Orderflow Scalper EA

- Experts

- TitanScalper

- Versão: 4.5

- Atualizado: 19 novembro 2025

- Ativações: 15

ORDERFLOW SCALPER EA 4.5 [Real time high accurate absorption/exhaustion detection]

Advanced Delta Merge Trading System for Professional Traders

📖 Full Documentation: [Download PDF]

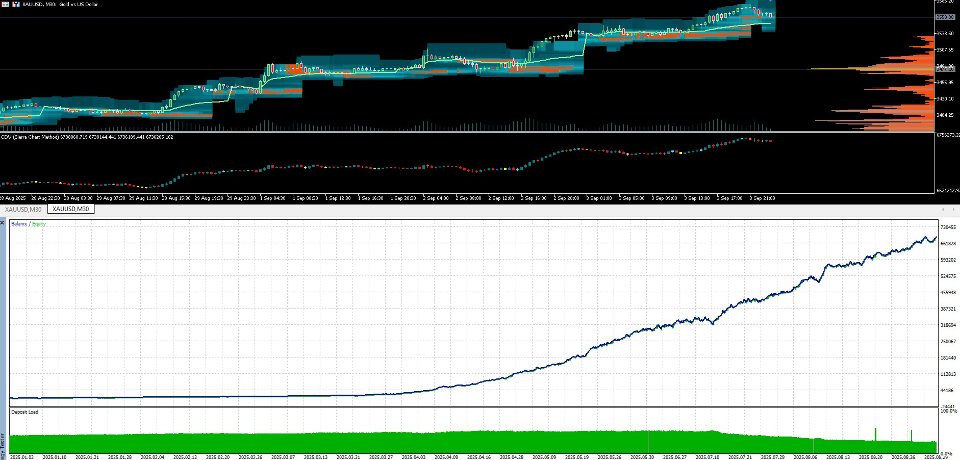

📈 Instrument : US30 [DJ30]

🕒 Time Frame : 15Min

📊 Myfxbook Chart: [myfxbook.com/members/DeltaMerge/]

🏦 Recommended Brokers : icmarkets, fpmarkets [This EA is fully optimized for ICMARKETS US30 conditions]

🏷️ Original Price: $2,399 ➜ Limited-Time Offer: $899

Revolutionary Order Flow Analysis Technology with Smart Money Concepts

The Orderflow Scalper EA 4.5 transforms how traders approach the US30 market by leveraging institutional-grade volume analysis techniques combined with cutting-edge Smart Money Concepts and professional trend filtering. This sophisticated system reads market sentiment through advanced delta calculations, volume profile analysis, and institutional order flow patterns, providing traders with the same tools used by professional trading floors and hedge funds.

