Apple LongTerm Quantum EA ONNX

- Experts

- Jaroslaw Jakub Kata

- Versão: 1.0

Apple LongTerm Quantum EA ONNX

## Short market description

Carefully engineered EA for AAPL using three ONNX models trained on roughly a decade of data. It focuses on directional filtering, return magnitude, and volatility-aware exits. The demo is intentionally conservative and blocks live trading, so you can explore signals and execution behavior safely in Strategy Tester. We recommend running multiple backtests across years and sessions, then sharing feedback so we can further refine robustness and defaults. No promises of profits; this is a research-grade tool meant to be evaluated thoughtfully.

Run only on AAPL.NAS (Forex not working)

- **Purpose**: MT5 Expert Advisor for trading AAPL. This build is a demo — live trading is blocked by design.

- **Decision engine**: 3 specially trained ONNX models on ~10 years of data:

- **Direction**: 3-class (Down/Hold/Up) for M15 horizon

- **Return**: regression of next M15 percentage move (bps)

- **Volatility**: regression used to derive dynamic TP/SL/TS/BE levels

- **Safety guidance**:

- **1 concurrent position**: relatively safer.

- **>1 concurrent position**: effectively “all-in” up to broker margin limits. High risk of margin call. Use at your own risk after reading your broker’s terms.

- **Deposit guidance**: about **$100 per 1 share**, **$1000 per 10 shares** (rule of thumb).

- **Drawdown**: inbacktest ~17%, theoretical under adverse global events up to **30%** possible.

- **Manual TP/SL/TS/BE**: your own risk. Can improve results or hurt them (premature exits, losses).

- **Best results**: with default configuration. **No profitability is promised.** You are solely responsible for your capital.

- **Project status**: completed beta after two years of work.

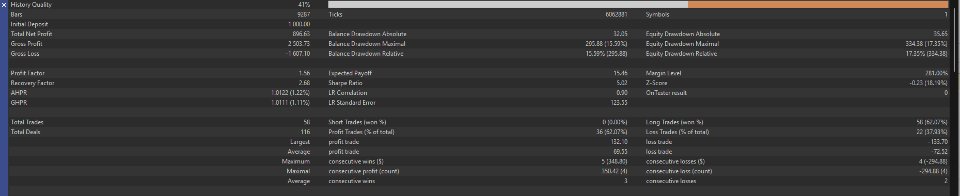

### Example backtest snapshot (Strategy Tester — wwww.html)

Based on `wwwww.html` (ICMarketsEU-Demo, AAPL.NAS, M15, 2024-03-01 — 2025-08-07):

- **History quality**: 41% real ticks

- **Total net profit**: 896.63 (initial deposit 1,000)

- **Profit Factor**: 1.56; **Sharpe Ratio**: 5.02

- **Trades**: 58 total (17 months, e.g 3/month) , **Win rate**: 62.07%

- **Max DD (balance)**: 15.59% (295.88); **Max DD (equity)**: 17.35% (334.38)

- **Largest profit/loss trade**: 132.10 / -133.70

Note: Historical tests do not guarantee future outcomes.

### Inputs and switches (brief)

- **InpSymbol**: trading symbol, e.g., `AAPL.NAS`

- **InpTF**: timeframe in minutes, e.g., `15`

- **InpModelDirection / InpModelReturn / InpModelVol**: ONNX model filenames (or embedded resources)

- **InpUpProb / InpDnProb / InpMargin**: Direction gate thresholds (up prob, down prob, min margin between top classes)

- **InpAbsBps**: absolute Return threshold (bps) to allow entries

- **InpAtrK / InpAtrScaleOn**: scale Return threshold by ATR (factor, on/off)

- **InpDynamicTPSL**: enable dynamic TP/SL from Volatility model

- **InpTPmult / InpSLmult**: multipliers for TP and SL levels

- **InpTSon**: enable Trailing Stop

- **InpTSstartK / InpTSstepK / InpTSstopOffset**: TS start factor, step factor, and stop offset

- **InpBEon**: enable Break-Even

- **InpBEtriggerK / InpBEoffsetBps**: BE trigger factor and offset in bps

- **InpExitOnFlip**: close if Direction flips against the position

- **InpExitOnDecay**: close if Return signal decays below threshold

- **InpMaxPositions**: max concurrent positions (1 is safer)

- **InpMaxShares / InpMaxSharesLimit**: position size in shares and hard cap

- **InpAsyncMode**: asynchronous order send mode

- **InpDeviationPoints**: price deviation allowance (points)

- **InpSpreadLimit**: maximum allowed spread

- **InpUseSessionFilter**: enable trading session filter

- **InpOpenHour/Minute, InpCloseHour/Minute, InpBufferMinutes, InpFridayShort**: session schedule controls

- **InpDashboardOn**: lightweight on-chart dashboard

- **InpUseResource**: load models from embedded resources instead of files

- **InpLoggingOn**: enable console logging (default OFF)

Important: This demo build blocks live trading on non-tester charts