Optimized Trend Tracker Oscillator

- Indicatori

- Mohammad Taher Halimi Tabrizi

- Versione: 1.0

- Attivazioni: 5

A precision-engineered trend tracking oscillator designed for traders who demand clarity, adaptability, and multi-layered signal confirmation. OTTO combines adaptive volatility modelling, advanced moving averages, and trend-stop logic to produce an oscillator that reacts intelligently to market structure rather than noise.

This indicator is suitable for traders who want early trend detection, dynamic stop-zones, and visually clean cross-over signals without repainting.

It does not place trades and does not guarantee profit. Use at your own discretion.

Key Features

1. Adaptive Volatility Engine (VAR / CMO-Driven Smoothing)

The indicator uses a two-stage volatility adaptation mechanism:

-

Stage 1: Calculates a CMO-weighted adaptive value of the source price.

-

Stage 2: Applies a second volatility-adjusted smoothing to the transformed price array.

This structure allows the oscillator to respond quickly during high momentum while avoiding false signals in ranging markets.

2. Multi-Type Moving Average Framework (10 modes)

Choose from multiple MA types for the oscillator baseline:

-

SMA

-

EMA

-

WMA

-

DEMA

-

TMA

-

VAR Adaptive MA

-

WWMA

-

ZLEMA

-

TSF

-

Hull MA

Every MA is internally optimized for buffer-based calculations to ensure speed and accuracy even during heavy backtests.

3. Trend-Stop Logic (OTT Core Mechanism)

The oscillator uses an optimized trend-stop system based on:

-

Calculated baseline

-

Dynamic offset (% factor)

-

Trend direction switching

-

Long-stop and short-stop stabilization logic

This creates a stable trend tracker that adapts to price acceleration and deceleration.

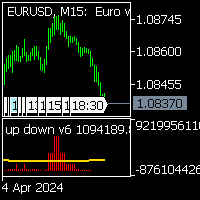

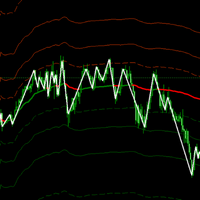

4. Clean OTTO Visualization

The indicator draws two main components:

-

HOTT: The optimized trend-stop value

-

LOTT: The transformed data stream

A filling zone makes trend changes visually clear without clutter.

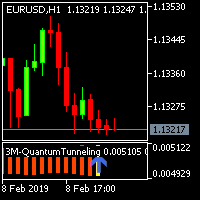

5. Buy and Sell Signal Markers (Optional)

When enabled, the indicator generates crossover-based signals based on HOTT and LOTT interactions:

-

Buy when HOTT crosses below LOTT

-

Sell when HOTT crosses above LOTT

These signals are plotted with arrows using Wingdings for high visibility.

6. Theme Customization

Includes optional light theme auto-configuration, adjusting chart colors, background, grid, candle colors, and price lines for comfortable viewing.

7. Built-in Testing Panel (Optional)

The indicator includes a full backtest visualization mode for manual evaluation:

-

Buy/Sell counters

-

Total and winning trades

-

Win rate

-

Direction status

-

TP/SL simulation using points

-

Adjustable start date for custom ranges

All elements are displayed in a floating panel with movable UI buttons.

8. Alerts and Notifications

Optional alert system with support for:

-

Terminal alerts

-

Push notifications

Alerts trigger only on new confirmed signals.

9. Non-Repainting Structure

All signals are generated on closed candles.

The indicator does not repaint previous values.

Inputs Overview

Core Inputs

-

OTT period

-

Percent offset

-

Fast/slow VIDYA lengths

-

Correcting constant

-

MA type

-

Source price

Display and Functionality Options

-

Show/Hide crossover signals

-

Light theme mode

-

Tester mode with TP/SL rules and start date

-

Alerts and push notifications

Important Notes

-

This indicator is for educational and analytical purposes only.

-

It does not guarantee profit or provide investment advice.

-

Always test thoroughly before using in live trading.

-

Market conditions can change; use this tool as part of a broader strategy.