Gold Traders AI Integration

- Experts

- Fintex Trading, Sociedad Limitada

- Versione: 1.1

- Aggiornato: 11 settembre 2025

- Attivazioni: 15

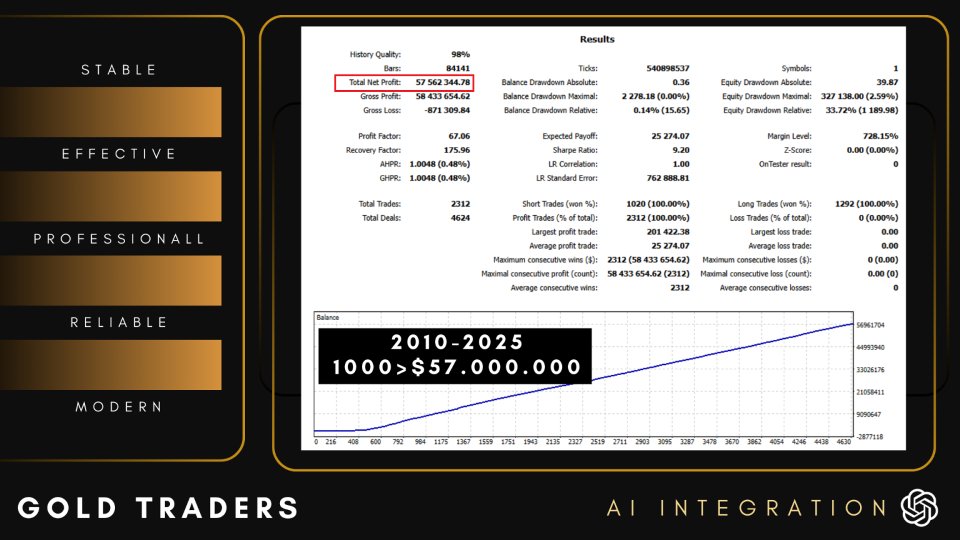

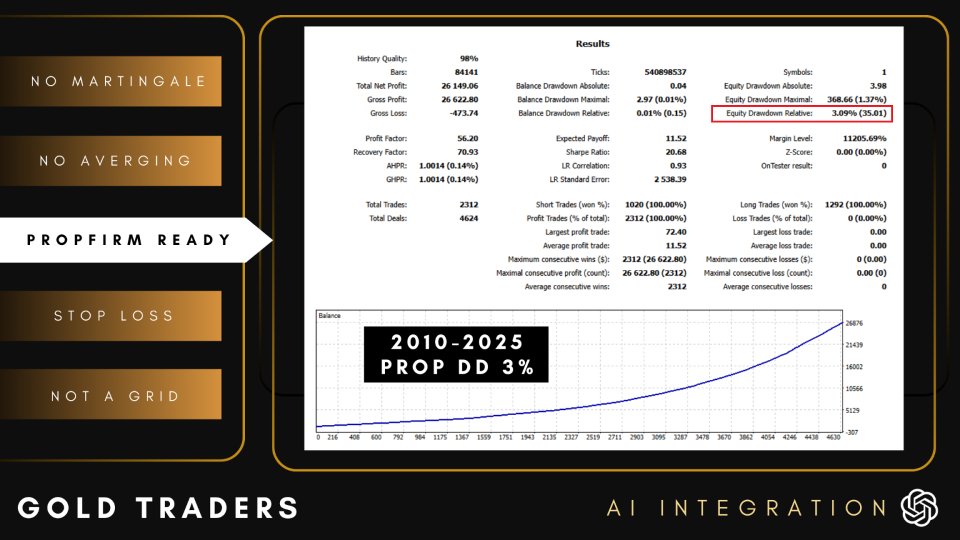

Gold Traders AI Integrations is an Expert Advisor (EA) designed for MetaTrader platforms, specializing in automated trading on gold instruments (XAUUSD). The system integrates advanced artificial intelligence (AI) and neural network technologies to process market data and execute trades based on algorithmic decisions. The core algorithm employs multilayer perceptron (MLP) neural networks, a feedforward architecture with input, hidden, and output layers. These networks utilize non-linear activation functions and are trained via backpropagation, enabling the EA to analyze historical and real-time data for pattern recognition in gold price movements. The implementation incorporates recent advancements in AI programming, including TensorFlow-inspired frameworks adapted for MQL5, allowing for efficient model deployment within the trading environment. A built-in AI module handles data preprocessing, feature extraction, and model inference. This module supports quantum-inspired optimization techniques, such as simulated annealing variants, to refine neural network parameters without external dependencies. It processes inputs like price volatility, volume, and macroeconomic indicators specific to gold, including interest rate differentials and commodity correlations. The EA operates exclusively on gold (XAUUSD) pairs, leveraging its specialized dataset for training, which includes over 20 years of tick data. Uniqueness lies in its hybrid integration of classical quantitative models (e.g., ARIMA for time series) with deep learning, reducing overfitting through techniques like dropout and early stopping. The system avoids high-risk methods such as martingale or grid trading, focusing instead on position sizing based on volatility calculations (e.g., ATR multiples). For operational calculations, the EA includes embedded functions for risk management, such as position sizing via Kelly criterion adaptations and drawdown limits computed from Monte Carlo simulations. It also provides outputs for backtesting metrics, including Sharpe ratio, maximum drawdown, and expectancy, derived from historical trade simulations. Deployment requires a VPS for continuous operation, with compatibility tested on ECN brokers offering low-latency execution. Overall, Gold Traders AI Integrations represents a technical advancement in AI-driven trading tools, distinguished by its focused application to gold markets and incorporation of contemporary neural computing methods.

PRICING POLICY LAUNCH PRICE $500 for the first 10 copies only

LIVE SIGNAL https://www.mql5.com/en/signals/2331169

- XAUUSD (GOLD)

- No martingale

- No grid

- No scalping

- No hedging

