Cross-Platform Expert Advisor: Order Manager

Table of Contents

- Introduction

- Objectives

- Base Implementation

- Calculation of Trade Volume

- Calculation of Stoploss and Takeprofit

- Closing an Order or Position

- Validation of Settings

- Counting of the Number of Trades

- Archiving a COrder Instance

- MQL4-Specific Implementation

- Opening an Order or Position

- Closing an Order or Position

- MQL5-Specific Implementation

- Opening an Order or Position

- Closing an Order or Position

- Creation of an Instance of COrder

- Modification of Order or Position

- Example

- Overview of Structure

- Conclusion

Introduction

As also discussed in earlier articles in the series, MetaTrader 4 and MetaTrader 5 has certain differences that make it difficult to simply copy MQL4 source file and compile them using the MQL5 compiler. One of the most prominent differences between the two is on how the two platforms differ in executing trade operations. This article deals with the creation of the COrderManager class. The said class, along with other helper classes, would be mainly responsible for the execution of trades within the expert advisor as well as in maintenance of the trades entered by the expert.

Objectives

The order manager in this article will be capable of executing the following operations:

- Lotsize Calculation

- Stoploss and Takeprofit

- Misc Parameters Needed for Entry (Expiration, Comment, Magic)

- Some Preconditions before sending an order

- Management of Orders and Orders History

The part involving lotsize calculation is often best delegated to an object member since there are many ways by which the optimum lotsize for the next trade can be calculated (depending on the trading strategy involved). The same is true for the calculation of Stoploss and Takeprofit levels.

Miscellaneous parameters needed to enter an order, such as expiration, order comment, and magic number require less complexity and so are best handled by the order manager object itself.

Certain preconditions are required before a trade can be entered on the market by an expert advisor. These include trading signals based on market conditions, time constraints, as well as the maximum number of active trades at any given time and the maximum number of trades to open in its entire lifetime (between OnInit and OnDeinit). For the order manager, the last two preconditions will be included as a condition before an order is finally sent to the market. This will be implemented so that duplicate trades will not occur during the operation of the expert advisor. The other preconditions, on the other hand, can be delegated to certain components external to the order manager.

Base Implementation

Similar to other class objects discussed in this article series, a common ground between MQL4 and MQL5 must be sought, and implemented in the base class, while the parts where the implementation diverges are implemented in language-specific descendants of the base class. In developing the base class, we have to understand the following areas on the processing of trade requests:

- How trade requests are sent is different

- How trade actions are documented is different

- There are certain features in MQL5 that have no MQL4 equivalents

There are some components that are different between MQL4 and MQL5 in this area. Consider the OrderSend function (mql4, mql5), as shown in the documentations for the two platforms:

(MQL4)

string symbol, // symbol

int cmd, // operation

double volume, // volume

double price, // price

int slippage, // slippage

double stoploss, // stop loss

double takeprofit, // take profit

string comment=NULL, // comment

int magic=0, // magic number

datetime expiration=0, // pending order expiration

color arrow_color=clrNONE // color

);

(MQL5)

MqlTradeRequest& request, // query structure

MqlTradeResult& result // structure of the answer

);

The MQL4 function has a more straightforward approach. The MQL5 function, on the other hand, is a bit more complicated, but reduces the number of parameters to just two, which contain the data (struct) for the request and the result, respectively. This obstacle has been largely addressed on a previous article regarding the importation of certain components of the MQL5 Standard Library into MQL4, particularly the CExpertTrade and CExpertTradeX classes. Thus, the order manager will simply utilize these classes to ensure compatibility between the two languages when issuing trade requests.

Another aspect is the way the exit of the trade or the deletion of an order is handled in MetaTrader 4 and MetaTrader 5. While there is not much difference in the way pending orders are deleted, there is a huge difference in the way market orders (MQL4) or positions (MQL5) are exited from the market. In MQL4, exiting a market order is achieved by calling the OrderClose function. In MetaTrader 5, the same effect is realized by calling the PositionClose function or issuing a trade request with the same volume as the current position and opposite the current position.

In MetaTrader 5, every

trade action is documented. Whether an action is an trade entry,

modification, or exit, that action would leave a footprint, and the

data concerning these actions are accessible to the expert advisor.

This is not the case in MetaTrader 4. For example, when a ticket ID

is assigned to a pending order, the same ID is often used throughout

the lifetime of that order, even if it has hit its trigger price and

became a market order before it has left the market. In order to see

the full progression of a certain trade, one has to look at the

expert and journal log files, which can be a time-consuming task.

Furthermore, log files are meant to be read by humans, and there are

no built-in MQL4 function(s) that would make it easier for an expert

advisor to access those information.

There are certain features in MQL5 that are simply not available in MQL4. An example of this is the order filling type. MQL5 has the following volume filling options for an order:

- ORDER_FILLING_FOK – when the requested volume cannot be filled, cancel the order

- ORDER_FILLING_IOC – when the requested volume cannot be filled, use the maximum volume available and cancel the remaining volume.

- ORDER_FILLING_RETURN – when the requested volume cannot be filled, use the maximum volume available. The order with remaining volume stays on the market.