CORE TRADING METHODOLOGY

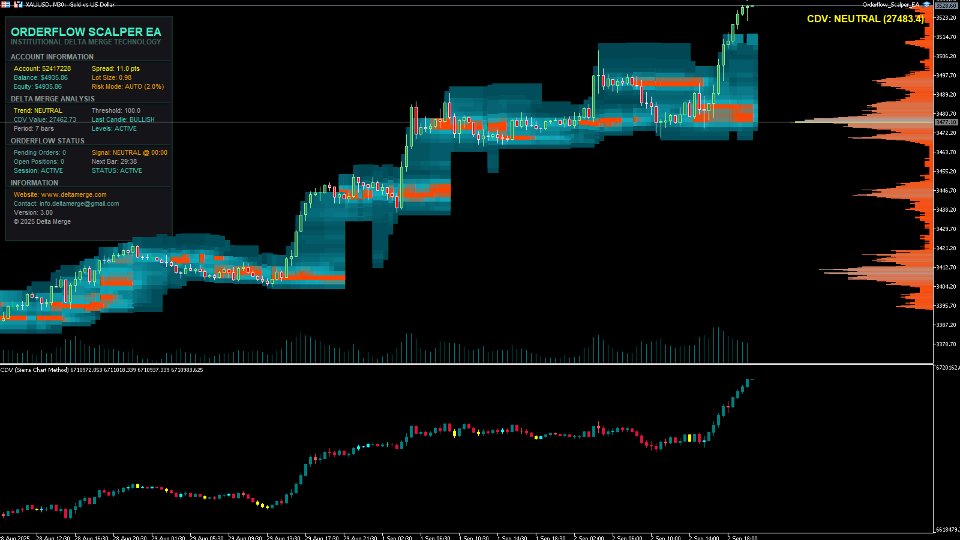

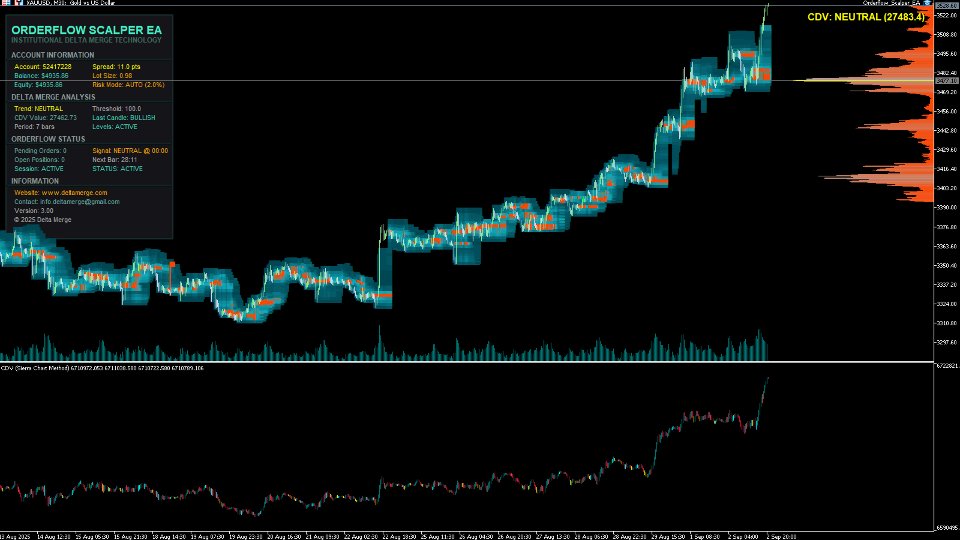

Cumulative Delta Volume (CDV) Engine

At the heart of this EA lies a proprietary CDV calculation engine that measures real-time buying and selling pressure. Unlike traditional technical indicators that rely solely on price action, this system analyzes the relationship between price movement and volume flow to identify where institutional money is positioned.

Volume Profile Integration

The EA incorporates three critical volume profile elements:

- Point of Control (POC): Identifies the price with maximum trading activity

- Value Area High (VAH): Upper boundary where 70% of volume occurs

- Value Area Low (VAL): Lower boundary of the high-volume zone

Dynamic Heatmap Technology

Real-time price level calculation creates a dynamic heatmap of institutional interest zones. The system automatically identifies and monitors critical price levels where large orders typically accumulate, providing precise entry and exit opportunities.

VERSION 4.5 ENHANCEMENTS

Now includes Multi-Timeframe (MTF) Momentum Confirmation for stronger trend validation and Advanced Volume Flow Confirmation for more accurate absorption/exhaustion detection.

