Statistical Mean Reversion EA ZScore ADF

- Experts

- Mael Francois Claude Deman

- Versione: 1.1

- Aggiornato: 20 giugno 2025

- Attivazioni: 5

Statistical Mean Reversion EA – ZScore + ADF + Dynamic Quantiles

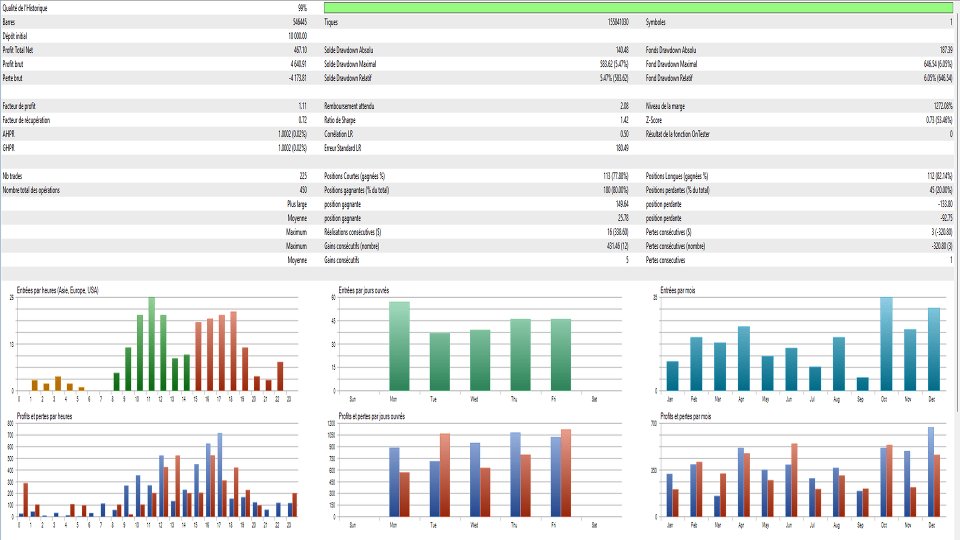

This Expert Advisor implements a robust mean reversion trading strategy based on advanced statistical techniques.

It dynamically adapts to changing market conditions by analyzing z-scores, volatility-adjusted spreads, stationarity, and half-life of price deviations.

Ideal for traders looking for a quantitative edge in range-bound or reverting market regimes.

Key Features

-

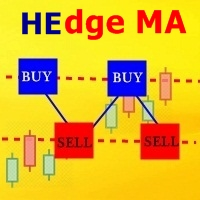

✅ Z-Score Entry & Exit Logic

Uses a dynamic z-score calculated from the normalized price spread relative to ATR and EMA. -

✅ Adaptive Half-Life Estimation

Calculates the half-life of the mean-reverting process daily via AR(1) regression. -

✅ Augmented Dickey-Fuller (ADF) Stationarity Test

Filters entries when the spread is not statistically stationary. -

✅ Dynamic Entry/Exit Quantiles

Quantiles are adjusted based on real-time transaction costs and volatility. -

✅ Full Risk Management Module

Position size is automatically adjusted based on ATR and account balance. -

✅ Time-Based Stop-Loss (Max Holding Time)

Positions are force-closed after a set number of hours. -

✅ Spread & Cost Awareness

Entry threshold dynamically adjusted to compensate for real trading costs. -

✅ Graphical Z-Score Visualization

Draws z-score and quantile levels directly on the chart for transparency.

- ✅ Compatible with Netting & Hedging Accounts

The EA supports both account types and is safe for all brokers

All key parameters (ATR period, EMA period, risk %, holding time, ADF lookback, etc.) can be configured by the user, allowing full control over strategy behavior.

No external libraries or indicators required. Everything is self-contained in the EA.

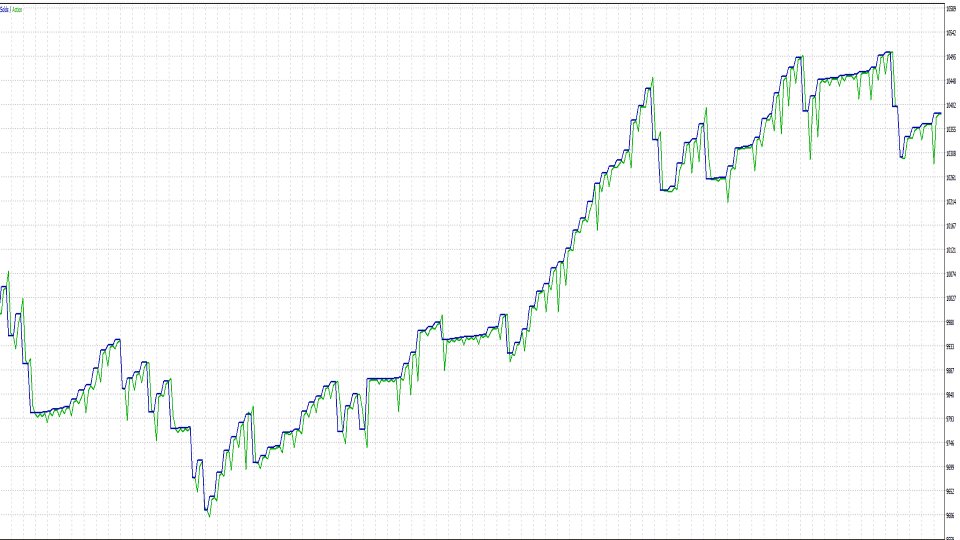

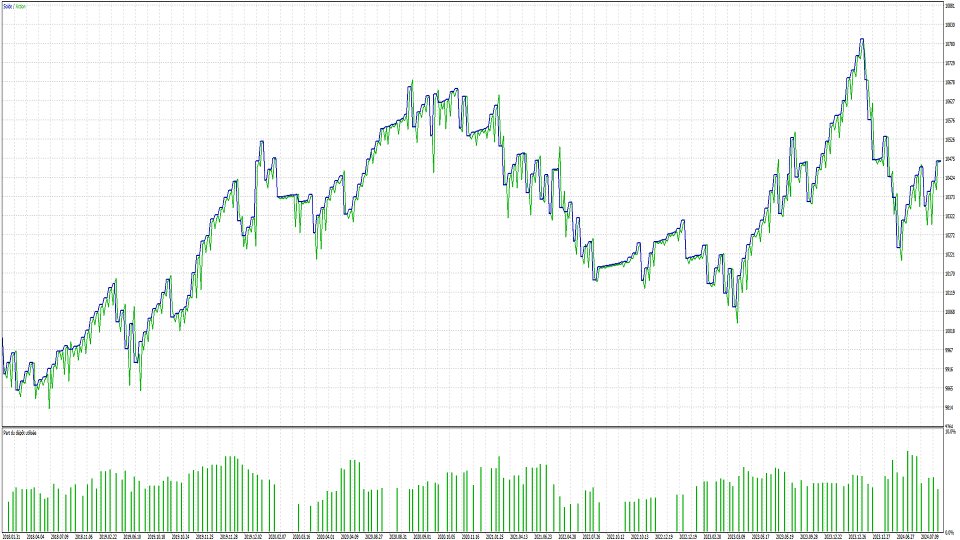

Screenshots comes from AUDUSD, GBPAUD, EURCHF with no optimisation only out of sample backtest.