In MetaTrader 4, a trade request is simply filled or not (cancelled), which is essentially equivalent to ORDER_FILLING_FOK, while the other two options are unavailable. However, these filling policies are only implemented whenever the requested volume exceeds the available volume on the market, which does not happen often especially for setups with low risk and/or low account balance. ORDER_FILLING_IOC and ORDER_FILLING_RETURN can be difficult, if not impossible or impractical to implement in MQL4, primarily because expert advisors do not have any means to determine how much volume is available for a certain trade request (and if it were so, such information can be highly volatile and would be frequently subject to change). Thus, to ensure compatibility between MQL4 and MQL5, ORDER_FILLING_FOK will be the only filling option used (which is also the default in MetaTrader 5). Meanwhile, there are events where an expert calculates a lot size for a trade request which exceeds SYMBOL_VOLUME_MAX, which is the maximum allowable volume for any trade/deal set by the broker. MetaTrader 5 addresses this by automatically splitting the trade into several deals, but this feature is not available in MetaTrader 4 (causing the cancellation of the trade request). Thus, it is better for a cross platform expert advsior to check this in advance (preferably after deriving or calculating the volume to trade) prior to sending a trade request for market entry using the order manager.

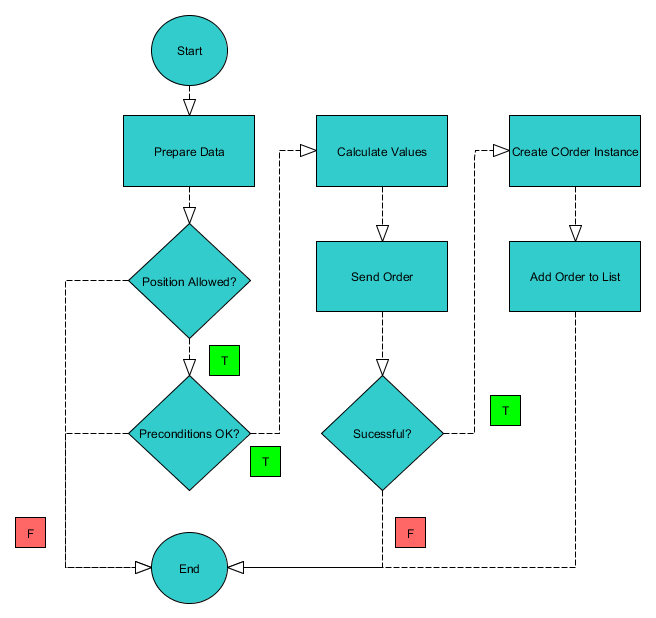

The following figure broadly illustrates how the order manager will implement the entry of trades:

As shown in the figure, the method starts by preparing the data needed for the operation. If the position is allowed to be entered and the preconditions are satisfied, the method proceeds with the entry of the order. Otherwise, the process ends. Before sending the trade requests, necessary values will need to be calculated. If the request is successful, the result is checked and a new instance of COrder is created, which is then added to the list of current orders/positions (m_orders).

Methods that only perform pure calculation can be found within the

base class. The methods invoking functions that are different between

the two languages extends the base methods into their respective

language-specific classes. On this method, however, there is very little difference on how the operation is to be performed. Thus, the base class method is purely virtual, and implementations can be found separately between the two versions. We will find the implementation for the base class method as follows:

{

return NULL;

}

Calculation of Trade Volume

As mentioned earlier, calculation of trade volume for the next trade is best delegated to another class object, which will be a class member of the order manager. This approach is also used in the Experts library of the MQL5 Standard Library. The following shows the code for the LotSizeCalculate method, which is the method responsible for calculating the volume of the next trade:

{

if(CheckPointer(m_moneys))

return m_moneys.Volume(m_symbol.Name(),0,type,stoploss);

return m_lotsize;

}

The method checks of a pointer to an instance of CMoneys, which is just a container for the money management objects used by the order manager (in the same way that COrders is a container for instances of COrder). This money management object will be discussed in a separate article. At this point at least, it is sufficient to know that there is a separate component that deals with the calculation of the lotsize, and that the lotsize calculated will be valid. In the event that no money management instance was provided to the order manager, the order manager would simply use the default lotsize through its class member, m_lotsize.

Calculation of Stop Loss and Takeprofit

The calculation of Stoploss and Takeprofit is achieved through the methods StopLossCalculate and TakeProfitCalculate, respectively. The following code snippets show how each of these methods are implemented in the order manager:

{

if(CheckPointer(m_main_stop))

return m_main_stop.StopLossTicks(type,price);

return 0;

}

{

if(CheckPointer(m_main_stop))

return m_main_stop.TakeProfitTicks(type,price);

return 0;

}

The calculation of the

stop levels are delegated to a separate class object, which will be a

member of the order manager (will be discussed on another article).

The stop object will also have its separate implementations for

MetaTrader 4 and MetaTrader 5. However, in the event that no pointer

to a stop object is supplied to order manager, the calculated

Stoploss or Takeprofit would default to zero (no SL/TP).

