ATR Stop Loss All Trades MT4

- Utilità

- Prafull Manohar Nikam

- Versione: 1.3

- Aggiornato: 13 gennaio 2026

- Attivazioni: 5

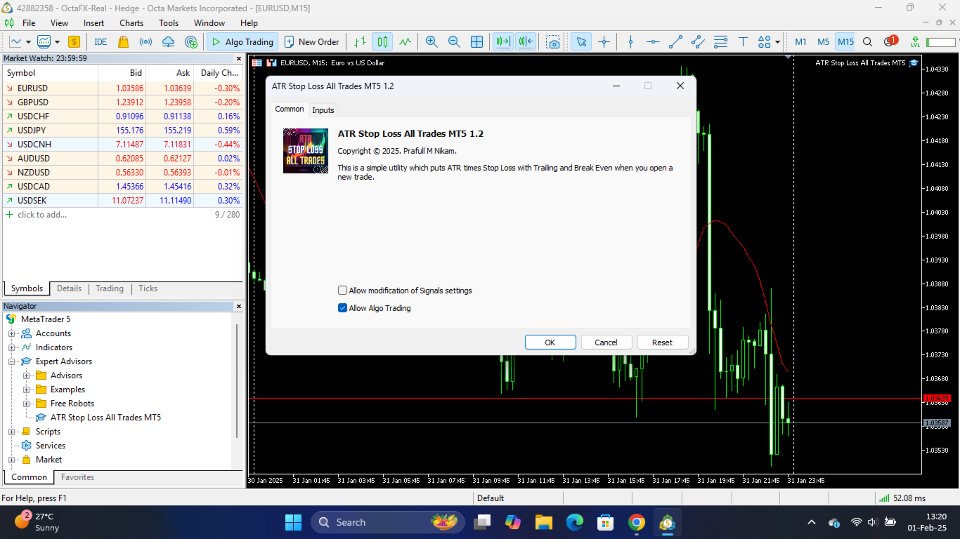

This is a simple utility which will put automatic Stop Loss and Take Profit on every new trade based on ATR values. It also has Stop Loss Trailing and Break Even function. Whenever you open a trade, it will put ATR times Stop Loss and Take Profit automatically.

Stop loss and take profit are two important tools used by traders to manage risk and set profit targets in financial markets. The Average True Range (ATR) indicator can be a valuable tool in helping traders determine appropriate levels for these orders.

Inputs Explained:

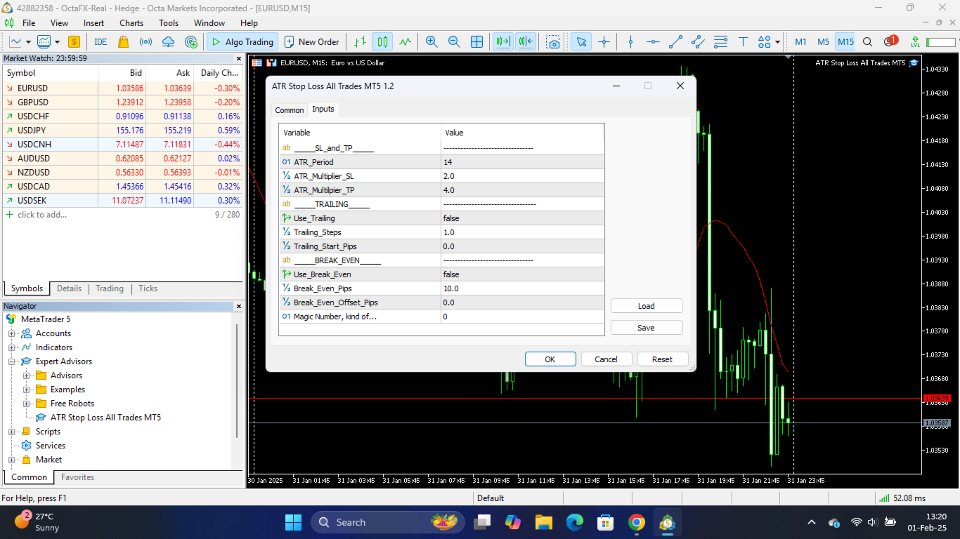

ATR Settings

-

ATR Period: The number of candles used to calculate the Average True Range (ATR). A standard setting is 14.

-

ATR TimeFrame: The timeframe used for the volatility calculation (e.g., H1 for Intraday/Swing). This is independent of your current chart timeframe.

-

Stop Loss Multiplier (x ATR): Sets the initial Stop Loss distance. For example, a value of 2.0 places the SL at 2.0 x ATR distance from the entry price.

-

Take Profit Multiplier (x ATR): Sets the initial Take Profit distance. A value of 3.0 aims for a 1:3 Risk/Reward ratio if SL is 1.0.

Management Settings

-

Manage Manual Trades?: If true , the utility will manage trades you open manually (Magic Number 0).

-

Manage EA Trades?: If true , the utility will manage trades opened by other Expert Advisors.

-

Specific Magic Number (0 = Manual): Enter a specific Magic Number to manage only trades with that ID. Leave as 0 to manage Manual trades or use the toggles above.

-

Enable Trailing Stop?: If true , the Stop Loss will automatically trail the price by the defined ATR distance (locked to the SL Multiplier distance).

-

Enable Break Even?: If true , the trade will be moved to Break Even once it reaches a certain profit.

-

Break Even Trigger (x ATR profit): The profit distance required to trigger the move to Break Even. (e.g., 1.0 means wait until profit = 1x ATR).

-

Break Even Lock (x ATR profit): The profit distance to lock in. (e.g., 0.1 locks in a small profit above the entry price to cover commissions/swap).

Explanation of how ATR based SL and TP is used:

1. **Stop Loss (SL): **

- A stop loss is an order placed by a trader to limit potential losses on a trade.

- The ATR indicator helps traders set a stop loss by providing information about market volatility. It measures the average range between the high and low prices over a specific period, typically 14 periods.

- To use the ATR for setting a stop loss, traders can calculate a certain multiple of the ATR and subtract it from the entry price (for long positions) or add it to the entry price (for short positions). This multiple is often referred to as the "ATR multiplier."

- For example, if the current ATR is 20 and a trader uses an ATR multiplier of 2, they might set their stop loss 40 points away from their entry price. This accounts for recent market volatility and provides a buffer against sudden price movements.

2. **Take Profit (TP): **

- Take profit is an order placed by a trader to lock in profits at a predetermined price level.

- Similar to the stop loss, the ATR indicator can be used to set a take profit level. However, traders typically use a different multiplier or approach.

- A common strategy is to use a multiple of the ATR to set a take profit level that's further away from the entry price than the stop loss. This allows traders to capture potential larger moves in the market while still taking into account volatility.

- For example, if the current ATR is 20 and a trader uses an ATR multiplier of 3 for take profit, they might set their take profit level at 60 points away from their entry price.

Does not work half the time

Edit - Changed the rating to high because the developer quickly released an update which seems to have fixed the problem