GoldSuper PRO X

- 专家

- Ikram A Taha

- 版本: 2.21

- 更新: 9 六月 2025

- 激活: 5

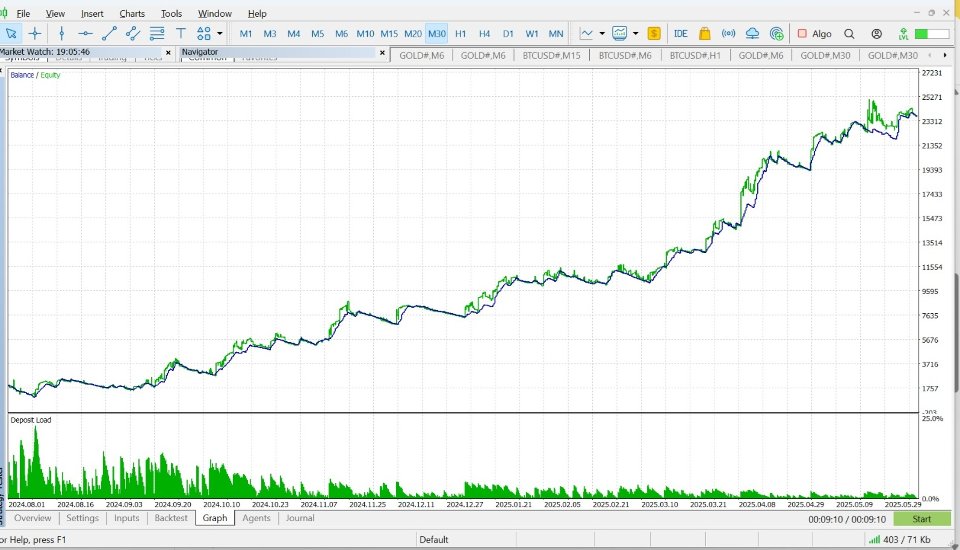

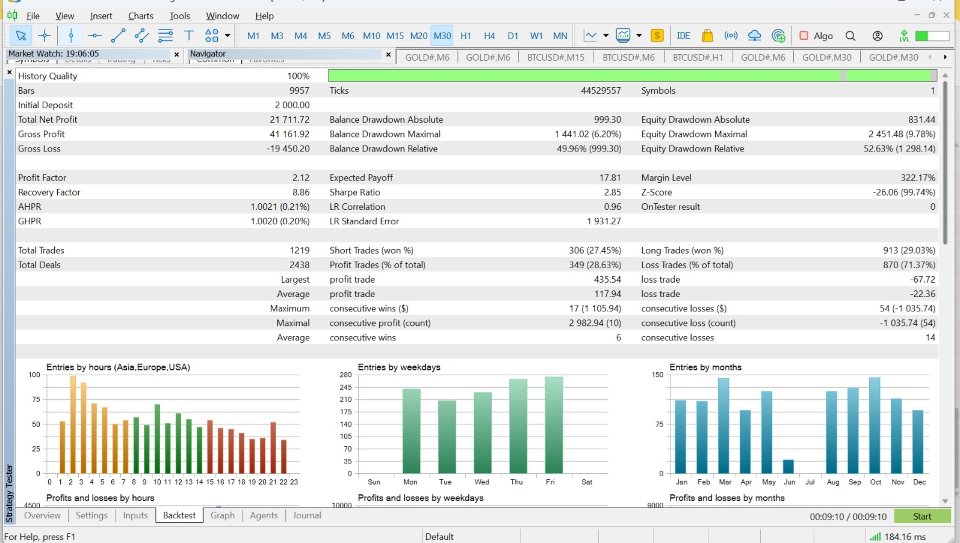

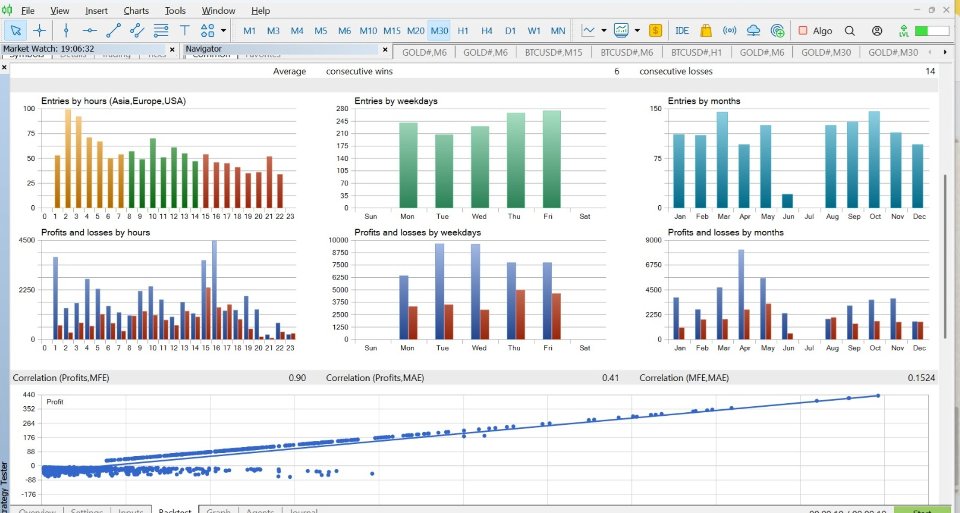

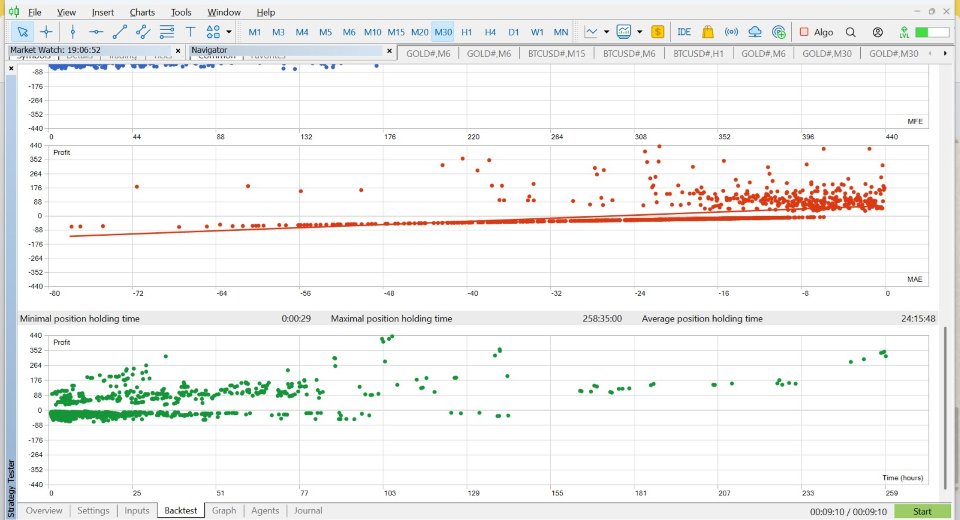

GoldSuper PRO X — Scalping Strategy Expert Advisor

Designed for the 30-minute timeframe (M30), this Expert Advisor is tailored for active gold (XAUUSD) traders who want precision, control, and optimized entry logic with adjustable trend filters and risk settings.

This EA combines Keltner Channels, MACD, Stochastic, SMA, and EMA to provide high-quality trade entries and customizable trade management. Whether you trade Buy only, Sell only, or both directions, this EA adapts to your strategy.

✅ Key Features

-

Fully Automated Scalping EA for M30 timeframe (ideal for XAUUSD).

-

Triple Confirmation Entry Logic: Combines Stochastic, MACD, and Keltner Channel with trend filters (SMA and EMA).

-

Trade Mode Options: Buy Only, Sell Only, or Both.

-

Flexible Time Filter: Automatically restricts trading to your specified time window.

-

Custom Risk Control: SL and TP calculated dynamically based on ATR volatility.

-