Closing an Order or Position

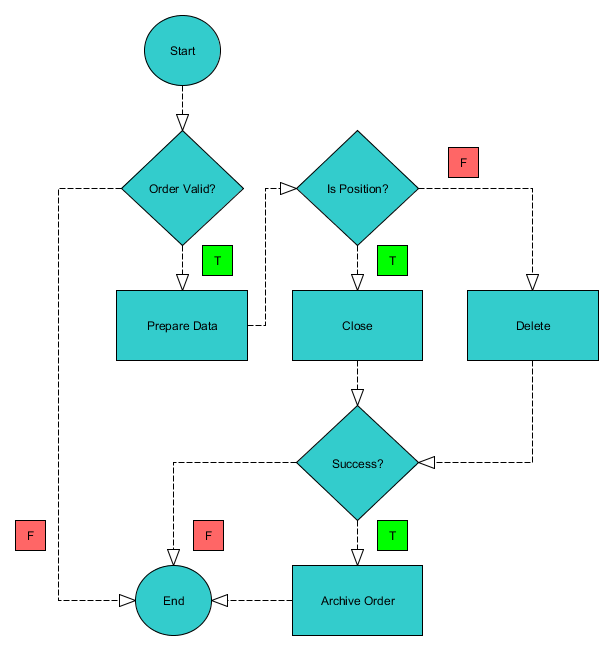

The following figure broadly illustrates how the order manager will close positions and delete orders:

As shown in the figure, the method first checks if the pointer to a instance of COrder is valid. It then proceeds to getting the correct instances to the symbol and trade objects which are needed to process the exit request. It then either deletes or closes the order depending on its type. After a successful closing/deletion of the order, the COrder instance is then moved from the list of active orders to the list of historical orders for the order manager (archived). The method would also set the flags that would mark the COrder object as closed.

Validation of Settings

The validation of settings on the order manager will be achieved by calling the Validate method of the class. The code for the said method is shown in the following snippet:

{

if(CheckPointer(m_moneys)==POINTER_DYNAMIC)

{

if(!m_moneys.Validate())

return false;

}

if(CheckPointer(m_stops)==POINTER_DYNAMIC)

{

if(!m_stops.Validate())

return false;

}

return true;

}

This code is similar to the ValidationSettings method which is often found in the in some classes within the MQL5 Standard Library. It simply calls the Validate methods of its object members, and returns false whenever one of these objects fails validation (ultimately causing the OnInit function of the expert to fail or return INIT_FAILED). The method is meant to be called during execution of the Initialization function of the expert advisor.

Counting of the Number of Trades

The trades total is the total number of trades the order manager has entered thus far, including those already in the history, since the expert advisor or script, is started. The orders total refers to the number of current trades on the account, and the orders history total refers to those found within the order manager's own tally of historical orders. Thus:

{

return m_orders.Total();

}

{

return m_orders_history.Total();

}

{

return m_orders.Total()+m_orders_history.Total()+m_history_count;

}

int orders_total = OrdersTotal();

It is important to note that here, OrdersTotal refers to the method native to the class, not the OrdersTotal function that is found in both MQL4 and MQL5. If we are to use the native function in the language instead, OrdersTotal should be invoked with a scope resolution operator preceding the name of the function:

Archiving a COrder Instance

Since the order manager will keep its own independent tally of trades entered the way MetaTrader 4 and MetaTrader 5 does (but compatible with both), it has to have a way to flag instances of COrder as already belonging to history. The orders are stored in m_orders and m_orders_history, which are instances of COrders, depending on whether they are already history, or still active in the market. As a consequence, for both versions, the cross-platform expert would need to check if a given order or trade has already left the market.

Since the two platforms differ in the way they document trades entered on the market, the order manager will need to keep its own independent record of trades entered. Upon a successful opening of an order, a COrder instance will be created, which will be eventually added to m_orders. As soon as order or position it represents exits the market, the order manager will then have to move the COrder instance to m_orders_history. The ArchiveOrder method of the class, which will be used for both versions, is shown below:

{

return m_orders_history.Add(order);

}

MQL4-Specific Implementation

Opening an Order or Position

The following snippet of code shows the TradeOpen method of the MQL4-specifc class descendant of CorderManagerBase:

{

int trades_total = TradesTotal();

int orders_total = OrdersTotal();

m_symbol = m_symbol_man.Get(symbol);

if (!CheckPointer(m_symbol))

return NULL;

if(!IsPositionAllowed(type))

return NULL;

if(m_max_orders>orders_total && (m_max_trades>trades_total || m_max_trades<=0))

{

ENUM_ORDER_TYPE ordertype = type;

double price=PriceCalculate(ordertype);

double sl=0,tp=0;

if(CheckPointer(m_main_stop)==POINTER_DYNAMIC)

{

sl = m_main_stop.StopLossCustom()?m_main_stop.StopLossCustom(symbol,type,price):m_main_stop.StopLossCalculate(symbol,type,price);

tp = m_main_stop.TakeProfitCustom()?m_main_stop.TakeProfitCustom(symbol,type,price):m_main_stop.TakeProfitCalculate(symbol,type,price);

}

double lotsize=LotSizeCalculate(price,type,sl);

ulong ticket = SendOrder(type,lotsize,price,sl,tp);

if (ticket>0)

{

if (OrderSelect((int)ticket,SELECT_BY_TICKET))

return m_orders.NewOrder(OrderTicket(),OrderSymbol(),OrderMagicNumber(),(ENUM_ORDER_TYPE)::OrderType(),::OrderLots(),::OrderOpenPrice());

}

}

return NULL;

}

The function accepts two parameters, the name of symbol or instrument, and the type of order to open. It starts by getting the values needed for processing the request: the trades total, orders total, and the symbol object for the order (as indicated by the first argument of the method).