- No arbitrage

- Working timeframe H1

- Minimum recommended deposit $100

-----------------------------------------------------------------------------

- Time-tested strategy

- No dangerous methods of money management

- Smart artificial intelligence filters in code

- Not sensitive to broker conditions

- Good resistance to unexpected market events

- Stress tested with 99.90% tick data using variable spread

- Easy to install

- PROP firm ready

- FTMO compatible

-----------------------------------------------------------------------------

Requirements

- ECN broker

- VPS is desirable, but not necessary

About AI Integration Project

AI Integration Projects is a comprehensive suite of Expert Advisors (EAs) developed for MetaTrader platforms, focusing on automated trading across diverse financial instruments. This series builds on cutting-edge artificial intelligence and neural network technologies, adapting the foundational architecture from specialized systems like Gold Traders AI Integrations to a broader ecosystem. Each EA in the series is engineered to handle specific asset classes, ensuring modular, scalable, and efficient market engagement without high-risk methodologies.

The core framework employs multilayer perceptron (MLP) neural networks, featuring feedforward structures with input, hidden, and output layers. These models utilize non-linear activation functions and backpropagation for training, enabling robust pattern recognition in volatile markets. Recent AI programming advancements, including optimized frameworks inspired by TensorFlow and adapted for MQL5, facilitate seamless model integration. A dedicated AI module manages data preprocessing, feature selection, and inference, incorporating quantum-inspired optimizations like simulated annealing to fine-tune parameters dynamically.

The series will includes specialized EAs for various derivatives Currency Pairs, Indices, Gold and Commodities, Oil and Cryptocurrencies.

All EAs share a unified risk management system, featuring position sizing via Kelly criterion variants, drawdown controls from Monte Carlo simulations, and volatility assessments using ATR. They avoid aggressive tactics, emphasizing FIFO compliance and prop firm compatibility. Calculations for trading include Sharpe ratio, maximum drawdown, and expectancy metrics, computed from historical simulations.

This project represents a unique convergence of AI-driven analytics and multi-asset trading, distinguished by its emphasis on neural adaptability and rigorous optimization techniques like walk-forward testing and genetic algorithms. Deployment on VPS ensures low-latency execution, with modular code allowing parameter adjustments. AI Integration Projects offers a technical foundation for systematic trading across global markets.

Risk Warning:

Trading Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.