VERSION 4.1

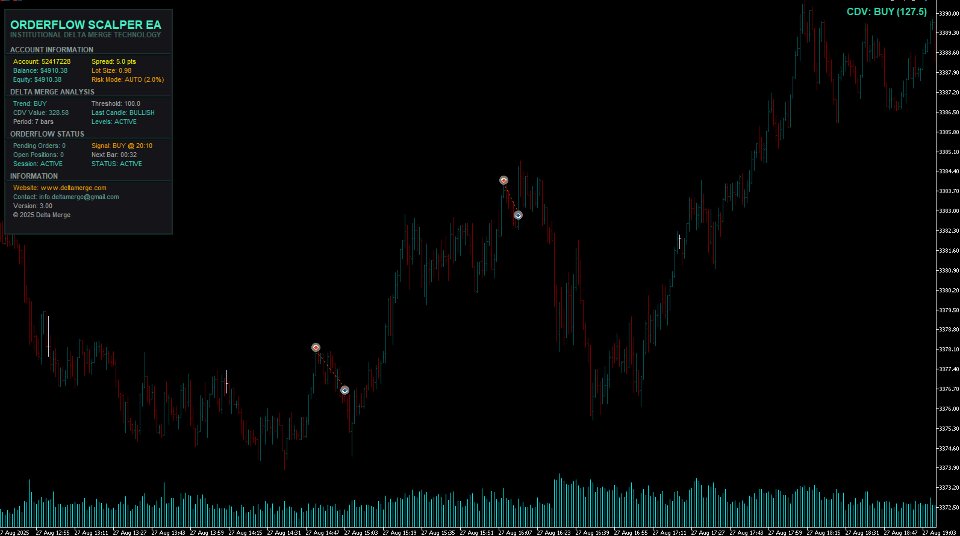

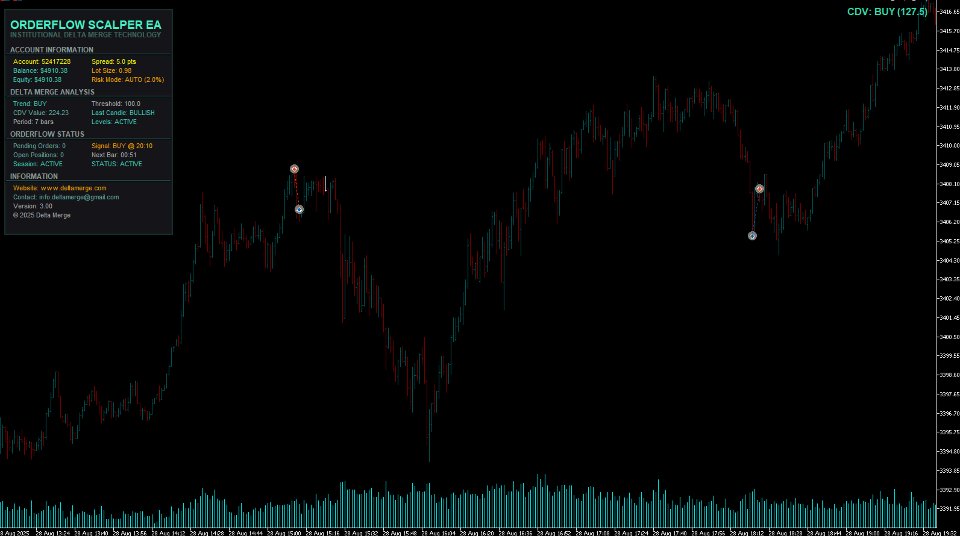

Smart Money Concepts Integration

Professional institutional analysis tools now built directly into the EA:

Order Block Detection: Real-time identification of institutional supply and demand zones where large orders accumulate. The system tracks order block validation and mitigation for optimal entry timing.

Fair Value Gap Analysis: Automated detection of market inefficiencies and imbalance zones. These gaps represent areas where price moved too quickly, creating high-probability reversal or continuation zones.

Liquidity Grab Recognition: Identifies when institutions sweep retail stop losses before reversing direction, providing optimal entry opportunities after liquidity collection.

Market Structure Analysis: Break of Structure (BOS) and Change of Character (CHoCH) detection ensures trades align with institutional flow direction.

Professional ADX Trend Filter

Advanced directional movement analysis for high-probability setups:

Multi-Component ADX System: Analyzes ADX value, Plus Directional Indicator (+DI), and Minus Directional Indicator (-DI) to confirm trend strength and direction before trade execution.