Upon satisfying the 2 preconditions (max orders and max trades), the method proceeds to the calculation of the main stop loss and take profit levels, and the volume of the trade, using special object members. Finally, it sends the order, and after a successful operation, creates a new instance of COrder and stores it in the list of active orders (within the order manager).

Closing an Order or Position

The following snippet of code shows the CloseOrder method of the MQL4-specifc class descendant of COrderManagerBase:

bool COrderManager::CloseOrder(COrder *order,const int index=-1) { bool closed=true; if(CheckPointer(order)==POINTER_DYNAMIC) { if(!CheckPointer(m_symbol) || StringCompare(m_symbol.Name(),order.Symbol())!=0) m_symbol=m_symbol_man.Get(order.Symbol()); if(CheckPointer(m_symbol)) m_trade=m_trade_man.Get(order.Symbol()); if(order.Volume()>0) { if(order.OrderType()==ORDER_TYPE_BUY || order.OrderType()==ORDER_TYPE_SELL) closed=m_trade.OrderClose((ulong)order.Ticket()); else closed=m_trade.OrderDelete((ulong)order.Ticket()); } if(closed) { int idx = index>=0?index:FindOrderIndex(GetPointer(order)); if(ArchiveOrder(m_orders.Detach(idx))) { order.Close(); order.Volume(0); } } } return closed; }

As we will later see, the MQL4 version is much simpler than the MQL5 version, primarily because it only has one margin mode (hedging). And even if hedging is disabled by the MetaTrader 4 broker, the process of closing an order will remain the same: delete if pending, close if market.

The function accepts two parameters, the order object, and its index on the list of active orders/positions. If the pointer to the COrder object is valid, we then get the correct instance of CExpertTradeX and CSymbolInfo to close the order, and then put it on the history of the trading terminal by calling the appropriate function.

As soon as the order or position is exited, the COrder object will need to be updated. First, it is removed from the list of active orders, and then transferred at the end of the list of the historical orders. Then, the object is flagged as closed, and its volume zeroed out.

The second argument of the method of the class accepts an optional parameter (index). This is to speed up the processing of the request if the index of the COrder instance in an orders array is already known in advance (this is usually the case since orders often need to be iterated). In the event that the index is not known, then the method can be called with only a single argument and the method would call another class method, FindOrderIndex, which would be responsible for locating the position of the COrder instance in the order array.

MQL5-Specific Implementation

Opening an Order or Position

The following snippet of code shows the TradeOpen method of the MQL5-specifc class descendant of COrderManagerBase:

{

double lotsize=0.0,price=0.0;

int trades_total =TradesTotal();

int orders_total = OrdersTotal();

m_symbol=m_symbol_man.Get(symbol);

if(!IsPositionAllowed(type))

return NULL;

if(m_max_orders>orders_total && (m_max_trades>trades_total || m_max_trades<=0))

{

price=PriceCalculate(type);

lotsize=LotSizeCalculate(price,type,m_main_stop==NULL?0:m_main_stop.StopLossCalculate(symbol,type,price));

if (SendOrder(type,lotsize,price,0,0))

return m_orders.NewOrder((int)m_trade.ResultOrder(),m_trade.RequestSymbol(), (int)m_trade.RequestMagic(),m_trade.RequestType(),m_trade.ResultVolume(),m_trade.ResultPrice());

}

return NULL;

}

As we can see, the

implementation does not differ greatly from the MQL4 one. However,

one of the key difference is that in this code, we do not need to get

the values for the Stoploss and Takeprofit levels. The reason for

this is that how the stop levels behave in MetaTrader 5 is different

from that of its predecessor. A programmer who has experience in

working with MQL5 Expert Advisors will know that in this library, we

are going to use pending orders as a counterpart for broker-based

stops in MQL4.

Closing an Order or Position

The following snippet of code shows the CloseOrder method of the MQL5-specifc class descendant of COrderManagerBase:

bool COrderManager::CloseOrder(COrder *order,const int index=-1)

{

bool closed=true;

COrderInfo ord;

if(!CheckPointer(order))

return true;

if(order.Volume()<=0)

return true;

if(!CheckPointer(m_symbol) || StringCompare(m_symbol.Name(),order.Symbol())!=0)

m_symbol=m_symbol_man.Get(order.Symbol());

if(CheckPointer(m_symbol))

m_trade=m_trade_man.Get(order.Symbol());

if(ord.Select(order.Ticket()))

{

closed=m_trade.OrderDelete(order.Ticket());

}

else

{

ResetLastError();

if(IsHedging())

{

closed=m_trade.PositionClose(order.Ticket());

}

else

{

if(COrder::IsOrderTypeLong(order.OrderType()))

closed=m_trade.Sell(order.Volume(),0,0,0);

else if(COrder::IsOrderTypeShort(order.OrderType()))

closed=m_trade.Buy(order.Volume(),0,0,0);

}

}

if(closed)

{

if(ArchiveOrder(m_orders.Detach(index)))

{

order.Close();

order.Volume(0);

}

}

return closed;

}

In closing an order or a position in MQL5, we have to consider the margin mode (netting or hedge). But first we need to identify whether or not the item to be closed is an MQL5 order or an MQL5 position. We can use the functions OrderSelect and HistoryOrderSelect to accomplish this, but in order to shorten the code needed for this method and make the process easier, we will simply use the COrderInfo class from the MQL5 Standard Library to accomplish this.

