Dollar Yen Killer

- エキスパート

- Jestoni Santiago

- バージョン: 2.0

- アクティベーション: 10

Unlike systems that act on single triggers, this EA uses multiple filters and a scoring system to determine when to place trades. You can customize how many filters must be satisfied before execution.

Core System Logic:

-

Detects breakout zones by scanning historical price structure

-

Validates setups through optional filters, such as directional flow, volatility pulse, and structural alignment

-

Uses conditional trigger-based entries at defined price levels

-

Applies adaptive stop loss and trailing behavior based on volatility

-

Auto-lot sizing based on risk configuration and margin availability

-

Compatible with ECN brokers, adapts to pip digits and stop-levels

-

Optimized for low-resource environments and VPS usage

Configuration Overview:

-

Risk Engine: Set fixed or percentage-based risk

-

Validation Filters: Enable up to 5 filters, adjust strictness

-

Breakout Scanner: Control scan depth and pivot distance

-

Sensitivity Tuning: Adjust responsiveness to price behavior

-

Protection Logic: Trailing stop behavior, SL/TP settings, order expiration

Deployment Guide:

-

Symbol: USDJPY

-

Timeframe: M5–H1

-

Broker Type: ECN with low spreads (Fusion, IC Markets, Pepperstone)

-

VPS: Strongly recommended

-

Initial setup: Start with two filters, increase for more conservative entries

Testing Tips:

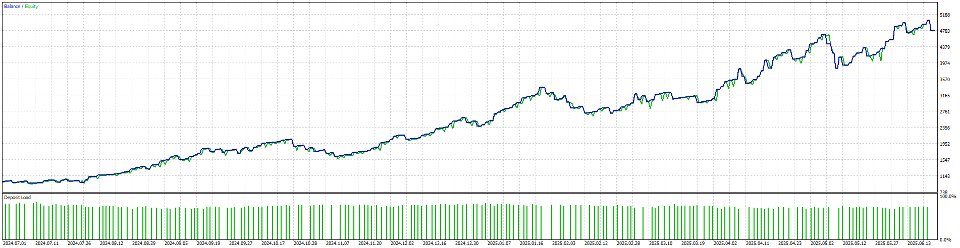

Use “Every Tick” mode when backtesting for more accurate logic simulation. Forward demo testing is encouraged to see how the EA behaves under live tick conditions.

Who It’s For:

-

Beginner to Advance traders

For questions and inquiries about this EA, kindly drop a message here at MQL.