AI Hybrid Trader

- Experts

- Catur Cipto Nugroho

- Versione: 6.0

- Aggiornato: 20 febbraio 2026

- Attivazioni: 10

— AI-Hybrid Trader v6.0 —

The Self-Evolving AI Trading System

🚀 MAJOR UPDATE: Version 6.0 — Self-Evolving AI Infrastructure

🔥 What's New in v6.0:

- 🧠 AI Model Evaluator — Tracks prediction accuracy in real-time, per market regime

- 📊 Structured Telemetry — Full CSV logging of every entry, exit, and feature snapshot

- 🛡️ Risk Intelligence Engine — Confidence-based position sizing & model-aware circuit breaker

- 📡 Training Data Pipeline — Export datasets for external AI/ML training

- 🌐 Portfolio Orchestration — Multi-EA coordination via shared performance metrics

AI-Hybrid-Trader v6.0 is a next-generation Expert Advisor that combines the power of Artificial Intelligence with battle-tested trading strategies. This EA uses a proprietary Neural Network Ensemble and Reinforcement Learning (Q-Learning) algorithm that learns, adapts, and evolves with the market in real-time.

Unlike conventional EAs that rely on static rules, AI Hybrid Trader employs a Hybrid Intelligence Approach: 70% proven algorithmic rules combined with 30% adaptive AI, creating a system that is both reliable and intelligent. Version 6.0 takes this further — the AI now evaluates its own decisions and adjusts accordingly.

🧠 AI CORE TECHNOLOGY

Multi-Layer Neural Network Ensemble

- 🔬 Self-Learning Neural Network Ensemble — Multiple neural networks work together, each trained on different data perspectives, then their predictions are combined for higher accuracy and consistency

- 🎯 Q-Learning (Reinforcement Learning) — The AI learns optimal trading decisions through experience, maximizing long-term rewards rather than reacting to short-term noise

- ⚡ Hybrid Intelligence — A carefully calibrated blend of 70% proven algorithmic rules + 30% adaptive AI, giving you the best of both worlds

- 🔄 Genetic Optimizer — Built-in genetic algorithm automatically discovers the most effective parameter combinations through evolutionary optimization

Adaptive Market Intelligence

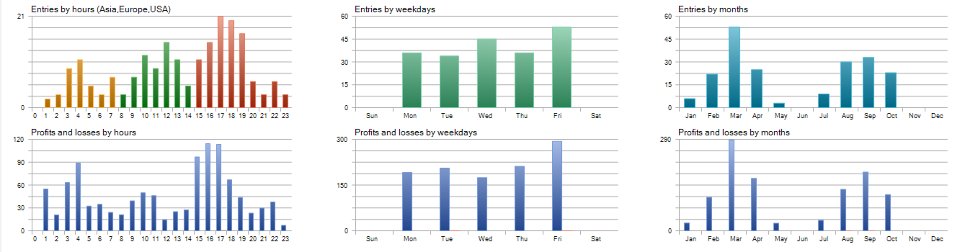

- 📈 Real-Time Market Regime Detection — Automatically classifies the market as Trending, Ranging, or Volatile and adjusts its full strategy accordingly

- 🎛️ Dynamic Parameter Adaptation — Risk multiplier, stop loss distance, take profit ratio, and AI weighting all adapt in real-time to current market conditions

- 📉 Emergency Risk Reduction — Automatically reduces position sizing after consecutive losses to protect your capital

🆕 v6.0: SELF-EVOLVING AI MODULES

📊 Structured Telemetry & Logging System

Every trade is now captured with full transparency. The new telemetry system logs:

- ✅ Entry logs: Timestamp, all AI signal scores, market regime, feature snapshot, confidence levels

- ✅ Exit logs: Duration, profit/loss in pips & money, exit reason, AI prediction accuracy

- ✅ Model performance logs: Rolling accuracy, per-regime analysis, degradation alerts

All data is exported in clean CSV format — ready for analysis in Excel, Python, or any data tool.

🧠 AI Model Evaluator

The AI now grades its own predictions. This is a game-changer:

- 📈 Rolling Accuracy Tracking — Continuously measures how often the AI was right over the last N trades

- 🎯 Per-Regime Analysis — Shows accuracy separately for Trending, Ranging, and Volatile markets, so you know exactly where the AI excels

- ⚠️ Degradation Detection — Alerts you when AI accuracy is declining, so you can retrain before it becomes a problem

- 📺 Live Dashboard — Model accuracy is displayed in real-time on the info panel

🛡️ Risk Intelligence Engine

Take your risk management to the next level:

- 🎚️ Confidence-Based Position Sizing — Lot size automatically scales with AI confidence. High confidence = larger position. Low confidence = smaller or no position.