An order in MQL5 comes as a result of a trade request, which would often result to a deal or a set of deals (roughly equivalent to a MetaTrader 4 market order). However, if the request is not instant execution, then it refers to a pending order (as opposed in MetaTrader 4, where orders can be market or pending). Now, to differentiate the item to exit, the method first checks if the item is a pending order using COrderInfo, and if so, that pending order is deleted. If it fails selection by COrderInfo, then we are certain that it is a market order or a position. For hedging mode, the position is simply closed using PositionClose function. Otherwise, in netting mode, we simply neutralize the position by entering an opposite position with equivalent volume.

Creation of an Instance of COrder

We have seen how the order manager opens and closes a trade. In a previous article, we have also shown a way on how the CExpertTrade Class can be altered so as to make it compatible with both trading platforms. Now, there is a difference in how Stoploss and Takeprofit levels are implemented in the two trading platforms, and this is only barely processed by the order manager. The rest of the process is set upon the initialization of the COrder instance, which is invoked on the NewOrder method of COrders. The following code shows the Init method of COrdersBase:

{

COrder *order=new COrder(ticket,symbol,type,volume,price);

if(CheckPointer(order)==POINTER_DYNAMIC)

if(InsertSort(GetPointer(order)))

{

order.Magic(magic);

order.Init(GetPointer(this),m_stops);

return order;

}

return NULL;

}

As we can see, the Init method of the COrder class accepts a certain custom object (CStops) as its second argument. This is a container for stop objects (like m_main_stop object shown earlier). This class object will be discussed on a separate article.

Modification of Order or Position

We have not shown any code yet that would allow the order manager to modify an existing position. This would be delegated to another stop object (CStop and CorderStop), which will be discussed on a separate article. These objects would be responsible for any update or modification of the stop levels of the position, as well as coordination with the COrder object that they belong to.

In MetaTrader 4, the pending order entry price can be modified any number of times. This is not the case in MetaTrader 5. This time, the MQL5 version is the limiting component, so we will adopt the MQL5 standard. Modifying a pending order will require the deletion of the existing pending order and the creation of a new one with updated properties.

Example

As an example, we will implement an expert advisor using the class objects discussed so far in this article series. After creating the expert advisor source file on MetaEditor, we will begin with the reference to the library:

#include "MQLx\Base\OrderManager\OrderManagerBase.mqh"

Note that in this statement, we are using quotation marks rather than "<" and ">". We are going to put the library on the same directory as the expert advisor source code file.

For this EA, we are going to require at least three pointers, which has to be declared globally within the program (COrderManager, CSymbolInfo, and CSymbolManager):

COrderManager *order_manager; CSymbolManager *symbol_manager; CSymbolInfo *symbol_info;

Under the OnInit function, we will have to initialize these three pointers, especially for the instance of CSymbolInfo, which requires a particular name of an instrument to assign to during initialization.

int OnInit() { //--- order_manager = new COrderManager(); symbol_manager = new CSymbolManager(); symbol_info = new CSymbolInfo(); if (!symbol_info.Name(Symbol())) { Print("symbol not set"); return (INIT_FAILED); } symbol_manager.Add(GetPointer(symbol_info)); order_manager.Init(symbol_manager,NULL); //--- return(INIT_SUCCEEDED); }

Under OnDeinit, we will have to delete these three pointers so they won't leak memory (at least within the trading platform):

void OnDeinit(const int reason) { //--- delete symbol_info; delete symbol_manager; delete order_manager; }

Under OnTick, we have to implement the actual strategy. The expert in this example will use a simple method of detecting a new bar (by checking the count of bars on the chart). The previous bar count has to be stored in a static variable (or global variable). The same is true for the direction variable, which will be used to store the previous direction the expert previously took (or zero, if it's the first time to trade). However, since the function used to counting the bars on the chart differ between the two platforms, we will have to split the implementation in this regard:

static int bars = 0; static int direction = 0; int current_bars = 0; #ifdef __MQL5__ current_bars = Bars(NULL,PERIOD_CURRENT); #else current_bars = Bars; #endif

For the MQL4 version, we are simply using the predefined variable named Bars (a call to the function iBars, can also be used). On the other hand, for the MQL5 version, we are using a call to the Bars function.

