DualVector Sentinel EA

- Experts

- Bero Abdullah Skaf

- 버전: 3.47

- 업데이트됨: 28 1월 2026

- 활성화: 5

DualVector Sentinel EA

Adaptive Dual-Position Trading Engine with Smart Risk Control

DualVector Sentinel EA is a professionally engineered Expert Advisor designed to operate consistently across changing market conditions using a dual-position execution model and strict risk discipline.

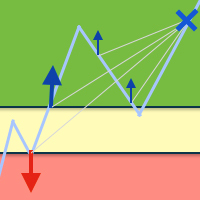

The EA evaluates price structure at the open of each new candle, identifies directional bias using Donchian Channel equilibrium, and deploys a dominant + counter position pair with predefined stop-loss and take-profit levels.

All trades are opened with full risk parameters defined at entry — ensuring transparent, broker-compliant execution without post-entry modification.

🔹 Core Trading Logic

-

Trades are evaluated and executed only on new candles

-

Directional bias is determined using the Donchian Channel midpoint

-

Two positions are opened per signal:

-

Dominant position aligned with market bias

-

Secondary position acting as a statistical counterbalance

-

-

Stop-Loss and Take-Profit are calculated using ATR-based volatility

-

No trailing stops, no delayed modifications, no execution ambiguity

🔹 Risk & Capital Protection

-

All trades are opened with predefined SL & TP

-

Integrated equity-to-balance watchdog to protect against abnormal conditions

-

Automatic position liquidation if risk thresholds are exceeded

-

Designed to comply fully with MQL5 Market validation rules

🔹 Execution & Stability

-

Netting-account compatible

-

No martingale, no grid, no averaging

-

No hedging dependency

-

No modification of open positions

-

Built for robust broker execution and long-term stability

🔹 Visual Dashboard

A clean on-chart dashboard displays:

-

Active symbol and timeframe

-

Number of open positions

-

Account equity, balance, and floating P/L

-

Current EA status and last action

This provides full transparency without interfering with execution.

🔹 Recommended Usage

-

Designed to work on multiple symbols

-

Optimizable per instrument and timeframe

-

Particularly suitable for volatile instruments (e.g., GOLD, indices, major FX pairs)

-

Best results achieved after parameter optimization per symbol