Trend Strength Classification: Automatic categorization of market conditions as Strong, Moderate, or Weak trends based on configurable ADX thresholds.

Directional Confirmation: Requires minimum separation between +DI and -DI values, ensuring clear directional bias exists before entering positions.

Enhanced Volatility and Momentum Filters

Intelligent market condition analysis eliminates low-quality trading environments:

ATR-Based Volatility Filter: Ensures sufficient market movement exists before trade execution, filtering out ranging periods.

Momentum Confirmation: Multi-candle momentum analysis validates directional bias before entries, preventing counter-trend trades.

News Event Avoidance: Time-based filtering prevents trading during major economic releases, protecting capital during unpredictable volatility.

Dynamic Stop Loss and Take Profit: ATR multiplier-based risk management automatically adjusts SL/TP levels based on current market volatility.

Daily Volume Level Integration

Revolutionary intraday volume analysis provides additional confluence:

M5 Volume Rejection Detection: Analyzes 5-minute candles within the current daily session, identifying significant wick formations indicating strong rejection levels.

Fibonacci-Volume Confluence: When Delta Merge extension levels align with volume rejection zones, the EA recognizes premium entry opportunities with multiple layers of confirmation.

INTELLIGENT TRADING FEATURES

Smart Money Flow Detection

- Real-time analysis of institutional order flow patterns

- Automatic identification of accumulation and distribution phases

- Market structure confirmation before trade execution

- Order Block mitigation tracking and Fair Value Gap monitoring

- Delta divergence alerts for trend reversal opportunities

- Volume-weighted price level calculations

Adaptive Risk Framework

- Percentage-based position sizing for consistent risk exposure

- Toggle-enabled trailing stop with custom trigger and gap settings

- Toggle-enabled break even protection with adjustable parameters

- Dynamic stop-loss adjustment based on ATR volatility

- Maximum drawdown controls and margin level monitoring

- Session-based trading filters

Professional Order Management

- Strategic pending order placement at volume confluence zones

- Automatic opposing position cancellation

- Time-based order timeout management (configurable candle hold time)

- Spread filtering to ensure execution quality

- Broker stop level and freeze level validation

ADVANCED MARKET ANALYSIS DASHBOARD

Real-Time Multi-Indicator Monitor

Live institutional-grade trading dashboard featuring:

- ADX Trend Status: Current direction and strength with color coding

- CDV Analysis: Buying/selling pressure intensity meters

- SMC Confluence: Order Block, FVG, and structure status indicators

- Market sentiment classification (Bullish/Bearish/Neutral)