The next code snippet implements the actual behavior of the expert that can be observed. If a discrepancy between the previous and current bars has been detected, the expert begins by initializing the rates of the symbol (CSymbolInfo), to be used for further operations. It then checks if there is a previous trade to close. If one was found, the expert closes it, and proceeds to processing the entry of another trade, based on the previous direction. The code ends by updating the count of bars on the EA.

if (bars<current_bars) { symbol_info.RefreshRates(); COrder *last = order_manager.LatestOrder(); if (CheckPointer(last) && !last.IsClosed()) order_manager.CloseOrder(last); if (direction<=0) { Print("Entering buy trade.."); order_manager.TradeOpen(Symbol(),ORDER_TYPE_BUY,symbol_info.Ask()); direction = 1; } else { Print("Entering sell trade.."); order_manager.TradeOpen(Symbol(),ORDER_TYPE_SELL,symbol_info.Bid()); direction = -1; } bars = current_bars; }

To ensure that we use the same code for the initial version and for all future versions of the expert advisor, we move the code we have made so far in a header file, and then reference it in the main source file (each for the MQL4 and MQL5 versions). Both the source files (test_ordermanager.mq4 or test_ordermanager.mq5, depending on the target platform) will have a single line of code referencing the main header file:

#include "test_ordermanager.mqh"

The following tables show the results of running the expert advisor on MetaTrader 4, and the netting and hedging modes of MetaTrader 5, as they appeared on their respective strategy tester reports. For the sake of brevity, the first 10 trades were only included in the article (the full reports can be found on the zip package at the end of this article).

MT4:

| # | Time | Type | Order | Size | Price | S / L | T / P | Profit | Balance |

| 1 | 2017.01.02 00:00 | buy | 1 | 0.10 | 1.05102 | 0.00000 | 0.00000 | ||

| 2 | 2017.01.02 01:00 | close | 1 | 0.10 | 1.05172 | 0.00000 | 0.00000 | 7.00 | 10007.00 |

| 3 | 2017.01.02 01:00 | sell | 2 | 0.10 | 1.05172 | 0.00000 | 0.00000 | ||

| 4 | 2017.01.02 02:00 | close | 2 | 0.10 | 1.05225 | 0.00000 | 0.00000 | -5.30 | 10001.70 |

| 5 | 2017.01.02 02:00 | buy | 3 | 0.10 | 1.05225 | 0.00000 | 0.00000 | ||

| 6 | 2017.01.02 03:00 | close | 3 | 0.10 | 1.05192 | 0.00000 | 0.00000 | -3.30 | 9998.40 |

| 7 | 2017.01.02 03:00 | sell | 4 | 0.10 | 1.05192 | 0.00000 | 0.00000 | ||

| 8 | 2017.01.02 04:00 | close | 4 | 0.10 | 1.05191 | 0.00000 | 0.00000 | 0.10 | 9998.50 |

| 9 | 2017.01.02 04:00 | buy | 5 | 0.10 | 1.05191 | 0.00000 | 0.00000 | ||

| 10 | 2017.01.02 05:00 | close | 5 | 0.10 | 1.05151 | 0.00000 | 0.00000 | -4.00 | 9994.50 |

| 11 | 2017.01.02 05:00 | sell | 6 | 0.10 | 1.05151 | 0.00000 | 0.00000 | ||

| 12 | 2017.01.02 06:00 | close | 6 | 0.10 | 1.05186 | 0.00000 | 0.00000 | -3.50 | 9991.00 |

| 13 | 2017.01.02 06:00 | buy | 7 | 0.10 | 1.05186 | 0.00000 | 0.00000 | ||

| 14 | 2017.01.02 07:00 | close | 7 | 0.10 | 1.05142 | 0.00000 | 0.00000 | -4.40 | 9986.60 |

| 15 | 2017.01.02 07:00 | sell | 8 | 0.10 | 1.05142 | 0.00000 | 0.00000 | ||

| 16 | 2017.01.02 08:00 | close | 8 | 0.10 | 1.05110 | 0.00000 | 0.00000 | 3.20 | 9989.80 |

| 17 | 2017.01.02 08:00 | buy | 9 | 0.10 | 1.05110 | 0.00000 | 0.00000 | ||

| 18 | 2017.01.02 09:00 | close | 9 | 0.10 | 1.05131 | 0.00000 | 0.00000 | 2.10 | 9991.90 |

| 19 | 2017.01.02 09:00 | sell | 10 | 0.10 | 1.05131 | 0.00000 | 0.00000 | ||

| 20 | 2017.01.02 10:00 | close | 10 | 0.10 | 1.05155 | 0.00000 | 0.00000 | -2.40 | 9989.50 |

MT5 (netting):

| Open Time | Order | Symbol | Type | Volume | Price | S / L | T / P | Time | State | Comment | ||

| 2017.01.02 00:00:00 | 2 | EURUSD | buy | 0.10 / 0.10 | 1.05140 | 2017.01.02 00:00:00 | filled | |||||

| 2017.01.02 01:00:00 | 3 | EURUSD | sell | 0.10 / 0.10 | 1.05172 | 2017.01.02 01:00:00 | filled | |||||

| 2017.01.02 01:00:00 | 4 | EURUSD | sell | 0.10 / 0.10 | 1.05172 | 2017.01.02 01:00:00 | filled | |||||

| 2017.01.02 02:00:00 | 5 | EURUSD | buy | 0.10 / 0.10 | 1.05293 | 2017.01.02 02:00:00 | filled | |||||

| 2017.01.02 02:00:00 | 6 | EURUSD | buy | 0.10 / 0.10 | 1.05293 | 2017.01.02 02:00:00 | filled | |||||

| 2017.01.02 03:00:00 | 7 | EURUSD | sell | 0.10 / 0.10 | 1.05192 | 2017.01.02 03:00:00 | filled | |||||

| 2017.01.02 03:00:00 | 8 | EURUSD | sell | 0.10 / 0.10 | 1.05192 | 2017.01.02 03:00:00 | filled | |||||

