FX Five Indicator Average Dashboard for MT4

- Indicatori

- Vener Garayev

- Versione: 1.1

- Attivazioni: 5

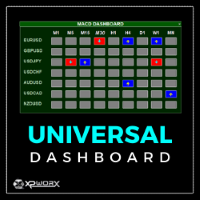

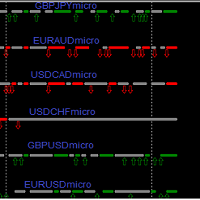

Multi-timeframe dashboard showing the average value of five core momentum indicators across multiple currency pairs to quickly identify overbought and oversold market conditions.

🔹 What the Indicator Does

-

Calculates a single average value of five indicators (0–100)

-

Uses five well-known momentum indicators

-

Displays values across multiple timeframes and symbols

-

Highlights oversold and overbought zones

-

Provides a BUY / SELL decision column based on consecutive timeframe alignment

🔹 Indicators Used (AverageFive)

-

Relative Strength Index (RSI)

-

Stochastic Oscillator

-

Money Flow Index (MFI)

-

Williams’ Percent Range (WPR), normalized to 0–100

-

DeMarker, normalized to 0–100

All five indicators are averaged into one composite value.

🔹 Color Logic

-

Blue (Oversold / BUY)

-

AverageFive value at or below lower threshold

-

-

Red (Overbought / SELL)

-

AverageFive value at or above upper threshold

-

-

Neutral (“–”)

-

Value inside normal range

-

🔹 Decision Column Logic

-

BUY

-

At least N consecutive timeframes below the lower threshold

-

-

SELL

-

At least N consecutive timeframes above the upper threshold

-

-

Neutral

-

No sufficient consecutive alignment

-

🔹 Supported Timeframes

-

M1

-

M5

-

M15

-

M30

-

H1

-

H4

-

D1

-

W1

-

MN1

🔹 Key Features

-

Multi-symbol dashboard view

-

Multi-timeframe analysis

-

Single composite oscillator (0–100)

-

Clean, grid-based visual layout

-

Fast scanning of market extremes

-

Optimized with cached indicator handles

-

Lightweight and non-intrusive

-

No chart clutter

🔹 Input Parameters

-

Dashboard Update Interval

-

Time between dashboard refreshes (seconds)

-

-

Shift for Calculation

-

0 = forming candle

-

1 = last closed candle

-

-

Period for Calculation

-

Shared period for all five indicators

-

-

Low Bound Threshold

-

Oversold level

-

-

High Bound Threshold

-

Overbought level

-

-

Min Consecutive Timeframes for Decision

-

Number of aligned timeframes required for BUY or SELL decision

-

-

Dashboard Placement X Coordinate

-

Dashboard Placement Y Coordinate

-

Pairs Column Width

-

Dashboard Cells Width

-

Decision Column Width

-

Dashboard Rows Height

-

Dashboard Text Font Size

-

Oversold Level Color (Buy)

-

Overbought Level Color (Sell)

-

Dashboard Header Color

-

Neutral Zone Color

Pairs

-

Up to 28 symbols

-

Each pair configurable individually

-

Empty fields automatically ignored

🔹 Recommended Usage

-

Market scanning for extremes

-

Multi-timeframe confirmation

-

Trade filtering tool

-

Mean-reversion strategies

-

Momentum exhaustion detection

🔹 Important Notes

-

Indicator does not open trades

-

Indicator does not repaint historical values

-

Best used together with price action or trend context

-

Indicator can be attached to any chart and any timeframe