1; //----+ defining signals for trade closing if (TrendX_Up < 0) BUY_Stop = true; } //----+ +----------------------------------------+ //----+ DEFINING SIGNAL FOR MARKET ENTERING | //----+ +----------------------------------------+ if (LastBars_Up != IBARS_Up) { //----+ Initialization of variables BUY_Sign = false; LastBars_Up = IBARS_Up; //----+ calculating indicator values and uploading them into buffer for(bar = 1; bar <= 3; bar++) Mov[bar - 1]= iCustom(NULL, Timeframe_Up, "JFatl", Length_Up, Phase_Up, 0, IPC_Up, 0, bar); //----+ defining signals for trades dMov12 = Mov[0] - Mov[1]; dMov23 = Mov[1] - Mov[2]; if (TrendX_Up > 0) if (dMov23 < 0) if (dMov12 > 0) BUY_Sign = true; } //----+ +-------------------+ //----+ EXECUTION OF TRADES | //----+ +-------------------+ if (!OpenBuyOrder1(BUY_Sign, 1, Money_Management_Up, STOPLOSS_Up, TAKEPROFIT_Up)) return(-1); if (ClosePos_Up) if (!CloseOrder1(BUY_Stop, 1)) return(-1); } } //----+ +---------------------------------------------------------------+ //----++ CODE FOR SHORT POSITIONS | //----+ +---------------------------------------------------------------+ if (Test_Dn) { int IBARS_Dn = iBars(NULL, Timeframe_Dn); int IBARSX_Dn = iBars(NULL, TimeframeX_Dn); if (IBARS_Dn >= MinBar_Dn && IBARSX_Dn >= MinBarX_Dn) { //----+ +----------------------+ //----+ DEFINING TREND | //----+ +----------------------+ if (LastBarsX_Dn != IBARSX_Dn) { //----+ Initialization of variables LastBarsX_Dn = IBARSX_Dn; SELL_Stop = false; //----+ calculating indicator values Fama1 = iCustom(NULL, TimeframeX_Dn, "MAMA_NK", FastLimitX_Dn, SlowLimitX_Dn, IPCX_Dn, 0, 1); //--- Mama1 = iCustom(NULL, TimeframeX_Dn, "MAMA_NK", FastLimitX_Dn, SlowLimitX_Dn, IPCX_Dn, 1, 1); //----+ defining trend TrendX_Dn = Mama1 - Fama1; //----+ defining signals for trade closing if (TrendX_Dn > 0) SELL_Stop = true; } //----+ +----------------------------------------+ //----+ DEFINING SIGNAL FOR MARKET ENTERING | //----+ +----------------------------------------+ if (LastBars_Dn != IBARS_Dn) { //----+ Initialization of variables SELL_Sign = false; LastBars_Dn = IBARS_Dn; //----+ calculating indicator values and uploading them into buffer for(bar = 1; bar <= 3; bar++) Mov[bar - 1]= iCustom(NULL, Timeframe_Dn, "JFatl", Length_Dn, Phase_Dn, 0, IPC_Dn, 0, bar); //----+ defining signals for trades dMov12 = Mov[0] - Mov[1]; dMov23 = Mov[1] - Mov[2]; if (TrendX_Dn < 0) if (dMov23 > 0) if (dMov12 < 0) SELL_Sign = true; } //----+ +-------------------+ //----+ EXECUTION OF TRADES | //----+ +-------------------+ if (!OpenSellOrder1(SELL_Sign, 2, Money_Management_Dn, STOPLOSS_Dn, TAKEPROFIT_Dn)) return(-1); if (ClosePos_Dn) if (!CloseOrder1(SELL_Stop, 2)) return(-1); } } //----+ return(0); } //+------------------------------------------------------------------+

Though the basic algorithm of this EA differs from the one underlying the previous EA, the general idea of using two graphs appears to be absolutely operating in this case too.

Conclusion

I think the approach of constructing automated trading systems described in this article will help readers who already have some experience in EA writing to construct analogous Expert Advisors with minimal waste of effort. It should be also added here that the practical usefulness of such expert Advisors depends greatly on their proper optimization.

Translated from Russian by MetaQuotes Ltd.

Original article: https://www.mql5.com/ru/articles/1525

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

Show Must Go On, or Once Again about ZigZag

Show Must Go On, or Once Again about ZigZag

Comfortable Scalping

Comfortable Scalping

Integrating MetaTrader 4 Client Terminal with MS SQL Server

Integrating MetaTrader 4 Client Terminal with MS SQL Server

Expert Advisors Based on Popular Trading Systems and Alchemy of Trading Robot Optimization (Part IV)

Expert Advisors Based on Popular Trading Systems and Alchemy of Trading Robot Optimization (Part IV)

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

dear sirs, i would like to set up a

The optimization status is 172/10496 (1030301)

genetic algorithm is ON

It has been 30 hours 32 minutes so far (after this it says 1822.45.07)

How much longer is this likely to take?

I haven't used genetic algorithm before, I thought it was meant to speed up as it progresses?