| 2017.01.02 04:00:00 | 9 | EURUSD | buy | 0.10 / 0.10 | 1.05234 | 2017.01.02 04:00:00 | filled | |||||

| 2017.01.02 04:00:00 | 10 | EURUSD | buy | 0.10 / 0.10 | 1.05234 | 2017.01.02 04:00:00 | filled | |||||

| 2017.01.02 05:00:00 | 11 | EURUSD | sell | 0.10 / 0.10 | 1.05151 | 2017.01.02 05:00:00 | filled | |||||

| 2017.01.02 05:00:00 | 12 | EURUSD | sell | 0.10 / 0.10 | 1.05151 | 2017.01.02 05:00:00 | filled | |||||

| 2017.01.02 06:00:00 | 13 | EURUSD | buy | 0.10 / 0.10 | 1.05230 | 2017.01.02 06:00:00 | filled | |||||

| 2017.01.02 06:00:00 | 14 | EURUSD | buy | 0.10 / 0.10 | 1.05230 | 2017.01.02 06:00:00 | filled | |||||

| 2017.01.02 07:00:00 | 15 | EURUSD | sell | 0.10 / 0.10 | 1.05142 | 2017.01.02 07:00:00 | filled | |||||

| 2017.01.02 07:00:00 | 16 | EURUSD | sell | 0.10 / 0.10 | 1.05142 | 2017.01.02 07:00:00 | filled | |||||

| 2017.01.02 08:00:00 | 17 | EURUSD | buy | 0.10 / 0.10 | 1.05169 | 2017.01.02 08:00:00 | filled | |||||

| 2017.01.02 08:00:00 | 18 | EURUSD | buy | 0.10 / 0.10 | 1.05169 | 2017.01.02 08:00:00 | filled | |||||

| 2017.01.02 09:00:00 | 19 | EURUSD | sell | 0.10 / 0.10 | 1.05131 | 2017.01.02 09:00:00 | filled | |||||

| 2017.01.02 09:00:00 | 20 | EURUSD | sell | 0.10 / 0.10 | 1.05131 | 2017.01.02 09:00:00 | filled | |||||

| 2017.01.02 10:00:00 | 21 | EURUSD | buy | 0.10 / 0.10 | 1.05164 | 2017.01.02 10:00:00 | filled | |||||

MT5 (hedging):

| Open Time | Order | Symbol | Type | Volume | Price | S / L | T / P | Time | State | Comment | ||

| 2017.01.02 00:00:00 | 2 | EURUSD | buy | 0.10 / 0.10 | 1.05140 | 2017.01.02 00:00:00 | filled | |||||

| 2017.01.02 01:00:00 | 3 | EURUSD | sell | 0.10 / 0.10 | 1.05172 | 2017.01.02 01:00:00 | filled | |||||

| 2017.01.02 01:00:00 | 4 | EURUSD | sell | 0.10 / 0.10 | 1.05172 | 2017.01.02 01:00:00 | filled | |||||

| 2017.01.02 02:00:00 | 5 | EURUSD | buy | 0.10 / 0.10 | 1.05293 | 2017.01.02 02:00:00 | filled | |||||

| 2017.01.02 02:00:00 | 6 | EURUSD | buy | 0.10 / 0.10 | 1.05293 | 2017.01.02 02:00:00 | filled | |||||

| 2017.01.02 03:00:00 | 7 | EURUSD | sell | 0.10 / 0.10 | 1.05192 | 2017.01.02 03:00:00 | filled | |||||

| 2017.01.02 03:00:00 | 8 | EURUSD | sell | 0.10 / 0.10 | 1.05192 | 2017.01.02 03:00:00 | filled | |||||

| 2017.01.02 04:00:00 | 9 | EURUSD | buy | 0.10 / 0.10 | 1.05234 | 2017.01.02 04:00:00 | filled | |||||

| 2017.01.02 04:00:00 | 10 | EURUSD | buy | 0.10 / 0.10 | 1.05234 | 2017.01.02 04:00:00 | filled | |||||

| 2017.01.02 05:00:00 | 11 | EURUSD | sell | 0.10 / 0.10 | 1.05151 | 2017.01.02 05:00:00 | filled | |||||

| 2017.01.02 05:00:00 | 12 | EURUSD | sell | 0.10 / 0.10 | 1.05151 | 2017.01.02 05:00:00 | filled | |||||

| 2017.01.02 06:00:00 | 13 | EURUSD | buy | 0.10 / 0.10 | 1.05230 | 2017.01.02 06:00:00 | filled | |||||

| 2017.01.02 06:00:00 | 14 | EURUSD | buy | 0.10 / 0.10 | 1.05230 | 2017.01.02 06:00:00 | filled | |||||

| 2017.01.02 07:00:00 | 15 | EURUSD | sell | 0.10 / 0.10 | 1.05142 | 2017.01.02 07:00:00 | filled | |||||

| 2017.01.02 07:00:00 | 16 | EURUSD | sell | 0.10 / 0.10 | 1.05142 | 2017.01.02 07:00:00 | filled | |||||

| 2017.01.02 08:00:00 | 17 | EURUSD | buy | 0.10 / 0.10 | 1.05169 | 2017.01.02 08:00:00 | filled | |||||

| 2017.01.02 08:00:00 | 18 | EURUSD | buy | 0.10 / 0.10 | 1.05169 | 2017.01.02 08:00:00 | filled | |||||

| 2017.01.02 09:00:00 | 19 | EURUSD | sell | 0.10 / 0.10 | 1.05131 | 2017.01.02 09:00:00 | filled | |||||

| 2017.01.02 09:00:00 | 20 | EURUSD | sell | 0.10 / 0.10 | 1.05131 | 2017.01.02 09:00:00 | filled | |||||

| 2017.01.02 10:00:00 | 21 | EURUSD | buy | 0.10 / 0.10 | 1.05164 | 2017.01.02 10:00:00 | filled | |||||

