Acceleration Bias v4

- Göstergeler

- Sabina Fik

- Sürüm: 1.0

- Etkinleştirmeler: 5

Acceleration Bias is a modern analytical tool designed to measure changes in price acceleration and visualize impulse asymmetry using a robust mathematical model.

This indicator is intended for traders working with market volatility, impulse phases, and price-movement structure, as well as those who need algorithmic, rule-based analytical support.

Purpose and Core Concept

Unlike traditional oscillators that analyze only velocity changes (first derivative), Acceleration Bias evaluates the second derivative of price — price acceleration.

The algorithm determines whether the internal impulse is gaining strength or slowing down, analyzes the dominance of positive or negative accelerations within a selected range, and calculates a normalized output known as the Acceleration Bias coefficient.

This makes it possible to:

-

detect transitions between acceleration and deceleration phases of a trend;

-

assess the internal strength of a price impulse;

-

identify early dynamic shifts before traditional indicators react;

-

highlight asymmetry within the movement structure.

Algorithmic Foundation

At the core of the indicator lies the following function:

-

decomposition of the selected segment into velocity elements,

-

calculation of sequential velocity changes (accelerations),

-

counting of positive and negative acceleration values,

-

normalization of the acceleration imbalance over the sample length.

The resulting output ranges from –1 to +1:

closer to +1 → dominance of positive accelerations;

closer to –1 → dominance of negative accelerations.

This allows for detailed insight into internal market impulse behavior.

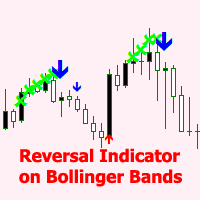

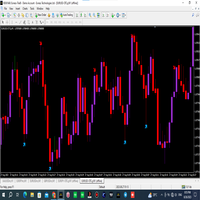

Visual Representation

Acceleration Bias uses 7 buffers and draws 6 visual components in a separate indicator window:

-

🔵 Buy Arrow — indicates positive acceleration conditions

-

🔴 Sell Arrow — indicates negative acceleration conditions

-

🔵 Zero Arrow — displays neutral zones

-

🔵 Line Blue — positive impulse line

-

🔴 Line Red — negative impulse line

-

🟢 Expert Line (Green) — a universal line exposed for Expert Advisors

The visual system combines arrows, dual-color lines and a smooth analytical curve to provide a precise interpretation of acceleration behavior.

Configurable Parameters

The indicator includes a wide set of inputs for fine-tuning:

Data Source

-

VectorData — choice of price vector (Close, High, Low, etc.)

Sample Length and Representation

-

Length — depth of acceleration analysis

-

AvgBars — smoothing level

-

Representation — data representation model

-

Index — data index selection

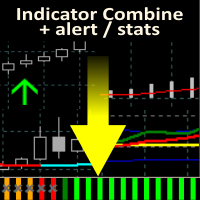

Extended Options

-

ForwardOn — forward-shifted analysis

-

Inversion — signal inversion

-

LimitHistory — maximum historical depth

-

SignalOn — enable/disable signal plotting

-

MinLevel — minimum amplitude threshold

-

IndexSignal — source index for signal generation

These settings allow Acceleration Bias to be integrated into virtually any analytical or algorithmic framework.

Suitable Use Cases

Acceleration Bias is effective for:

-

impulse-driven markets (Forex, Crypto, Metals, Indices)

-

intraday and swing-trading methodologies

-

algorithmic trading systems and EAs using the dedicated buffer

-

noise filtering and impulse structure confirmation

-

multi-indicator analytical modules

Key Advantages

-

✔ Unique acceleration-based analytical model

-

✔ Clear and structured interpretation

-

✔ Universal compatibility with trend and countertrend systems

-

✔ Normalized output for precise impulse evaluation

-

✔ Full EA integration via exposed buffers

Legal Information

Copyright © 2024–2025, Sabina Fik

License: PROPRIETARY — all rights reserved.

Unauthorized copying, modification or distribution is strictly prohibited.

Summary

Acceleration Bias is a professional tool for analyzing price acceleration and impulse asymmetry.

With its precise mathematical core, flexible configuration and advanced visualization, it fits perfectly into modern market analysis systems and algorithmic trading solutions.