Multi-Entry System: Supports multiple positions up to a maximum limit you define.

-

Adaptive Entry Conditions: No trades when market is too far outside the trend channel.

⚙️ Input Parameters

🔍 Indicator Settings

-

Trend Filters

-

Channel Settings

-

Oscillator Settings

-

Momentum/Confirmation Settings

💼 Trade & Risk Settings

-

Trade Size & Identification

-

Trade Frequency & Position Limits

-

Risk Management Controls

-

Profit Target Settings

🔁 Trade Mode

-

trade_mode : Trade direction mode.

-

TRADE_BUY_ONLY – Only Buy trades.

-

TRADE_SELL_ONLY – Only Sell trades.

-

TRADE_BOTH – Both Buy and Sell (default).

-

🕒 Time Filter (Optional)

-

Enable/Disable time-based trade control

-

Trading session start and end time

-

Delay for first entry after session opens

-

Automatic cut-off before session closes

⏰ Time Filter Settings

📈 Recommended Pair & Timeframe:

-

Pair: XAUUSD (Gold)

-

Timeframe: M30

📌 Notes:

-

This EA does not use martingale, grid, or risky recovery systems.

-

Best tested and optimized on brokers with low spread and fast execution.

-

Default settings are optimized, but users are encouraged to adjust based on broker behavior and risk preference.