- Historical delta pattern analysis

Professional Interface

- Institutional-style control panel with key metrics

- Account performance tracking and risk monitoring

- Active position and pending order status with countdown timers

- Market session analysis and timing controls

- Trading session active/standby status display

TECHNICAL OPTIMIZATION

Specially Calibrated for US30 - Dual Timeframe Strategy

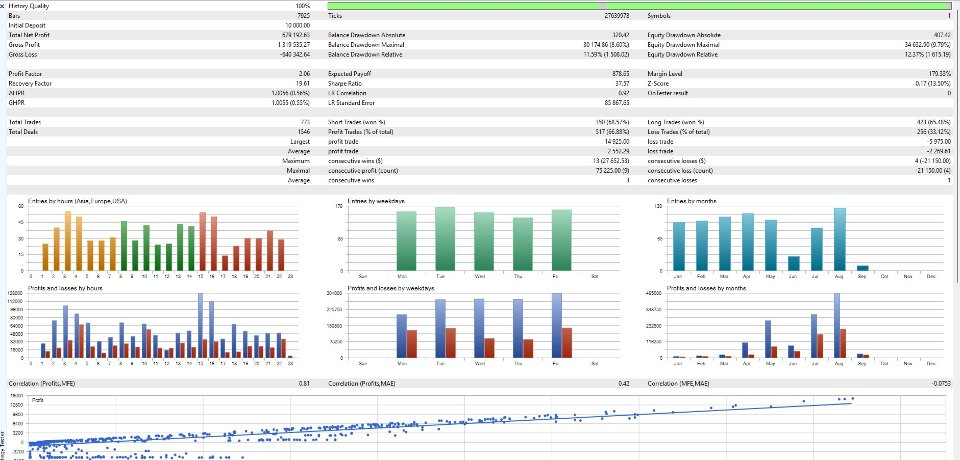

Years of backtesting and optimization have proven this system's effectiveness on US30 (Dow Jones Industrial Average):

3-Minute Chart: Aggressive High-Return Strategy

- High-frequency trade opportunities during volatile sessions

- Captures rapid momentum moves during US market hours

- Maximum profit potential per trading day

- Risk Profile: Moderate to High

- Return Potential: High

4-Minute Chart: Low Drawdown Stable Returns

- Lower trade frequency with higher selectivity

- Reduced drawdown and smoother equity curves

- Higher win rate through additional confirmation time

- Better suited for smaller account sizes

- Risk Profile: Low to Moderate

- Return Potential: Stable and Consistent

Why US30 Excellence:

- Institutional participation creates clear volume signatures

- Consistent intraday volatility patterns are highly predictable

- High liquidity ensures tight spreads and excellent execution

- Strong technical respect for volume levels and extensions

- ADX and SMC filters provide superior accuracy

- Optimal performance during New York session hours

SYSTEM REQUIREMENTS

- Minimum account balance: $500 recommended ($300 minimum)

- Symbol: US30 (Dow Jones Industrial Average)

- Recommended Timeframes: M3 (aggressive) or M4 (stable)

- VPS hosting recommended for optimal performance

- Low-latency broker connection preferred

- ECN/STP execution model ideal

- Platform: MetaTrader 5 (Build 3900+)

CONFIGURATION AND SETUP

Core Parameters

- CDV calculation period and threshold controls

- ADX period, trend threshold, and directional filter settings

- Smart Money Concepts lookback and sensitivity adjustments

- Daily Volume Level detection and distance parameters

- Volatility and momentum filter configuration

- Risk percentage and position sizing options

- Trading session time restrictions

Risk Controls

- Maximum concurrent pending orders

- Order timeout management (candles held)

- Stop Loss and Take Profit settings (static or dynamic ATR-based)

- Toggle-enabled Trailing Stop with trigger and gap controls

- Toggle-enabled Break Even with trigger and offset settings

- Maximum drawdown protection limits

- Spread and slippage filters

PROFESSIONAL SUPPORT PACKAGE

Comprehensive Documentation

- Detailed setup and optimization guide for US30

- Volume analysis theory and application

- Smart Money Concepts educational materials

- ADX trend filtering best practices

- Risk management guidelines

- Troubleshooting and FAQ section

Ongoing Development

- Regular updates based on market evolution

- Performance optimization improvements

- New feature integration

- Community feedback implementation

- Lifetime free updates included

PERFORMANCE CHARACTERISTICS

This EA is designed for traders who understand that consistent profitability comes from reading institutional order flow combined with Smart Money Concepts rather than chasing price patterns. The system excels in:

- Capturing scalping opportunities during high-volume periods

- Identifying reversal points through delta divergence and SMC confluence

- Managing risk through professional money management

- Filtering trades with ADX trend strength and volatility analysis

- Adapting to changing market microstructure

- Combining multiple confirmation layers for high-probability setups

IMPORTANT TRADING NOTICE

Financial markets involve substantial risk of capital loss. This EA represents advanced trading methodology requiring proper understanding of volume analysis, Smart Money Concepts, and order flow principles. Thorough demo testing for at least 2-4 weeks is essential before live deployment. Never trade with funds you cannot afford to lose, and ensure you fully understand the system's operation and all parameter settings before use.