- 🚫 Minimum Confidence Threshold — Trades are blocked if the combined signal confidence is below your defined threshold

- 🔒 Model-Aware Circuit Breaker — Automatically halts all trading if model accuracy drops below a critical threshold. Your money is protected even when the AI is uncertain.

- 📊 Exposure Control — Limits simultaneous open positions to prevent overexposure

📡 Training Data Pipeline

Prepare for the future of AI trading:

- 📤 Automatic Dataset Export — Feature vectors and trade outcomes are exported in a clean format, ready for use in Python, TensorFlow, or any ML framework

- 🔮 ONNX Model Ready — Infrastructure prepared for future ONNX model hot-reloading (v7.0 roadmap)

🌐 Portfolio Orchestration Readiness

Run multiple AI Hybrid Traders across different symbols:

- 📡 Performance Broadcasting — Each EA instance shares its win rate, model accuracy, and P/L via MetaTrader's Global Variables

- 🎮 External Lot Override — An external orchestrator or script can dynamically control lot sizes across all EA instances

- 🔗 Multi-EA Coordination — Foundation for portfolio-level risk management across multiple symbols

🛡️ COMPREHENSIVE RISK MANAGEMENT

- 📏 Dynamic Stop Loss & Take Profit that adapts to market volatility

- 🛑 Daily & Weekly Circuit Breaker — Automatically halts trading when loss limits are reached

- 🧮 Intelligent Lot Sizing — Smart position sizing based on account equity, ATR, and AI confidence

- 📉 Maximum Drawdown Protection — Multi-layer protection against large drawdowns

- 🔒 Breakeven & Trailing Stop — Lock in profits with configurable breakeven and multiple trailing modes

⚙️ FLEXIBLE TRADING MODES

- 🤖 Standalone AI Trading — Fully automated decision-making

- 📊 Optional Grid Trading System — Smart grid with cumulative TP and lot multiplier

- 🔍 Multiple Confirmation Filters — Candlestick pattern recognition, bar length trend analysis, and proprietary signal filters

- 📰 News Filter — Automatically avoids high-impact news events

- ⏰ Time & Day Filter — Control exactly when the EA is allowed to trade

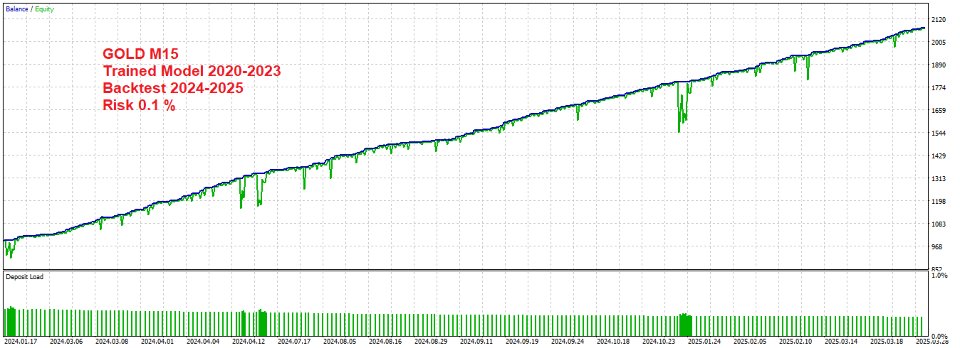

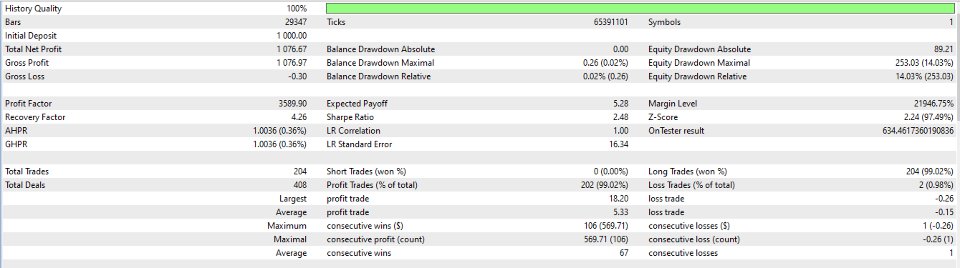

⚠️ IMPORTANT: TRAINING REQUIRED BEFORE LIVE TRADING

This EA MUST be trained before use!

Unlike regular EAs, AI-Hybrid-Trader needs to learn your chosen market first:

- Attach EA to your chart

- Set TRAIN_AND_SAVE mode in settings

- Run backtest for 1-2 minutes to train the AI

- AI model is saved — now EA is ready for live trading!

Training only takes a few minutes but is essential for optimal performance.

