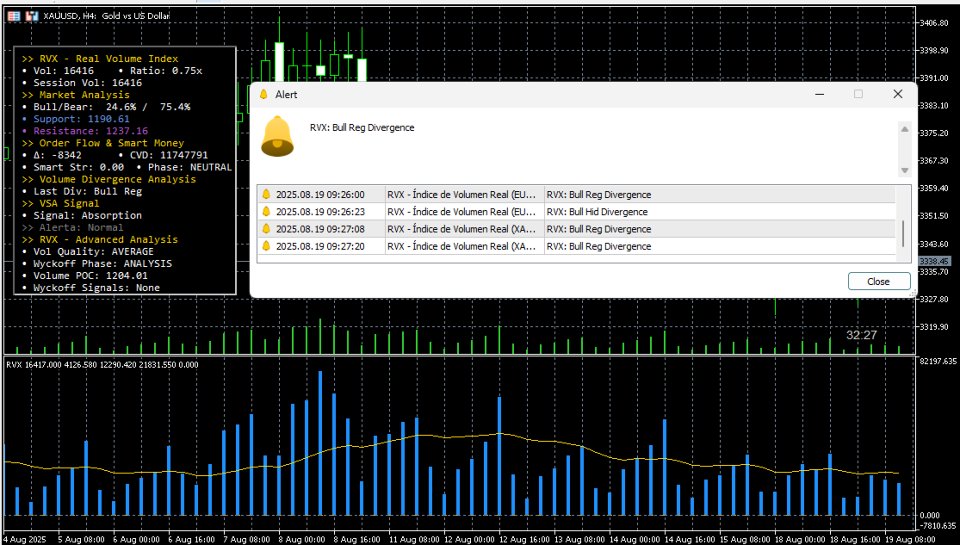

Volume Structure Nexus MT5

- Indicateurs

- German Pablo Gori

- Version: 1.0

- Activations: 6

Volume Structure Nexus - SMC Volume and Structure Analysis

Description: Understand what's going on "behind the chart." Volume Structure Nexus is an advanced tool for traders who trade based on Real Volume and Smart Money Concepts (SMC).

What you'll get with this tool:

-

Tick Volume Metrics: Identify where institutional liquidity is injected.

-

Order Block Detection: Automatically visualizes the areas where institutions leave their pending orders.

-

Break of Structure (BOS): Automatic identification of changes in market trend.

-

Confluence of Supply/Demand: Points of interest (POIs) marked in real-time.

Ideal for: Traders looking to improve their Risk/Reward ratio through "Discount" or "Premium" entries.