Note that for the hedging and netting modes on MT5, the results are identical. Although the underlying implementation is the same, the difference lies in the fact that in netting mode, a position is neutralized by entering a trade of the same volume, while on hedging mode, the position is closed similar to what many traders are accustomed with in MetaTrader 4. Under the hedging mode, we could see a message such as the following:

PE 0 16:19:15.747 Trade 2017.01.02 01:00:00 instant sell 0.10 EURUSD at 1.05172, close #2 (1.05172 / 1.05237 / 1.05172) GP 0 16:19:15.747 Trades 2017.01.02 01:00:00 deal #3 sell 0.10 EURUSD at 1.05172 done (based on order #3) DS 0 16:19:15.747 Trade 2017.01.02 01:00:00 deal performed [#3 sell 0.10 EURUSD at 1.05172]

Note the statement that says "close #2" right on the first line. Hedging mode indicates which particular trade is to be neutralized (closed). On the other hand, under netting mode, we would only see a message such as the following:

PG 0 16:20:51.958 Trade 2017.01.02 01:00:00 instant sell 0.10 EURUSD at 1.05172 (1.05172 / 1.05237 / 1.05172) MQ 0 16:20:51.958 Trades 2017.01.02 01:00:00 deal #3 sell 0.10 EURUSD at 1.05172 done (based on order #3) KN 0 16:20:51.958 Trade 2017.01.02 01:00:00 deal performed [#3 sell 0.10 EURUSD at 1.05172]

Under this mode, it is less obvious if the deal performed was for the entry of a new order, or simply an act of neutralizing an existing position.

Overview of Structure

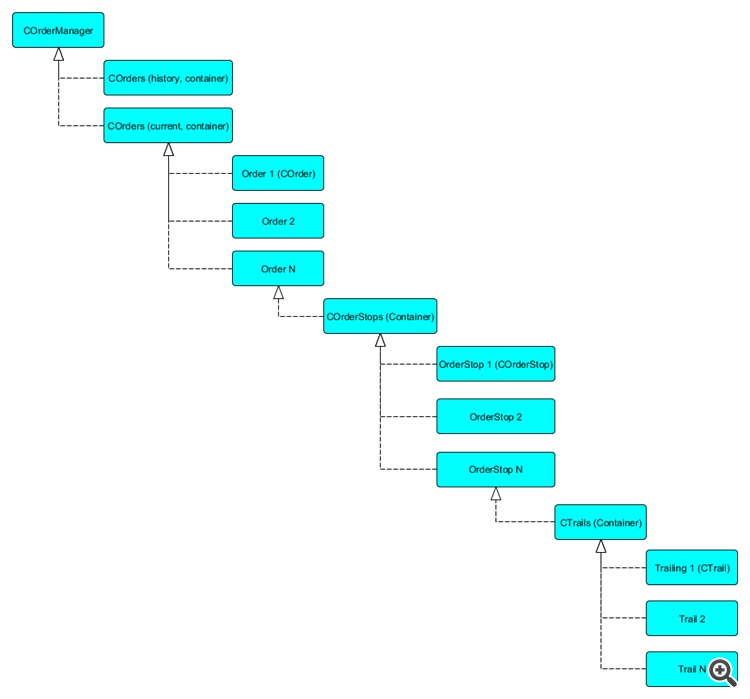

The COrderManager class is one of the most complex class objects to be discussed in this article series. In order to give an idea on how the final order manager would look like with its object members, consider the following diagram:

In simple words, the order manager would contain two instances of COrders (current and historical), which would act as containers for the orders entered by the order manager (COrder). Each of these orders can accommodate stop levels (can be none, but more than one is possible), and each of these levels can have its own trailing methods (can be none, but more than one is also possible). Although most expert advisors may not find use for such a complexity, some strategies, especially those that deal with multiple support and resistance levels, will find this structure useful. These class members will be discussed on future articles.

Conclusion

In this article, we have discussed the COrderManager class, which is responsible for the management of the trade operations of the EA. The COrderManager class was designed in such a way to be able to deal with MQL4 and MQL5 so traders and programmers coding expert advisors would be able to ensure cross-platform compatibility in the code that they write on the main source or header file.

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

MQL5 Cookbook - Creating a ring buffer for fast calculation of indicators in a sliding window

MQL5 Cookbook - Creating a ring buffer for fast calculation of indicators in a sliding window

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

super, I've been waiting for a ready solution for a long time.

thanks to the author in advance.

Hello Enrico,

I haven't found any method for getting order profit. There is no one?

Hello Enrico,

I haven't found any method for getting order profit. There is no one?