📈 RECOMMENDED SETTINGS

| Setting | Recommendation |

|---|---|

| Symbols | GOLD (XAUUSD), EURUSD, GBPUSD, USDJPY, and most major pairs |

| Timeframe | M5, M15, H1 (optimized for H1) |

| Minimum Deposit | $500 USD (recommended $1,000+) |

| Leverage | 1:100 or higher recommended |

| Account Type | Hedge or Netting |

| Broker | Low spread broker recommended (ECN preferred) |

| VPS | Strongly recommended for 24/7 AI learning |

🆕 v6.0 DEFAULT SETTINGS

| Module | Default | Description |

|---|---|---|

| Structured Logging | ✅ ON | Full CSV telemetry — transparent trade tracking |

| Model Evaluator | ✅ ON | AI accuracy tracking & degradation detection |

| Risk Intelligence | ❌ OFF | Confidence-based sizing — enable when ready |

| Training Export | ❌ OFF | For advanced users — export data for external AI |

| Portfolio Orchestration | ❌ OFF | For multi-EA setups — enable when coordinating |

💡 WHY CHOOSE AI-HYBRID-TRADER v6.0?

✅ Self-Evolving — The AI tracks its own accuracy and adapts its behavior over time

✅ Self-Evaluating — Per-regime accuracy analysis reveals exactly where the AI performs best

✅ Self-Protecting — Model-aware circuit breaker stops trading when AI confidence is low

✅ Fully Transparent — Structured telemetry provides complete visibility into every decision

✅ Data-Ready — Export training datasets for your own external AI/ML research

✅ Portfolio-Ready — Coordinate multiple EA instances across different markets

✅ Universal — Works on Forex, Gold, Indices, and more

✅ Future-Proof — ONNX model support and external orchestration coming in v7.0

⚡ QUICK START GUIDE

METHOD 1: Via Strategy Tester (Faster)

- Open MT5 Strategy Tester

- Select the EA and your chart (e.g., XAUUSD M15)

- Set InpBacktestMode = TRAIN_AND_SAVE

- Run backtest (1-2 minutes) — AI model is automatically saved

- Attach EA to live chart with InpBacktestMode = MODE_TRADING

- Important: Use the SAME Magic Number as in Strategy Tester!

- Enable AutoTrading and start trading

METHOD 2: Via Info Panel (On Live Chart)

- Attach EA to chart with InpBacktestMode = MODE_TRADING

- Enable Show Info Panel = true in settings

- Click TRAIN_MODEL button on the panel — wait until complete

- Click SAVE_MODEL button to save the trained AI

- Click LOAD_MODEL button to activate the AI

- EA is now ready for trading!

For detailed setup instructions, read our guide: https://www.mql5.com/en/blogs/post/763944

📥 Optimized .set files available — see Comments tab

📋 An Important Note on Backtesting vs. Live Trading

AI Hybrid Trader is engineered to excel in dynamic, live market conditions. Its greatest strength lies in its ability to learn and adapt in real-time from every trade it takes.

Due to this adaptive nature, backtest results may not fully reflect the true performance potential in a live market:

- Backtesting is Static: A backtest cannot replicate how the Adaptive AI will evolve and refine its strategy over weeks or months of live trading.

- The News Filter is Inactive: The crucial news filter does not function during backtests, meaning the simulation will not avoid periods of extreme volatility.

- v6.0 Telemetry is Limited in Tester: The structured telemetry and model evaluation modules run at reduced capacity during backtests for performance reasons.

We strongly encourage running a forward test on a demo account for several weeks to see the true power of our self-evolving AI engine in action.

📜 VERSION HISTORY

v6.0 — Self-Evolving AI Infrastructure

- 🆕 Structured Telemetry Logger (CSV entry/exit/performance logs)

- 🆕 AI Model Evaluator (rolling accuracy, per-regime analysis, degradation detection)

- 🆕 Risk Intelligence Engine (confidence-based sizing, model-aware circuit breaker)

- 🆕 Training Data Pipeline (external AI/ML dataset export)

- 🆕 Portfolio Orchestration (multi-EA coordination via GlobalVariables)

- 🆕 Model Accuracy Display on Info Panel

- ♻️ Complete code restructuring for maintainability

v5.387 — Hybrid AI Foundation

- Neural Network Ensemble + Q-Learning core

- Hybrid 70/30 rule-based + AI approach

- Genetic Optimizer, Adaptive Market Engine

- Grid Trading, Candlestick Filters, News Filter

⚖️ Risk Disclaimer

Trading foreign exchange, commodities, and other financial instruments on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest, you should carefully consider your investment objectives, level of experience, and risk appetite. Past performance is not indicative of future results. The possibility exists that you could sustain a loss of some or all of your initial investment, and therefore you should not invest money that you cannot afford to lose. Use this software responsibly.